Analyzing Nvidia's Forecast: Balancing Growth With China Market Risks

Table of Contents

Nvidia's Growth Projections and Key Drivers

Nvidia's optimistic outlook is fueled by several key drivers, primarily centered around the exploding demand for its high-performance computing solutions.

Strong Demand in AI and Data Centers

The current demand for Nvidia GPUs in AI, machine learning, high-performance computing (HPC), and data centers is unprecedented. This surge is driven by several factors:

- The rise of generative AI: Models like large language models (LLMs) and diffusion models require immense computational power, making Nvidia's A100 and H100 GPUs indispensable.

- Increased cloud computing adoption: Data centers worldwide are expanding rapidly, fueling demand for high-performance computing resources.

- Advancements in scientific research: Fields like drug discovery, climate modeling, and genomics rely heavily on HPC solutions powered by Nvidia GPUs.

Nvidia's market share in these sectors is substantial, and analysts predict continued double-digit growth rates in the coming years. For instance, a recent report from [insert credible source and data here] projects a [insert percentage]% growth in the AI accelerator market by [insert year]. This strong performance significantly contributes to a positive Nvidia's forecast.

Gaming Market Performance and Future Outlook

While the gaming market has shown some recent volatility, it remains a vital contributor to Nvidia's revenue. The long-term outlook for gaming remains positive, driven by:

- The emergence of cloud gaming: Services like GeForce Now are expanding access to high-quality gaming experiences.

- Advancements in gaming technology: The increasing adoption of ray tracing and other advanced graphics techniques necessitates more powerful GPUs.

- Growth in esports and competitive gaming: This expanding sector fuels demand for high-end gaming hardware.

However, challenges persist: competition from AMD and Intel, economic downturns affecting consumer spending, and the potential for cryptocurrency mining regulations to impact GPU demand all pose potential risks to Nvidia's gaming-related revenue projections within Nvidia's forecast.

China Market Risks and Mitigation Strategies

Despite the positive growth projections, Nvidia faces considerable challenges in navigating the complexities of the Chinese market.

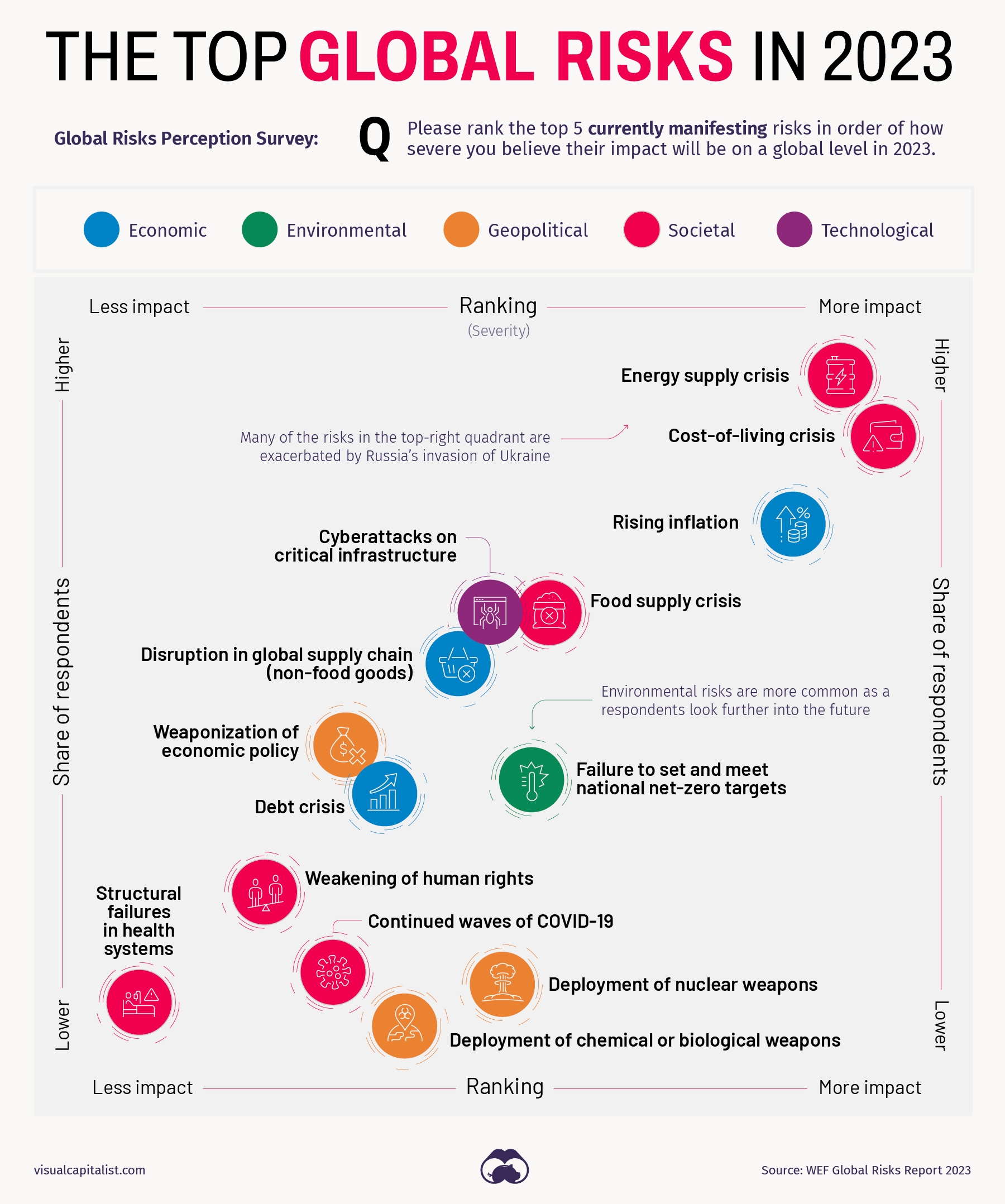

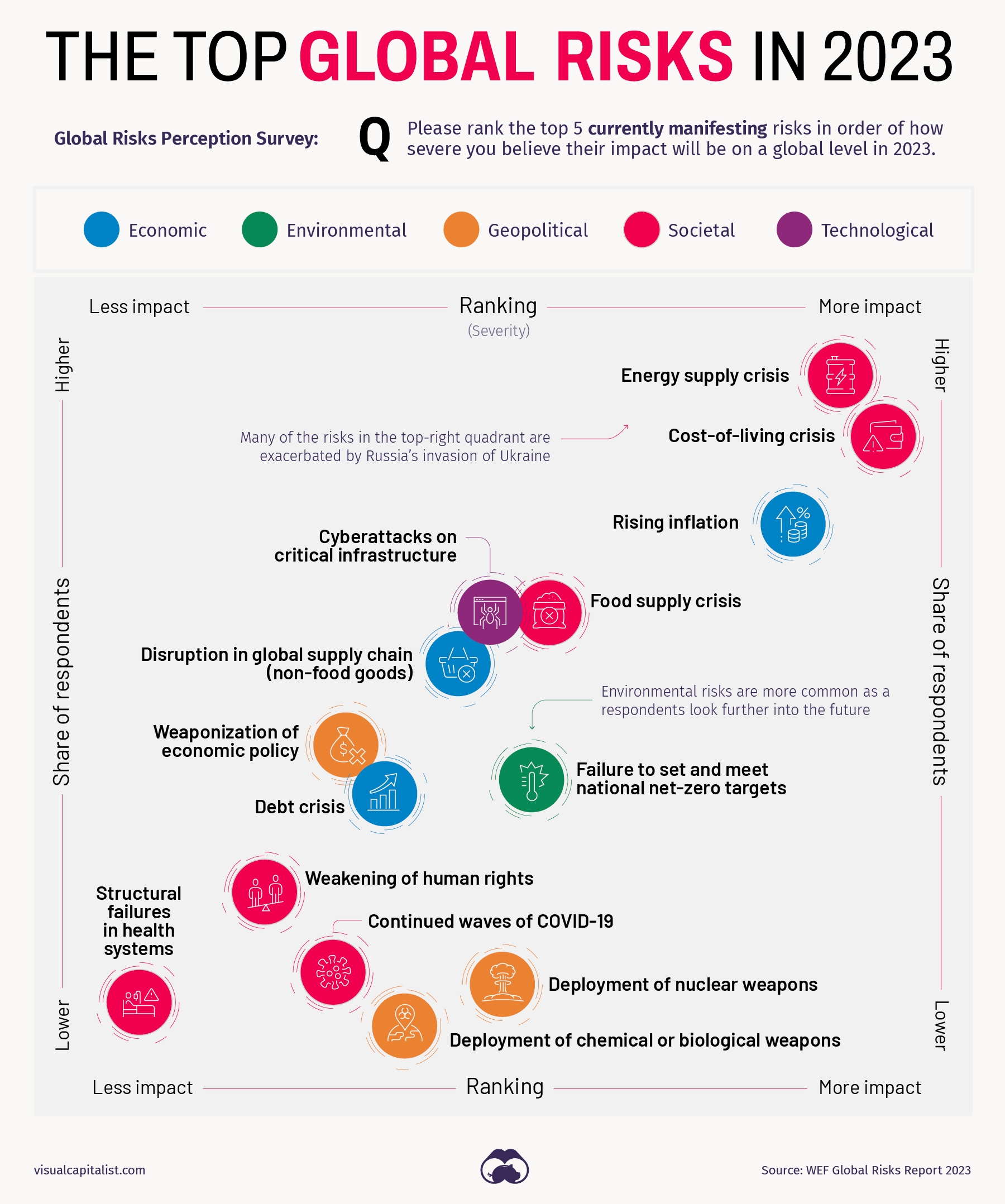

Geopolitical Uncertainty and Trade Restrictions

The ongoing US-China trade tensions present significant headwinds for Nvidia. Potential sanctions or export controls on advanced semiconductor technology could severely restrict Nvidia's ability to sell its most advanced GPUs to Chinese customers, impacting its revenue and Nvidia's forecast. The unpredictable nature of geopolitical relations adds considerable uncertainty. Supply chain disruptions due to trade restrictions also pose a significant risk.

Competition from Domestic Chinese Chipmakers

Chinese semiconductor companies are rapidly advancing their technological capabilities. Companies like [mention specific Chinese competitors] are increasingly competing with Nvidia in the domestic market, potentially eroding Nvidia's market share and impacting the accuracy of Nvidia's forecast. This competition is further intensified by government support for domestic chipmakers.

Nvidia's Strategies to Mitigate China Risks

Nvidia is actively pursuing strategies to mitigate its dependence on the Chinese market:

- Diversification of markets: Investing heavily in other regions like Europe, North America, and Southeast Asia to reduce reliance on a single market.

- Development of alternative technologies: Focusing on software and other complementary technologies to lessen the impact of potential hardware restrictions.

- Strategic partnerships: Collaborating with global partners to strengthen its supply chain resilience and market access.

The effectiveness of these mitigation strategies remains to be seen and is a key factor influencing the long-term viability of Nvidia's forecast.

Financial Analysis and Valuation of Nvidia's Forecast

Understanding the financial underpinnings of Nvidia's forecast is crucial for accurate assessment.

Revenue Projections and Profitability

Nvidia's forecast projects significant revenue growth driven by the factors mentioned above. However, analyzing the assumptions underlying these projections is vital. Are the projected growth rates in AI and data centers realistic, considering potential macroeconomic slowdowns and competitive pressures? A careful examination of profit margins and profitability is equally important to ascertain the financial health and sustainability of the projected growth.

Stock Valuation and Investor Sentiment

Nvidia's stock valuation reflects investor sentiment regarding the company's future prospects. While high valuations indicate confidence in Nvidia's forecast, it's crucial to consider potential risks, including geopolitical instability, competition, and macroeconomic factors. Analyzing investor sentiment through news articles, analyst reports, and market data provides a comprehensive understanding of the market's perception of Nvidia's future performance.

Conclusion

Nvidia's forecast paints a picture of significant growth, primarily driven by the burgeoning AI and data center markets. However, the significant risks associated with the China market necessitate a cautious approach. Geopolitical uncertainties, competition from domestic Chinese chipmakers, and potential trade restrictions create a volatile environment. While Nvidia is implementing mitigation strategies, continued monitoring of these risks is paramount. Understanding the intricacies of Nvidia's forecast and its inherent challenges requires a comprehensive analysis of financial performance, market position, and geopolitical exposure. Therefore, continuous analysis of Nvidia's forecast and its response to the China market is essential for informed decision-making by investors and industry analysts alike. Stay informed and continue to analyze Nvidia's forecast to make informed decisions.

Featured Posts

-

San Diego Water Authority Selling Surplus Water Cost Reduction Strategy

May 30, 2025

San Diego Water Authority Selling Surplus Water Cost Reduction Strategy

May 30, 2025 -

Grand Est Polemique Autour Des Subventions Pour Un Concert De Medine

May 30, 2025

Grand Est Polemique Autour Des Subventions Pour Un Concert De Medine

May 30, 2025 -

Olokliromenos Odigos Tileoptikon Metadoseon 10 5

May 30, 2025

Olokliromenos Odigos Tileoptikon Metadoseon 10 5

May 30, 2025 -

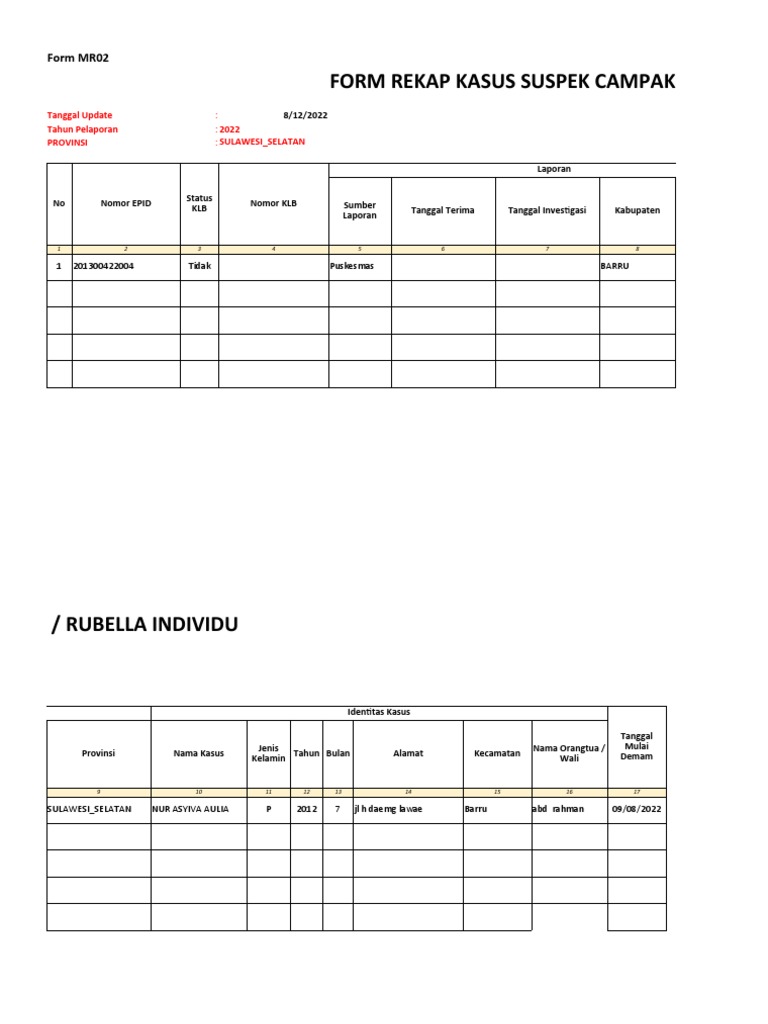

Meningkatnya Kasus Suspek Campak Di Pohuwato Ancaman Bagi Kesehatan Anak

May 30, 2025

Meningkatnya Kasus Suspek Campak Di Pohuwato Ancaman Bagi Kesehatan Anak

May 30, 2025 -

Agassi Recuerda A Su Rival Sudamericano Rios Entre Sus Principales Oponentes

May 30, 2025

Agassi Recuerda A Su Rival Sudamericano Rios Entre Sus Principales Oponentes

May 30, 2025