Analyzing The Net Asset Value (NAV) Of The Amundi DJIA UCITS ETF

Table of Contents

What is Net Asset Value (NAV) and how is it calculated for the Amundi DJIA UCITS ETF?

Net Asset Value (NAV) represents the net value of an ETF's assets per share. Simply put, it's the total value of everything the ETF owns (stocks, bonds, etc.), minus its liabilities (expenses, debts), divided by the number of outstanding shares. For the Amundi DJIA UCITS ETF, which tracks the Dow Jones Industrial Average (DJIA), the NAV calculation involves several key components:

- Market Value of Holdings: This is the most significant component, representing the current market value of all the stocks in the ETF's portfolio that mirror the DJIA composition. Fluctuations in the DJIA directly impact this value.

- Expenses: These include management fees, administrative costs, and other operational expenses incurred by the ETF provider, Amundi.

- Liabilities: These are any outstanding debts or obligations the ETF might have.

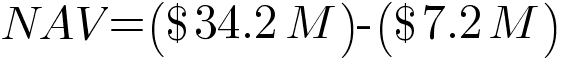

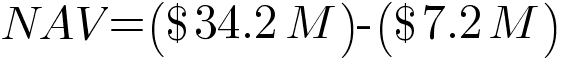

A simplified formula for NAV calculation is:

(Total Asset Value - Total Liabilities) / Number of Outstanding Shares = NAV

The Amundi DJIA UCITS ETF's NAV is typically calculated daily, reflecting the closing market prices of its underlying assets. Keywords: NAV calculation, Amundi DJIA UCITS ETF NAV, ETF NAV calculation, asset valuation.

Analyzing the Amundi DJIA UCITS ETF's NAV Trends

Tracking the Amundi DJIA UCITS ETF's NAV trends over time is vital for assessing its performance and understanding market influences. Several methods can be employed:

- Charting: Visualizing the NAV over a specific period (e.g., weekly, monthly, yearly) on a chart allows for easy identification of upward or downward trends.

- Benchmark Comparison: Comparing the ETF's NAV movement to the DJIA itself provides insight into how effectively the ETF tracks its benchmark index. Significant deviations might indicate potential issues.

- Percentage Change Analysis: Calculating the percentage change in NAV over different timeframes helps identify periods of strong growth or decline.

Long-term NAV analysis reveals the ETF's overall growth trajectory, while short-term analysis highlights more immediate market responses. Factors influencing NAV fluctuations include:

- Market Conditions: Broad market trends (bull or bear markets) significantly impact the NAV.

- DJIA Performance: As the ETF tracks the DJIA, its NAV closely follows the index's performance.

- Currency Fluctuations: For internationally traded ETFs, currency exchange rates can impact the NAV. Keywords: NAV trends, Amundi DJIA UCITS ETF performance, ETF price tracking, market analysis, index tracking.

Using NAV to Compare the Amundi DJIA UCITS ETF to Competitors

While NAV is a crucial metric, it shouldn't be the sole basis for comparing the Amundi DJIA UCITS ETF to its competitors. Other ETFs might track the same DJIA index but differ in fees and operational structure.

- Expense Ratios: The Total Expense Ratio (TER) represents the annual cost of holding the ETF. Lower TERs translate to higher returns for investors. Compare the Amundi DJIA UCITS ETF's TER to similar ETFs to assess cost-effectiveness.

- Other Performance Metrics: Consider other metrics like the tracking error (how closely the ETF tracks its benchmark), dividend yield, and historical performance data.

A holistic approach to ETF comparison, considering NAV in conjunction with these other factors, leads to more informed investment decisions. Keywords: ETF comparison, competitor analysis, DJIA ETF comparison, expense ratio, TER, investment strategy.

Accessing and Interpreting the Amundi DJIA UCITS ETF NAV Data

Reliable NAV data is essential for effective analysis. Several sources provide this information:

- Amundi's Website: The official Amundi website is a primary source for accurate and up-to-date NAV data for all their ETFs, including the Amundi DJIA UCITS ETF.

- Financial News Sources: Reputable financial news websites and data providers (e.g., Bloomberg, Yahoo Finance) usually display ETF NAV data.

Visualizing the data through charts and tables simplifies interpretation. Remember that NAV data represents a snapshot in time and doesn't predict future performance. Always rely on credible and verified data sources. Keywords: NAV data, Amundi DJIA UCITS ETF data, ETF data sources, data interpretation.

Conclusion: Mastering the Amundi DJIA UCITS ETF NAV Analysis

Understanding the Net Asset Value of the Amundi DJIA UCITS ETF is critical for informed investment decisions. By analyzing NAV trends, comparing it to competitors, and accessing reliable data, investors can effectively monitor their investment performance and adapt their strategies accordingly. Remember to consider expense ratios and other performance metrics alongside NAV for a comprehensive assessment. By consistently monitoring the Net Asset Value and applying the analytical techniques outlined above, you can effectively manage your investment in the Amundi DJIA UCITS ETF and make well-informed decisions. Keywords: Amundi DJIA UCITS ETF NAV analysis, ETF investment strategy, informed investment decisions, NAV monitoring.

Featured Posts

-

The Price Of Dissent When Seeking Change Leads To Punishment

May 24, 2025

The Price Of Dissent When Seeking Change Leads To Punishment

May 24, 2025 -

Lauryn Goodmans Relocation To Italy A Bizarre Twist Following Kyle Walkers Transfer

May 24, 2025

Lauryn Goodmans Relocation To Italy A Bizarre Twist Following Kyle Walkers Transfer

May 24, 2025 -

Inside The New Ferrari Service Centre Bengalurus Automotive Landmark

May 24, 2025

Inside The New Ferrari Service Centre Bengalurus Automotive Landmark

May 24, 2025 -

Live Updates M6 Crash Causes Significant Traffic Disruption

May 24, 2025

Live Updates M6 Crash Causes Significant Traffic Disruption

May 24, 2025 -

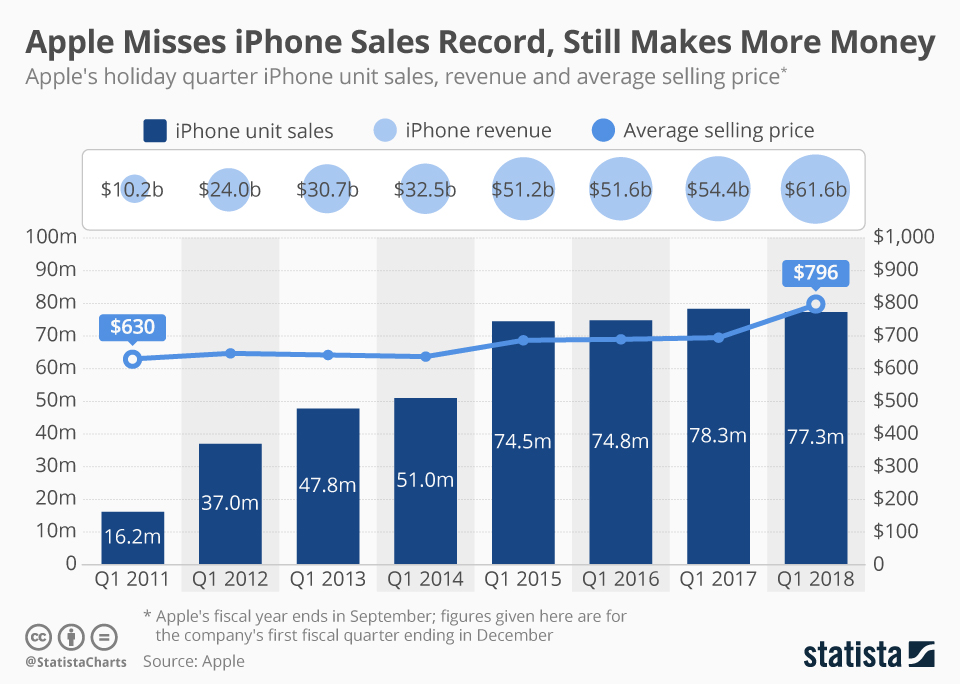

Apple Stock Q2 Earnings I Phone Sales And Revenue Growth

May 24, 2025

Apple Stock Q2 Earnings I Phone Sales And Revenue Growth

May 24, 2025

Latest Posts

-

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 24, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 24, 2025 -

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025 -

Mia Farrow On Trump Deportations Of Venezuelan Gang Members Warrant Arrest

May 24, 2025

Mia Farrow On Trump Deportations Of Venezuelan Gang Members Warrant Arrest

May 24, 2025 -

Frank Sinatra And His Four Wives A Retrospective On His Marriages

May 24, 2025

Frank Sinatra And His Four Wives A Retrospective On His Marriages

May 24, 2025