Analyzing The Growth Of Canada's Premier Natural Gas Producer

Table of Contents

Production Capacity and Reserves: Fueling the Expansion

[Insert Company Name Here]'s impressive growth is fueled by its substantial production capacity and vast natural gas reserves. Over the past five years, the company has consistently increased its natural gas production, demonstrating a commitment to meeting the growing energy demands of Canada and potentially international markets. Its proven and probable reserves are estimated at [Insert Quantifiable Data, e.g., X trillion cubic feet], ensuring a long-term supply of this vital energy resource.

The company's production assets are strategically located across key natural gas producing regions in Canada, including [List Key Regions, e.g., Alberta, British Columbia]. This diversified geographical footprint minimizes risks associated with regional production fluctuations and allows for efficient distribution across the country.

- Year-over-year production increase: [Insert Percentages for the last few years, e.g., 5% in 2022, 7% in 2023].

- Key producing regions and their contribution: [Specify contributions from different regions, e.g., Alberta contributes 60% of total production].

- Exploration and development activities: [Describe ongoing exploration and development projects, highlighting their potential impact on future production].

- Technological advancements: [Mention technological improvements increasing efficiency, such as enhanced drilling techniques or improved pipeline infrastructure].

Market Position and Strategic Partnerships: Securing Market Share

[Insert Company Name Here] holds a significant market share within the competitive Canadian natural gas market, estimated at [Insert Percentage] as of [Insert Date]. This strong position is a result of its reliable production, strategic partnerships, and competitive pricing strategies. The company has established long-term supply contracts with major domestic and international clients, ensuring a steady stream of revenue.

- Key clients and their contribution to revenue: [Mention major clients and their approximate contribution to revenue without revealing sensitive information].

- Significant supply contracts: [Briefly describe some key supply agreements without revealing confidential details].

- Market analysis: [Provide a concise analysis showing the company’s competitive advantages].

- Joint ventures and strategic alliances: [Highlight any significant joint ventures or partnerships that contribute to market share].

Environmental Initiatives and Sustainability: A Responsible Approach to Growth

[Insert Company Name Here] recognizes the importance of environmental sustainability and is actively implementing strategies to minimize its environmental footprint. The company has set ambitious greenhouse gas emission reduction targets and is investing in technologies to achieve these goals.

- Specific examples of sustainability programs: [Provide examples of initiatives, such as methane emission reduction projects, or investments in carbon capture technologies].

- Emission reduction targets: [Clearly state the company’s targets and their timeline].

- Investments in renewable energy: [Mention any investments in renewable energy projects or research].

- Compliance with regulations: [Highlight the company’s commitment to compliance with environmental regulations and policies].

Financial Performance and Investment Strategies: Driving Future Growth

[Insert Company Name Here]'s robust financial performance underscores its success. Over the past few years, the company has demonstrated consistent growth in revenue and profitability. [Insert specific financial data, e.g., Revenue increased by X% in 2022, and net income increased by Y%]. The company's strategic investment plans further solidify its position for future expansion.

- Key financial indicators: [Include relevant data points such as revenue, profit margins, return on equity, etc.].

- Capital expenditure plans: [Describe the company's capital expenditure plans and their focus areas (e.g., exploration, infrastructure development)].

- Acquisitions and divestitures: [Mention any significant acquisitions or divestitures and their rationale].

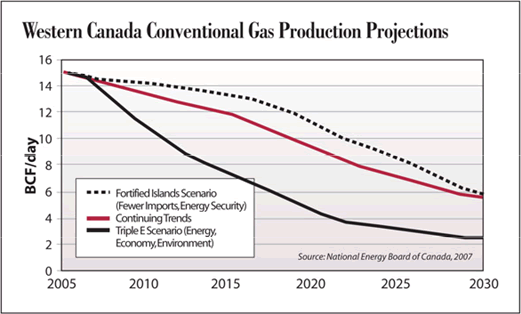

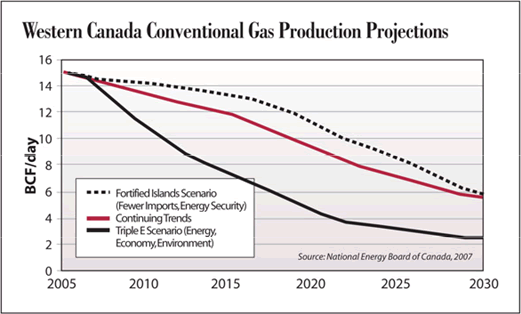

- Long-term growth projections: [Briefly discuss the company's long-term growth projections and the assumptions underpinning them].

The Future of Canada's Premier Natural Gas Producer

[Insert Company Name Here]'s growth trajectory demonstrates its strength and resilience within the Canadian energy sector. Its substantial reserves, strategic market positioning, and commitment to environmental sustainability position it for continued success. While challenges such as fluctuating energy prices and evolving environmental regulations exist, the company’s proactive approach and strategic investments suggest a positive outlook. To learn more about [Insert Company Name Here]'s innovative sustainability efforts and impressive financial performance, we encourage you to visit their website [Insert Website Link Here] and review their latest financial reports. Further research into the company’s commitment to responsible natural gas production will reveal a compelling story of growth and sustainability in Canada’s energy future.

Featured Posts

-

10 John Wick Esque Action Movies You Should Watch

May 12, 2025

10 John Wick Esque Action Movies You Should Watch

May 12, 2025 -

Tyreek Hill Vs Noah Lyles Michael Johnsons Take On The Hypothetical Race

May 12, 2025

Tyreek Hill Vs Noah Lyles Michael Johnsons Take On The Hypothetical Race

May 12, 2025 -

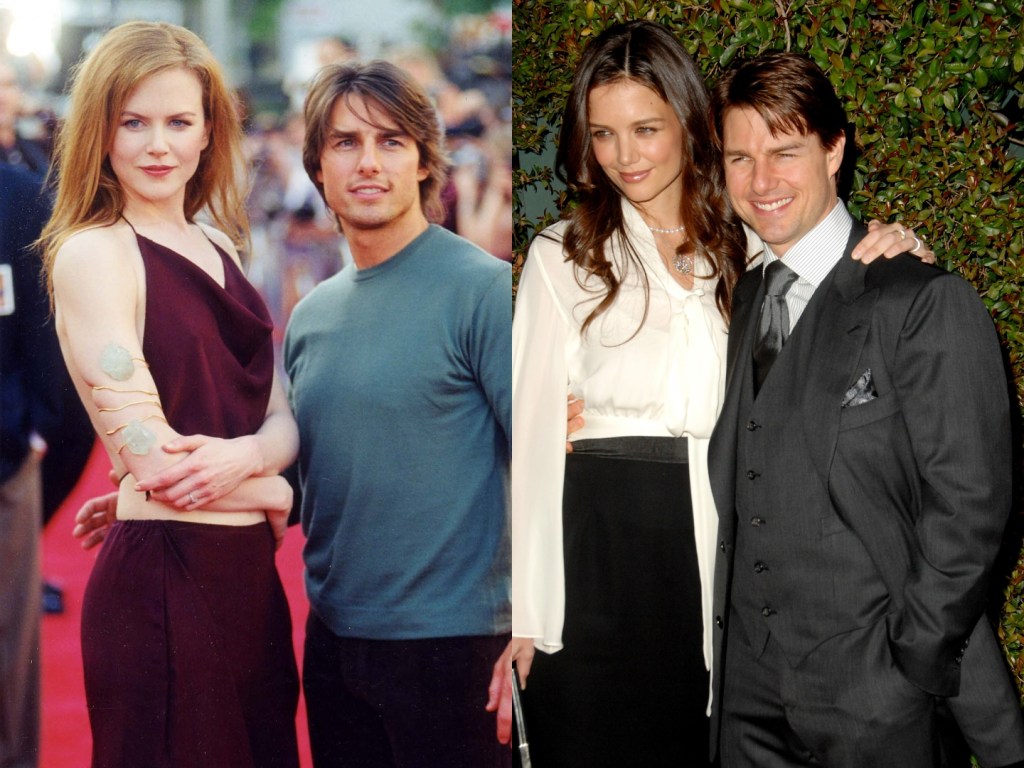

Exploring Tom Cruises Romantic Past Marriages And Dating Speculation

May 12, 2025

Exploring Tom Cruises Romantic Past Marriages And Dating Speculation

May 12, 2025 -

Henry Golding Discusses Crazy Rich Asians Sequel And Tv Show

May 12, 2025

Henry Golding Discusses Crazy Rich Asians Sequel And Tv Show

May 12, 2025 -

A Voir L Animateur Phare De M6 Brise Le Silence Sur L Arrivee De Cyril Hanouna

May 12, 2025

A Voir L Animateur Phare De M6 Brise Le Silence Sur L Arrivee De Cyril Hanouna

May 12, 2025

Latest Posts

-

Eric Antoine En Couple Mystere Autour De Son Actuelle Relation Amoureuse

May 12, 2025

Eric Antoine En Couple Mystere Autour De Son Actuelle Relation Amoureuse

May 12, 2025 -

Silence Brise Reaction D Un Animateur De M6 Concernant Cyril Hanouna

May 12, 2025

Silence Brise Reaction D Un Animateur De M6 Concernant Cyril Hanouna

May 12, 2025 -

L Arrivee De Cyril Hanouna Sur M6 Le Point De Vue D Un Animateur Phare

May 12, 2025

L Arrivee De Cyril Hanouna Sur M6 Le Point De Vue D Un Animateur Phare

May 12, 2025 -

Exclusif Un Animateur De M6 Donne Son Avis Sur L Arrivee De Cyril Hanouna

May 12, 2025

Exclusif Un Animateur De M6 Donne Son Avis Sur L Arrivee De Cyril Hanouna

May 12, 2025 -

Hanouna Sur M6 Un Animateur Vedette Reagit A L Arrivee Du Trublion

May 12, 2025

Hanouna Sur M6 Un Animateur Vedette Reagit A L Arrivee Du Trublion

May 12, 2025