Analysis: The Impact Of Proposed Endowment Tax On Harvard And Yale

Table of Contents

Financial Ramifications of an Endowment Tax on Harvard and Yale

An endowment tax on institutions like Harvard and Yale, with their multi-billion dollar endowments, would have profound financial consequences.

Impact on Operating Budgets

A significant tax on their endowments would directly impact the universities' annual operating budgets. Harvard's endowment, for example, stands at over $50 billion, while Yale's is similarly vast. Even a relatively small percentage tax would generate billions in revenue for the government but could severely cripple university operations. Potential cuts might include:

- Reduced financial aid: This could drastically limit access to higher education for low-income students.

- Decreased research funding: This could stifle groundbreaking scientific discoveries and technological advancements.

- Lower faculty salaries: This could lead to difficulties in attracting and retaining top-tier professors.

- Deferred infrastructure maintenance: This could result in aging buildings and deteriorating facilities.

The resulting shortfall could necessitate substantial tuition increases, making higher education even less accessible.

Investment Strategies and Diversification

An endowment tax could force Harvard and Yale to drastically alter their investment strategies. To mitigate the impact of future taxes, they might:

- Shift away from lower-yielding, but stable, asset classes: This could increase risk and potentially lead to greater volatility in their endowments.

- Increase risk-taking: This could involve investing in higher-risk, higher-return assets, increasing the chance of significant losses.

- Reduce long-term investments: Focusing on short-term gains could hinder the long-term growth and sustainability of the endowments.

However, it's important to note that these universities employ highly skilled investment managers with considerable expertise in managing large and complex portfolios. These professionals will likely attempt to mitigate any negative impacts through sophisticated strategies.

Impact on Philanthropic Giving

A tax on endowments could significantly discourage future donations to these institutions. Donors might:

- Reduce their contributions: Feeling their donations will be partially taxed, they may choose to direct their philanthropy elsewhere.

- Shift philanthropic priorities: Donors might support other causes less affected by potential taxes.

Experts warn of a potential “chilling effect” on philanthropy, where the uncertainty and reduced return on investment dissuade potential donors, ultimately harming the long-term financial health of these universities.

Legal Challenges and Constitutional Considerations

An endowment tax on Harvard and Yale would likely face significant legal challenges.

Arguments Against the Tax

The universities could argue that the tax:

- Violates their non-profit status: They provide significant public benefits through education and research, justifying their tax-exempt status.

- Infringes on their due process rights: A tax specifically targeting their endowments might be considered discriminatory.

- Sets a dangerous precedent: It could open the door to similar taxes on other non-profit organizations and charities.

Legal precedents and arguments focusing on the public good provided by these institutions would be central to any legal battle.

Precedents and Similar Cases

Examining past legal battles involving taxes on non-profits and educational institutions provides valuable insight. Analyzing successful and unsuccessful challenges, including the legal strategies employed, will be crucial in predicting the outcome of any future litigation. Specific cases involving similar taxation attempts on non-profit organizations will be critical in shaping the arguments for or against the proposed endowment tax.

Broader Societal Implications of an Endowment Tax on Harvard and Yale

The consequences of an endowment tax extend far beyond the financial well-being of these two universities.

Access to Higher Education

An endowment tax could significantly impact access to higher education, potentially leading to:

- Increased tuition fees: This would disproportionately affect low and middle-income students.

- Reduced financial aid: This would limit opportunities for students from disadvantaged backgrounds.

- Widening the gap in educational access: This could exacerbate existing inequalities within the higher education system.

Impact on Research and Innovation

Reduced research funding due to the tax could have far-reaching consequences, including:

- Slowdown in scientific breakthroughs: Fundamental research often requires significant financial investment.

- Hindered technological advancements: Innovation relies heavily on research and development.

- Reduced competitiveness: The U.S. could fall behind other nations in key areas of scientific and technological progress.

Effect on the Overall Higher Education Landscape

The impact could ripple through the entire higher education system, potentially leading to:

- Similar taxes on other universities: Setting a precedent could lead to similar taxes on other institutions, both public and private.

- Negative public perception of higher education: This could lead to decreased public support and funding for universities.

Conclusion: The Future of Endowment Taxes on Harvard and Yale – A Call to Action

The potential implementation of an endowment tax on Harvard and Yale presents a complex issue with significant financial, legal, and societal ramifications. This analysis has highlighted the potential for substantial budget cuts, legal challenges, and a chilling effect on philanthropy. Furthermore, the broader impacts on access to higher education, research, and the overall higher education landscape are considerable. While some argue that taxing these massive endowments is a matter of fairness and equitable resource distribution, others warn of the detrimental consequences for research, education, and the future of higher learning.

It is crucial to engage in informed discussion and debate regarding the impact of endowment taxes on institutions like Harvard and Yale. We urge you to research this complex issue further and contact your representatives to voice your concerns about Harvard and Yale endowment taxation. The future of higher education hinges on a thoughtful and comprehensive approach to the debate surrounding endowment taxes.

Featured Posts

-

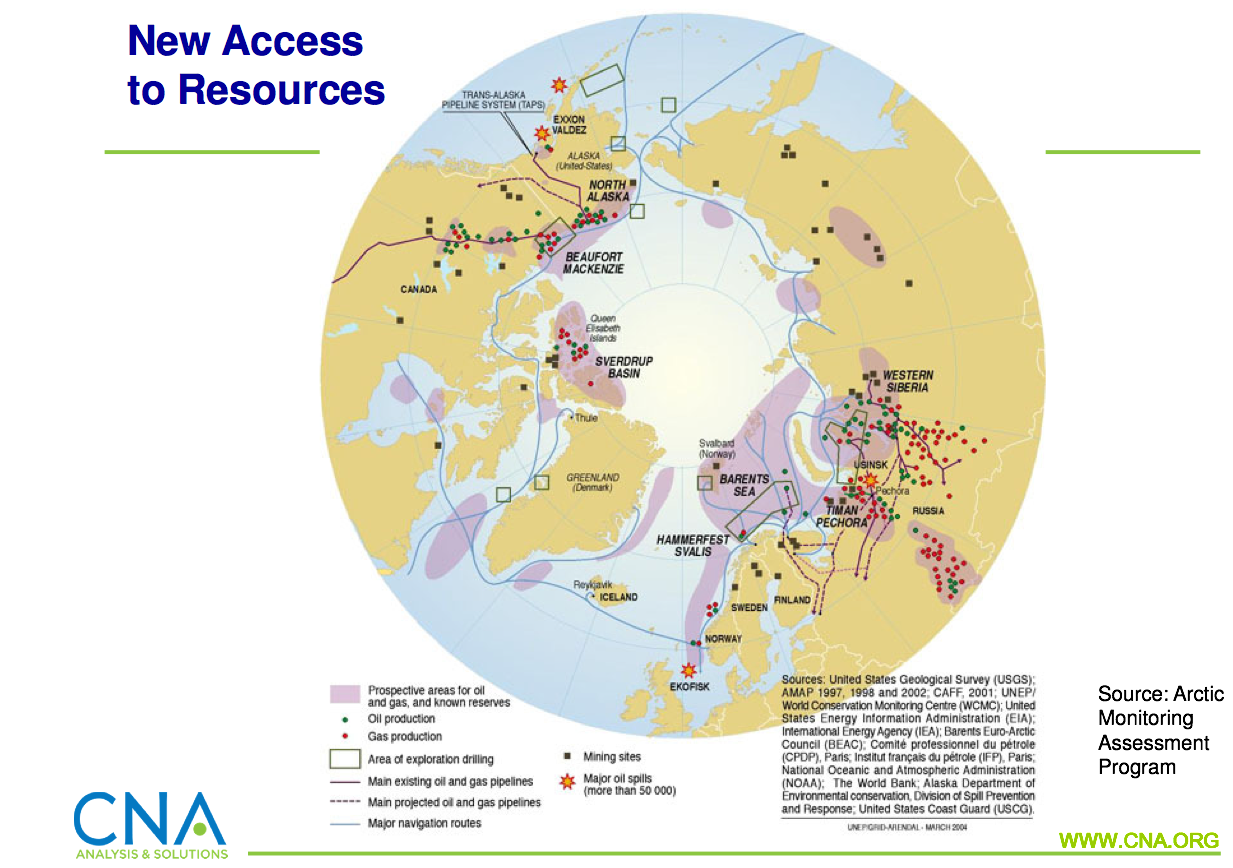

Putins Resurfaced Arctic Fleet Analyzing The Strategic Implications

May 13, 2025

Putins Resurfaced Arctic Fleet Analyzing The Strategic Implications

May 13, 2025 -

V Moskve Sostoitsya Krupniy Rossiysko Myanmanskiy Delovoy Forum

May 13, 2025

V Moskve Sostoitsya Krupniy Rossiysko Myanmanskiy Delovoy Forum

May 13, 2025 -

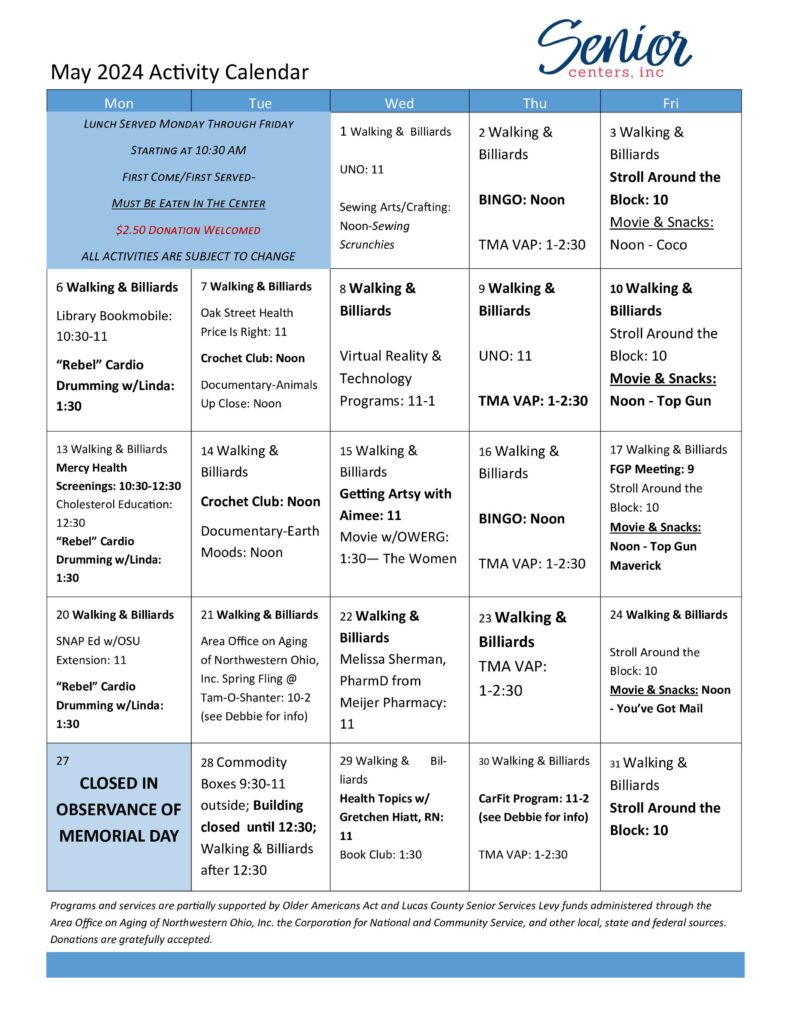

2024 Senior Calendar Of Trips Activities And Events

May 13, 2025

2024 Senior Calendar Of Trips Activities And Events

May 13, 2025 -

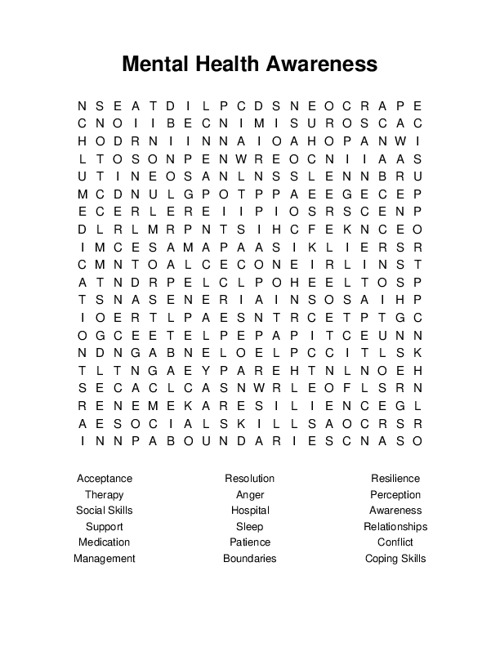

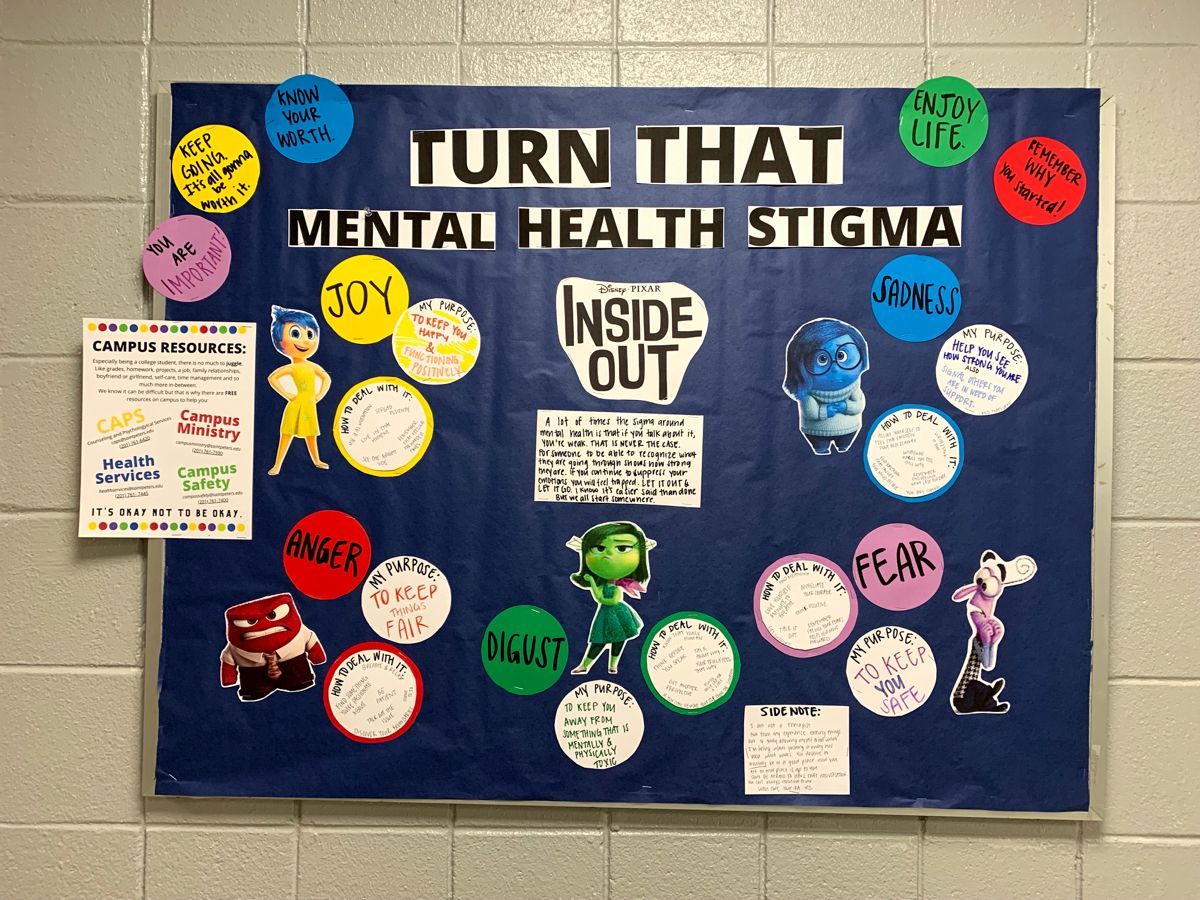

Improve Mental Health Join A Dog Walk In Didcot This Mental Health Awareness Week

May 13, 2025

Improve Mental Health Join A Dog Walk In Didcot This Mental Health Awareness Week

May 13, 2025 -

Walk Your Dog Boost Your Wellbeing Didcot Mental Health Awareness Event

May 13, 2025

Walk Your Dog Boost Your Wellbeing Didcot Mental Health Awareness Event

May 13, 2025

Latest Posts

-

Trumps Plan To Lower Drug Prices Examining The Executive Order

May 13, 2025

Trumps Plan To Lower Drug Prices Examining The Executive Order

May 13, 2025 -

The Implications Of Trumps Executive Order For Drug Costs

May 13, 2025

The Implications Of Trumps Executive Order For Drug Costs

May 13, 2025 -

Analysis Of Trumps Executive Order On Pharmaceutical Prices

May 13, 2025

Analysis Of Trumps Executive Order On Pharmaceutical Prices

May 13, 2025 -

Understanding Trumps Executive Order To Reduce Drug Costs

May 13, 2025

Understanding Trumps Executive Order To Reduce Drug Costs

May 13, 2025 -

Efficient Podcast Production Using Ai To Process Repetitive Documents

May 13, 2025

Efficient Podcast Production Using Ai To Process Repetitive Documents

May 13, 2025