Analyzing The Treasury Market's Performance On The Night Of April 8th

Table of Contents

Pre-Market Conditions and Leading Indicators

The market sentiment leading up to April 8th was a complex mix of optimism and apprehension. Several key economic indicators and Federal Reserve pronouncements played a significant role in shaping this sentiment. Leading economic indicators, such as inflation data and consumer confidence indices, offered a mixed bag, fueling uncertainty among market participants.

- Review of key economic data released before April 8th: Inflation figures released just days before showed a persistent, albeit slightly decelerated, upward trend, stoking concerns about the Federal Reserve's upcoming monetary policy decisions. This uncertainty contributed to the volatility seen later.

- Analysis of market sentiment based on news and analyst reports: News reports leading up to April 8th highlighted ongoing geopolitical tensions and concerns about supply chain disruptions, creating a risk-off sentiment in some market sectors. Analyst predictions were equally divided, further increasing the uncertainty.

- Examination of bond futures pricing and their implications: Bond futures prices reflected this uncertainty, exhibiting increased volatility in the days prior to April 8th. This suggested a heightened anticipation of potential market shifts in response to upcoming economic data releases and policy announcements.

Overnight Treasury Market Activity on April 8th

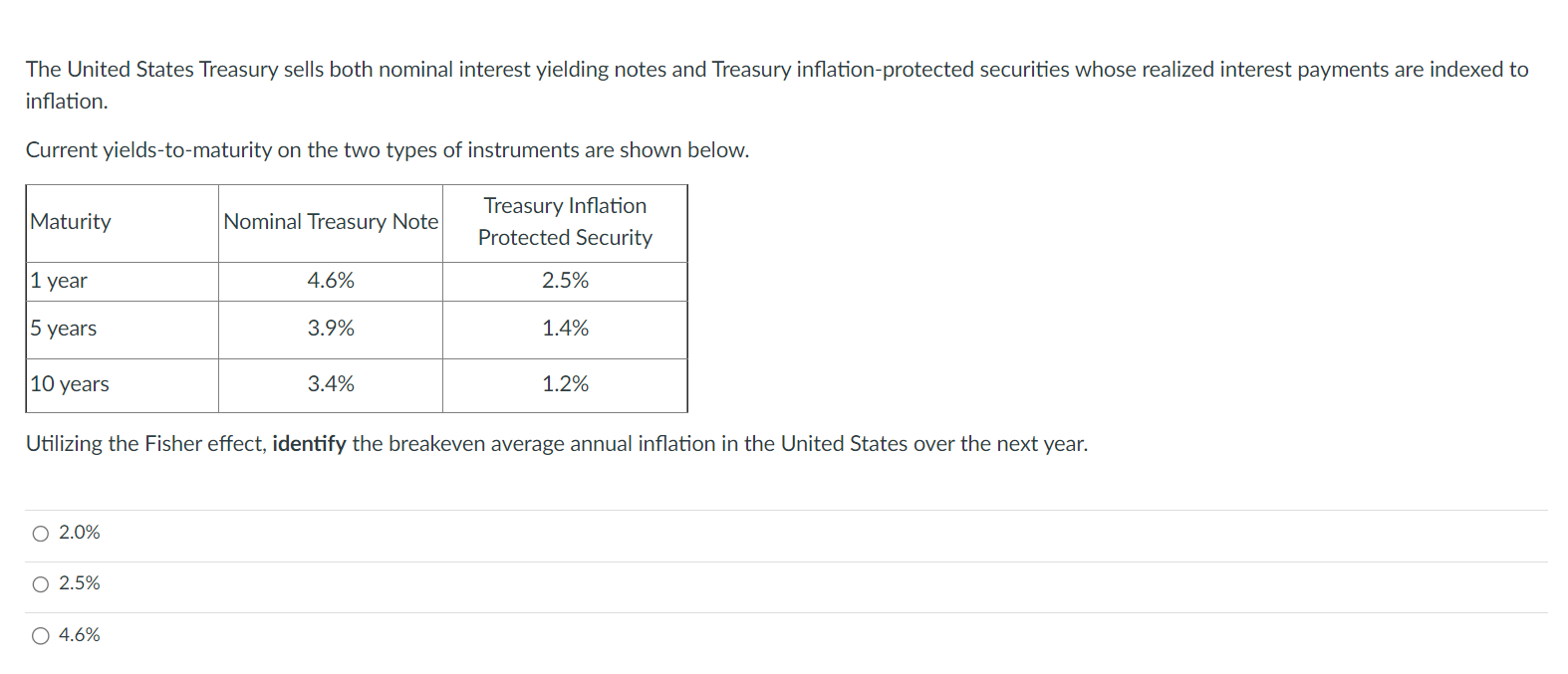

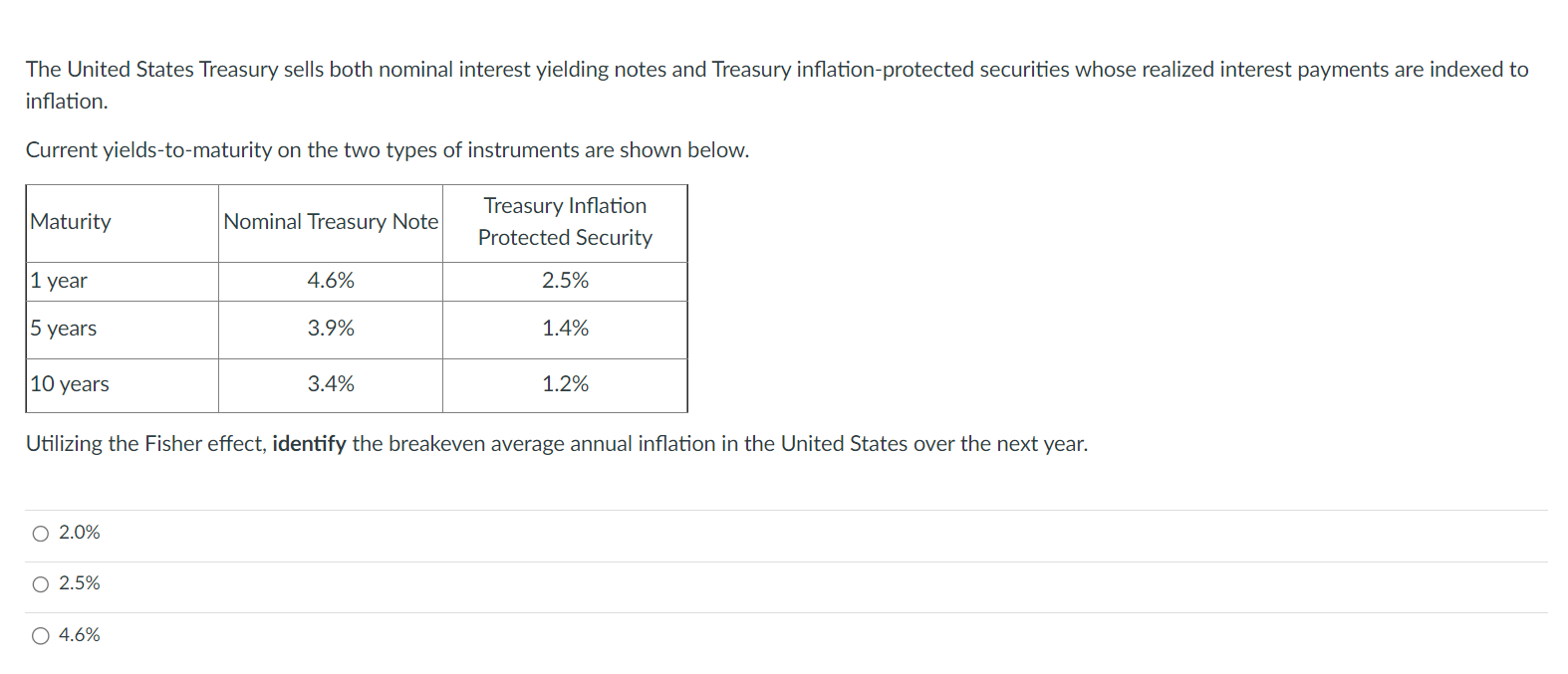

The overnight Treasury market activity on April 8th was characterized by significant price fluctuations and increased trading volume, particularly in shorter-term Treasury bills and notes. The yield curve, which typically reflects the difference in yields between Treasury instruments of varying maturities, showed notable shifts.

- Graphical representation of yield curve shifts: (Note: A visual representation of the yield curve shift would be included here in an actual published article.) The yield curve flattened, indicating a potential shift in investor expectations regarding future interest rate hikes.

- Analysis of trading volume across different maturities: Trading volume spiked significantly across all maturities, suggesting increased nervousness and active trading among market participants. The surge was particularly pronounced in the shorter-term Treasury instruments.

- Discussion of any significant price jumps or drops: Several instances of sharp price movements were observed throughout the night, indicating periods of intense buying and selling pressure. These jumps and drops are worthy of further investigation to determine the specific catalysts.

- Examination of liquidity conditions in the repo market: Liquidity in the repo market, crucial for overnight financing in the Treasury market, appeared to be adequate, though some minor strains were noted, potentially contributing to some of the observed price volatility. Further research into the specifics of the repo market transactions that night would illuminate this point.

Impact of Macroeconomic Factors and Geopolitical Events

The Treasury market's performance on April 8th was undeniably influenced by a confluence of macroeconomic and geopolitical factors. Global economic uncertainty, fueled by persistent inflation and geopolitical tensions, played a substantial role in shaping investor sentiment and market behavior.

- Discussion of the impact of global economic uncertainty: Concerns about slowing global growth, coupled with ongoing inflation, created a complex environment where investors sought safe haven assets but were also wary of potential interest rate hikes.

- Analysis of the role of inflation expectations: Persistent inflation expectations continued to exert upward pressure on bond yields, as investors anticipated the potential for further monetary tightening by central banks around the globe.

- Examination of the influence of geopolitical events: Ongoing geopolitical instability added further complexity, prompting investors to reassess risk profiles and potentially seek the safety of Treasury bonds.

Identifying Key Drivers of Volatility

The volatility observed in the Treasury market on the night of April 8th was likely driven by a combination of factors. Understanding whether this volatility was systemic or idiosyncratic is crucial for risk assessment.

- Correlation analysis between Treasury yields and other market indicators: A correlation analysis comparing Treasury yields to other market indicators, such as the VIX (volatility index) and equity indices, could help identify the key drivers of this volatility.

- Assessment of systemic versus idiosyncratic risk factors: Determining whether the observed volatility was a systemic event reflecting broader market instability or an idiosyncratic event related to specific factors impacting the Treasury market is crucial for future risk management strategies.

Post-Market Analysis and Implications

The days following April 8th witnessed a period of consolidation and reassessment within the Treasury market. The overnight volatility prompted investors to review their portfolio allocations and assess the implications for future investment strategies.

- Review of post-April 8th market performance: A detailed analysis of the market's performance in the following days can reveal whether the volatility was temporary or indicative of broader trends.

- Discussion of implications for investors’ portfolio strategies: Investors may need to adjust their portfolio strategies to account for the increased volatility and reassess their risk tolerance.

- Analysis of the long-term implications for interest rates: The events of April 8th could have implications for long-term interest rate predictions, necessitating a review of long-term investment strategies.

Conclusion

The Treasury market's performance on the night of April 8th highlighted the interconnectedness of macroeconomic factors, geopolitical events, and investor sentiment. The overnight volatility underscores the importance of continuous monitoring and careful risk assessment. Understanding the interplay of these factors is crucial for informed decision-making. Understanding the nuances of the Treasury market, particularly events like the overnight performance on April 8th, is crucial for informed investing. Continue to monitor the Treasury market and stay updated on crucial economic indicators to optimize your investment strategy. Consider subscribing to a reputable financial news service for real-time updates and in-depth analysis to enhance your understanding of the Treasury market and its volatility.

Featured Posts

-

Adhd En Levensverwachting Klopt Het Dat Volwassenen Met Adhd Korter Leven

Apr 29, 2025

Adhd En Levensverwachting Klopt Het Dat Volwassenen Met Adhd Korter Leven

Apr 29, 2025 -

6 0 Kantersieg Lask Gewinnt Qualifikationsgruppe Gegen Klagenfurt

Apr 29, 2025

6 0 Kantersieg Lask Gewinnt Qualifikationsgruppe Gegen Klagenfurt

Apr 29, 2025 -

More Young People Diagnosed With Adhd At Aiims Opd Understanding The Increase

Apr 29, 2025

More Young People Diagnosed With Adhd At Aiims Opd Understanding The Increase

Apr 29, 2025 -

Capital Summertime Ball 2025 Tickets Your Step By Step Guide To Buying Tickets

Apr 29, 2025

Capital Summertime Ball 2025 Tickets Your Step By Step Guide To Buying Tickets

Apr 29, 2025 -

The Fly Did Jeff Goldblums Performance Get Underrated By The Oscars

Apr 29, 2025

The Fly Did Jeff Goldblums Performance Get Underrated By The Oscars

Apr 29, 2025

Latest Posts

-

Boris Dzhonson I Kommertsializatsiya Ego Imidzha Analiz Situatsii

May 12, 2025

Boris Dzhonson I Kommertsializatsiya Ego Imidzha Analiz Situatsii

May 12, 2025 -

Incidente Con Avestruz Boris Johnson Herido Durante Paseo Familiar En Texas

May 12, 2025

Incidente Con Avestruz Boris Johnson Herido Durante Paseo Familiar En Texas

May 12, 2025 -

Skolko Zarabatyvaet Boris Dzhonson Na Selfi Novye Fakty

May 12, 2025

Skolko Zarabatyvaet Boris Dzhonson Na Selfi Novye Fakty

May 12, 2025 -

Chto Obsuzhdali Putin I Dzhonson Ugroza Atomnykh Podlodok Rossii

May 12, 2025

Chto Obsuzhdali Putin I Dzhonson Ugroza Atomnykh Podlodok Rossii

May 12, 2025 -

El Ex Primer Ministro Britanico Boris Johnson Victima De Ataque De Avestruz En Texas

May 12, 2025

El Ex Primer Ministro Britanico Boris Johnson Victima De Ataque De Avestruz En Texas

May 12, 2025