Analysis Of CoreWeave (CRWV) Stock: Understanding The Recent Price Surge

Table of Contents

CoreWeave's Business Model and Competitive Advantages

CoreWeave distinguishes itself in the crowded cloud computing market with its laser focus on high-performance computing (HPC) and AI workloads. Unlike general-purpose cloud providers, CoreWeave offers a specialized infrastructure built around powerful GPUs, making it ideal for computationally intensive tasks like machine learning model training, AI development, and scientific simulations. This niche positioning gives CoreWeave significant competitive advantages:

- Proprietary Technology: CoreWeave leverages its unique technology to optimize GPU utilization and provide superior performance compared to competitors. This includes innovative resource allocation and management systems that minimize latency and maximize efficiency within its cloud infrastructure.

- Unmatched Scalability: CoreWeave's data centers boast massive scalability, allowing clients to easily adjust their computing resources based on fluctuating demand. This flexibility is crucial for AI projects and HPC applications that often require significant computational power.

- Strategic Partnerships: Collaborations with leading technology companies provide CoreWeave access to cutting-edge hardware and software, further enhancing its offerings and expanding its reach within the competitive landscape. These partnerships also help to drive broader adoption of its cloud solutions.

Bullet Points:

- Superior GPU infrastructure, exceeding the capabilities of many competitors in raw processing power and efficiency.

- Robust partnerships with key players in the AI and HPC sectors, ensuring access to the latest technologies and market insights.

- Cost-effective solutions for AI and HPC workloads, offering competitive pricing while maintaining exceptional performance.

- Commitment to sustainable practices, utilizing energy-efficient hardware and optimizing operations to reduce environmental impact.

Market Factors Driving CRWV Stock Price

The impressive rise in CRWV stock price is not solely attributable to CoreWeave's internal strengths; broader market trends are also significantly fueling its growth.

- Booming AI Market: The insatiable demand for AI and machine learning solutions is driving exponential growth in the high-performance computing market. CoreWeave is ideally positioned to capitalize on this surge, providing the crucial infrastructure needed to power AI innovations.

- Cloud Computing Adoption: The ongoing shift towards cloud-based computing continues to accelerate, creating a massive market opportunity for specialized cloud providers like CoreWeave. Companies are increasingly recognizing the cost-effectiveness and scalability advantages of cloud solutions for their HPC and AI needs.

Bullet Points:

- Massive investments in AI and machine learning initiatives by both private and public sector entities are creating sustained demand for CoreWeave's services.

- The increasing adoption of cloud-based computing solutions across various industries is propelling the growth of the entire cloud computing market, directly benefiting CoreWeave.

- A current shortage of readily available GPU capacity is creating a supply-demand imbalance, increasing the value proposition of CoreWeave's infrastructure.

- Positive analyst ratings and forecasts are reinforcing investor confidence in CoreWeave's future prospects.

Financial Performance and Future Projections

CoreWeave's recent financial results, while still relatively limited given its young age, have shown promising signs of revenue growth and increasing profitability. While detailed financial breakdowns may be limited publicly, analysts are eagerly monitoring key metrics such as revenue growth, operating margins, and cash flow to assess the company's financial health and sustainability. A closer examination of these financial indicators, along with comparisons to industry competitors, is crucial for forming a comprehensive evaluation of CoreWeave's financial performance.

Bullet Points:

- Analysis of key financial ratios and indicators will reveal the company's efficiency and overall financial health.

- Comparison to industry competitors' financial performance will help investors gauge CoreWeave's competitive positioning within the market.

- Discussion of potential risks and challenges, such as competition and scaling challenges, is vital for a balanced perspective.

- Expert opinions and forecasts regarding future growth will provide insights into the potential upside and downside of investing in CRWV stock.

Assessing the Risk and Volatility of CRWV Stock

Investing in CoreWeave (CRWV) stock involves inherent risks. As a relatively new company operating in a fast-paced, competitive market, CRWV stock exhibits significant volatility.

Bullet Points:

- Economic downturns can negatively impact spending on cloud computing and AI, potentially impacting CoreWeave's revenue.

- Intense competition from established cloud providers like AWS, Google Cloud, and Azure poses a significant challenge.

- Regulatory risks related to data privacy and security could impact CoreWeave's operations and profitability.

- Dependence on specific customer segments could expose the company to concentrated risk, making it vulnerable to changes in individual client needs.

Investing in CoreWeave (CRWV) Stock – A Final Thought

The recent surge in CoreWeave (CRWV) stock price reflects a combination of the company's strong business model, its focus on the rapidly growing AI and HPC markets, and positive broader market trends. While CoreWeave possesses considerable potential for future growth, investors must acknowledge the associated risks, including market volatility and competition. Whether the current CRWV stock price accurately reflects the company's long-term value is a matter of ongoing analysis and debate. Therefore, before making any investment decisions, conducting thorough due diligence is paramount. Learn more about CoreWeave's potential and analyze CoreWeave stock performance carefully to determine if it aligns with your risk tolerance and investment goals. Remember to conduct thorough due diligence before investing in CRWV stock.

Featured Posts

-

Wildlife Rescue A New Film On Helping Pronghorn After A Devastating Winter

May 22, 2025

Wildlife Rescue A New Film On Helping Pronghorn After A Devastating Winter

May 22, 2025 -

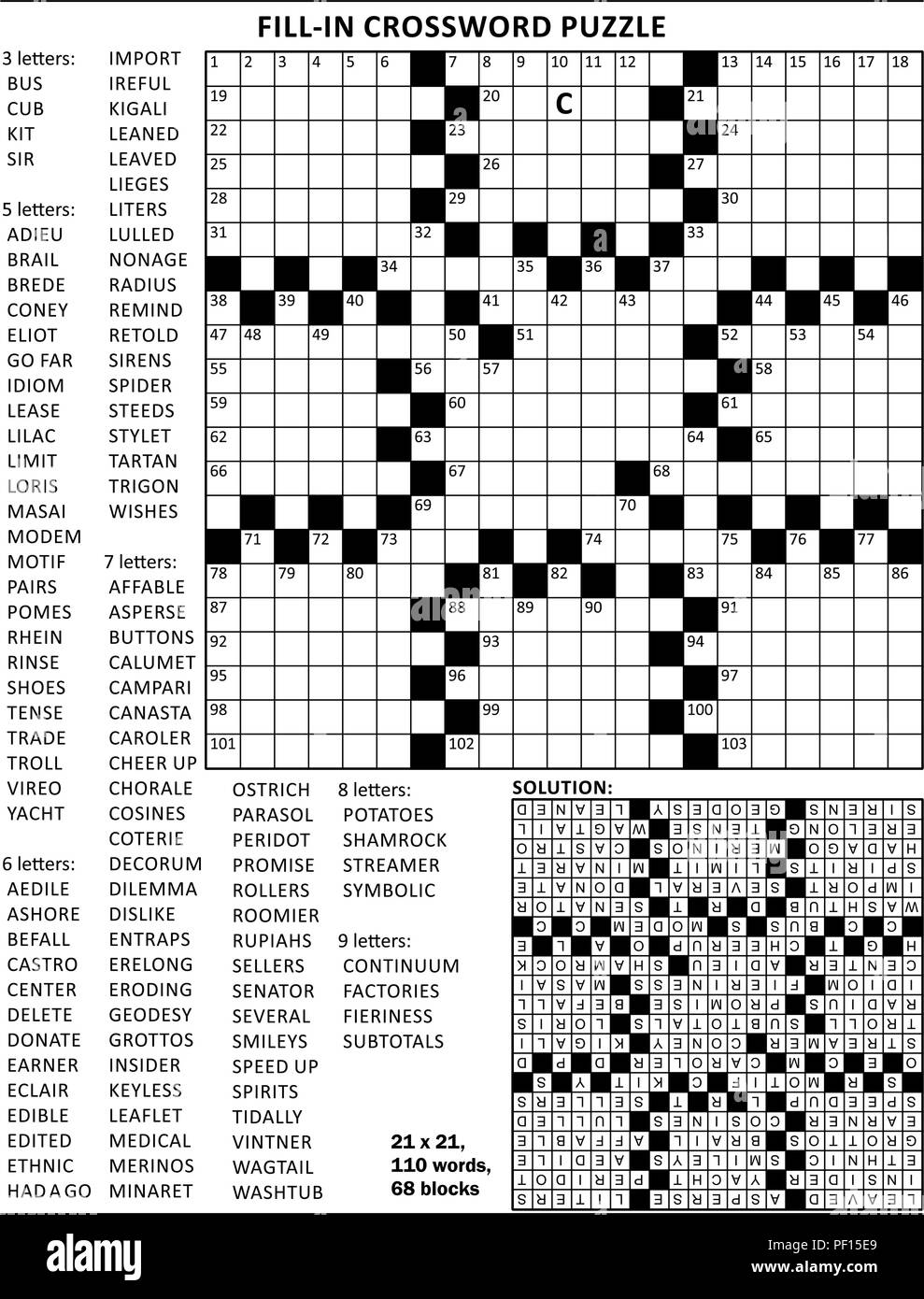

Peppa Pigs 21 Year Old Puzzle The Answer Revealed

May 22, 2025

Peppa Pigs 21 Year Old Puzzle The Answer Revealed

May 22, 2025 -

Was Liverpool Lucky To Beat Psg Arne Slots Perspective On Alisson

May 22, 2025

Was Liverpool Lucky To Beat Psg Arne Slots Perspective On Alisson

May 22, 2025 -

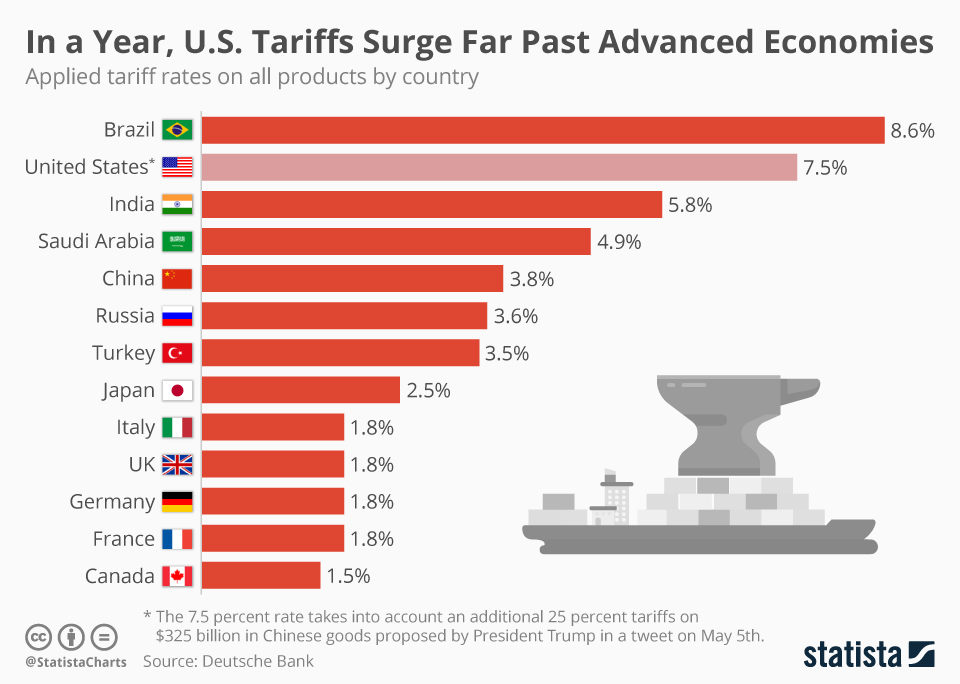

Analysis G 7s Proposed Changes To Tariffs On Chinese Imports

May 22, 2025

Analysis G 7s Proposed Changes To Tariffs On Chinese Imports

May 22, 2025 -

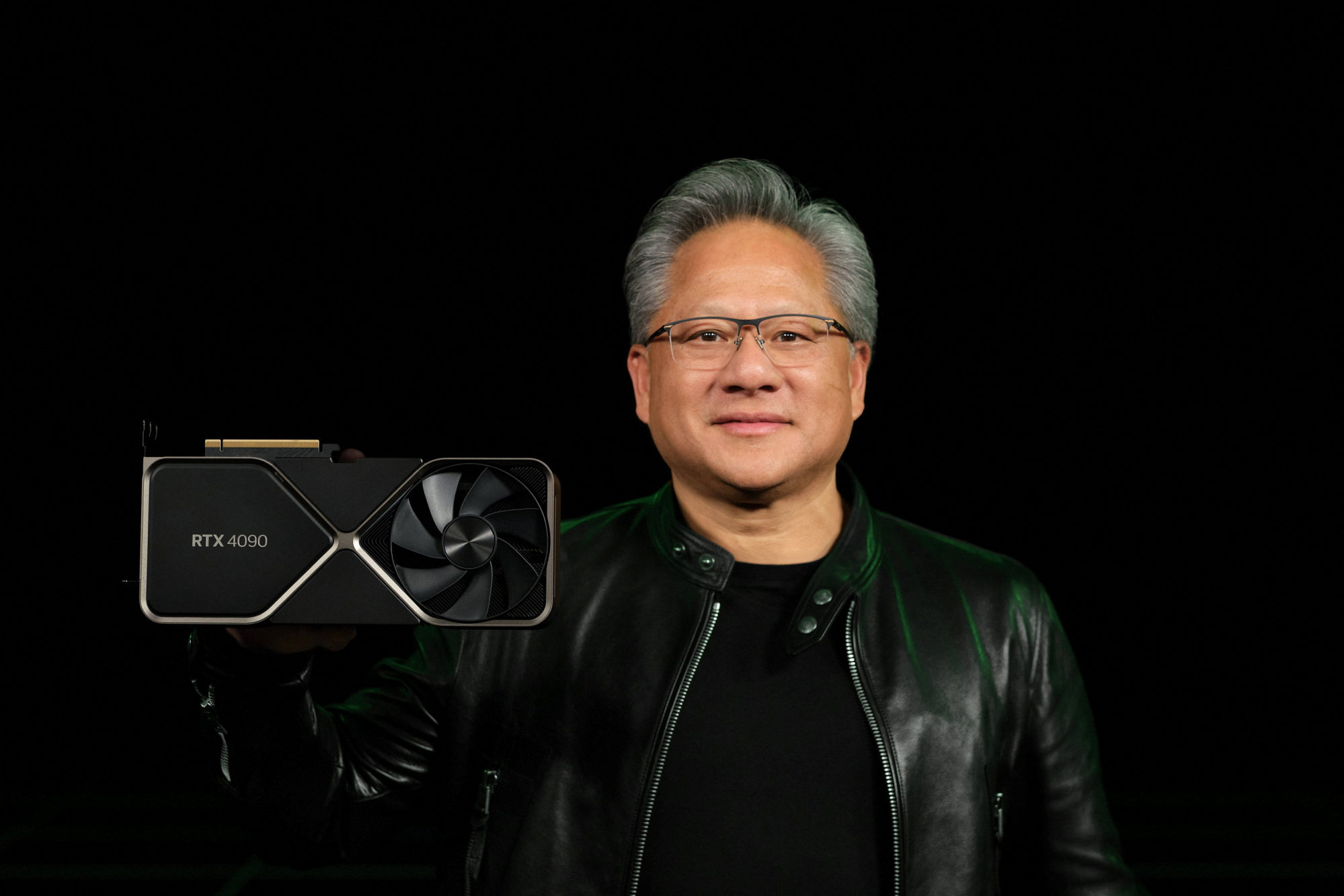

Huang Of Nvidia Condemns Us Export Restrictions Supports Trumps Policies

May 22, 2025

Huang Of Nvidia Condemns Us Export Restrictions Supports Trumps Policies

May 22, 2025

Latest Posts

-

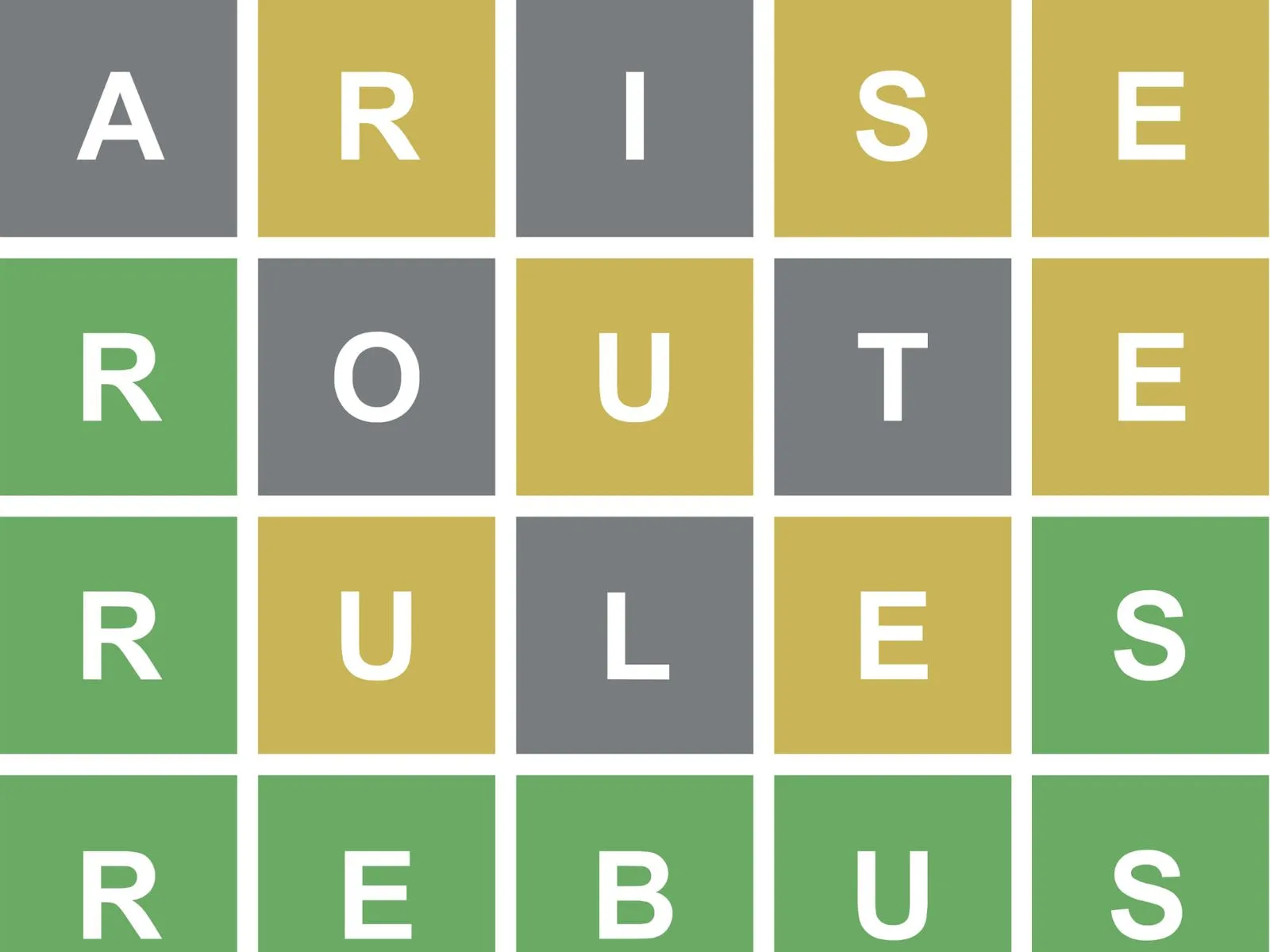

Solve Wordle 370 Clues And Solution For March 20th

May 22, 2025

Solve Wordle 370 Clues And Solution For March 20th

May 22, 2025 -

Wordle Today 370 March 20th Hints Clues And The Answer

May 22, 2025

Wordle Today 370 March 20th Hints Clues And The Answer

May 22, 2025 -

Conquering Todays Nyt Wordle March 26 A Step By Step Guide

May 22, 2025

Conquering Todays Nyt Wordle March 26 A Step By Step Guide

May 22, 2025 -

Nyt Wordle March 26 Solution And Gameplay Analysis

May 22, 2025

Nyt Wordle March 26 Solution And Gameplay Analysis

May 22, 2025 -

March 26 Nyt Wordle How To Solve Todays Difficult Puzzle

May 22, 2025

March 26 Nyt Wordle How To Solve Todays Difficult Puzzle

May 22, 2025