Analyzing Palantir Stock Before The May 5th Earnings Announcement

Table of Contents

Palantir Technologies (PLTR) is set to release its earnings report on May 5th, creating considerable anticipation among investors. This analysis delves into crucial factors influencing Palantir stock before this pivotal date, helping you make informed investment decisions. We'll examine recent performance, upcoming catalysts, and potential risks to guide your approach to Palantir stock. Understanding these factors is crucial for navigating the complexities of the PLTR stock price and making smart investment choices.

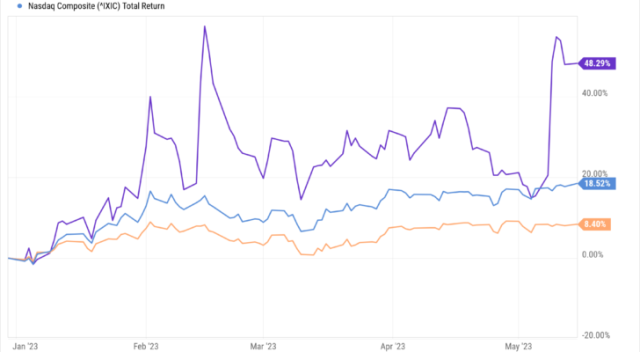

Recent Palantir Stock Performance and Market Sentiment

Analyzing Palantir stock requires examining its recent price movements within the broader market context. The company's valuation isn't solely determined by its internal performance; external factors play a significant role.

-

Review of PLTR's stock price changes in the last quarter: Tracking the stock's performance over the past three months gives a clear picture of its recent trajectory. This includes identifying any significant upward or downward trends, and correlating them with specific news events or market fluctuations.

-

Comparison to sector peers and market indices (e.g., S&P 500, Nasdaq): Comparing Palantir's performance to similar companies in the big data analytics sector and broader market indices like the S&P 500 and Nasdaq provides valuable context. This reveals whether PLTR is outperforming or underperforming its peers and the overall market.

-

Summary of recent news impacting Palantir's stock price: News items, such as new contract announcements, partnerships, regulatory changes, or competitor actions, directly affect investor sentiment and, consequently, the Palantir stock price. Analyzing these news items is crucial for understanding price fluctuations.

-

Analysis of positive and negative investor sentiment expressed online and in financial news: Investor sentiment, reflected in online forums, social media, and financial news articles, can offer insights into market expectations and potential future price movements. Positive sentiment typically indicates bullish expectations, while negative sentiment suggests bearishness. Analyzing this sentiment helps gauge the overall market outlook for Palantir.

Key Factors to Consider Before the Earnings Announcement

Several key factors will significantly influence Palantir stock's performance following the May 5th earnings announcement. Understanding these factors is critical for informed investment decisions.

Revenue Growth and Profitability

Examining Palantir's revenue growth, particularly within its Government and Commercial sectors, is paramount. Progress toward profitability and operating margins are also key indicators of financial health.

-

Analysis of revenue growth rates in the last few quarters: Consistent and accelerating revenue growth signals a healthy and expanding business. Conversely, slowing growth could raise concerns.

-

Discussion of the company's path to profitability: Investors closely watch Palantir's progress toward profitability. Analyzing its operating expenses, cost-cutting measures, and revenue projections offers insight into its potential to achieve profitability.

-

Examination of operating margins and their implications: Operating margins reveal Palantir's efficiency in converting revenue into profit. Improving margins indicate better cost management and increased profitability.

Government Contracts and New Business

Government contracts form a substantial part of Palantir's revenue. The pipeline of potential deals and the success in securing new contracts directly impact future growth. Geopolitical factors also influence this sector.

-

Overview of recent contract wins and losses: Tracking recent contract wins and losses provides a clear indication of Palantir's success in securing new business.

-

Analysis of the company's government contracting strategy: Understanding Palantir's strategy in winning government contracts, including its bidding process and relationships with government agencies, helps predict its future success.

-

Discussion of potential geopolitical risks and opportunities: Geopolitical events can significantly impact government spending and, subsequently, Palantir's revenue stream. Analyzing these factors is essential for assessing potential risks and opportunities.

Competition and Market Share

The competitive landscape within the big data and analytics market significantly impacts Palantir's market share and stock price.

-

Identification of key competitors in the big data and analytics market: Identifying key competitors, such as AWS, Microsoft Azure, and Google Cloud, helps understand Palantir's competitive positioning.

-

Assessment of Palantir's competitive advantages: Analyzing Palantir's strengths, such as its specialized software and strong government relationships, is vital for understanding its ability to maintain or increase market share.

-

Discussion of potential threats to Palantir's market position: Evaluating potential threats from competitors, including pricing pressure, technological advancements, and new market entrants, is crucial for assessing risk.

Potential Risks and Opportunities for Palantir Stock

Investing in Palantir stock, like any investment, involves both risks and opportunities. Understanding these factors is crucial for making informed decisions.

-

Identification of key risks and uncertainties facing Palantir: These include market volatility, intense competition, regulatory changes, and dependence on government contracts.

-

Evaluation of the potential impact of these risks on the stock price: Assessing the potential impact of these risks on the stock price allows for a more realistic expectation of future performance.

-

Discussion of potential opportunities for future growth: These include expansion into new markets, technological advancements, and increased adoption of its software across various sectors.

Conclusion

Analyzing Palantir stock before the May 5th earnings announcement requires a careful evaluation of recent performance, upcoming catalysts, and potential risks. Revenue growth, government contracts, competition, and market sentiment all play crucial roles in shaping the stock's future trajectory. While Palantir presents significant growth opportunities, investors must also consider the inherent risks associated with the stock.

Before making any decisions about your Palantir stock holdings, conduct thorough research and consider consulting a financial advisor. Continue to monitor Palantir stock and its performance after the May 5th earnings announcement. Remember, this analysis is for informational purposes only and does not constitute financial advice. Stay informed on all developments concerning Palantir stock and make educated decisions.

Featured Posts

-

Enquete Ouverte Apres La Chute Mortelle D Un Ouvrier A Dijon

May 10, 2025

Enquete Ouverte Apres La Chute Mortelle D Un Ouvrier A Dijon

May 10, 2025 -

Bondi Under Fire Senate Democrats Allege Suppression Of Epstein Documents

May 10, 2025

Bondi Under Fire Senate Democrats Allege Suppression Of Epstein Documents

May 10, 2025 -

Can Palantir Hit A Trillion Dollar Valuation By 2030

May 10, 2025

Can Palantir Hit A Trillion Dollar Valuation By 2030

May 10, 2025 -

Bajaj Twins Drag On Sensex And Nifty 50 Todays Stock Market Summary

May 10, 2025

Bajaj Twins Drag On Sensex And Nifty 50 Todays Stock Market Summary

May 10, 2025 -

Open Ai Facing Ftc Investigation Analyzing The Potential Impact

May 10, 2025

Open Ai Facing Ftc Investigation Analyzing The Potential Impact

May 10, 2025