Analyzing The D-Wave Quantum (QBTS) Stock Decrease On Thursday

Table of Contents

Market-Wide Factors Influencing QBTS Performance

Several market-wide factors could have contributed to the decline in QBTS stock on Thursday. The overall market sentiment played a significant role. A general downturn in the stock market, often driven by investor uncertainty, can negatively impact even strong performing companies like D-Wave Quantum. This is especially true for growth stocks, which are more susceptible to market volatility.

- Negative overall market performance: A broad-based sell-off across various sectors can drag down even fundamentally sound companies. This general negative sentiment impacted risk appetite, leading to a reduction in investment across the board.

- Tech sector correction: The technology sector, which includes quantum computing, often experiences periods of correction. Thursday might have seen a sector-wide sell-off, impacting QBTS along with other tech stocks.

- Impact of interest rate hikes: Rising interest rates can negatively affect investor sentiment, leading to a reassessment of risk and potentially prompting a shift away from growth-oriented stocks like QBTS.

- Geopolitical uncertainties: Global geopolitical instability can introduce uncertainty into the market, impacting investor confidence and causing sell-offs across the board.

These macroeconomic factors, combined with investor sentiment, created a challenging environment for QBTS and many other stocks on Thursday. Understanding these broader market dynamics is crucial to analyzing the QBTS stock drop. Keywords like market volatility, investor sentiment, and economic indicators are critical for understanding the context of the decline.

Company-Specific News and Developments Affecting QBTS

Beyond the broader market trends, company-specific news and developments might have contributed to the QBTS stock decrease. While no major announcements were released by D-Wave Quantum on Thursday itself, events leading up to the drop warrant consideration.

- Lack of significant new contracts or partnerships: The absence of major announcements regarding new contracts or strategic partnerships could have disappointed investors expecting continued growth. The quantum computing market is highly competitive, and securing large deals is crucial for maintaining investor confidence.

- Delayed product launches or technological setbacks: Potential delays in product development or unexpected technical challenges could have negatively impacted investor perception of D-Wave Quantum's future prospects. Any hint of slowing progress can trigger negative market reactions.

- Changes in management or leadership: While no changes were reported recently, any significant shifts in leadership could influence investor confidence and market perception of the company's strategic direction.

- Negative analyst reports or ratings: Negative analyst reports or downgrades can significantly impact a company's stock price. Any concerns raised by analysts about D-Wave Quantum's financial performance or future outlook might have influenced Thursday's trading activity.

These factors, though speculative in the absence of specific company announcements, highlight the need for ongoing monitoring of D-Wave Quantum's news and developments for a comprehensive understanding of the stock's performance. Keywords such as D-Wave Quantum news, QBTS announcements, and financial performance are important here.

Analyzing the Quantum Computing Sector's Overall Performance

To fully understand the QBTS stock drop, it’s essential to examine the broader performance of the quantum computing sector on Thursday. Was the QBTS decline an isolated incident or a reflection of a wider trend within the industry?

- Comparison to other quantum computing stocks: Comparing QBTS's performance to other publicly traded quantum computing companies provides valuable context. If the entire sector experienced a downturn, it suggests broader market forces were at play.

- Impact of competitor advancements: Significant advancements by competitors could influence investor sentiment towards D-Wave Quantum, possibly leading to a shift in investment towards rival companies.

- Overall investor sentiment towards the quantum computing industry: The overall investor perception of the quantum computing industry's potential and future growth prospects can impact all stocks within the sector, including QBTS.

- Funding trends in the quantum computing sector: Changes in investment and funding trends within the industry could signal shifting investor confidence, impacting the stock prices of companies like D-Wave Quantum.

Analyzing the quantum computing market as a whole provides a more complete picture of the forces influencing QBTS's stock price. Keywords like quantum computing market, competitor analysis, and industry trends are vital in this context.

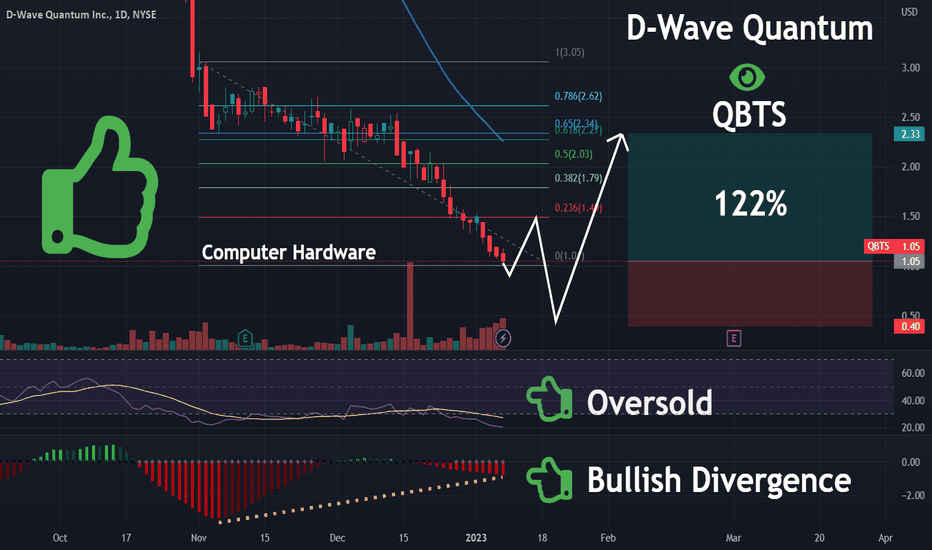

Technical Analysis of QBTS Stock Chart

A technical analysis of the QBTS stock chart for Thursday can provide additional insights into the reasons for the price drop. While a deep technical analysis requires specialized expertise, some key indicators can offer valuable context.

- Volume analysis: High trading volume on Thursday alongside the price drop could suggest significant selling pressure. Conversely, low volume might imply a less significant market reaction.

- Support and resistance levels: If the price broke through key support levels, it could indicate a weakening of the stock and trigger further selling.

- Key candlestick patterns: Certain candlestick patterns, such as bearish engulfing patterns, can indicate a shift in market sentiment and potentially predict further price declines.

- Technical indicators (e.g., RSI, MACD): Technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can help assess the stock's momentum and identify potential overbought or oversold conditions (links to external resources explaining RSI and MACD would be helpful here).

While technical analysis offers valuable insights, it’s crucial to remember that it’s just one piece of the puzzle. Combining technical analysis with fundamental analysis (as done above) provides a more comprehensive picture. Relevant keywords include technical analysis, QBTS stock chart, and trading volume.

Conclusion: The Future of D-Wave Quantum (QBTS) Stock

The D-Wave Quantum (QBTS) stock decrease on Thursday was likely a result of a combination of factors. Broad market trends, including a potential tech sector correction and overall market volatility, played a significant role. Additionally, the absence of positive company-specific news might have contributed to investor apprehension. However, it’s crucial to remember that the quantum computing sector remains a promising area for future growth.

The future of D-Wave Quantum (QBTS) depends on several factors, including its ability to secure new contracts, overcome any technological challenges, and successfully navigate the competitive landscape. While Thursday’s drop presents a potential risk, it also presents opportunities for long-term investors who believe in the company’s vision. It’s vital to conduct thorough research before making any investment decisions related to D-Wave Quantum or any other quantum computing stock. Further investigation into D-Wave Quantum's future developments and the broader quantum computing market outlook is essential for informed decision-making. Consider your risk tolerance carefully before investing in QBTS or other volatile stocks.

Featured Posts

-

Wwe Raw Recap Rollins And Breakker Bully Sami Zayn

May 20, 2025

Wwe Raw Recap Rollins And Breakker Bully Sami Zayn

May 20, 2025 -

Wwe Raw 5 19 2025 Review Best And Worst Moments

May 20, 2025

Wwe Raw 5 19 2025 Review Best And Worst Moments

May 20, 2025 -

Michael Schumacher Gina Maria Schumacher A Devenit Mama Prima Nepoata A Lui Schumi

May 20, 2025

Michael Schumacher Gina Maria Schumacher A Devenit Mama Prima Nepoata A Lui Schumi

May 20, 2025 -

Transfert De Melvyn Jaminet Les Declarations Explosives De Kylian Jaminet

May 20, 2025

Transfert De Melvyn Jaminet Les Declarations Explosives De Kylian Jaminet

May 20, 2025 -

Delving Into The Psychology Of Agatha Christies Poirot

May 20, 2025

Delving Into The Psychology Of Agatha Christies Poirot

May 20, 2025

Latest Posts

-

How A Billionaire Boy Shapes The World Philanthropy Power And Politics

May 20, 2025

How A Billionaire Boy Shapes The World Philanthropy Power And Politics

May 20, 2025 -

Billionaire Boy Exploring The Challenges And Responsibilities Of Extreme Wealth

May 20, 2025

Billionaire Boy Exploring The Challenges And Responsibilities Of Extreme Wealth

May 20, 2025 -

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025 -

The Life And Times Of A Billionaire Boy Inheritance Influence And Impact

May 20, 2025

The Life And Times Of A Billionaire Boy Inheritance Influence And Impact

May 20, 2025 -

79 Manazerov Uprednostnuje Osobne Stretnutia Home Office Vs Kancelaria

May 20, 2025

79 Manazerov Uprednostnuje Osobne Stretnutia Home Office Vs Kancelaria

May 20, 2025