Analyzing The 40% Palantir Stock Price Prediction For 2025: A Detailed Guide

Table of Contents

H2: Factors Supporting the 40% Palantir Stock Price Prediction for 2025

Several factors could contribute to a significant increase in Palantir's stock price by 2025. A robust growth strategy, coupled with positive market trends, makes this prediction plausible, though not guaranteed.

H3: Growing Government Contracts and Revenue:

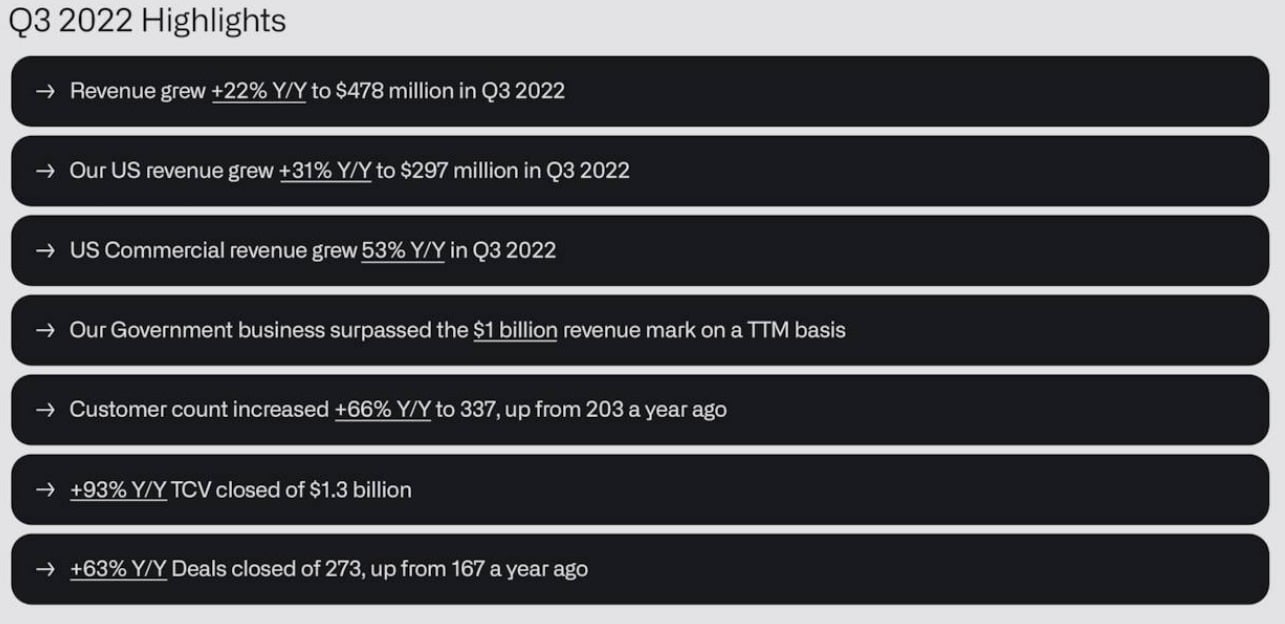

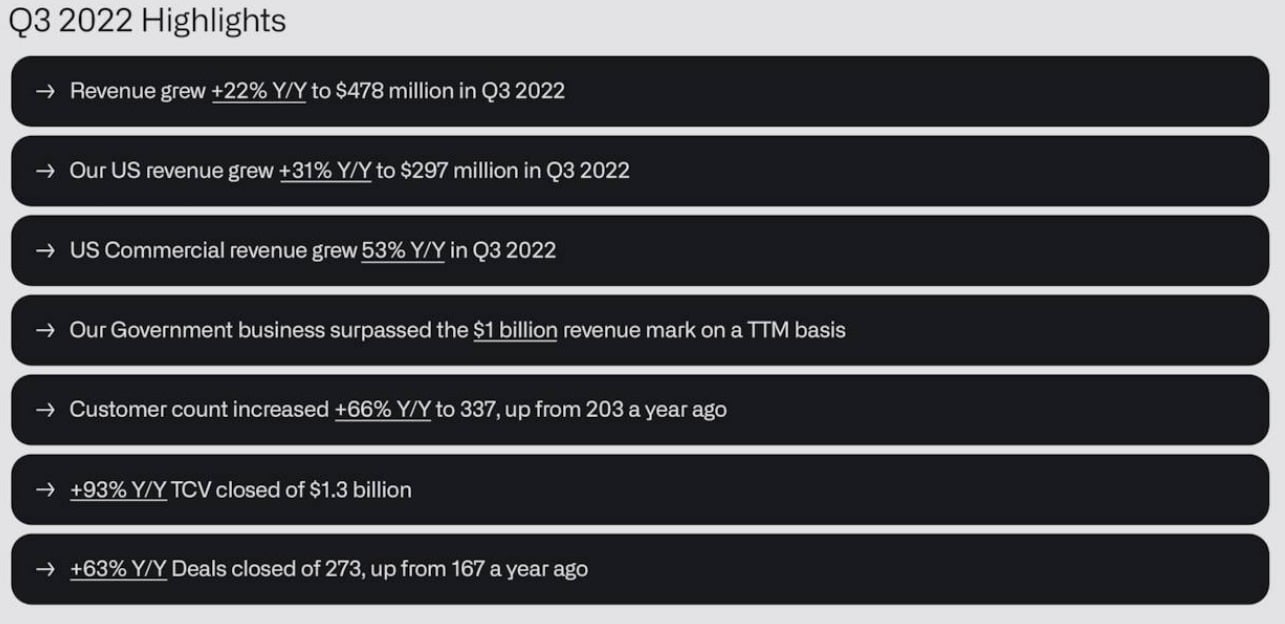

Palantir's substantial presence in government contracts, both domestically and internationally, forms a solid foundation for its future growth. The increasing demand for sophisticated data analytics and AI solutions within defense and intelligence agencies fuels this expansion.

- Significant Revenue Growth: Palantir's government revenue consistently shows strong growth year-over-year, demonstrating the continued demand for its services. This trend is expected to continue, bolstering overall financial performance.

- Key Contract Wins: Recent examples include multi-year contracts with various government agencies, highlighting their continued confidence in Palantir's capabilities. These contracts represent significant revenue streams and long-term partnerships.

- Example 1: [Insert Example of a Large Government Contract]

- Example 2: [Insert Example of a Large Government Contract]

- International Expansion: Palantir's strategic expansion into international markets presents additional growth opportunities, further diversifying its revenue streams and reducing reliance on any single market.

H3: Expanding Commercial Market Penetration:

While the government sector is a crucial part of Palantir's business, its success in the commercial market is equally important for long-term growth, furthering the Palantir stock price prediction 2025.

- Strategic Partnerships: Palantir is forging key partnerships with industry leaders, expanding its reach and opening doors to new clients across various sectors like healthcare and finance.

- Successful Implementations: Numerous case studies showcase successful deployments of Palantir's platform within commercial organizations, demonstrating the value proposition and driving further adoption.

- Example 1: [Insert Example of a Successful Commercial Deployment]

- Example 2: [Insert Example of a Successful Commercial Deployment]

- Market Disruption: Palantir’s technology offers a unique approach to data analysis, potentially disrupting existing market players and securing a leading position within specific commercial niches.

H3: Technological Innovation and Product Development:

Palantir's continuous investment in R&D and its commitment to advancing AI and data analytics capabilities are essential for maintaining its competitive edge and driving future growth.

- Cutting-Edge Technology: Palantir consistently incorporates cutting-edge technologies into its platform, ensuring it remains at the forefront of data analytics and AI. This drives both efficiency and competitive advantage.

- New Product Releases: Regular product updates and releases introduce new features and functionalities, attracting new clients and enhancing the value proposition for existing customers.

- Example 1: [Insert Example of a New Product/Feature]

- Example 2: [Insert Example of a New Product/Feature]

- AI Integration: The increasing integration of AI and machine learning into Palantir's platform enhances its analytical capabilities and increases efficiency for users.

H2: Factors that Could Hinder the 40% Palantir Stock Price Prediction for 2025

Despite the potential for growth, several factors could negatively impact Palantir's stock price and hinder the realization of the 40% prediction.

H3: Geopolitical Risks and Economic Uncertainty:

Global events and economic instability can significantly impact government spending and commercial investment, creating uncertainty for Palantir.

- Government Budget Constraints: Economic downturns may lead to reduced government spending on technology and defense, impacting Palantir's government contracts.

- International Relations: Geopolitical tensions and changes in international relations could affect the stability of existing and future contracts, creating risks.

- Economic Slowdown: A broader economic slowdown could reduce commercial spending on data analytics solutions, impacting Palantir's revenue growth in this sector.

H3: Intense Competition in the Data Analytics Market:

The data analytics market is highly competitive, with major players like AWS, Google Cloud, and Microsoft Azure constantly vying for market share.

- Competitive Pressures: Palantir faces pressure from these established tech giants, who possess significant resources and market reach.

- Disruptive Technologies: The emergence of new technologies and approaches within data analytics could challenge Palantir's current position and require substantial adaptation.

- Pricing Strategies: Competitive pricing pressure from larger players could also impact Palantir's profit margins.

H3: Profitability and Valuation Concerns:

Palantir's current profitability and valuation are key factors influencing the likelihood of the 40% prediction.

- Profit Margin Analysis: A detailed analysis of Palantir's profit margins is needed to determine the sustainability of its growth trajectory and support the 40% stock price increase.

- Valuation Metrics: Careful examination of relevant valuation metrics, like Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio, is necessary to assess whether the current stock price reflects the company's true potential.

- Overvaluation Risk: The potential for overvaluation needs to be considered, as overly optimistic predictions can lead to market corrections.

3. Conclusion:

The 40% Palantir Stock Price Prediction for 2025 rests on a foundation of significant growth potential in both the government and commercial sectors, coupled with ongoing technological innovation. However, considerable risks, including geopolitical instability, intense competition, and potential valuation concerns, need careful consideration. While the potential for significant gains exists, it's crucial to acknowledge the inherent uncertainties. A balanced assessment is essential, and a thorough understanding of the factors discussed above is vital for informed investment decisions. Therefore, further independent research into the 40% Palantir Stock Price Prediction for 2025 is crucial before making any investment decisions. This analysis is not financial advice.

Featured Posts

-

Nyt Strands Game 366 Hints And Solutions For Tuesday March 4

May 10, 2025

Nyt Strands Game 366 Hints And Solutions For Tuesday March 4

May 10, 2025 -

Cocaine At The White House Secret Service Completes Investigation

May 10, 2025

Cocaine At The White House Secret Service Completes Investigation

May 10, 2025 -

Edmonton Oilers Projected To Win Against Los Angeles Kings Betting Analysis

May 10, 2025

Edmonton Oilers Projected To Win Against Los Angeles Kings Betting Analysis

May 10, 2025 -

Following Trump Order Ihsaa Bans Transgender Girls From Sports

May 10, 2025

Following Trump Order Ihsaa Bans Transgender Girls From Sports

May 10, 2025 -

Antipremiya Zolotaya Malina Razgromnye Otsenki Dlya Filmov S Dakotoy Dzhonson

May 10, 2025

Antipremiya Zolotaya Malina Razgromnye Otsenki Dlya Filmov S Dakotoy Dzhonson

May 10, 2025