Analyzing Palantir Stock Before Its May 5th Earnings Report

Table of Contents

Palantir's Recent Performance and Market Trends

Palantir's recent stock performance has mirrored the broader tech sector's rollercoaster ride. Understanding the factors driving these fluctuations is crucial for a comprehensive Palantir stock analysis. The PLTR stock chart reveals periods of significant gains and losses, influenced by a confluence of factors.

-

Review of PLTR stock price movement in the past quarter: The past quarter has seen a mixed bag for PLTR, with periods of growth followed by corrections. Analyzing these shifts requires considering broader market trends.

-

Discussion of key factors driving stock price fluctuations: Interest rate hikes by the Federal Reserve, persistent inflation, and overall investor sentiment towards the tech sector have all played a role in influencing Palantir's stock price. Concerns about the slowing global economy are also relevant.

-

Comparison to competitor performance in the big data analytics space: Comparing Palantir's performance to competitors like Databricks and Snowflake provides valuable context. Examining their market share and growth rates helps gauge Palantir's competitive position.

-

Analysis of overall market sentiment toward Palantir: News coverage, analyst ratings, and social media sentiment provide a sense of the overall market's perception of Palantir and its future prospects. Understanding this sentiment is crucial for gauging potential investor reaction to the upcoming earnings report.

Key Financial Metrics to Watch in the Earnings Report

The May 5th Palantir earnings report will be scrutinized for key financial metrics that offer insights into the company's financial health and future prospects. Investors will be keenly focused on the following:

-

Revenue growth (YoY and QoQ): Year-over-year (YoY) and quarter-over-quarter (QoQ) revenue growth are crucial indicators of Palantir's ability to expand its customer base and increase sales. Sustained high growth rates will likely be viewed positively.

-

Earnings per share (EPS): EPS indicates the company's profitability on a per-share basis. Exceeding expectations will boost investor confidence.

-

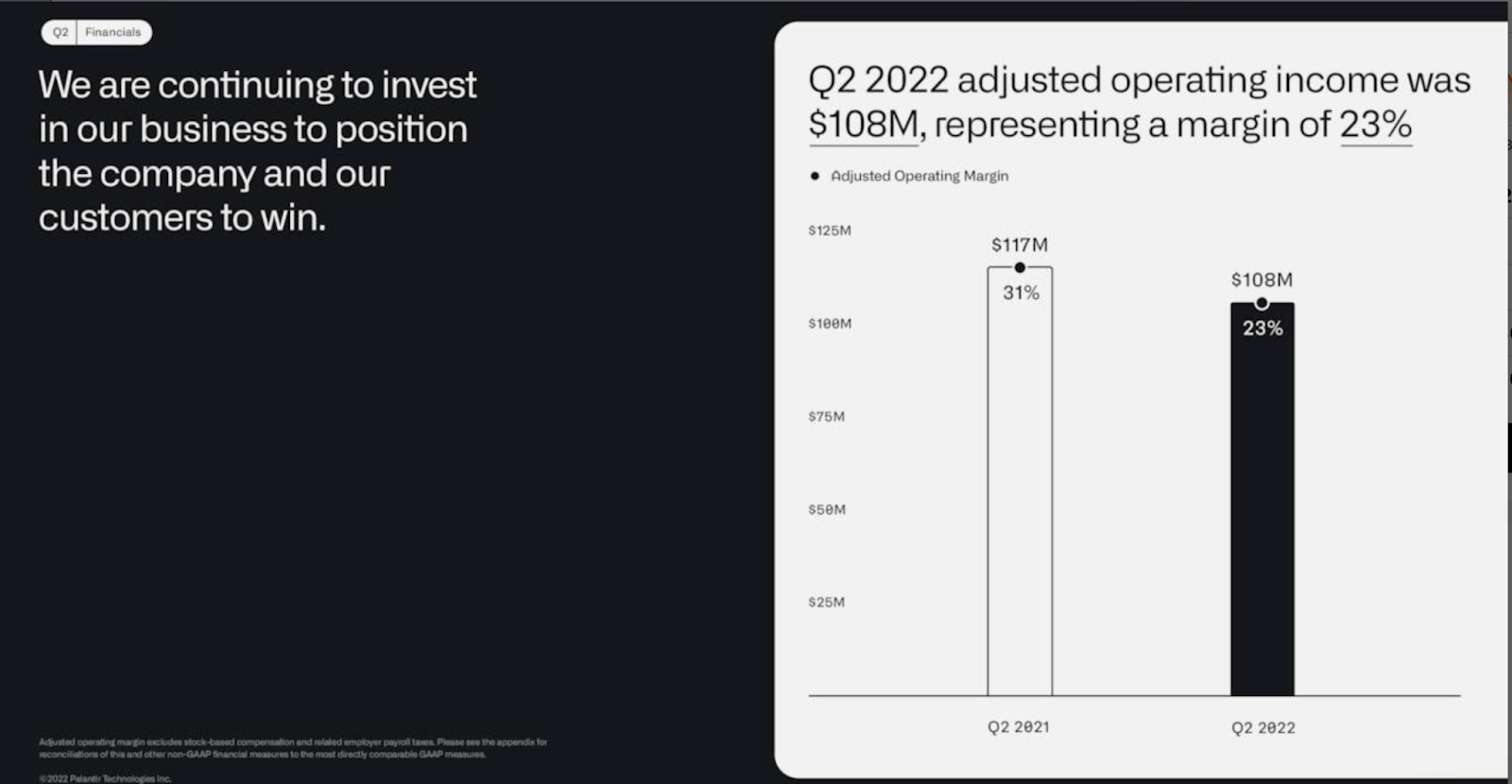

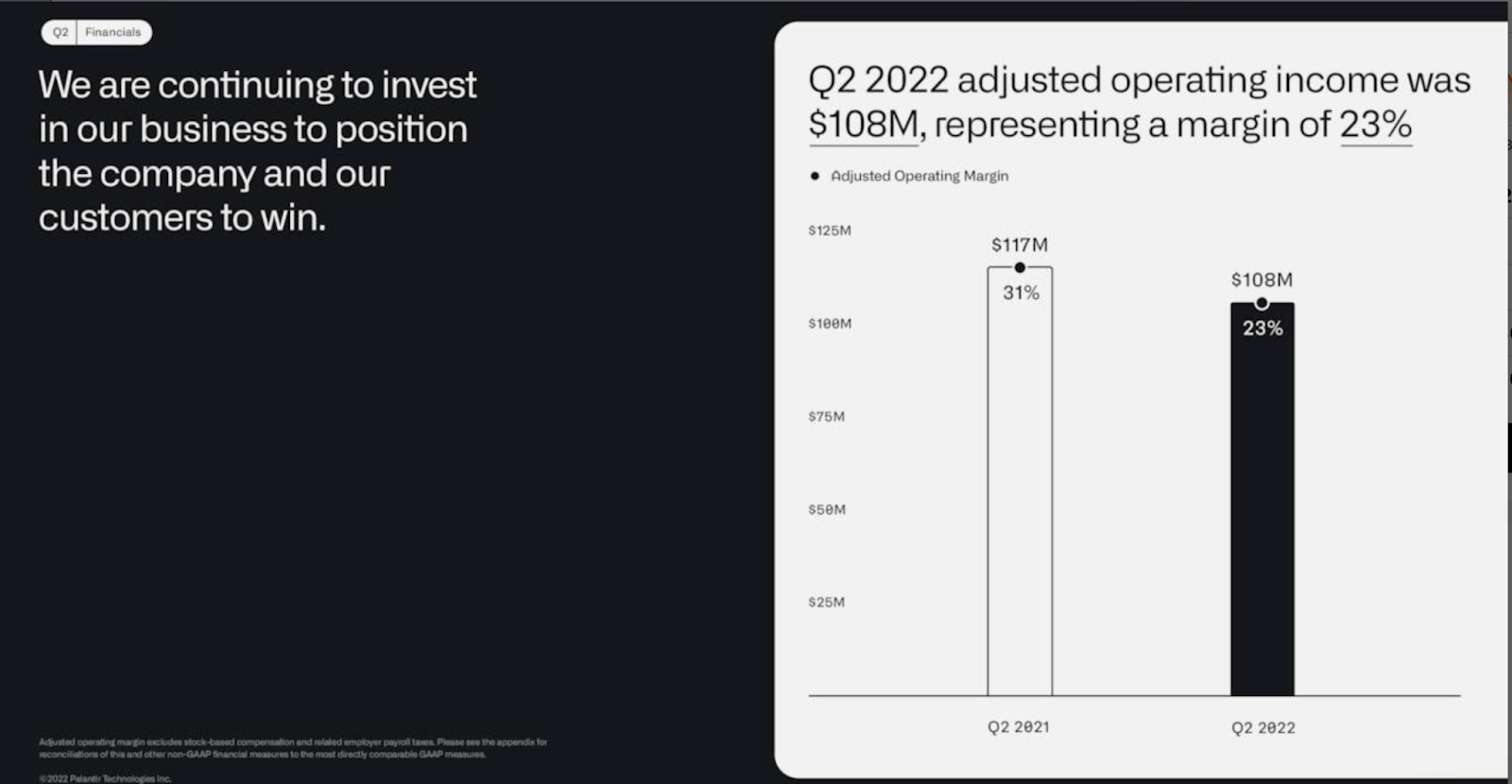

Operating margin: Operating margin reveals Palantir's operational efficiency. Improvements in operating margin suggest enhanced cost management.

-

Customer acquisition cost: This metric is vital for understanding the efficiency of Palantir's sales and marketing efforts. A decreasing customer acquisition cost suggests improved efficiency.

-

Guidance for future quarters: Palantir's guidance for the upcoming quarters will be closely examined for signs of sustained growth or potential headwinds. Positive guidance often signals future success. Investors will carefully analyze the earnings call for detailed explanations of these metrics.

Assessing Palantir's Long-Term Growth Potential

Palantir's long-term growth potential hinges on several factors, including its expansion into new markets, its government contracts, and the overall demand for its sophisticated data analytics platforms.

-

Discussion of Palantir's AI initiatives and their potential impact: Palantir's investments in artificial intelligence and machine learning are expected to significantly boost its capabilities and broaden its market reach. This will be a key factor in long-term growth.

-

Analysis of the company's strategy for penetrating the commercial market: Palantir's success in expanding its commercial client base will be pivotal for sustained revenue growth. Its strategy in this sector is critical for long-term success.

-

Evaluation of the sustainability of its government contracts: Government contracts form a significant portion of Palantir's revenue. Analyzing the sustainability and potential for future contracts is crucial for assessing long-term stability.

-

Assessment of competitive threats and market saturation risks: The competitive landscape in the big data analytics market is increasingly crowded. Analyzing Palantir's competitive advantages and the potential for market saturation is vital for evaluating its long-term potential.

Analyzing Palantir's Customer Base and Partnerships

Examining Palantir's customer base and partnerships provides valuable insights into its market position and future growth prospects.

-

Palantir customers: The diversity and strength of Palantir's client base, encompassing both government agencies and commercial enterprises, are significant factors in evaluating its stability and growth potential. A diversified customer base reduces risk.

-

Palantir partnerships: Strategic alliances and collaborations can significantly impact Palantir's growth trajectory. Analyzing existing partnerships and the potential for future collaborations is key to understanding its future prospects. Customer retention rates also offer valuable insight into customer satisfaction and loyalty.

Conclusion

Analyzing Palantir stock before the May 5th earnings report requires a careful consideration of both short-term market dynamics and long-term growth potential. Key financial metrics like revenue growth, EPS, and operating margin will be closely scrutinized. Palantir's strategic initiatives in AI and the commercial sector, as well as the sustainability of its government contracts, are all crucial factors. While the potential for significant gains exists, investors should conduct their own thorough due diligence before making any investment decisions. Remember to stay updated on post-earnings report analysis for a more informed decision on Palantir stock. Understanding the nuances of the Palantir earnings report and its implications for Palantir stock price is essential for making sound investment choices. Conduct your own in-depth Palantir stock analysis to determine the best course of action for your portfolio.

Featured Posts

-

Analysis Trump Teams Push For Rapid Nuclear Power Plant Development

May 10, 2025

Analysis Trump Teams Push For Rapid Nuclear Power Plant Development

May 10, 2025 -

Trump Executive Orders Impact On Transgender Individuals

May 10, 2025

Trump Executive Orders Impact On Transgender Individuals

May 10, 2025 -

Bangkok Post Reports On The Mounting Pressure For Transgender Rights

May 10, 2025

Bangkok Post Reports On The Mounting Pressure For Transgender Rights

May 10, 2025 -

Go Compare Ad Campaign Controversy Wynne Evans Removal Following Sexism Claims

May 10, 2025

Go Compare Ad Campaign Controversy Wynne Evans Removal Following Sexism Claims

May 10, 2025 -

Dijon 2026 Le Projet Ecologique Pour Les Municipales

May 10, 2025

Dijon 2026 Le Projet Ecologique Pour Les Municipales

May 10, 2025