Analyzing The Secondary Impacts Of Reciprocal Tariffs On India

Table of Contents

Impact on Domestic Industries

Reciprocal tariffs significantly impact Indian industries, leading to unforeseen challenges and complexities. The cascading effects extend far beyond initial import costs.

Increased Production Costs

Reciprocal tariffs lead to higher input costs for Indian industries relying on imported raw materials or intermediate goods. This increase in costs directly affects profitability and competitiveness.

- Increased prices for steel, chemicals, and textiles: These are crucial inputs for numerous manufacturing sectors, pushing up production costs across the board.

- Supply chain disruptions: Dependence on imported components makes Indian industries vulnerable to supply chain disruptions caused by tariff-related delays and uncertainties.

- Reduced competitiveness in global markets: Higher production costs make Indian goods less competitive internationally, potentially leading to decreased exports and market share.

- Potential for job losses in import-dependent industries: Companies may be forced to downsize or even close down if they cannot absorb the increased costs, resulting in job losses.

Inflationary Pressures

Higher import prices inevitably translate into increased consumer prices, fueling inflation and eroding purchasing power. This has significant social and economic consequences.

- Impact on essential goods like food and energy: Increased import costs for these essential items disproportionately affect lower-income households, exacerbating inequality.

- Reduced consumer spending: Higher prices lead to reduced consumer spending, dampening economic growth and potentially leading to a recessionary spiral.

- Potential for social unrest due to rising prices: Widespread dissatisfaction stemming from increased living costs can lead to social instability and protests.

- Government measures to control inflation: The government may need to implement measures like interest rate hikes or subsidies to mitigate inflationary pressures, each with its own potential downsides.

Effects on Foreign Investment

The uncertainty created by reciprocal tariffs can significantly deter foreign investment and negatively impact existing foreign direct investment (FDI).

Deterrent to FDI

The unpredictable nature of trade policy under a regime of reciprocal tariffs creates a climate of uncertainty that discourages new foreign investment.

- Reduced investor confidence: Investors are hesitant to commit capital to an environment where trade policies are volatile and potentially harmful to their returns.

- Shift of investment to other countries: Investors will likely divert their capital to countries with more stable and predictable trade policies.

- Impact on job creation and economic growth: Reduced FDI directly impacts job creation and overall economic growth, hindering India's development trajectory.

- Loss of technological advancements and expertise: Foreign investment often brings in advanced technologies and expertise, the absence of which hinders innovation and productivity growth.

Impact on Existing FDI

Companies that have already invested in India face challenges adapting to the increased costs and reduced market access caused by reciprocal tariffs.

- Potential for relocation of manufacturing units: Companies may relocate their operations to other countries to avoid the higher costs associated with reciprocal tariffs.

- Downsizing of operations in India: Existing investors may be forced to downsize their operations in India due to reduced profitability.

- Reduced profitability for foreign companies: Higher production costs and decreased market access squeeze profit margins for foreign companies operating in India.

- Impact on employment in joint ventures: Downsizing and relocation efforts lead to job losses in joint ventures involving Indian and foreign companies.

Agricultural Sector Vulnerability

India's agricultural sector, a significant contributor to the economy, is particularly vulnerable to the secondary effects of reciprocal tariffs.

Impact on Exports

Reciprocal tariffs can severely restrict access to international markets for Indian agricultural products.

- Reduced market access for Indian farmers: Higher tariffs make Indian agricultural exports less competitive, leading to decreased sales and income for farmers.

- Price volatility and income losses for farmers: Fluctuations in global prices, exacerbated by tariffs, create income instability for farmers, increasing their vulnerability.

- Increased reliance on domestic consumption: Reduced export opportunities force farmers to rely more heavily on the domestic market, which may not be able to absorb the increased supply.

- Potential for food security concerns: Disruptions in agricultural exports can affect food security, particularly for vulnerable populations reliant on imported food.

Dependence on Imports

Tariffs on imported agricultural inputs, like fertilizers and machinery, increase domestic production costs and affect yields.

- Increased cost of agricultural production: Higher input costs reduce the profitability of farming and can lead to decreased agricultural output.

- Reduced agricultural output and productivity: The increased costs of production can result in lower yields, impacting overall food availability.

- Impact on food prices and availability: Reduced output and higher production costs can lead to increased food prices and potentially shortages.

- Need for government support to farmers: Governments may need to provide greater support to farmers to offset the negative effects of reciprocal tariffs, including subsidies or financial assistance.

Geopolitical Implications

Reciprocal tariffs can have significant geopolitical implications, damaging trade relationships and international cooperation.

Strained Trade Relations

The imposition of reciprocal tariffs often escalates existing trade tensions and negatively impacts diplomatic relations between countries.

- Escalation of trade wars: Reciprocal tariffs can trigger retaliatory measures, leading to a tit-for-tat escalation of trade barriers.

- Damage to bilateral relationships: Trade disputes fueled by reciprocal tariffs strain diplomatic relationships and create distrust between nations.

- Impact on regional trade agreements: The uncertainty created by reciprocal tariffs can undermine regional trade agreements and integration efforts.

- Need for diplomatic solutions and negotiations: Addressing the challenges posed by reciprocal tariffs requires diplomatic solutions, negotiations, and a commitment to multilateral cooperation.

Conclusion

The secondary impacts of reciprocal tariffs on India are multifaceted and far-reaching, affecting various sectors and impacting economic growth, social stability, and international relations. Understanding these indirect effects is crucial for formulating effective policy responses and mitigating potential negative consequences. While some domestic industries might benefit initially, the overall economic cost of reciprocal tariffs is likely to outweigh any short-term advantages. Further research into the long-term effects of reciprocal tariffs on India is crucial for effective policy-making and protecting the nation’s economic interests. Therefore, a comprehensive strategy is needed to address the challenges posed by reciprocal tariffs in India, promoting sustainable economic growth and mitigating the associated risks. Careful consideration of the long-term implications is paramount to navigating these complex trade dynamics. Addressing the challenges presented by reciprocal tariffs requires proactive policy adjustments and a commitment to fostering a more stable and predictable trading environment for India.

Featured Posts

-

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Details On The January 6th Claims

May 15, 2025

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Details On The January 6th Claims

May 15, 2025 -

Euphoria Season 3 Set Photos Cassies Wedding And Mystery Husband Revealed

May 15, 2025

Euphoria Season 3 Set Photos Cassies Wedding And Mystery Husband Revealed

May 15, 2025 -

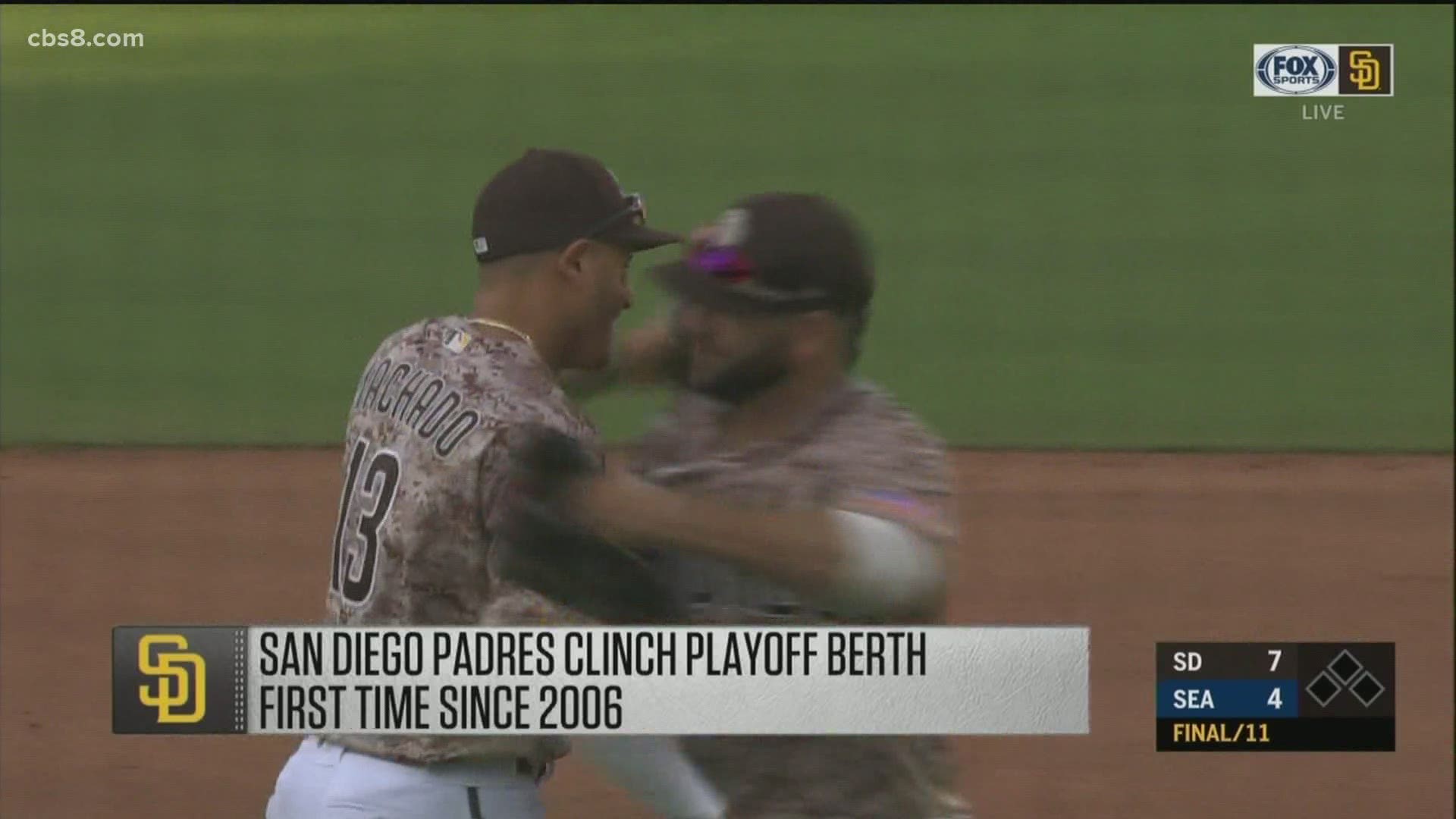

Padres Clinch Series Victory Against Cubs

May 15, 2025

Padres Clinch Series Victory Against Cubs

May 15, 2025 -

Nba Playoffs Game 6 Rockets Vs Warriors Jimmy Butlers Best Bets

May 15, 2025

Nba Playoffs Game 6 Rockets Vs Warriors Jimmy Butlers Best Bets

May 15, 2025 -

Kim Kardashians Testimony Fear For Her Life During Robbery

May 15, 2025

Kim Kardashians Testimony Fear For Her Life During Robbery

May 15, 2025

Latest Posts

-

Rays Sweep Padres Complete Game Coverage On Fm 96 9 The Game

May 15, 2025

Rays Sweep Padres Complete Game Coverage On Fm 96 9 The Game

May 15, 2025 -

Real Radio 104 1 Rays Achieve Perfect Padres Sweep

May 15, 2025

Real Radio 104 1 Rays Achieve Perfect Padres Sweep

May 15, 2025 -

Taylor Wards Grand Slam Propels Angels Past Padres

May 15, 2025

Taylor Wards Grand Slam Propels Angels Past Padres

May 15, 2025 -

Tampa Bay Rays Sweep Padres In Commanding Fashion

May 15, 2025

Tampa Bay Rays Sweep Padres In Commanding Fashion

May 15, 2025 -

Complete Sweep Rays Triumph Over Padres On Real Radio 104 1

May 15, 2025

Complete Sweep Rays Triumph Over Padres On Real Radio 104 1

May 15, 2025