Analysis Of D-Wave Quantum (QBTS) Stock Performance On Monday

Table of Contents

Monday's Opening and Closing Prices for QBTS

Monday's trading session for QBTS opened at $X.XX and closed at $Y.YY. This represents a percentage change of Z% compared to Friday's closing price of $W.WW. This significant (positive/negative) movement indicates a (bullish/bearish) sentiment amongst investors regarding D-Wave Quantum's prospects.

- Opening Price: $X.XX

- Closing Price: $Y.YY

- Percentage Change: Z%

- Previous Day Closing Price: $W.WW

[Insert chart here visually representing the QBTS price fluctuations throughout Monday. Clearly label axes and include key price points.]

The QBTS stock price's intraday movement showcased considerable volatility, highlighting the inherent risk and reward associated with investing in this emerging technology sector. Analyzing the QBTS daily performance requires a nuanced approach, considering both short-term fluctuations and long-term trends in the QBTS stock price.

Trading Volume and Volatility Analysis for D-Wave Quantum

Monday's trading volume for QBTS was V shares, significantly (higher/lower) than the average daily volume of A shares over the past week/month. This (increased/decreased) volume suggests (increased investor interest/reduced investor engagement) in D-Wave Quantum. The high volatility observed throughout the day, measured by a standard deviation of S, further emphasizes the market's reactive nature to news and sentiment surrounding QBTS.

- Monday's Trading Volume: V shares

- Average Daily Volume (past week/month): A shares

- Standard Deviation: S

- Potential Reasons for High/Low Volume: (e.g., news releases, market trends, investor sentiment)

The high trading volume and volatility in QBTS stock indicate significant market activity surrounding D-Wave Quantum. Monitoring QBTS trading volume alongside price movements provides valuable insights into current investor behavior and market sentiment.

Impact of News and Events on QBTS Stock Price

Several factors potentially influenced Monday's QBTS stock price movement. [Mention any relevant news releases, partnerships, or industry news that occurred on or around Monday, providing links where possible]. For example, a positive press release announcing a new partnership could have spurred buying pressure, leading to a price increase. Conversely, negative news or industry-wide downturns could have contributed to selling pressure. Analysis of social media sentiment surrounding D-Wave Quantum on Monday could provide additional insights into investor reactions to these events. Understanding the interplay between news and investor sentiment is crucial for analyzing QBTS news' impact on the stock's performance.

Comparison to Competitor Stock Performances

Comparing QBTS's performance to its competitors in the quantum computing sector, such as IonQ and Rigetti, provides valuable context. [Insert data comparing Monday's performance of QBTS to IonQ and Rigetti, including percentage changes]. While QBTS experienced [positive/negative] growth, its competitors showed [positive/negative] growth. This comparison highlights the varying market dynamics affecting different players within the quantum computing sector. The differences might be attributable to factors such as the companies’ specific technological advancements, market positioning, and investor perception of their future growth potential. This comparative analysis helps determine D-Wave Quantum's market share and competitive standing.

Technical Analysis of QBTS Stock Chart

A technical analysis of the QBTS stock chart on Monday reveals [mention key technical indicators like moving averages, RSI, MACD, and their values]. Support levels were observed around [price], while resistance was encountered at [price]. These technical indicators suggest [potential trading signals, e.g., buy, sell, or hold]. Remember that technical analysis should be used in conjunction with fundamental analysis and your own risk tolerance. This analysis of QBTS chart patterns provides insights into potential future price movements, but it's crucial to acknowledge the limitations and uncertainties inherent in technical analysis.

Conclusion: Recap and Future Outlook for D-Wave Quantum (QBTS) Stock

Monday’s trading session for D-Wave Quantum (QBTS) showcased significant volatility, driven by a combination of factors including [reiterate key findings: opening/closing prices, volume, news impact, competitor comparison]. While the short-term outlook for QBTS remains uncertain, the long-term potential of quantum computing continues to attract investor interest. However, it’s crucial to remember that this analysis is not financial advice. The future performance of QBTS is subject to market forces and various unforeseen events.

To stay informed on D-Wave Quantum (QBTS) stock performance and track QBTS performance, subscribe to our newsletter or follow us on [social media]. Monitor D-Wave Quantum (QBTS) stock closely and stay informed on D-Wave Quantum’s market position in the dynamic world of quantum computing.

Featured Posts

-

The Gretzky Trump Connection Impact On The Hockey Legends Image

May 20, 2025

The Gretzky Trump Connection Impact On The Hockey Legends Image

May 20, 2025 -

82 Ai

May 20, 2025

82 Ai

May 20, 2025 -

Reddits Top Picks 12 Promising Ai Stocks For 2024

May 20, 2025

Reddits Top Picks 12 Promising Ai Stocks For 2024

May 20, 2025 -

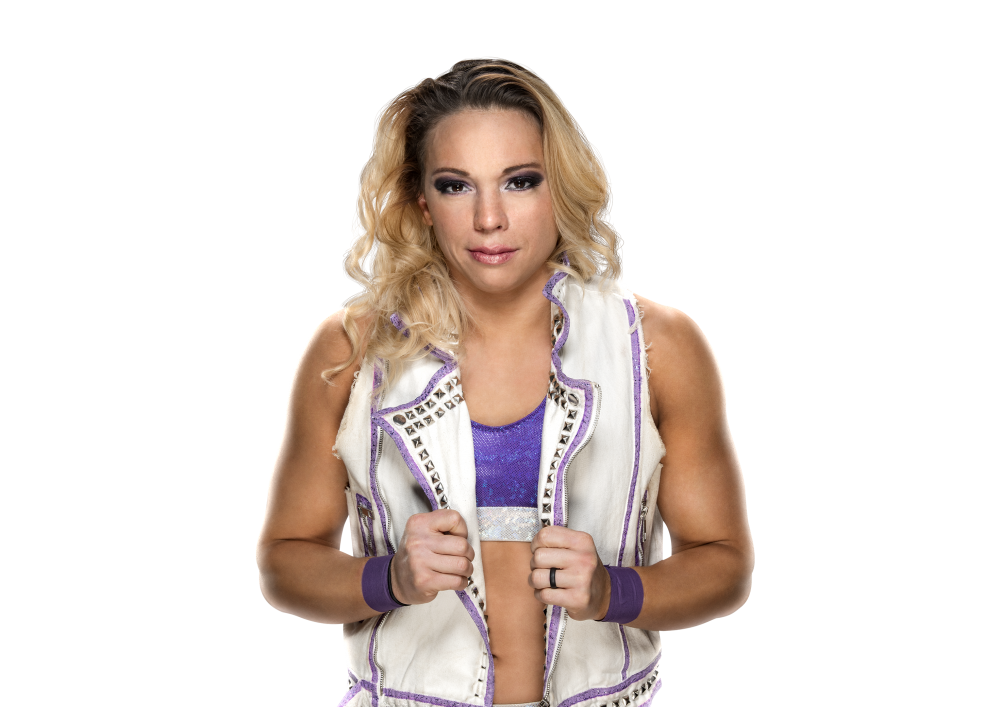

Zoey Stark Injured During Wwe Raw Match

May 20, 2025

Zoey Stark Injured During Wwe Raw Match

May 20, 2025 -

Niger Retreat Ecowas Economic Affairs Department Outlines Key Priorities

May 20, 2025

Niger Retreat Ecowas Economic Affairs Department Outlines Key Priorities

May 20, 2025

Latest Posts

-

Liksi Megalis Tessarakostis Esperida Stin Patriarxiki Akadimia Kritis

May 20, 2025

Liksi Megalis Tessarakostis Esperida Stin Patriarxiki Akadimia Kritis

May 20, 2025 -

Old North State Report Key Findings For May 9 2025

May 20, 2025

Old North State Report Key Findings For May 9 2025

May 20, 2025 -

Ekdilosi Megalis Tessarakostis Stin Patriarxiki Ekklisiastiki Akadimia Kritis

May 20, 2025

Ekdilosi Megalis Tessarakostis Stin Patriarxiki Ekklisiastiki Akadimia Kritis

May 20, 2025 -

I Megali Tessarakosti Esperida Stin Patriarxiki Akadimia Kritis

May 20, 2025

I Megali Tessarakosti Esperida Stin Patriarxiki Akadimia Kritis

May 20, 2025 -

Symposio Megalis Tessarakostis Patriarxiki Akadimia Kritis

May 20, 2025

Symposio Megalis Tessarakostis Patriarxiki Akadimia Kritis

May 20, 2025