Analysts Reset Palantir Stock Forecast: Understanding The Recent Rally

Table of Contents

The Recent Palantir Stock Rally: A Deep Dive

The recent surge in Palantir stock price has been nothing short of remarkable. After a period of relative stagnation, the PLTR stock experienced a significant price increase, climbing [Insert Percentage]% in [Insert Timeframe, e.g., the last month]. This impressive rally is clearly visible in the following chart:

[Insert Chart/Graph showing Palantir stock price performance over the relevant timeframe]

Specific dates and price points are key to understanding the magnitude of this change. For example, on [Date], the Palantir stock price stood at [Price], while on [Date], it reached [Price], a substantial increase. Several factors contributed to this impressive rally:

- Positive Earnings Reports: Palantir's recent earnings reports exceeded analysts' expectations, showcasing strong revenue growth and improved profitability. This positive financial performance instilled confidence among investors, driving up the Palantir stock price.

- New Contract Wins: The company secured several significant new contracts, both in the government and commercial sectors. These wins demonstrate Palantir's continued success in attracting major clients and expanding its market reach. This strengthened the Palantir stock prediction for many analysts.

- Improved Guidance: Palantir provided upbeat guidance for future quarters, indicating continued growth and profitability. This positive outlook reassured investors about the long-term prospects of the company, contributing to the Palantir rally.

- Comparison to Market Trends: It's important to contextualize the Palantir stock price increase against broader market trends. While the overall market experienced [Describe overall market trend], the performance of Palantir significantly outpaced these trends. This suggests that investor confidence in Palantir is growing independently of general market sentiment.

- Significant News Events: Any significant news or events (e.g., partnerships, product launches, regulatory changes) impacting Palantir should be mentioned here and linked to the price movements.

Revised Analyst Forecasts and Their Implications

Following the recent Palantir rally, analysts have revised their forecasts for the PLTR stock price. Many have increased their price targets, reflecting a more optimistic outlook for the company. The range of forecasts varies, with some analysts predicting a price of [Price] while others suggest a higher target of [Price]. The average price target among analysts now sits at approximately [Average Price].

- Examples of Revised Forecasts: [Mention specific examples of revised forecasts from reputable analysts and financial institutions, e.g., "Goldman Sachs raised its price target from $X to $Y," "Morgan Stanley maintained its 'Overweight' rating but increased its target to $Z."]

- Rationale Behind Revisions: Analysts cite several reasons for their updated predictions, including improved financial performance, new contract wins, and the company's strong position in the growing data analytics market. Their analysis usually considers factors like revenue growth, profitability, and competitive landscape.

- Comparison with Previous Predictions: A comparison of the new forecasts with previous predictions is crucial to assess the accuracy of analyst predictions and understand the shift in market sentiment toward Palantir stock.

Key Factors Driving the Palantir Stock Price Movement

Several key factors are driving the recent movement in Palantir stock price. Understanding these factors is crucial for evaluating the long-term outlook for the company.

- Financial Performance: Palantir's financial performance, including revenue growth, profitability (margins), and cash flow, is a primary driver of its stock price. Strong financial results build investor confidence, pushing the price upward.

- Government Contracts and Commercial Partnerships: Palantir's success in securing both government contracts and commercial partnerships plays a vital role in its revenue growth and future potential. These contracts often represent significant revenue streams.

- Technological Advancements and Market Competition: Palantir's ability to innovate and adapt to the ever-evolving data analytics market is crucial. Its competitive advantage and the market's reception of its technological advancements heavily influence investor sentiment and the Palantir stock price.

Assessing the Long-Term Outlook for Palantir

While the recent rally is encouraging, it's crucial to consider potential risks and challenges before making any investment decisions.

- Potential Risks: The company faces several challenges, including intense competition in the data analytics market, potential regulatory hurdles, and vulnerability to economic downturns.

- Long-Term Growth Potential: Palantir's long-term growth potential is linked to its ability to expand its customer base in both the government and commercial sectors and to maintain its technological edge. The sustainability of its growth trajectory will depend on consistent innovation and successful execution of its business strategy.

- Valuation and Future Potential: A thorough assessment of Palantir's valuation relative to its growth prospects and its potential within the data analytics industry is essential for evaluating the investment's risk-reward profile.

Conclusion

The recent rally in Palantir stock, fueled by positive earnings, new contracts, and revised analyst forecasts, presents a complex picture for investors. Understanding the key factors driving this price movement, including the company's financial performance, competitive landscape, and long-term growth prospects, is paramount. While the potential rewards are significant, it's essential to acknowledge the inherent risks.

Stay informed on the latest Palantir stock forecasts and make smart investment choices. Conduct thorough research and consider all available information before making any investment decisions regarding Palantir stock (PLTR). For further information, consult reputable financial news sources and Palantir's investor relations website.

Featured Posts

-

Analyzing Figmas Ai Advantage Over Adobe Word Press And Canva

May 09, 2025

Analyzing Figmas Ai Advantage Over Adobe Word Press And Canva

May 09, 2025 -

Liges Se Kampioneve Psg Me Formacionin Me Te Forte Ne Gjysmefinale

May 09, 2025

Liges Se Kampioneve Psg Me Formacionin Me Te Forte Ne Gjysmefinale

May 09, 2025 -

String Of Car Break Ins Reported Across Elizabeth City Apartment Complexes

May 09, 2025

String Of Car Break Ins Reported Across Elizabeth City Apartment Complexes

May 09, 2025 -

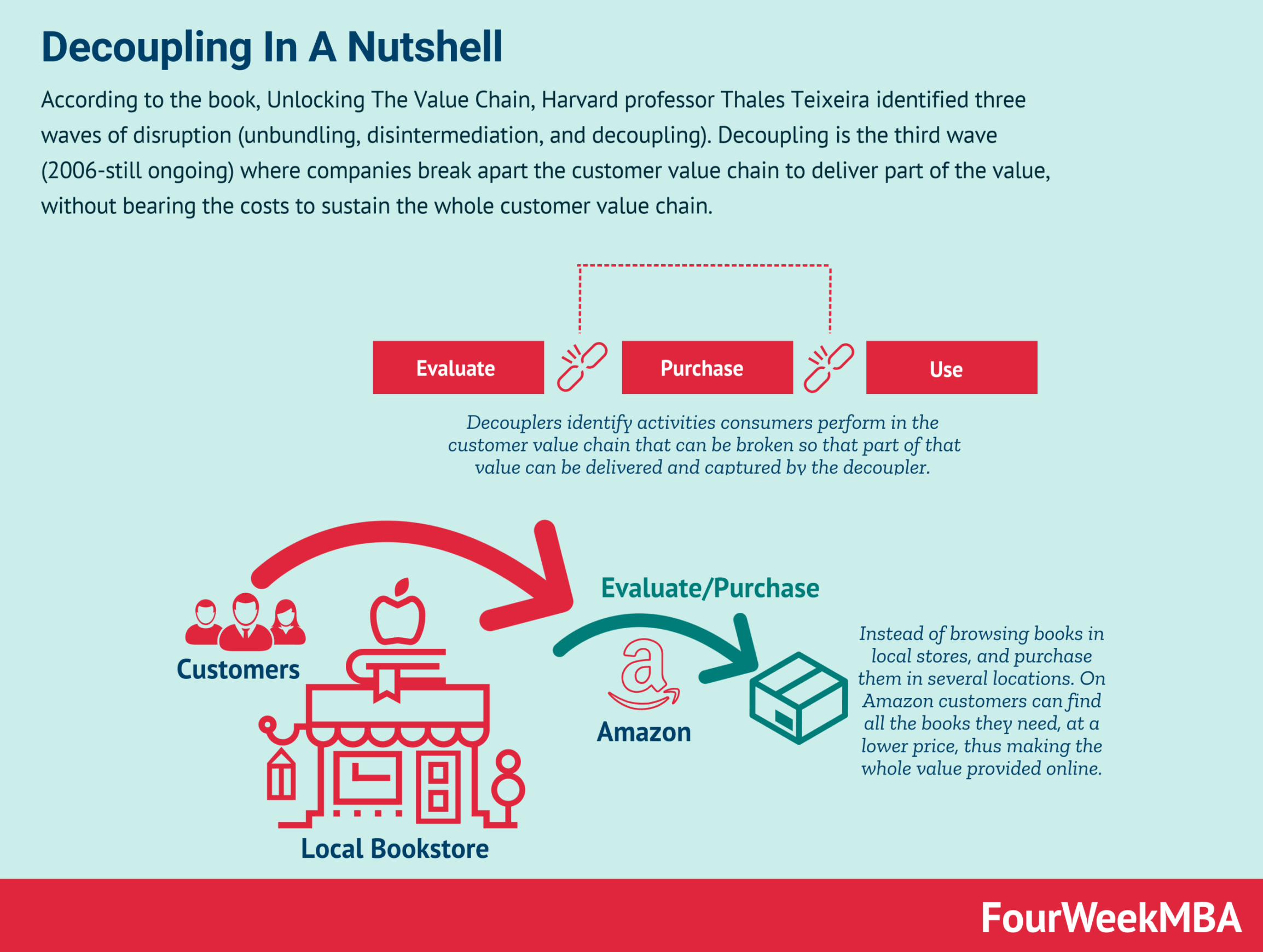

Managing Risk In The Era Of The Great Decoupling

May 09, 2025

Managing Risk In The Era Of The Great Decoupling

May 09, 2025 -

Celtics Jayson Tatum Suffers Visible Ankle Injury What We Know

May 09, 2025

Celtics Jayson Tatum Suffers Visible Ankle Injury What We Know

May 09, 2025