Analyzing The BigBear.ai (BBAI) Stock Drop: 2025 Market Trends

Table of Contents

Analyzing the Causes of the BBAI Stock Drop

Several factors contribute to the recent decline in BigBear.ai's (BBAI) stock price. Understanding these factors is crucial for assessing the long-term viability of this artificial intelligence stock investment.

Impact of Overall Market Volatility

The tech sector, and particularly AI stocks like BBAI, are highly sensitive to broader economic conditions. Several macroeconomic factors have influenced the recent market downturn.

-

Rising inflation impacting investor sentiment: High inflation erodes purchasing power and increases uncertainty, making investors less willing to invest in riskier growth stocks like BBAI. This impacts the overall market valuation of AI tech companies.

-

Increased risk aversion leading to sell-offs in the tech sector: As investors become more risk-averse, they often sell off their holdings in higher-risk sectors, including technology, leading to significant price drops across the board, including for promising companies like BBAI.

-

Comparison of BBAI's performance against other AI companies and the broader market indices (e.g., Nasdaq): Analyzing BBAI's performance relative to its competitors and broader market indicators like the Nasdaq Composite Index provides context for its stock drop. Underperformance relative to the market suggests company-specific issues may be at play, beyond the general market volatility.

Company-Specific Factors Affecting BBAI Stock Price

Beyond macroeconomic forces, several company-specific factors might have contributed to the BBAI stock drop. A thorough analysis of these factors is crucial for informed investment decisions.

-

Discussion of any missed earnings expectations: Failure to meet or exceed projected earnings can significantly impact investor confidence and lead to sell-offs, especially in the volatile tech sector. Analyzing BBAI's financial reports will reveal if missed earnings played a role in the stock's decline.

-

Analysis of contract wins/losses impacting future revenue projections: The success of AI companies heavily relies on securing lucrative contracts. Significant contract losses or delays could negatively affect future revenue projections, leading to a decline in the BBAI stock price.

-

Mention of any management changes or internal restructuring: Changes in leadership or significant internal restructuring can create uncertainty amongst investors, potentially leading to sell-offs. Transparency regarding such changes is crucial for maintaining investor confidence in BBAI.

Competitive Landscape and Technological Advancements

The AI industry is highly competitive, and rapid technological advancements can quickly render existing technologies obsolete. This competitive pressure significantly affects BBAI's stock performance.

-

Comparison with major competitors in the AI sector: Analyzing BBAI's competitive positioning relative to giants like Google, Microsoft, and Amazon, is crucial to understanding its market share and future growth potential.

-

Evaluation of BBAI’s technological advantages and disadvantages: BBAI needs to continually innovate to maintain a competitive edge. Assessing its technological strengths and weaknesses against its competitors helps determine its long-term prospects.

-

Assessment of potential disruptive technologies affecting BBAI’s future prospects: Emergence of groundbreaking AI technologies could render BBAI's existing offerings less competitive, posing a significant threat to its market share and future stock performance.

Predicting BBAI Stock Performance in 2025: Market Outlook

While the recent decline is concerning, assessing BBAI's potential future performance requires considering both growth drivers and potential challenges.

Potential Growth Drivers for BBAI

Despite the current challenges, several factors could drive future growth for BigBear.ai.

-

Discussion of the growing demand for AI solutions in various industries: The overall AI market is expected to continue growing rapidly, presenting significant opportunities for companies like BBAI to capitalize on increasing demand across various sectors.

-

Analysis of BBAI’s potential to capitalize on market opportunities: BBAI's success hinges on its ability to effectively identify and capture these market opportunities, leveraging its technological strengths and strategic partnerships.

-

Mention of any strategic initiatives that could drive growth: Strategic mergers, acquisitions, or partnerships could significantly enhance BBAI's capabilities and market reach, driving future growth. Analyzing these initiatives is vital for predicting future stock performance.

Risks and Challenges for BBAI in 2025

Despite the potential for growth, BBAI faces several significant risks and challenges.

-

Potential for increased competition from established players: The highly competitive nature of the AI industry means that BBAI faces constant pressure from established players with greater resources and market share.

-

Regulatory uncertainties and their impact on the AI sector: The evolving regulatory landscape surrounding AI presents significant uncertainty, impacting how BBAI operates and potentially hindering its growth.

-

Economic downturn and its potential effect on BBAI's revenue streams: A broader economic downturn could significantly reduce demand for AI solutions, impacting BBAI's revenue and stock price.

Conclusion

The recent decline in BigBear.ai (BBAI) stock presents a complex scenario influenced by both macroeconomic factors and company-specific issues. While the short-term outlook may be uncertain, a thorough understanding of the underlying causes and the potential for future growth is crucial for investors. Considering the long-term potential of the AI market and BBAI’s strategic positioning, investors need to carefully weigh the risks and rewards before making any investment decisions regarding BBAI stock. Further research and monitoring of market trends are vital to navigate the evolving landscape of the AI sector and make informed decisions about your BBAI stock investments in 2025 and beyond. Remember to always conduct thorough due diligence before investing in any stock, including BigBear.ai (BBAI).

Featured Posts

-

Femicide Defining The Crime And Investigating The Reasons Behind Its Growth

May 20, 2025

Femicide Defining The Crime And Investigating The Reasons Behind Its Growth

May 20, 2025 -

To Epomeno Epeisodio Toy Tampoy I Marilena Se Kindyno

May 20, 2025

To Epomeno Epeisodio Toy Tampoy I Marilena Se Kindyno

May 20, 2025 -

Agatha Christie En Ia Revolution Ou Imitation Dans Les Cours D Ecriture

May 20, 2025

Agatha Christie En Ia Revolution Ou Imitation Dans Les Cours D Ecriture

May 20, 2025 -

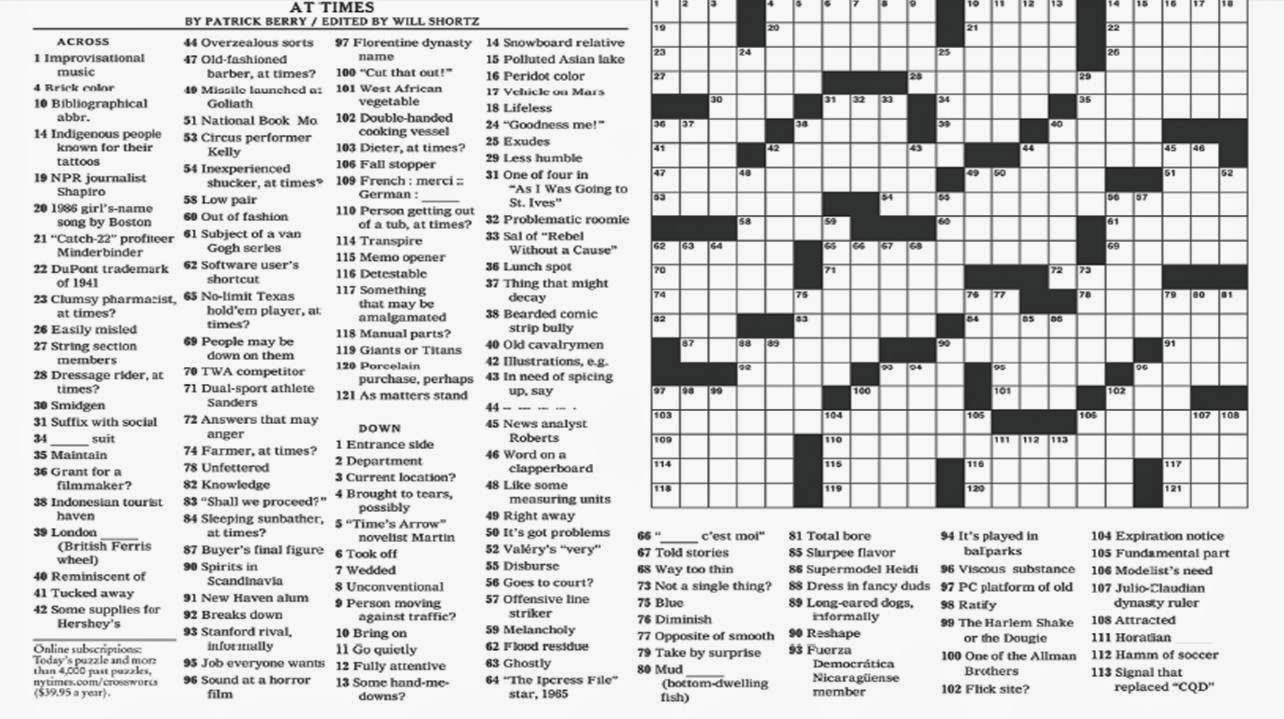

Nyt Crossword April 25 2025 All Clues And Answers

May 20, 2025

Nyt Crossword April 25 2025 All Clues And Answers

May 20, 2025 -

Darren Ferguson Celebrates Record Breaking Peterborough Efl Trophy Win

May 20, 2025

Darren Ferguson Celebrates Record Breaking Peterborough Efl Trophy Win

May 20, 2025

Latest Posts

-

Daftar Lengkap Juara Premier League Sepuluh Tahun Terakhir Dan Prediksi Musim Depan

May 21, 2025

Daftar Lengkap Juara Premier League Sepuluh Tahun Terakhir Dan Prediksi Musim Depan

May 21, 2025 -

Liverpool Juara Liga Inggris Siapa Pelatih Yang Berjasa 2024 2025

May 21, 2025

Liverpool Juara Liga Inggris Siapa Pelatih Yang Berjasa 2024 2025

May 21, 2025 -

Liverpool Dan 10 Tahun Sejarah Juara Premier League

May 21, 2025

Liverpool Dan 10 Tahun Sejarah Juara Premier League

May 21, 2025 -

Analisis Kesuksesan Liverpool Kontribusi Pelatih Dalam Menjuarai Liga Inggris 2024 2025

May 21, 2025

Analisis Kesuksesan Liverpool Kontribusi Pelatih Dalam Menjuarai Liga Inggris 2024 2025

May 21, 2025 -

Prediksi Juara Liga Inggris 2024 2025 Akankah Liverpool Menang

May 21, 2025

Prediksi Juara Liga Inggris 2024 2025 Akankah Liverpool Menang

May 21, 2025