Amundi MSCI World II UCITS ETF Dist: NAV Calculation And Implications

Table of Contents

Understanding the Components of Amundi MSCI World II UCITS ETF Dist NAV

The Amundi MSCI World II UCITS ETF Dist NAV represents the net value of the ETF's underlying assets per share. Understanding its components is key to grasping the overall value. The ETF primarily invests in a diverse portfolio of equities across developed markets, mirroring the MSCI World Index.

- Underlying Assets: The ETF holds a basket of stocks from numerous companies globally. The specific holdings are publicly available in the ETF's fact sheet.

- Market Value Determination: The market value of each asset is determined daily using closing prices from reputable exchanges where those stocks are traded. This ensures a fair and up-to-date valuation.

- Currency Exchange Rates: Because the ETF invests globally, currency exchange rates play a vital role. The value of foreign-currency denominated assets is converted to the ETF's base currency (likely Euros) using the prevailing exchange rates at the end of the trading day.

- Accrued Income and Expenses: Accrued dividends from the underlying holdings and any expenses incurred by the ETF (management fees, etc.) are also factored into the NAV calculation. These are added or subtracted, respectively, to arrive at the final NAV.

The Amundi MSCI World II UCITS ETF Dist NAV Calculation Process

The Amundi MSCI World II UCITS ETF Dist NAV is calculated daily, typically at the close of market hours. The process involves several steps:

- Asset Valuation: The market value of each asset in the ETF's portfolio is determined as described above.

- Currency Conversion: If applicable, the values of foreign assets are converted to the base currency using the closing exchange rates.

- Income and Expense Adjustments: Accrued income (dividends) is added, and expenses are subtracted from the total asset value.

- Total Net Asset Value: The total net asset value is calculated by summing up the values of all assets, adjusted for income and expenses.

- NAV per Share: This total NAV is then divided by the number of outstanding shares to arrive at the NAV per share.

- Data Sources: Reputable financial data providers supply the necessary market data for accurate NAV calculation.

- Custodian and Administrator Roles: The ETF's custodian safeguards the assets, while the administrator oversees the NAV calculation and dissemination of information.

Implications of NAV Fluctuations for Investors

Fluctuations in the Amundi MSCI World II UCITS ETF Dist NAV directly impact investor returns.

- Impact on Returns: An increase in NAV signifies growth in the value of your investment, while a decrease indicates a loss.

- Relationship to Share Price: While not always identical, the ETF's share price generally tracks its NAV closely. Deviations might arise from trading volume and market demand.

- Tracking Error: Tracking error measures the difference between the ETF's performance and its benchmark index (MSCI World Index). Changes in NAV contribute to this tracking error.

- Buy and Sell Decisions: Investors often consider NAV movements when making buy or sell decisions; buying low (relative to perceived value) and selling high.

- Dividend Distribution: The distribution of dividends reduces the NAV per share on the ex-dividend date, as the dividend payments are made to shareholders.

Comparing Amundi MSCI World II UCITS ETF Dist NAV to Competitors

Comparing the Amundi MSCI World II UCITS ETF Dist's NAV performance to similar ETFs in the market provides valuable context.

- Competitor ETFs: Several ETFs track similar indices, providing alternative options for investors.

- Benchmark Index: The MSCI World Index serves as the benchmark for comparison, illustrating the ETF's tracking ability.

- Factors Affecting Performance: Differences in NAV performance might stem from variations in expense ratios, tracking methodologies, or the specific composition of the underlying assets. A thorough analysis of these factors is crucial for comparison.

Conclusion: Making Informed Decisions with Amundi MSCI World II UCITS ETF Dist NAV Knowledge

Understanding the Amundi MSCI World II UCITS ETF Dist NAV calculation is crucial for making informed investment decisions. By grasping the components of the NAV, the calculation process, and the implications of NAV fluctuations, investors can better assess risk and potential returns. Regularly monitoring the Amundi MSCI World II UCITS ETF Dist NAV, along with its comparison to competitors and the benchmark index, allows for more effective investment strategies. Learn more about Amundi MSCI World II UCITS ETF Dist and its NAV by visiting [link to relevant resource]. Monitor the Amundi MSCI World II UCITS ETF Dist NAV regularly to optimize your investment strategy.

Featured Posts

-

Ferraris Inaugural Service Centre In Bengaluru What To Expect

May 24, 2025

Ferraris Inaugural Service Centre In Bengaluru What To Expect

May 24, 2025 -

Amundi Msci World Ex Us Ucits Etf Acc Nav Calculation And Implications

May 24, 2025

Amundi Msci World Ex Us Ucits Etf Acc Nav Calculation And Implications

May 24, 2025 -

Is A Us Band Playing Glastonbury Unofficial News Sets The Internet Ablaze

May 24, 2025

Is A Us Band Playing Glastonbury Unofficial News Sets The Internet Ablaze

May 24, 2025 -

The Ultimate Porsche Macan Buyers Guide Models Specs And Pricing

May 24, 2025

The Ultimate Porsche Macan Buyers Guide Models Specs And Pricing

May 24, 2025 -

Avrupa Borsalari Duesueste Stoxx Europe 600 Ve Dax 40 Gerilemesi 16 Nisan 2025

May 24, 2025

Avrupa Borsalari Duesueste Stoxx Europe 600 Ve Dax 40 Gerilemesi 16 Nisan 2025

May 24, 2025

Latest Posts

-

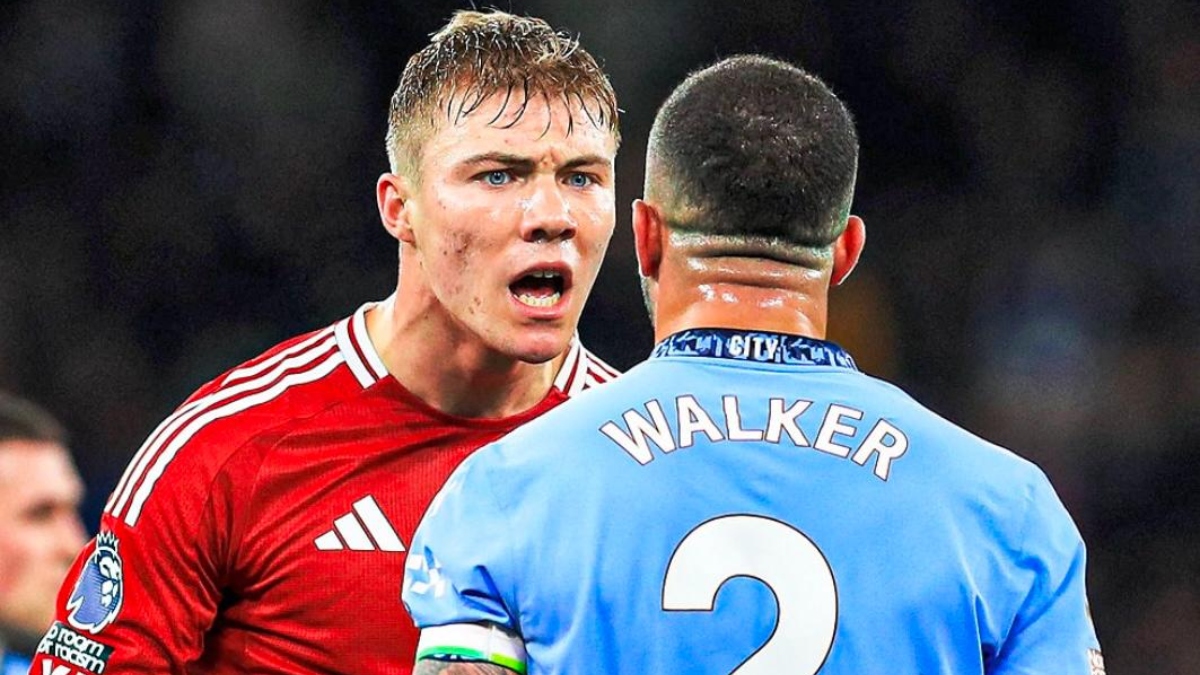

The Kyle Walker Annie Kilner Situation Explaining The Recent Events

May 24, 2025

The Kyle Walker Annie Kilner Situation Explaining The Recent Events

May 24, 2025 -

Dog Walker Drama Kyle And Teddis Fiery Exchange

May 24, 2025

Dog Walker Drama Kyle And Teddis Fiery Exchange

May 24, 2025 -

Recent Developments Annie Kilners Public Statements After The Kyle Walker Night Out

May 24, 2025

Recent Developments Annie Kilners Public Statements After The Kyle Walker Night Out

May 24, 2025 -

Kyle Walkers Recent Parties A Look At The Events Following Annie Kilners Return Home

May 24, 2025

Kyle Walkers Recent Parties A Look At The Events Following Annie Kilners Return Home

May 24, 2025 -

Kyle And Teddis Heated Confrontation Dog Walker Dispute

May 24, 2025

Kyle And Teddis Heated Confrontation Dog Walker Dispute

May 24, 2025