Analysis: Shopify Stock's 14%+ Jump On Nasdaq 100 News

Table of Contents

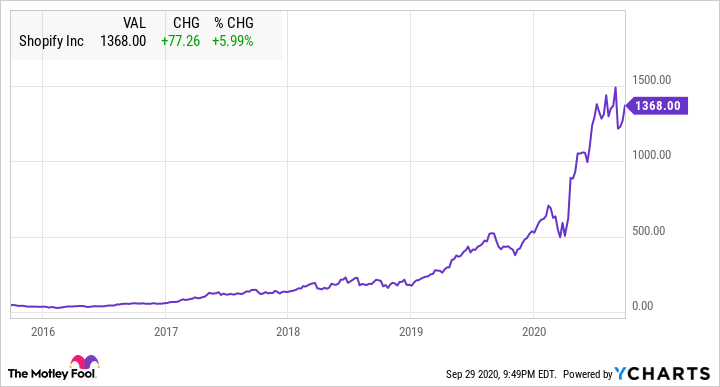

Shopify (SHOP) experienced a dramatic 14%+ surge on the Nasdaq following its inclusion in the prestigious Nasdaq 100 index. This significant jump sent ripples through the stock market, prompting investors to analyze the underlying factors driving this remarkable growth. This article delves into the key reasons behind this positive market reaction, examining the implications for investors and exploring the potential future trajectory of Shopify stock. We will unpack the various elements that contributed to this impressive price increase, providing a comprehensive analysis of this e-commerce giant's recent performance.

The Nasdaq 100 Inclusion: A Catalyst for Growth

Keywords: Nasdaq 100 inclusion, index inclusion, Shopify market capitalization, stock index, ETF impact, passive investing

Inclusion in the Nasdaq 100 is a major event for any company. For Shopify, it acted as a powerful catalyst for growth. This prestigious index inclusion has several significant implications:

-

Passive Investment Influx: Being part of the Nasdaq 100 automatically attracts a massive influx of investment from index funds and exchange-traded funds (ETFs) that track the index. These funds are passively managed, meaning they buy and hold the components of the index in proportion to their market capitalization. This results in significant buying pressure on SHOP stock.

-

Increased Trading Volume and Demand: The increased demand from passive investors naturally leads to higher trading volume for Shopify stock. This increased liquidity makes the stock more attractive to a wider range of investors.

-

Vote of Confidence: Inclusion in the Nasdaq 100 is a strong signal of confidence in Shopify's future prospects from the Nasdaq Stock Market itself. It signifies that the company has reached a level of maturity, stability, and market capitalization deemed worthy of inclusion in this elite index. Shopify's substantial market capitalization solidified its place amongst tech giants.

-

ETF Impact: Many popular ETFs tracking the Nasdaq 100, with billions of dollars in assets under management, were compelled to purchase SHOP shares to accurately reflect the index composition. This created a significant buying force.

Strong Q2 Earnings and Positive Future Outlook

Keywords: Shopify earnings, Q2 results, revenue growth, e-commerce trends, Shopify financials, profitability

Shopify's impressive stock jump wasn't solely driven by the Nasdaq 100 inclusion. The company also delivered strong Q2 earnings, further bolstering investor confidence:

-

Positive Q2 Results: Shopify's recent Q2 earnings report showcased positive revenue growth, exceeding market expectations. Specific details regarding revenue figures, profit margins, and key performance indicators (KPIs) should be referenced here for a complete analysis (refer to official Shopify financial reports for accurate data).

-

Sustained Revenue Growth: Analysis of Shopify's revenue growth trends over several quarters reveals a consistent upward trajectory, indicating the company's ability to maintain its momentum in the competitive e-commerce market.

-

Profitability and Projections: The company's profitability, or lack thereof depending on the report, and future financial projections play a critical role in investor decisions. Any significant shifts in profitability or changes in future outlook should be discussed here.

-

E-commerce Trends: Shopify's performance is closely tied to broader e-commerce trends. Analyzing these trends, such as the growth of mobile commerce, cross-border e-commerce, and the increasing adoption of digital payments, provides valuable insights into Shopify's future potential.

-

Strategic Initiatives: Any recent strategic initiatives undertaken by Shopify, such as new product launches, acquisitions, or partnerships, can also significantly impact investor sentiment and contribute to the positive market reaction.

Shopify's Expanding Ecosystem and Market Dominance

Keywords: Shopify app store, Shopify payments, Shopify shipping, e-commerce platform, market share, competition

Shopify's success stems not only from its core platform but also from its ever-expanding ecosystem:

-

Comprehensive Ecosystem: Shopify offers a comprehensive suite of tools and services, including its app store, payment processing solutions (Shopify Payments), and shipping integrations. This integrated approach provides merchants with a one-stop shop for all their e-commerce needs.

-

Market Share and Competition: Analyzing Shopify's market share in the e-commerce platform space provides a clear picture of its dominance. However, it's crucial to also acknowledge the competitive landscape and potential threats from other players in the market.

-

Maintaining Market Leadership: Shopify's strategy for maintaining its leading position in the market should be discussed, including its investments in innovation, technological advancements, and its ability to adapt to evolving market trends.

Market Sentiment and Investor Confidence

Keywords: Stock market volatility, investor sentiment, risk tolerance, market trends, technical analysis

The recent surge in Shopify stock is not only due to company-specific factors but also reflects broader market sentiment and investor confidence:

-

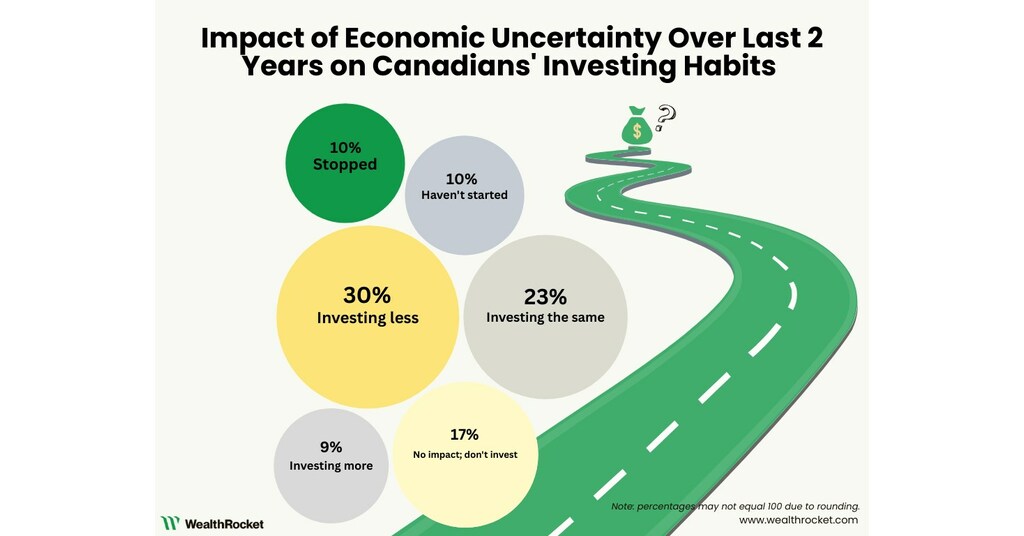

Overall Market Sentiment: The overall state of the stock market, including its volatility and prevailing trends, plays a significant role in influencing the performance of individual stocks like SHOP.

-

Investor Confidence: High investor confidence contributes to increased demand for stocks, driving prices upward. The positive outlook for Shopify, coupled with the Nasdaq 100 inclusion, has significantly boosted investor confidence.

-

Risk and Uncertainty: It’s important to acknowledge inherent risks and uncertainties associated with any investment, particularly in the technology sector. These risks should be discussed.

-

Technical Analysis: Incorporating relevant technical analysis, such as chart patterns and trading volume analysis, can provide further insights into the stock's price movements and support the overall analysis.

Conclusion

Shopify's remarkable 14%+ stock jump is a confluence of factors: its inclusion in the Nasdaq 100, strong Q2 earnings, a positive future outlook, and a robust ecosystem. The influx of passive investment from index funds, coupled with positive investor sentiment, amplified this already impressive growth. While the future performance of Shopify stock is always subject to market fluctuations and unforeseen events, the current indicators suggest a promising trajectory. However, potential investors should conduct their own thorough due diligence and consider their risk tolerance before making any investment decisions. Stay informed on Shopify stock news and market trends to navigate the ever-changing landscape of the e-commerce sector.

Featured Posts

-

Manchester United Assessing The Amorim Transfer Risk

May 14, 2025

Manchester United Assessing The Amorim Transfer Risk

May 14, 2025 -

Could This Be Manchester Uniteds Biggest Transfer Coup Yet

May 14, 2025

Could This Be Manchester Uniteds Biggest Transfer Coup Yet

May 14, 2025 -

Rachel Zegler Represents Snow White In Spain Gal Gadot Missing

May 14, 2025

Rachel Zegler Represents Snow White In Spain Gal Gadot Missing

May 14, 2025 -

Leger Poll Reveals Canadian Business Uncertainty Due To Trade And Economic Concerns

May 14, 2025

Leger Poll Reveals Canadian Business Uncertainty Due To Trade And Economic Concerns

May 14, 2025 -

Disneys Woke Snow White Critical And Commercial Failure

May 14, 2025

Disneys Woke Snow White Critical And Commercial Failure

May 14, 2025

Latest Posts

-

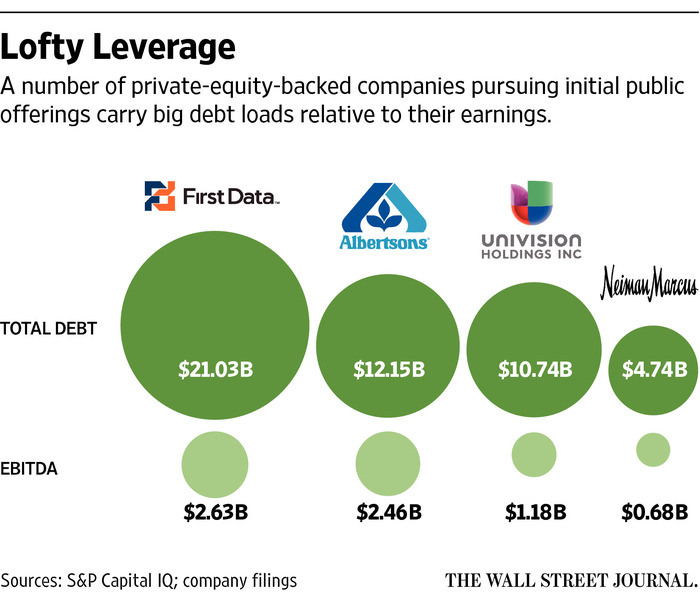

The Impact Of Trump Era Trade Policies On Fintech Ipos Analyzing Affirm Afrm

May 14, 2025

The Impact Of Trump Era Trade Policies On Fintech Ipos Analyzing Affirm Afrm

May 14, 2025 -

How Trump Tariffs Shut The Door On Affirm Holdings Afrm Ipo And Other Fintechs

May 14, 2025

How Trump Tariffs Shut The Door On Affirm Holdings Afrm Ipo And Other Fintechs

May 14, 2025 -

The Trump Tariff Effect A Deep Dive Into Affirm Holdings Afrm Ipo Struggles

May 14, 2025

The Trump Tariff Effect A Deep Dive Into Affirm Holdings Afrm Ipo Struggles

May 14, 2025 -

Figmas Quiet Ipo Push Post Adobe Acquisition Fallout

May 14, 2025

Figmas Quiet Ipo Push Post Adobe Acquisition Fallout

May 14, 2025 -

Trumps Tariffs Did They Kill The Fintech Ipo Market Affirms Afrm Experience

May 14, 2025

Trumps Tariffs Did They Kill The Fintech Ipo Market Affirms Afrm Experience

May 14, 2025