Analyzing The Net Asset Value Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Factors Influencing the Amundi Dow Jones Industrial Average UCITS ETF NAV

Several factors significantly impact the Amundi Dow Jones Industrial Average UCITS ETF NAV. Understanding these factors is key to anticipating potential fluctuations and making sound investment choices.

Underlying Asset Performance

The performance of the 30 companies comprising the Dow Jones Industrial Average directly dictates the ETF's NAV. Price increases in these stocks lead to a higher NAV, while price decreases have the opposite effect. This is because the ETF aims to mirror the performance of the index.

- Example 1: A significant price surge in Apple (AAPL), a major component of the Dow Jones Industrial Average, will positively influence the overall ETF NAV.

- Example 2: Conversely, a downturn in the price of Boeing (BA) will negatively impact the NAV, although the extent depends on its weighting within the index.

The weighting of each company within the Dow Jones Industrial Average is crucial. Companies with higher weightings have a more substantial impact on the NAV's sensitivity to price changes. Analyzing the portfolio holdings and their respective weights provides crucial insights into NAV fluctuations. Understanding "stock market performance" and the impact on "portfolio holdings" is crucial for effective "Dow Jones Industrial Average" ETF investment.

Currency Fluctuations

Currency exchange rates play a vital role, particularly if the ETF is denominated in a currency different from your home currency. The Amundi Dow Jones Industrial Average UCITS ETF is likely denominated in Euros (EUR), impacting investors outside the Eurozone.

- USD/EUR Fluctuations: If the USD strengthens against the EUR, an investor holding the ETF in a USD account will see a lower NAV in USD terms, even if the underlying asset performance remains unchanged.

- Hedging Strategies: The ETF might employ hedging strategies to mitigate currency risk. However, these strategies aren't always perfect and can introduce additional complexities. Understanding "currency risk" and "exchange rate fluctuations" is vital, as is researching any implemented "hedging strategies."

Expense Ratio and Management Fees

The ETF's expense ratio and management fees gradually erode the NAV over time. These fees represent the cost of managing and operating the fund.

- Expense Ratio Calculation: The expense ratio is usually expressed as a percentage of the ETF's assets under management (AUM) and is deducted annually.

- Fee Comparison: Comparing the "expense ratio," "management fees," and "total expense ratio (TER)" of the Amundi Dow Jones Industrial Average UCITS ETF to its competitors reveals its cost-effectiveness. Understanding these "management fees" is crucial for assessing long-term value.

Analyzing Historical NAV Data of the Amundi Dow Jones Industrial Average UCITS ETF

Examining the historical NAV performance provides valuable insights into long-term trends and potential future behavior.

Trends and Patterns

Analyzing historical "NAV data" reveals "long-term trends" and helps predict future performance. Charts visualizing the historical NAV data allow for easier pattern identification.

- High and Low Periods: Analyzing periods of high and low NAV performance, alongside their contributing factors (e.g., market corrections, economic events), facilitates a better understanding of the ETF's behavior. Such "performance analysis" is vital for investment strategy.

Comparing NAV to the Dow Jones Industrial Average

The ETF aims to track the Dow Jones Industrial Average. Comparing the ETF's NAV to the index reveals its tracking efficiency.

- Tracking Error: The difference between the ETF's NAV performance and the Dow Jones Industrial Average's performance is the tracking error. Understanding the causes of this "tracking error" is crucial.

- Index Tracking Efficiency: Analyzing the correlation illustrates how effectively the ETF mirrors the index. This is an important aspect of "index tracking" and "benchmark comparison."

Using NAV Information in Investment Strategies

Understanding NAV data can inform investment decisions, but caution is crucial.

Determining Investment Timing

While some investors attempt to use NAV data for "market timing" ("buy low, sell high"), this strategy is risky. Long-term strategies are often more effective.

- Dollar-Cost Averaging: A better approach is dollar-cost averaging – investing a fixed amount at regular intervals, regardless of the NAV.

Portfolio Diversification

The Amundi Dow Jones Industrial Average UCITS ETF provides exposure to large-cap US equities but shouldn't be the sole component of your portfolio.

- Asset Allocation: "Portfolio diversification" is essential for "risk management," requiring diversification across asset classes (bonds, real estate, etc.). The ETF contributes to this diversification by providing "asset allocation" within equities.

Conclusion: Making Informed Decisions with Amundi Dow Jones Industrial Average UCITS ETF NAV Analysis

Analyzing the Amundi Dow Jones Industrial Average UCITS ETF NAV requires considering underlying asset performance, currency fluctuations, and expense ratios. Historical NAV data analysis helps understand trends and the ETF’s tracking efficiency. Remember that effective investment strategies prioritize diversification and a long-term perspective, rather than relying solely on short-term NAV fluctuations. Conduct a thorough Amundi Dow Jones Industrial Average UCITS ETF NAV analysis before investing and remember that seeking professional financial advice is always recommended for creating a suitable ETF investment strategy and understanding ETF NAV.

Featured Posts

-

L Affaire Baffie Ardisson Repond Aux Critiques Sur Le Sexisme A La Tele

May 25, 2025

L Affaire Baffie Ardisson Repond Aux Critiques Sur Le Sexisme A La Tele

May 25, 2025 -

Analise Do Ferrari 296 Speciale Supercarro Hibrido De Alta Performance

May 25, 2025

Analise Do Ferrari 296 Speciale Supercarro Hibrido De Alta Performance

May 25, 2025 -

Renewed Scrutiny Woody Allen And The Resurfacing Sexual Abuse Claims Following Sean Penns Remarks

May 25, 2025

Renewed Scrutiny Woody Allen And The Resurfacing Sexual Abuse Claims Following Sean Penns Remarks

May 25, 2025 -

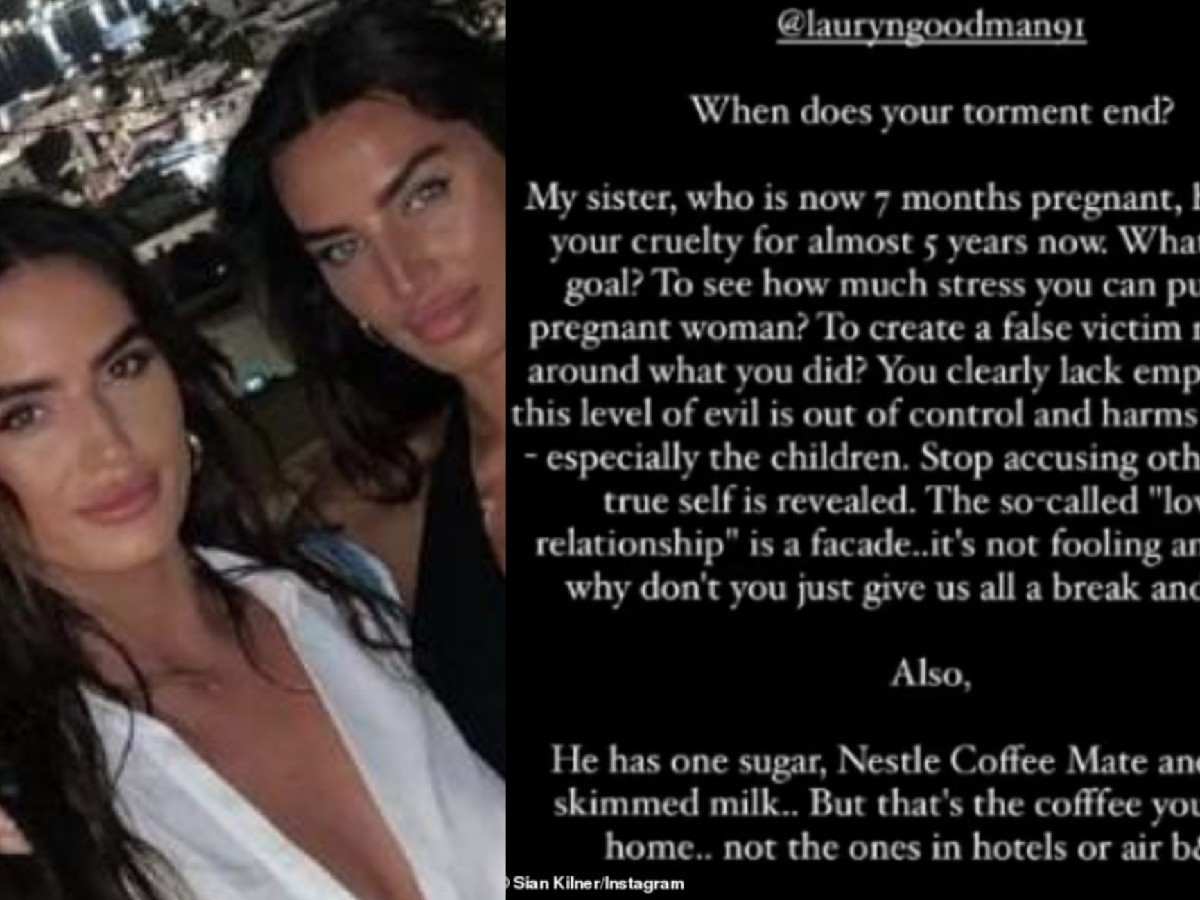

Annie Kilner And Kyle Walker A Diamond Ring And Relationship Speculation

May 25, 2025

Annie Kilner And Kyle Walker A Diamond Ring And Relationship Speculation

May 25, 2025 -

Get Your Bbc Radio 1 Big Weekend Tickets A Step By Step Guide

May 25, 2025

Get Your Bbc Radio 1 Big Weekend Tickets A Step By Step Guide

May 25, 2025