Analyzing The Net Asset Value (NAV) For The Amundi DJIA UCITS ETF (Distributing)

Table of Contents

What is Net Asset Value (NAV) and how is it calculated for the Amundi DJIA UCITS ETF (Distributing)?

Defining NAV:

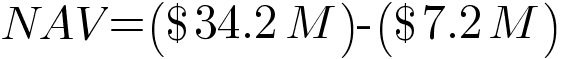

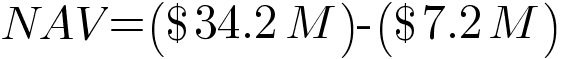

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, expressed per share. For the Amundi DJIA UCITS ETF (Distributing), the NAV reflects the total value of the underlying DJIA stocks held by the fund, adjusted for any liabilities like management fees and other expenses. Understanding the NAV is essential for evaluating the Amundi ETF's performance and making informed investment decisions.

- Definition of NAV: The NAV is calculated by taking the total market value of all the assets held within the ETF (in this case, the 30 constituent stocks of the DJIA), subtracting any liabilities (expenses, debts), and then dividing the result by the total number of outstanding shares.

- DJIA Composition Impact: The DJIA's composition directly impacts the NAV calculation. Changes in the price of any of the 30 constituent companies will affect the overall value of the ETF's assets and, consequently, the NAV.

- Currency Exchange Rates: Since the DJIA includes companies from different countries, currency exchange rates can influence the NAV if the fund holds assets denominated in currencies other than the base currency of the ETF.

- Frequency of NAV Calculation: The NAV of the Amundi DJIA UCITS ETF (Distributing) is typically calculated daily, reflecting the closing prices of the underlying DJIA stocks.

Factors Affecting the NAV of the Amundi DJIA UCITS ETF (Distributing)

Market Fluctuations:

The most significant factor influencing the Amundi DJIA UCITS ETF (Distributing)'s NAV is market fluctuation. The DJIA's daily movements directly translate to changes in the ETF's NAV.

- Individual Stock Price Movements: Changes in the price of individual stocks within the DJIA directly impact the ETF's overall value. A strong performance by a major component like Apple will positively influence the NAV, while a decline in another will have the opposite effect.

- Overall Market Trends: Broader market trends, like bull or bear markets, significantly impact the DJIA and, consequently, the Amundi DJIA UCITS ETF (Distributing)'s NAV. During bull markets, the NAV tends to rise, while bear markets usually cause a decline.

- Economic Indicators and News Events: Macroeconomic factors, such as interest rate changes, inflation reports, geopolitical events, and unexpected economic news, all influence investor sentiment and market movements, impacting the DJIA and the ETF's NAV.

Dividend Distributions:

The Amundi DJIA UCITS ETF (Distributing) is a distributing ETF, meaning it distributes dividends to its shareholders. This affects the NAV.

- Impact of the "Distributing" Nature: When the underlying DJIA companies pay dividends, the Amundi DJIA UCITS ETF receives these dividends, and a portion is distributed to the ETF's shareholders. The NAV decreases after the distribution, reflecting the payout.

- Dividend Reinvestment: Investors can choose to reinvest their dividends, which will increase the number of ETF shares held and potentially offset some of the NAV reduction.

- Timing of Dividend Distributions: The timing of dividend distributions impacts the NAV. The NAV will typically drop on the ex-dividend date, reflecting the upcoming dividend payment.

Expense Ratio:

The expense ratio, a crucial factor affecting the Amundi DJIA ETF's NAV, represents the annual cost of managing the fund.

- Definition and Explanation: The expense ratio covers administrative costs, management fees, and other operational expenses associated with running the ETF.

- Impact on NAV: The expense ratio is deducted from the ETF's assets, impacting the NAV. A higher expense ratio means a lower NAV, all other factors being equal.

- Comparison to Similar ETFs: Comparing the expense ratio of the Amundi DJIA UCITS ETF (Distributing) to similar DJIA ETFs helps assess its cost-effectiveness.

Using NAV to Evaluate the Amundi DJIA UCITS ETF (Distributing) Performance

Comparing NAV to Share Price:

The NAV and the ETF's market price are related but not always identical.

- Premium and Discount to NAV: The ETF's market price can trade at a premium or discount to its NAV. A premium indicates the market price is higher than the NAV, and a discount signifies the opposite.

- Factors Contributing to Price Discrepancies: Supply and demand, investor sentiment, and trading volume can all contribute to discrepancies between the market price and the NAV.

- Importance of Monitoring: Monitoring the difference between the NAV and market price is crucial for identifying potential buying or selling opportunities.

Tracking Performance Over Time:

Analyzing NAV changes over time allows for a comprehensive assessment of the Amundi DJIA UCITS ETF's performance.

- Historical NAV Data: Tracking historical NAV data reveals the long-term growth or decline of the ETF's value.

- Benchmark Comparison: Comparing the Amundi DJIA UCITS ETF (Distributing)'s NAV performance to the DJIA itself provides insight into how effectively the ETF tracks its benchmark index.

- Visualization: Charts and graphs visualizing NAV trends simplify performance analysis.

Conclusion

Understanding the Net Asset Value (NAV) is vital for investors in the Amundi DJIA UCITS ETF (Distributing). The NAV, calculated daily, reflects the underlying value of the ETF's holdings and is influenced by market fluctuations, dividend distributions, and the expense ratio. By comparing the NAV to the market price and tracking NAV changes over time, investors can gain valuable insights into the ETF's performance and make more informed investment decisions. Regularly monitor the NAV of your Amundi DJIA UCITS ETF investment, and consider consulting a financial advisor to develop a comprehensive investment strategy that aligns with your risk tolerance and financial goals. Learn to effectively track your Amundi DJIA ETF's NAV to maximize your investment potential.

Featured Posts

-

Thames Water Executive Bonus Scandal A Detailed Analysis

May 25, 2025

Thames Water Executive Bonus Scandal A Detailed Analysis

May 25, 2025 -

Roland White Reviews Imagine The Academy Of Armando On Bbc 1 A Comedy Writing Masterclass

May 25, 2025

Roland White Reviews Imagine The Academy Of Armando On Bbc 1 A Comedy Writing Masterclass

May 25, 2025 -

Florentino Perez Es A Real Madrid A Fejlodes Kulcsa

May 25, 2025

Florentino Perez Es A Real Madrid A Fejlodes Kulcsa

May 25, 2025 -

Exploring The Growth Of Alternative Delivery In Response To Canada Post Issues

May 25, 2025

Exploring The Growth Of Alternative Delivery In Response To Canada Post Issues

May 25, 2025 -

Novo Ferrari 296 Speciale Potencia De 880 Cv Em Um Hibrido

May 25, 2025

Novo Ferrari 296 Speciale Potencia De 880 Cv Em Um Hibrido

May 25, 2025