QBTS stock, earnings release, stock performance, post-earnings analysis, QBTS stock prediction, and investment strategy to guide our discussion.

QBTS stock, earnings release, stock performance, post-earnings analysis, QBTS stock prediction, and investment strategy to guide our discussion.

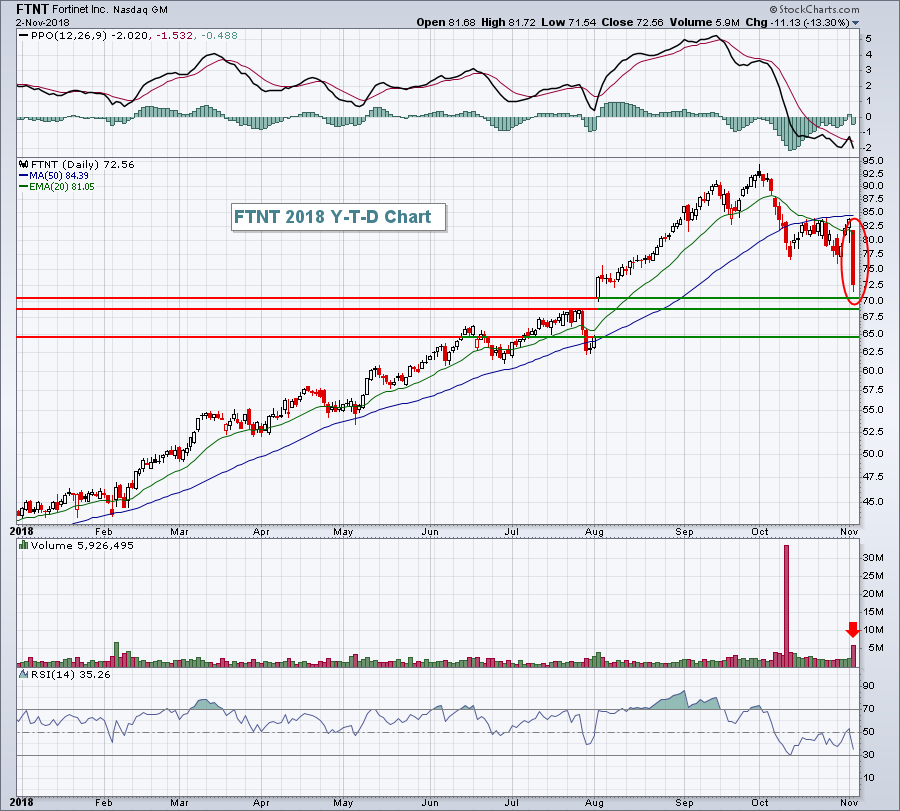

Analyzing QBTS's historical performance is key to predicting its post-earnings behavior. Examining past earnings reports and subsequent market reactions reveals valuable trends.

Consensus estimates from financial analysts provide valuable insight. These predictions represent a collective view of QBTS's expected EPS (earnings per share) and revenue for the upcoming quarter.

Gauging the overall market sentiment towards QBTS is crucial. This involves monitoring various indicators.

Three key scenarios are plausible: exceeding, meeting, or missing analyst expectations. Each will have a different impact on QBTS stock.

If QBTS significantly beats analyst expectations, a positive market reaction is likely.

Meeting expectations doesn't guarantee price stability, but it usually leads to less dramatic changes compared to exceeding or missing expectations.

If QBTS falls short of analyst predictions, a negative market reaction is expected.

Investing in QBTS stock, especially after earnings, involves inherent risks.

The optimal investment strategy depends on your risk tolerance.

Diversification is paramount. Don't put all your eggs in one basket. Spread your investments across various asset classes to mitigate risk.

Analyzing QBTS stock's post-earnings performance requires a comprehensive approach. Understanding its historical performance, analyst expectations, and current market sentiment are crucial. While exceeding expectations is positive, even meeting expectations can be affected by external factors. Conversely, missing expectations can lead to significant price drops. Risk assessment and a well-defined investment strategy aligned with your risk tolerance are paramount. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions regarding QBTS stock and its post-earnings performance. Continue to monitor QBTS stock closely after the earnings release for further insights and adjustments to your strategy.

Real Madrid In Yeni Teknik Direktoerue Arda Gueler Icin Ne Anlama Geliyor

Real Madrid In Yeni Teknik Direktoerue Arda Gueler Icin Ne Anlama Geliyor

Hell City Nouvelle Brasserie Pres Du Hellfest A Clisson

Hell City Nouvelle Brasserie Pres Du Hellfest A Clisson

Understanding The Increase In Femicide Incidents

Understanding The Increase In Femicide Incidents

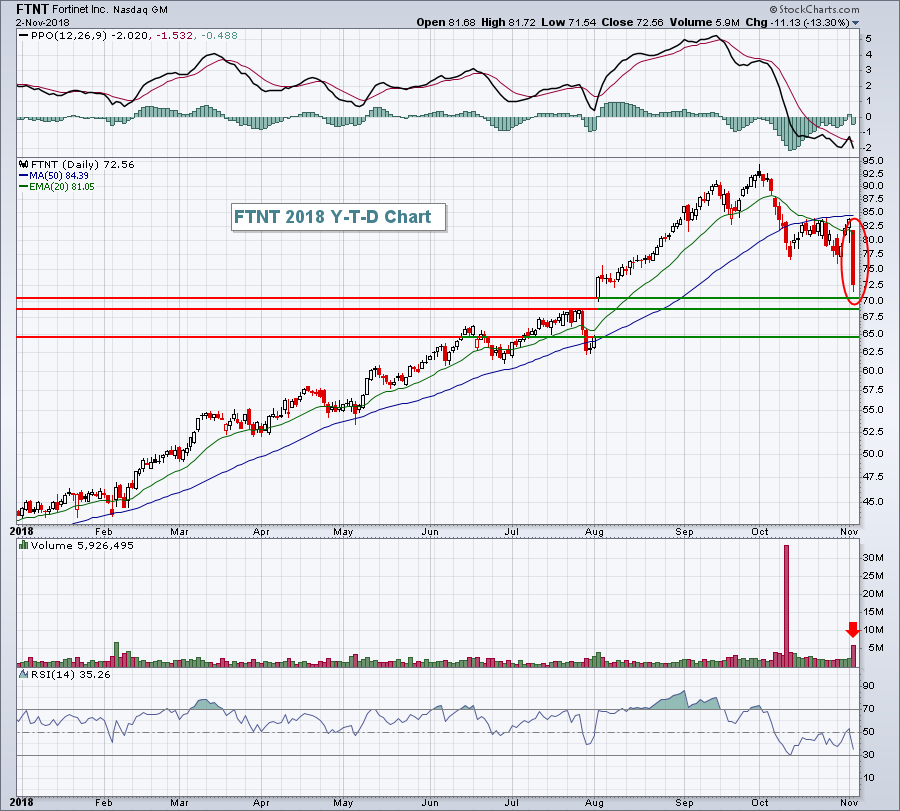

Exploring New Business Opportunities A Map Of The Countrys Hottest Areas

Exploring New Business Opportunities A Map Of The Countrys Hottest Areas

Tyler Bates Wwe Raw Return Reunion With Pete Dunne

Tyler Bates Wwe Raw Return Reunion With Pete Dunne

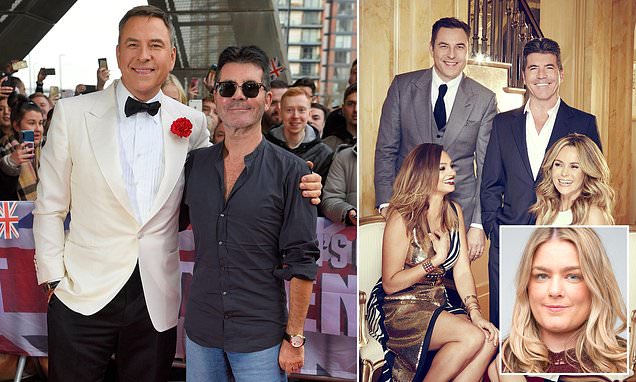

The David Walliams Britains Got Talent Controversy Explained

The David Walliams Britains Got Talent Controversy Explained

David Walliams And Simon Cowells Feud Are They No Longer Speaking

David Walliams And Simon Cowells Feud Are They No Longer Speaking

David Walliams Britains Got Talent Departure The Story

David Walliams Britains Got Talent Departure The Story

Bgt Blockbusters What Made It Special

Bgt Blockbusters What Made It Special

David Walliams What Happened On Britains Got Talent

David Walliams What Happened On Britains Got Talent