Analyzing The D-Wave Quantum (QBTS) Stock Crash Of Monday

Table of Contents

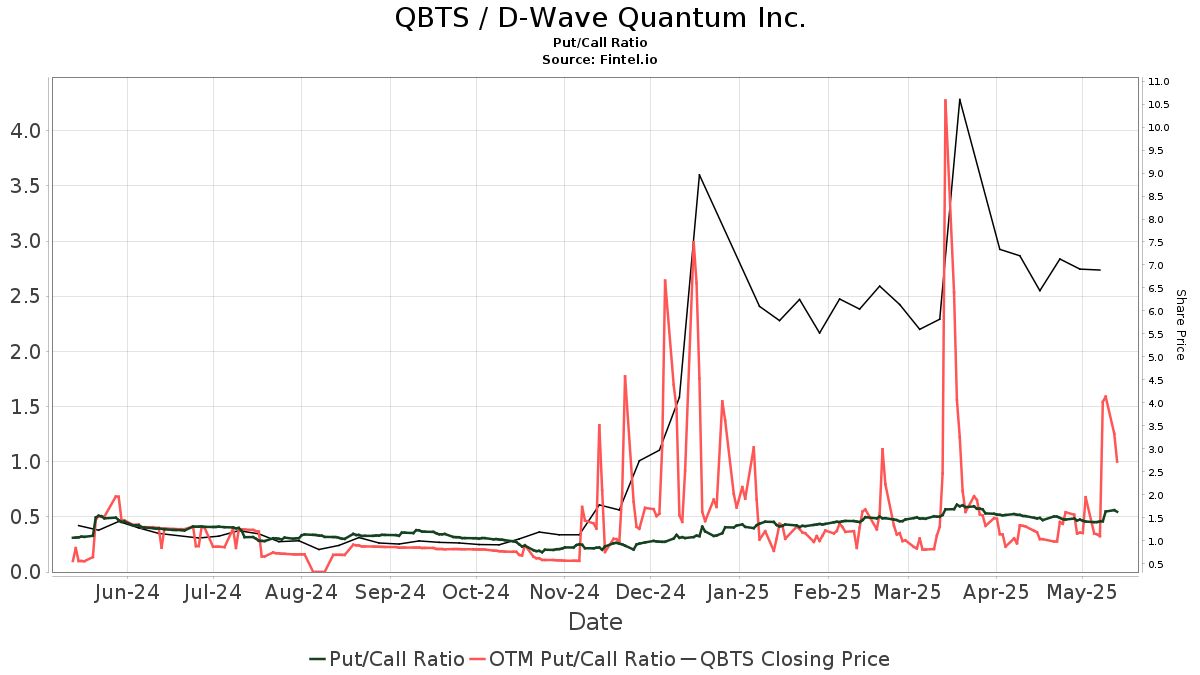

Pre-Crash Market Conditions and D-Wave's Performance Leading Up to Monday

Before Monday's dramatic downturn, several factors contributed to the overall market environment surrounding D-Wave Quantum. Understanding these conditions is crucial for contextualizing the crash. Let's look at D-Wave's performance and the broader market trends in quantum computing and technology stocks.

- D-Wave's Recent Performance: Analyzing D-Wave's financial performance in the preceding quarters reveals insights into investor sentiment before the crash. For example, a review of D-Wave's Q3 2023 earnings (or the relevant quarter depending on the actual date of the crash) would reveal if the company met or exceeded expectations. Any significant deviations from projected revenue or profitability might have foreshadowed the crash. Other key indicators include their progress on new product development and customer acquisition.

- Quantum Computing Investment: The quantum computing sector itself experienced considerable volatility in recent months. Increased investment and hype around the technology were counterbalanced by concerns about technological hurdles and the time to market for commercially viable quantum computers. This general uncertainty affected the entire sector, including D-Wave. Analyzing the overall quantum computing investment landscape is vital for understanding the broader context. Factors like total market capitalization for publicly traded quantum computing companies would be relevant.

- Technology Stock Market Trends: The overall performance of technology stocks in the days leading up to the D-Wave crash must also be considered. A broader market correction or sector-specific downturn could have amplified the negative impact on QBTS.

Bullet Points:

- Summary of D-Wave's Q[Insert Relevant Quarter] earnings (e.g., revenue, net income, EPS).

- Significant partnerships or contract wins/losses impacting investor confidence.

- Competitor activity, such as new product launches or funding announcements.

- General technology stock market performance (indices like NASDAQ) in the preceding days.

Potential Catalysts for the D-Wave Quantum (QBTS) Stock Crash

Pinpointing the precise cause of the D-Wave Quantum (QBTS) stock crash requires speculation based on available information. Several factors could have contributed to the sudden decline.

- Negative News: Unexpected negative news directly impacting D-Wave, its technology, financials, or operations could trigger a sharp sell-off. This could include a product recall, a regulatory setback, or a disappointing sales update.

- Broader Market Sell-Offs: A general downturn in the technology sector, perhaps triggered by macroeconomic factors like rising interest rates or inflation concerns, could negatively impact even fundamentally sound companies like D-Wave.

- Analyst Downgrades: Negative reports from influential financial analysts could significantly sway investor sentiment and lead to a cascade of selling.

- Rumors and Speculation: Market rumors or unsubstantiated speculation, even if untrue, can have a considerable effect on stock prices, especially in volatile sectors like quantum computing.

Bullet Points:

- Specific news articles or analyst reports released around the time of the crash, if any.

- Analysis of short-selling activity on QBTS stock on Monday.

- Trading volume on Monday compared to previous days, indicating the intensity of the sell-off.

Impact and Implications of the D-Wave Quantum (QBTS) Stock Crash

The D-Wave Quantum (QBTS) stock crash had significant immediate and potential long-term consequences.

- Immediate Impact: The percentage drop in QBTS stock price on Monday directly affected D-Wave's market capitalization, representing a substantial loss in shareholder value.

- Investor Confidence: The crash likely eroded investor confidence not just in D-Wave specifically but also in the broader quantum computing sector, impacting other publicly traded companies in the field.

- Long-Term Consequences: The crash could impact D-Wave's ability to secure future funding, potentially hindering its research and development efforts and slowing down its growth trajectory.

Bullet Points:

- Percentage change in QBTS stock price on Monday.

- Change in D-Wave's market capitalization following the crash.

- Impact on investor sentiment towards quantum computing stocks in general.

- Potential effects on D-Wave's ability to secure future funding or partnerships.

Analyzing Investor Sentiment and Future Predictions for QBTS

Assessing investor sentiment after the crash is crucial. Examining social media conversations, news articles, and expert opinions provides a nuanced picture of the market's reaction.

- Social Media Sentiment: Analyzing social media posts and comments regarding QBTS helps gauge the overall sentiment – whether investors are panicked, cautiously optimistic, or completely pessimistic.

- Expert Opinions: Opinions from financial analysts and industry experts offer valuable insights into the potential long-term impact of the crash and potential recovery scenarios.

- Stock Forecast: Predicting the future trajectory of QBTS stock price requires a thorough analysis of various factors. Determining potential support and resistance levels can offer a range of possible outcomes.

Bullet Points:

- Summary of social media sentiment (positive, negative, neutral) towards QBTS.

- Analysis of expert opinions on the future prospects of D-Wave and QBTS stock.

- Discussion of potential support and resistance levels that could influence the stock price recovery.

Conclusion: Understanding and Navigating the D-Wave Quantum (QBTS) Stock Crash and its Aftermath

The D-Wave Quantum (QBTS) stock crash of Monday highlights the inherent volatility of the technology stock market, especially in emerging sectors like quantum computing. Understanding the potential causes – from company-specific news to broader market forces – is crucial for informed investment decisions. While various factors contributed to the decline, the importance of thorough due diligence and risk assessment before investing in any technology stock, particularly in nascent fields, cannot be overstated. Further analysis of the D-Wave Quantum (QBTS) stock market performance is crucial for navigating future investment strategies. Stay informed about the ongoing developments impacting the D-Wave Quantum (QBTS) stock and conduct your own comprehensive research before making any investment choices.

Featured Posts

-

12 Ai Stocks Redditors Recommend A Comprehensive Guide

May 20, 2025

12 Ai Stocks Redditors Recommend A Comprehensive Guide

May 20, 2025 -

The Truth Behind The Bbc Agatha Christie Deepfake Claims

May 20, 2025

The Truth Behind The Bbc Agatha Christie Deepfake Claims

May 20, 2025 -

Kaellmanin Nousu Kentaeltae Ja Sen Ulkopuolelta

May 20, 2025

Kaellmanin Nousu Kentaeltae Ja Sen Ulkopuolelta

May 20, 2025 -

Pro D2 Maintien En Jeu Analyse Du Calendrier Et Des Chances De Valence Romans Et Su Agen

May 20, 2025

Pro D2 Maintien En Jeu Analyse Du Calendrier Et Des Chances De Valence Romans Et Su Agen

May 20, 2025 -

Patra Efimeries Giatron 12 And 13 Aprilioy 2024

May 20, 2025

Patra Efimeries Giatron 12 And 13 Aprilioy 2024

May 20, 2025

Latest Posts

-

Analysis Of The Old North State Report May 9 2025

May 20, 2025

Analysis Of The Old North State Report May 9 2025

May 20, 2025 -

Esperida Stin Patriarxiki Akadimia Kritis T Heologia Tis Megalis Tessarakostis

May 20, 2025

Esperida Stin Patriarxiki Akadimia Kritis T Heologia Tis Megalis Tessarakostis

May 20, 2025 -

Old North State Report May 9 2025 A Comprehensive Overview

May 20, 2025

Old North State Report May 9 2025 A Comprehensive Overview

May 20, 2025 -

Blog N Home Office Vs Kancelaria Preferencie Manazerov A Realita

May 20, 2025

Blog N Home Office Vs Kancelaria Preferencie Manazerov A Realita

May 20, 2025 -

Programma Esperidas Megalis Tessarakostis Patriarxiki Akadimia Kritis

May 20, 2025

Programma Esperidas Megalis Tessarakostis Patriarxiki Akadimia Kritis

May 20, 2025