Analyzing The Canadian Billionaire: Warren Buffett's Unexpected Successor

Table of Contents

Introduction Paragraph: The world watched with bated breath as the Oracle of Omaha, Warren Buffett, began to consider succession. While many speculated on potential heirs apparent within Berkshire Hathaway, a surprising figure, albeit not a direct successor to Buffett himself, emerges as a compelling comparison: Galen Weston, a Canadian billionaire. This article delves into the remarkable success of Galen Weston, analyzing his investment strategies, business acumen, and impressive legacy within the George Weston Limited empire. We'll explore how his background and approaches compare to, and contrast with, the iconic investor, providing insights into the mind of a remarkably successful Canadian billionaire.

H2: Galen Weston's Background and Early Career:

H3: From Humble Beginnings to Billions: Galen Weston's journey to becoming a Canadian billionaire wasn't born of sudden luck; rather, it's a testament to strategic planning and a keen business sense inherited and honed over generations. Born into a family with a long history in the Canadian retail and food industries, Weston's early life was immersed in the world of business. His education laid the groundwork for his future success, providing him with a strong foundation in business principles. This foundation was further strengthened by his early involvement in the family business.

- Bullet points:

- Early involvement in George Weston Limited, learning the ropes of the family business from a young age.

- Formal education at a prestigious university (mention specific university if known), further developing his business acumen.

- Mentorship from his father, W. Galen Weston, providing invaluable experience and guidance.

H3: Key Investments and Business Acquisitions: Galen Weston's impact on George Weston Limited and the Canadian business landscape is undeniable. His strategic acquisitions and investments have significantly shaped the company's trajectory and diversified its holdings. His decisions weren't purely driven by profit; they showcased an understanding of long-term growth and market trends.

- Bullet points:

- Acquisition of Loblaw Companies Limited, transforming it into a dominant force in Canadian grocery retail. This demonstrates a keen eye for undervalued assets with significant growth potential, a hallmark of value investing.

- Strategic investments in various sectors, diversifying the George Weston Limited portfolio and mitigating risk, a contrast to some of Buffet's more concentrated holdings. This exemplifies a diversification strategy that reduces reliance on any single sector's performance.

- Successful expansion into international markets, demonstrating a proactive approach to growth and a global perspective on business opportunities.

H2: Investment Strategies Compared to Warren Buffett:

H3: Value Investing Principles: While not directly comparable due to different business structures and contexts, Weston's investment strategies share some similarities with Warren Buffett's value investing principles. Both emphasize long-term investment horizons and a focus on understanding the underlying value of a business. However, Weston's approach leans towards a more diversified portfolio compared to Buffett's often concentrated investments.

- Bullet points:

- Similarities: Long-term vision, focus on intrinsic value, and shrewd acquisition strategies reflecting a similar philosophy of buying quality businesses at fair prices.

- Differences: Weston's diversified portfolio across multiple sectors in the food industry contrasts with Buffett’s more concentrated holdings in specific, high-conviction investments. The scale of operations also varies significantly.

H3: Diversification and Portfolio Management: Galen Weston's investment strategy displays a marked emphasis on diversification, a significant divergence from Buffett's approach. His portfolio's breadth across the food retail and related sectors mitigates risk, ensuring the resilience of the George Weston Limited empire. This approach reduces vulnerability to the volatility experienced by companies heavily concentrated in one sector.

- Bullet points:

- Asset allocation across various subsidiaries within the George Weston Limited umbrella.

- Sector diversification within the food and retail industries, lessening exposure to singular market downturns.

- Strategic risk management strategies that actively protect the value of assets.

H2: Galen Weston's Philanthropic Efforts and Corporate Social Responsibility:

H3: Giving Back to Society: While not as publicly visible as Warren Buffett's philanthropic endeavors, Galen Weston and the Weston family have a history of supporting various charitable causes, primarily through private foundations and initiatives tied to their businesses. Their contributions often focus on community development and education.

- Bullet points:

- Support of various Canadian charities (mention specific ones if publicly known).

- Commitment to sustainable business practices within George Weston Limited’s operations.

- Focus on community engagement and initiatives that promote social well-being.

H3: Corporate Governance and Ethical Practices: George Weston Limited operates under robust corporate governance structures, emphasizing transparency and ethical business practices. The company's commitment to fair labor practices, environmental sustainability, and responsible sourcing reflects a dedication to long-term value creation that extends beyond pure financial gain.

- Bullet points:

- Commitment to ethical sourcing and sustainable supply chains.

- Transparent financial reporting and corporate governance procedures.

- Focus on fair labor practices and employee well-being.

3. Conclusion:

Summary: Galen Weston's success as a Canadian billionaire represents a different, but equally compelling, path to wealth creation compared to Warren Buffett's iconic journey. While both demonstrate exceptional business acumen and strategic thinking, their approaches differ significantly in terms of portfolio diversification and public philanthropic activity. Weston's emphasis on diversification within the food and retail industries, coupled with his family's long-standing legacy, showcases a sustained commitment to building a resilient and ethical business empire. This contrasts with Buffett's concentrated approach and very public philanthropy.

Call to Action: Learn more about this fascinating Canadian billionaire and his unique investment approach, which provides a compelling case study in the world of business and finance. Continue your research into the world of successful Canadian billionaires and their investment strategies – the insights gained can be invaluable for aspiring investors and business leaders.

Featured Posts

-

The Political Ramifications Of Kilmar Abrego Garcias Asylum Case

May 10, 2025

The Political Ramifications Of Kilmar Abrego Garcias Asylum Case

May 10, 2025 -

Chinese Goods And Trade Wars The Impact On Bubble Blasters And Beyond

May 10, 2025

Chinese Goods And Trade Wars The Impact On Bubble Blasters And Beyond

May 10, 2025 -

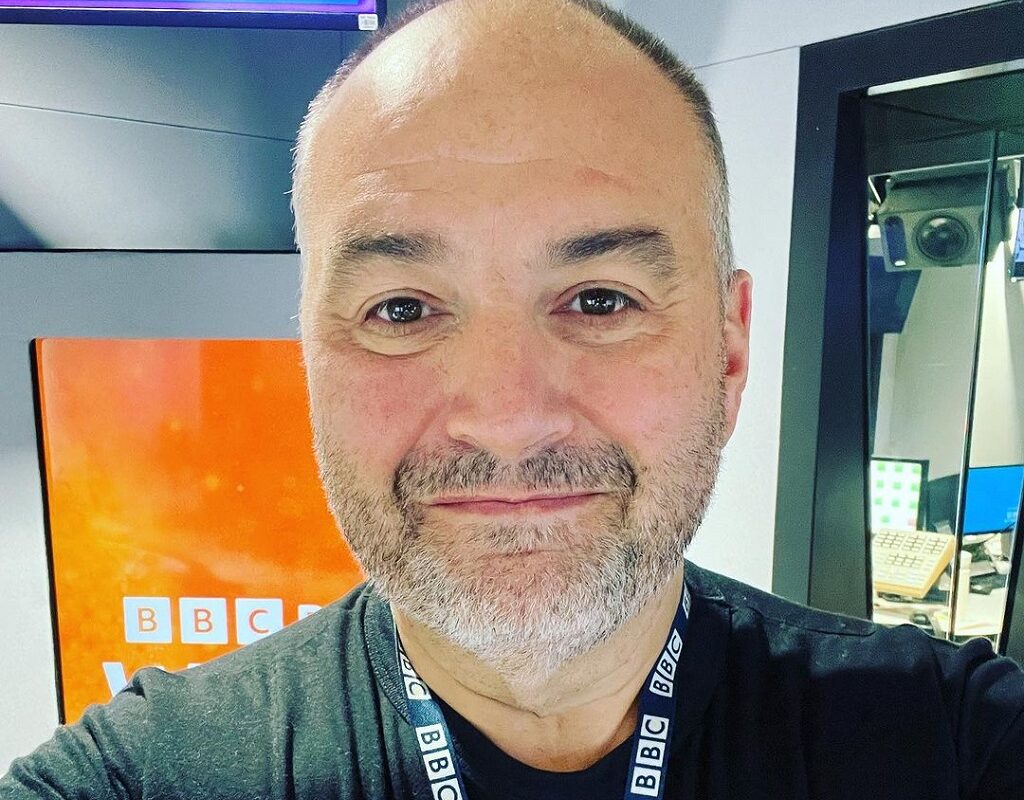

Wynne Evans Faces Backlash Amy Walsh Offers Support

May 10, 2025

Wynne Evans Faces Backlash Amy Walsh Offers Support

May 10, 2025 -

Oilers Overtime Thriller Evens Series Against Kings

May 10, 2025

Oilers Overtime Thriller Evens Series Against Kings

May 10, 2025 -

Details Emerge In Racist Stabbing Woman Kills Man In Unprovoked Attack

May 10, 2025

Details Emerge In Racist Stabbing Woman Kills Man In Unprovoked Attack

May 10, 2025