Analyzing The Success Of Deutsche Bank's FIC Trading Division

Table of Contents

Strategic Positioning and Market Opportunities

Deutsche Bank's success in FIC trading hinges on its strategic choices within specific market segments. The bank's decision to focus on particular areas, such as interest rate derivatives, foreign exchange (forex), and credit trading, has played a pivotal role in its overall performance. Analyzing the timing of entry and exit from these markets reveals a keen understanding of market cycles and risk management.

-

Focus on Specific Product Areas: Deutsche Bank's expertise in interest rate derivatives, a complex and lucrative market, has undeniably contributed to its success. Similarly, its robust forex trading operations and strategic positioning within the credit trading market demonstrate a well-defined approach to market selection.

-

Market Share and Competitive Advantage: Securing a significant market share requires a combination of strong trading capabilities, innovative strategies, and a deep understanding of client needs. Deutsche Bank's competitive advantage stems from its global reach, established client relationships, and its ability to offer a diverse range of products and services.

-

Geographic Diversification: A geographically diversified approach minimizes risk and allows the bank to capitalize on opportunities in various regions. Deutsche Bank's presence in key financial centers worldwide gives it access to diverse markets and enhances its ability to manage global risks. This geographic diversification is crucial for mitigating regional economic fluctuations. The keywords market share, competitive advantage, strategic positioning, and geographic diversification highlight the bank's adeptness.

Technological Advancements and Operational Efficiency

In today's fast-paced financial markets, technological innovation is paramount. Deutsche Bank's investment in advanced trading technologies has significantly boosted its operational efficiency and trading capabilities. The adoption of algorithmic trading and high-frequency trading (HFT) strategies demonstrates its commitment to technological advancement.

-

Investment in Trading Infrastructure and Technology: Deutsche Bank's significant investment in cutting-edge infrastructure, including high-speed trading platforms and data analytics tools, provides a crucial competitive edge. This infrastructure allows for faster execution speeds, improved risk management, and better decision-making.

-

Implementation of Risk Management Systems: Robust risk management systems are vital for mitigating potential losses. Deutsche Bank has implemented sophisticated systems to monitor and control risk across its various trading operations, ensuring regulatory compliance and minimizing exposure to unforeseen events. Strong risk management is crucial in fixed income currencies trading.

-

Automation of Trading Processes: Automation of various trading processes, from order execution to portfolio management, enhances efficiency and reduces operational costs. This automation reduces manual errors and frees up human capital to focus on strategic initiatives. The keywords algorithmic trading, high-frequency trading, trading technology, risk management, and operational efficiency are integral to this section's theme.

Talent Acquisition and Employee Performance

The success of any trading division heavily relies on the expertise and skills of its employees. Deutsche Bank's commitment to attracting and retaining top talent is a key factor in its performance. The bank's talent acquisition strategies and focus on employee retention are critical.

-

Recruitment of Top Talent: Deutsche Bank actively recruits highly skilled traders and analysts from competing firms, ensuring a constant influx of experienced professionals. This commitment to attracting top talent is vital for maintaining a competitive edge in the market.

-

Investment in Employee Training and Development Programs: The bank invests heavily in training and development programs, ensuring its employees remain at the forefront of industry knowledge and best practices. Continuous professional development is crucial for staying competitive.

-

Employee Compensation and Incentives: Competitive compensation and performance-based incentives attract and retain highly skilled professionals. A strong compensation strategy ensures employee motivation and encourages high performance. The keywords talent acquisition, employee retention, skilled traders, analysts, compensation, training, and development capture the essence of human capital management within the division.

Regulatory Compliance and Risk Management

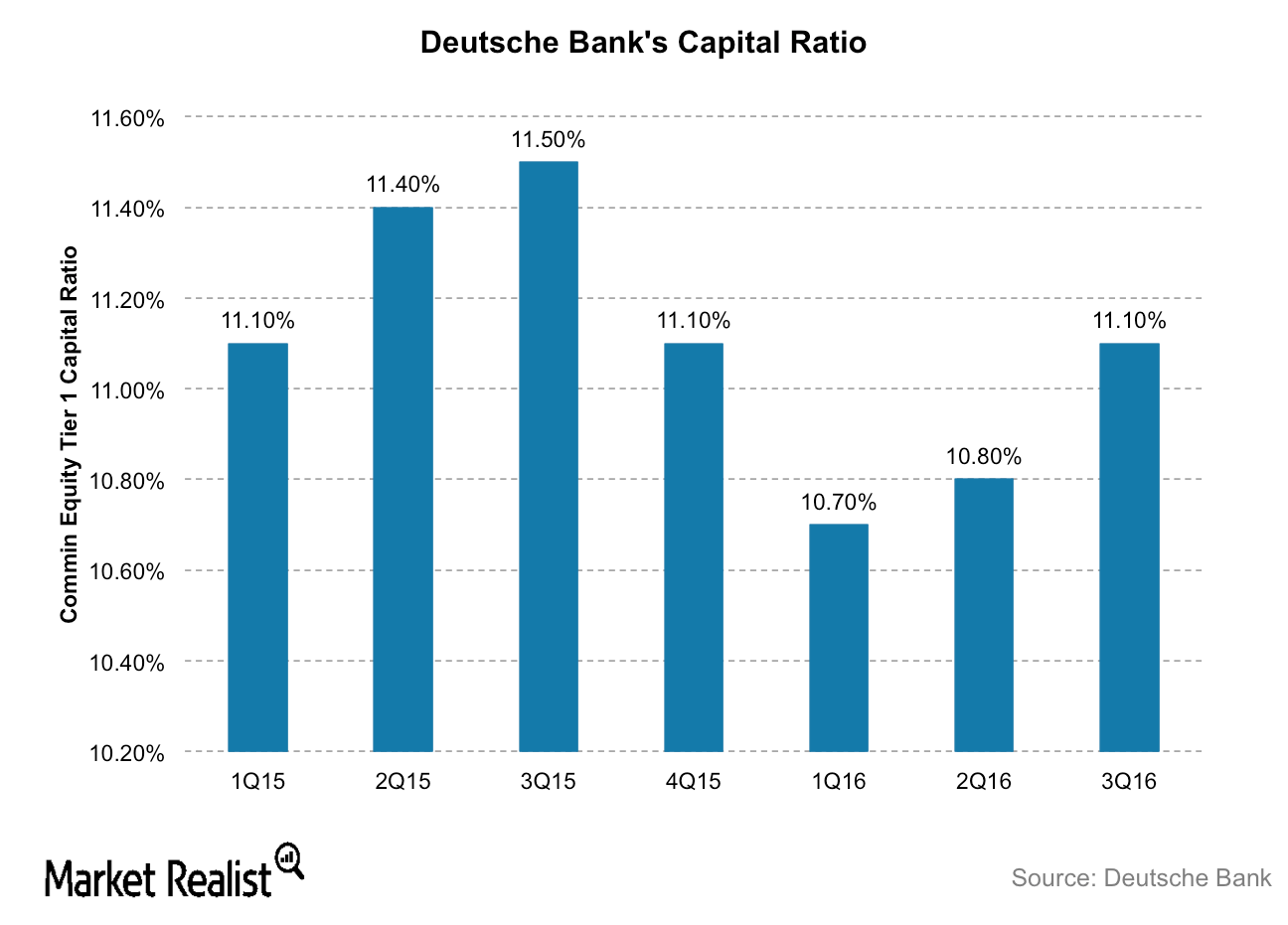

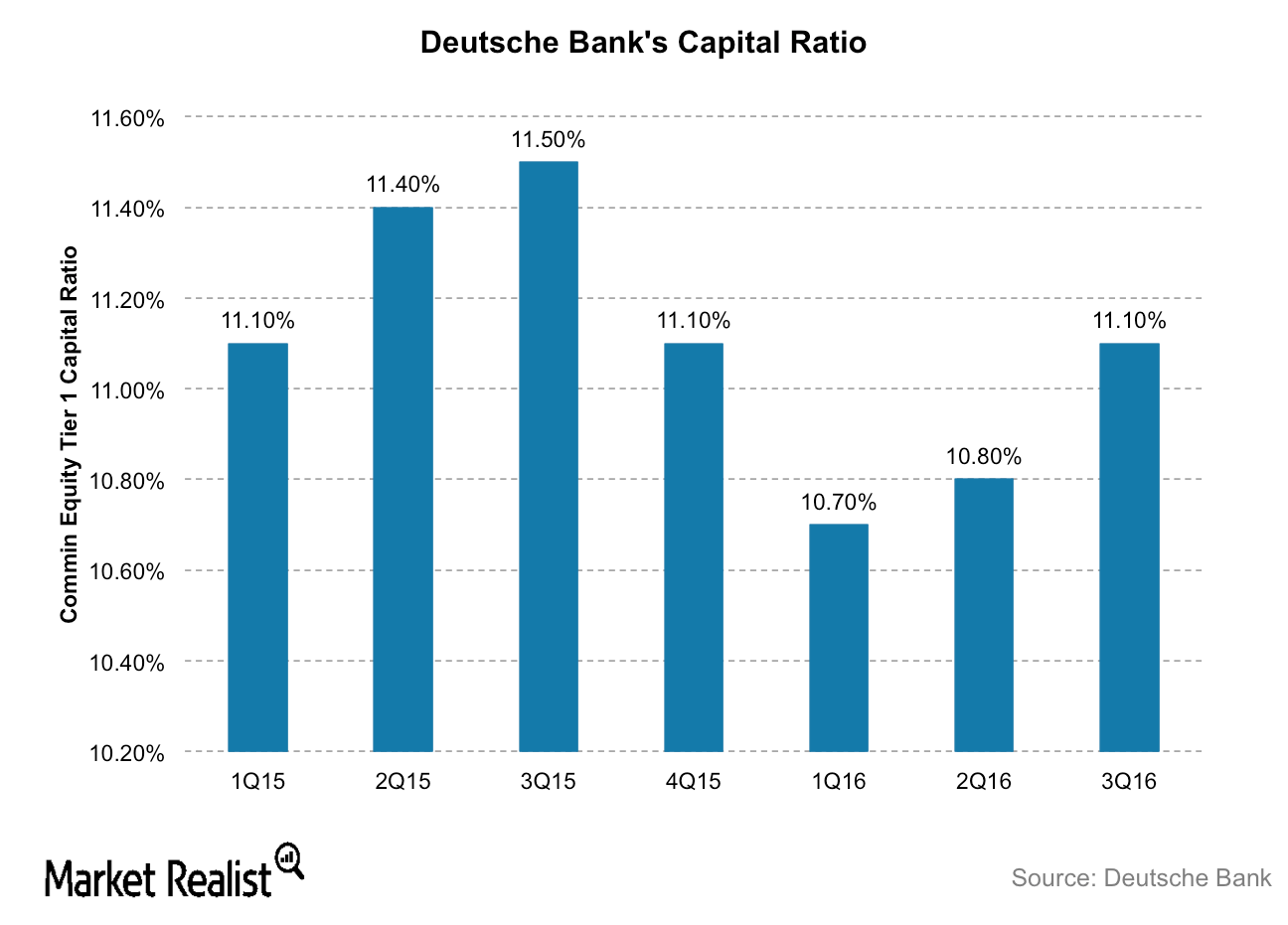

Navigating the complex regulatory landscape is crucial for the success of any financial institution. Deutsche Bank's commitment to regulatory compliance and effective risk management significantly influences its FIC trading division's performance. Compliance with regulations such as Dodd-Frank and Basel III is non-negotiable.

-

Compliance with Regulations: Adherence to regulations, such as Dodd-Frank and Basel III, is paramount. Deutsche Bank's rigorous compliance procedures ensure that its operations align with legal and ethical standards.

-

Effectiveness of Risk Mitigation Strategies: The bank employs sophisticated risk mitigation strategies to minimize potential losses from market fluctuations, operational failures, and other unforeseen events. Effective risk mitigation is crucial for long-term success.

-

Impact of Regulatory Fines and Penalties: While regulatory fines and penalties can negatively impact profitability, Deutsche Bank's focus on compliance minimizes the risk of substantial penalties. This proactive approach to regulatory compliance is essential for maintaining a strong reputation and avoiding significant financial repercussions. The keywords regulatory compliance, risk management, Dodd-Frank, Basel III, risk mitigation, regulatory fines demonstrate the critical role of regulatory compliance.

Assessing the Future of Deutsche Bank's FIC Trading Division

In conclusion, the success of Deutsche Bank's FIC trading division is a result of strategic positioning, technological investments, talent acquisition, and adherence to regulatory compliance. However, the financial landscape is ever-evolving. The division faces ongoing challenges, including increasing competition, technological disruption, and evolving regulatory requirements. Continued strategic planning, technological innovation, and effective risk management will be crucial for navigating these challenges and capitalizing on future opportunities. Further research into Deutsche Bank’s fixed income currencies trading strategies and its overall FIC trading performance is essential to fully understand its future prospects within the dynamic financial markets. We encourage you to delve deeper into the analysis of Deutsche Bank's FIC trading performance and its implications for the future of the financial markets.

Featured Posts

-

Mongoliya Massoviy Rost Sluchaev Kori Sozdaet Krizis V Zdravookhranenii

May 30, 2025

Mongoliya Massoviy Rost Sluchaev Kori Sozdaet Krizis V Zdravookhranenii

May 30, 2025 -

Tileorasi Savvatoy 10 Maioy Odigos Programmatos

May 30, 2025

Tileorasi Savvatoy 10 Maioy Odigos Programmatos

May 30, 2025 -

Otay Mountain Rescue Border Patrol Saves Two Women

May 30, 2025

Otay Mountain Rescue Border Patrol Saves Two Women

May 30, 2025 -

Dangerous Heat Texas Issues 111 F Temperature Warning

May 30, 2025

Dangerous Heat Texas Issues 111 F Temperature Warning

May 30, 2025 -

The Ultimate Guide To Air Jordan Sneakers Releasing In May 2025

May 30, 2025

The Ultimate Guide To Air Jordan Sneakers Releasing In May 2025

May 30, 2025