Analyzing Palantir Stock Before The May 5th Earnings Release

Table of Contents

Palantir's Recent Performance and Key Metrics

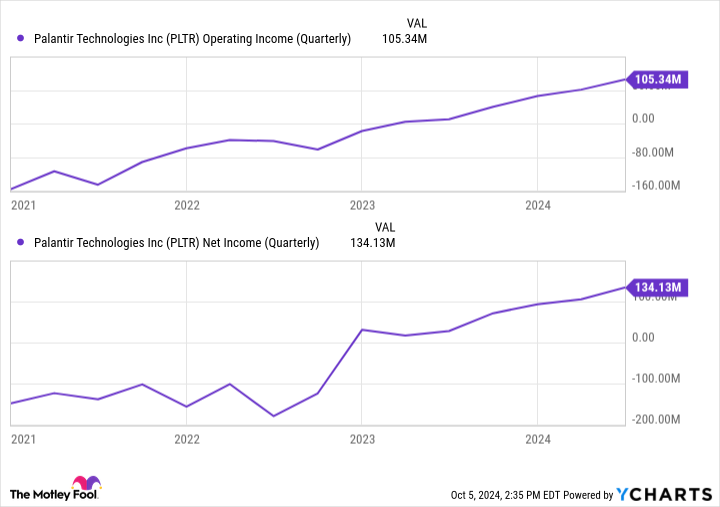

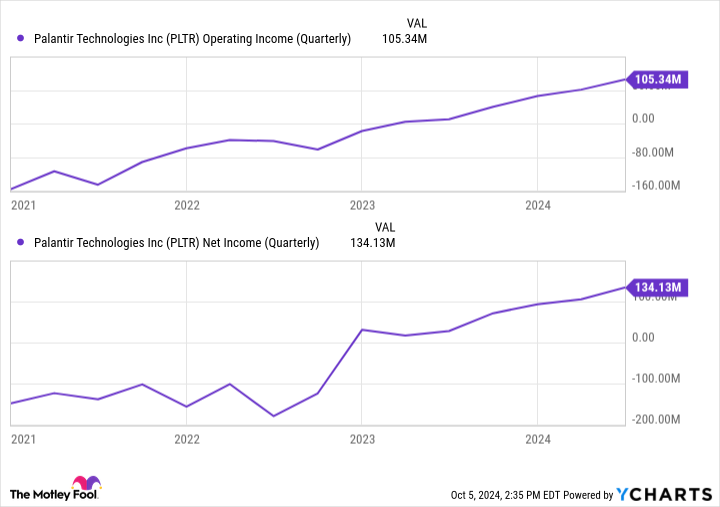

Analyzing Palantir's recent financial performance is critical for predicting its future trajectory. We need to look beyond the headlines and delve into the numbers presented in recent quarterly and annual reports. Key performance indicators (KPIs) provide a clearer picture of the company's health and growth potential.

-

Revenue Growth: Comparing revenue growth across quarters and years reveals trends in market penetration and product adoption. A consistent upward trend suggests strong market demand and successful execution of the company's strategy. Conversely, declining revenue would raise concerns. [Link to Palantir's latest financial report]

-

Profitability: Gross and operating margins offer insights into Palantir's cost efficiency and pricing strategies. Improving margins signify enhanced profitability and operational effectiveness. [Link to relevant financial news article on Palantir's margins]

-

Customer Acquisition and Retention: High customer acquisition and strong retention rates are vital for sustainable growth. This data reflects the effectiveness of Palantir's sales and marketing efforts, as well as the value proposition of its products.

-

Government vs. Commercial Revenue: Analyzing the breakdown of revenue between government and commercial sectors provides insights into the diversification of Palantir's revenue streams and potential future growth drivers. The relative strength of each sector can influence investor sentiment.

-

Cash Flow and Debt Levels: A healthy cash flow and manageable debt are crucial for long-term stability. Strong cash flow provides flexibility to invest in growth initiatives and withstand economic downturns. High levels of debt can present significant financial risks.

Recent news regarding new contracts with major government agencies or significant commercial partnerships could significantly impact Palantir's performance and subsequent Palantir stock valuation. Staying informed about such developments is paramount.

Growth Prospects and Future Outlook for Palantir

Palantir's growth strategy hinges on expanding into new markets and sectors, leveraging its AI-driven platforms. Several key factors contribute to its future outlook:

-

AI-Driven Platform Adoption: The increasing demand for AI-powered data analytics solutions positions Palantir favorably for significant growth. Its ability to adapt and innovate in this rapidly evolving landscape will be crucial.

-

Government and Commercial Sector Growth: Palantir’s success in both government and commercial sectors presents opportunities for diversified growth. Further penetration in these sectors, as well as expansion into new ones, will be critical drivers of future revenue.

-

Competitive Advantage: Palantir’s competitive advantage lies in its sophisticated data analytics platforms and strong relationships with key government and commercial clients. Analyzing how it maintains this advantage against competitors is key to understanding its future growth prospects.

-

Long-Term Strategic Goals: Investors should assess the feasibility and potential impact of Palantir's long-term strategic goals. These goals should align with the company's overall vision and market opportunities.

Potential risks to Palantir's future growth include increased competition, regulatory hurdles, and the potential impact of a global economic downturn. These factors need to be carefully weighed against the potential rewards.

Market Sentiment and Analyst Predictions for Palantir Stock

Understanding current market sentiment towards Palantir stock is essential before the earnings release. Analyst ratings and price targets provide valuable insights, but should be considered alongside broader market trends.

-

Analyst Reports and Price Forecasts: Consolidating recent analyst reports and their corresponding price forecasts helps gauge the overall market outlook for Palantir. Divergence in opinions may indicate uncertainty.

-

Investor Sentiment: Monitoring social media and news articles provides insights into the prevailing investor sentiment towards Palantir. Positive sentiment often translates to higher stock prices, while negative sentiment may depress the price.

-

Stock Price Volatility: The earnings release is likely to cause significant volatility in Palantir's stock price. Understanding historical volatility and employing appropriate risk management strategies is crucial.

-

Technical Analysis: Technical analysis of Palantir's stock chart (identifying support and resistance levels) can provide additional insights into potential price movements following the earnings announcement.

Market conditions and investor confidence significantly impact how the market reacts to the earnings release. A strong overall market may lead to a more favorable response, even if the earnings are slightly below expectations.

Evaluating the Risk/Reward Ratio for Palantir Stock

Investing in Palantir stock, like any investment, involves assessing the risk/reward ratio. This requires a careful consideration of potential outcomes.

-

Upside and Downside Scenarios: Based on different earnings scenarios, assess the potential upside and downside of investing in Palantir stock. Consider best-case, worst-case, and most-likely scenarios.

-

Risk Tolerance and Investment Timeframe: Align your investment strategy with your individual risk tolerance and investment timeframe. Higher-risk investments typically offer the potential for greater returns, but also come with the risk of larger losses.

-

Diversification Strategies: Diversifying your investment portfolio to mitigate risk is crucial. Don't put all your eggs in one basket.

Conclusion

Analyzing Palantir stock before the May 5th earnings release requires a comprehensive assessment of the company's performance, growth prospects, and market sentiment. While Palantir presents exciting growth opportunities, it's crucial to acknowledge the inherent risks associated with its volatile nature. The earnings report will likely significantly impact the Palantir stock price, necessitating a cautious approach. Remember to consider both positive and negative factors before making any investment decisions.

Call to Action: Before investing in Palantir stock, conduct your own thorough research and, if necessary, consult a financial advisor. Carefully analyze the May 5th earnings report and assess its implications for your investment strategy. Stay informed about Palantir Technologies and its future performance to make well-informed decisions regarding your Palantir stock holdings.

Featured Posts

-

Elon Musk Net Worth The Influence Of Us Economic Policy On Tesla

May 09, 2025

Elon Musk Net Worth The Influence Of Us Economic Policy On Tesla

May 09, 2025 -

Understanding Wynne And Joanna All At Sea

May 09, 2025

Understanding Wynne And Joanna All At Sea

May 09, 2025 -

Rising Tensions Caravan Communities And A Uk Citys Future

May 09, 2025

Rising Tensions Caravan Communities And A Uk Citys Future

May 09, 2025 -

Uk Asylum Crackdown Home Office Targets Migrants From Three Countries

May 09, 2025

Uk Asylum Crackdown Home Office Targets Migrants From Three Countries

May 09, 2025 -

Post Tour Boost Beyonces Cowboy Carter Streams Explode

May 09, 2025

Post Tour Boost Beyonces Cowboy Carter Streams Explode

May 09, 2025