Analyzing The Effect Of 3% Mortgage Rates On Canada's Housing Market

Table of Contents

Increased Housing Demand at 3% Mortgage Rates

A dramatic drop in mortgage rates to 3% would likely unleash a surge in housing demand across Canada. Lower borrowing costs significantly increase affordability, making homeownership more accessible to a larger pool of potential buyers.

Increased buyer activity: This lower barrier to entry would incentivize first-time homebuyers, who have been sidelined by higher rates, to enter the market. Existing homeowners might also be encouraged to upgrade to larger properties, further fueling demand.

Competition amongst buyers: The increased demand, coupled with a relatively limited supply of housing in many areas, could lead to fierce competition amongst buyers. Bidding wars would become more common, pushing housing prices upwards.

Impact on different housing segments: The impact wouldn't be uniform across all housing segments. Condos in urban centers might see the most significant price increases due to higher demand, while the effects on detached homes in suburban areas might be more moderate.

Geographic variations: The response to lower mortgage rates would vary geographically. High-demand markets like Toronto and Vancouver might experience a more significant surge in demand and price increases compared to smaller cities with less competitive markets.

- Increased affordability for potential homebuyers.

- Potential for multiple offers on desirable properties.

- Higher demand in urban centers.

- Increased competition in already tight markets.

Effects on Housing Prices at 3% Mortgage Rates

The increased demand spurred by 3% mortgage rates would undoubtedly exert upward pressure on housing prices. The extent of this increase would depend on the interplay between supply and demand.

Price appreciation: A significant percentage increase in housing prices is highly probable, particularly in competitive markets. The magnitude of this increase is difficult to predict precisely, but it could be substantial, especially in urban centers.

Market saturation: While the initial effect would likely be positive, there is a concern that a rapid and sustained rise in prices could lead to market saturation and ultimately, a housing bubble.

Regional price variations: Price increases are expected to vary significantly by region, reflecting existing market conditions and local demand.

- Potential for significant price increases, especially in competitive markets.

- Increased competition could lead to inflated property values.

- Risk of a housing bubble if the increase is unsustainable.

- Potential for regional disparities in price appreciation.

Impact on the Canadian Economy at 3% Mortgage Rates

The ripple effects of a 3% mortgage rate on Canada's housing market extend far beyond the real estate sector. It would have a significant impact on the broader economy.

Construction and related industries: A surge in housing demand would translate into increased construction activity. This would boost employment in the construction sector and related industries like lumber, manufacturing, and transportation.

Consumer spending: The increased activity in the housing market would stimulate consumer spending. Homebuyers would spend money on renovations, furnishings, and appliances, further contributing to economic growth.

GDP growth: The combined effects of increased construction, consumer spending, and job creation could lead to a notable increase in GDP.

Inflationary pressures: However, this increased demand could also contribute to inflationary pressures, especially if construction material costs rise alongside increased demand.

- Positive impact on job creation in the construction sector.

- Increased consumer spending driving economic growth.

- Potential inflationary pressures due to increased demand.

- Increased tax revenue for the government.

Potential Risks and Challenges Associated with 3% Mortgage Rates

While a 3% mortgage rate presents several benefits, it also carries potential risks and challenges.

Increased household debt: Lower interest rates could encourage individuals to take on larger mortgages, leading to a potential increase in household debt levels. This could become unsustainable if interest rates rise unexpectedly.

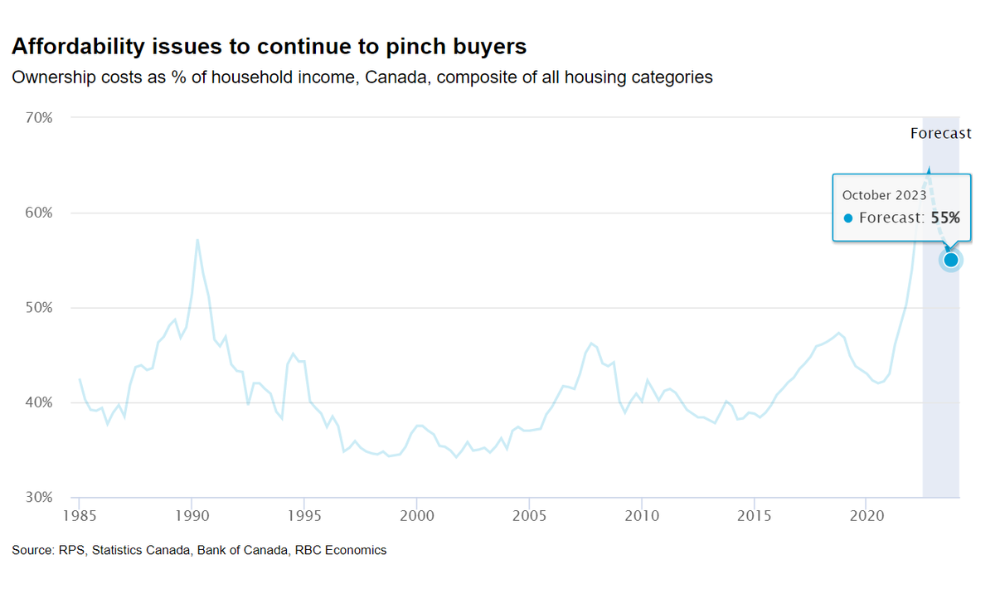

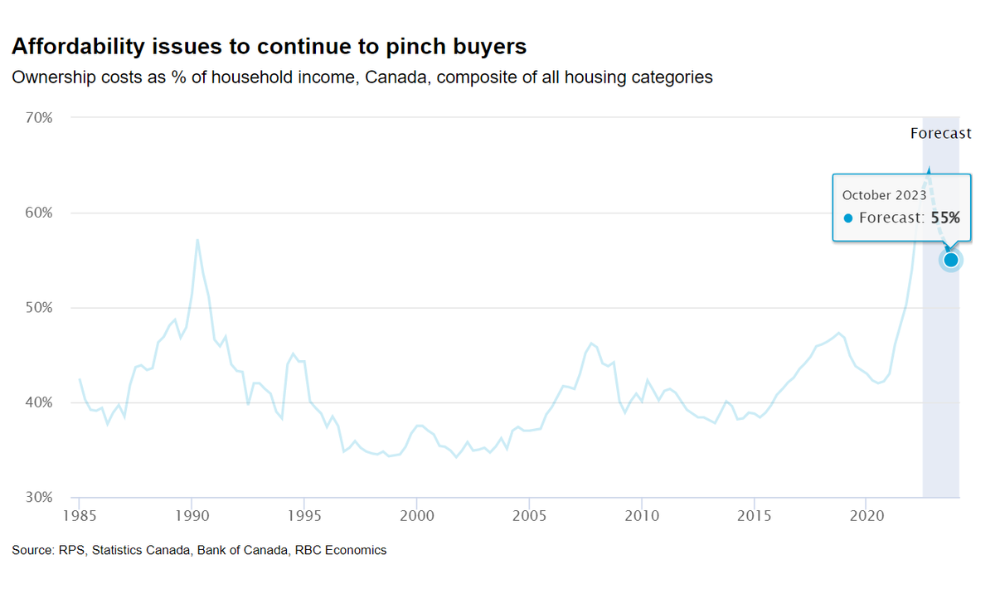

Housing affordability for low-income earners: Even with lower rates, housing might still remain unaffordable for many low-income earners. This could exacerbate existing inequalities in access to homeownership.

Market instability: If interest rates increase unexpectedly, it could trigger a market correction, leading to price declines and potential financial distress for homeowners with high levels of debt.

Impact on the Bank of Canada's monetary policy: The Bank of Canada might need to adjust its monetary policy to manage inflation and prevent overheating of the housing market, potentially leading to future interest rate adjustments.

- Increased risk of household debt exceeding sustainable levels.

- Worsening affordability issues for low and middle-income households.

- Potential for a market correction if interest rates rise unexpectedly.

- Increased risk for borrowers with variable-rate mortgages.

Conclusion: Understanding the Implications of 3% Mortgage Rates on Canada's Housing Market

A hypothetical 3% mortgage rate would significantly impact Canada's housing market, leading to increased demand, potential price appreciation, and broader economic effects. However, it's crucial to acknowledge the risks associated with lower mortgage rates, including increased household debt, affordability challenges for lower-income earners, and market instability. Analyzing your financial situation, researching the current market conditions, and consulting with a mortgage professional are crucial steps before making any major housing decisions. Understanding the effects of 3% mortgage rates on Canada's housing market is crucial for navigating this dynamic environment.

Featured Posts

-

Texas Islamic City Development Hiring Ex Paxton Attorney To Mitigate Concerns

May 13, 2025

Texas Islamic City Development Hiring Ex Paxton Attorney To Mitigate Concerns

May 13, 2025 -

Preco 74 Ludi Vaha Prenajom Nehnutelnosti Romovi Analyza Predsudkov

May 13, 2025

Preco 74 Ludi Vaha Prenajom Nehnutelnosti Romovi Analyza Predsudkov

May 13, 2025 -

Kelly Graves Lands Australian Star A Recruiting Coup For Oregon Ducks

May 13, 2025

Kelly Graves Lands Australian Star A Recruiting Coup For Oregon Ducks

May 13, 2025 -

Texas Mega City Plan Under Doj Investigation

May 13, 2025

Texas Mega City Plan Under Doj Investigation

May 13, 2025 -

Doom The Dark Ages Xbox Limited Edition Fact Or Fiction

May 13, 2025

Doom The Dark Ages Xbox Limited Edition Fact Or Fiction

May 13, 2025

Latest Posts

-

Your Source For Efl Highlights Videos And Analysis

May 13, 2025

Your Source For Efl Highlights Videos And Analysis

May 13, 2025 -

Community Gathers To Remember 15 Year Old Stabbing Victim

May 13, 2025

Community Gathers To Remember 15 Year Old Stabbing Victim

May 13, 2025 -

Efl Highlights Key Moments And Talking Points

May 13, 2025

Efl Highlights Key Moments And Talking Points

May 13, 2025 -

Vlada Predstavlja Predlog Novele Zakona O Romski Skupnosti Javna Obravnava

May 13, 2025

Vlada Predstavlja Predlog Novele Zakona O Romski Skupnosti Javna Obravnava

May 13, 2025 -

Efl Highlights Action Goals And Thrills From The Efl

May 13, 2025

Efl Highlights Action Goals And Thrills From The Efl

May 13, 2025