Analyzing Trump's Hints On Privatizing Federal Student Loans

Table of Contents

Trump's Past Statements on Student Loan Debt and Privatization

Examining Public Statements and Campaign Promises

During his presidential campaigns and public appearances, Trump frequently addressed student loan debt, albeit often with conflicting or ambiguous messaging. His rhetoric often focused on solutions other than outright privatization, but certain statements hinted at a potential shift towards a more market-driven system.

- "We will make it easier for students to refinance their student loan debt at lower rates." While not explicitly mentioning privatization, this statement suggested a willingness to alter the existing federal loan system. (Source: [Insert credible news source link])

- Proposals for "student loan forgiveness" were frequently mentioned, seemingly at odds with a privatization strategy which would likely involve transferring the responsibility of debt forgiveness from the government to private lenders. (Source: [Insert credible news source link])

- Focus on deregulation: Trump’s broader advocacy for deregulation could be interpreted as indirectly supporting privatization, suggesting a preference for less government involvement in the student loan market. (Source: [Insert credible news source link])

The ambiguity in Trump's pronouncements makes it challenging to definitively determine his stance on privatization. However, his emphasis on market-based solutions and deregulation warrants careful consideration within the context of his overall student loan policy.

Actions Taken During His Presidency Related to Student Loans

While Trump didn't explicitly push for privatization, certain actions during his presidency could be seen as laying groundwork for a more privatized system.

- Appointments to the Department of Education: The individuals appointed to key positions within the Department of Education may have held views favorable to market-based approaches to student loan management. (Source: [Insert official government document or reputable news source link])

- Changes to student loan interest rates: While the specific policies varied, changes to interest rates could be viewed through the lens of the long-term implications on potential profitability for private lenders under a privatized system. (Source: [Insert official government document link])

- Limited action on income-driven repayment plans: Trump's administration's limited efforts to expand or improve income-driven repayment plans, a cornerstone of existing government programs, could be seen as indirectly weakening the federal government’s role. (Source: [Insert official government document or reputable news source link])

Potential Impacts of Privatizing Federal Student Loans

Economic Consequences

The privatization of federal student loans would significantly impact the US economy, creating both potential benefits and drawbacks.

- Increased Competition (Potential Benefit): Private lenders entering the market could potentially lead to increased competition and potentially lower interest rates for some borrowers.

- Higher Interest Rates (Potential Drawback): Conversely, the pursuit of profit by private lenders could lead to higher interest rates for certain borrowers, increasing the overall cost of education.

- Increased Default Rates (Potential Drawback): Higher interest rates and more stringent lending practices could lead to an increase in student loan defaults, impacting borrowers' credit scores and overall economic stability.

- Market Volatility (Potential Drawback): Shifting student loan debt to the private sector introduces the potential for significant market volatility, directly impacting borrowers’ financial security.

Social Equity Implications

Privatization could exacerbate existing inequalities in access to higher education.

- Reduced Access for Low-Income Students: Private lenders might be more hesitant to provide loans to low-income students perceived as higher-risk borrowers, restricting access to higher education.

- Disproportionate Impact on Minorities: Similar to low-income students, minority students might face unequal access to loans under a privatized system, perpetuating existing systemic disparities.

- Increased Financial Burden: Higher interest rates and less flexible repayment options under a privatized system could place a disproportionate financial burden on already marginalized groups.

Alternative Approaches to Student Loan Debt

Numerous alternative solutions to the student loan debt crisis exist, offering potential advantages over privatization.

- Income-Driven Repayment Plans: These plans tie monthly payments to borrowers' income, making repayment more manageable for lower-earners.

- Targeted Loan Forgiveness Programs: Forgiving loans for specific professions or demographics could address both the debt crisis and societal needs.

- Increased Funding for Pell Grants: Expanding Pell Grants, which are need-based, could reduce reliance on loans altogether for many students.

- Tuition Reform: Policies that address the root causes of high tuition costs could fundamentally reduce the need for substantial student loans.

Political Landscape and Future Prospects

The current political climate surrounding student loan debt is dynamic, with various proposals being debated. While complete privatization seems unlikely in the near future due to the widespread opposition, the debate continues. The likelihood of any significant shift toward privatization depends heavily on future administrations and shifts in political priorities. Current legislative efforts are focused more on reform of the existing system rather than outright privatization. [Insert link to relevant legislation or news articles.]

Conclusion: Re-evaluating Trump's Hints on Privatizing Federal Student Loans

Trump's statements and actions regarding student loan debt were often ambiguous, leaving room for varied interpretations regarding his stance on privatization. While he didn't explicitly endorse privatization, his emphasis on market-based solutions and deregulation raised concerns about the potential for shifting responsibility from the federal government to private entities. Analyzing "Trump's hints on privatizing federal student loans" reveals potential negative economic and social equity implications. Alternative approaches, such as expanding income-driven repayment plans and addressing the root causes of rising tuition costs, offer more equitable and effective solutions to the student debt crisis. The future of student loan policy hinges on informed debate and advocacy. We urge readers to further research the implications of the privatization of student loans under Trump and other potential solutions by visiting [Link to relevant resources].

Featured Posts

-

Student Loan Debt And Homeownership A Realistic Look

May 17, 2025

Student Loan Debt And Homeownership A Realistic Look

May 17, 2025 -

Quiet Winter For Mariners Former Infielder Sounds Off

May 17, 2025

Quiet Winter For Mariners Former Infielder Sounds Off

May 17, 2025 -

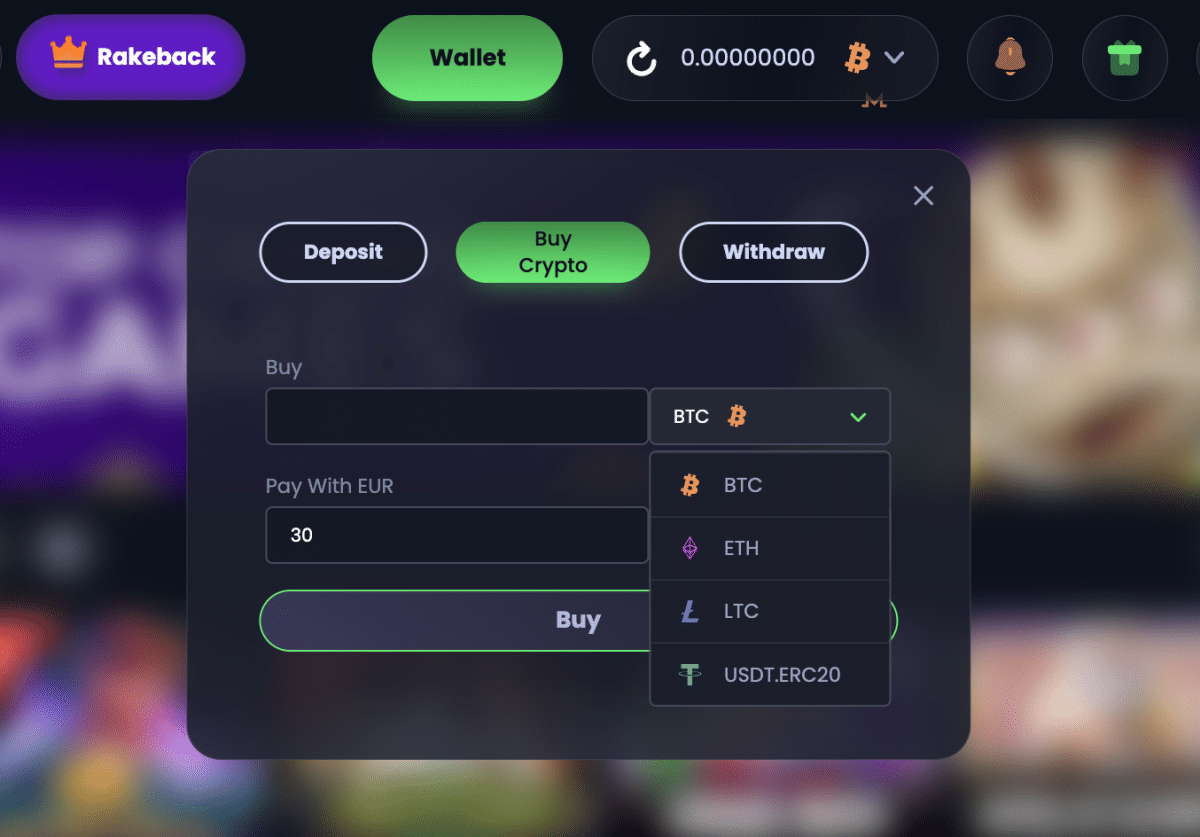

Jack Bit Casino Review Top Rated Crypto Casino For Fast Payouts

May 17, 2025

Jack Bit Casino Review Top Rated Crypto Casino For Fast Payouts

May 17, 2025 -

Tuerkiye Subat Ayi Uluslararasi Yatirim Pozisyonu Verileri Detayli Analiz

May 17, 2025

Tuerkiye Subat Ayi Uluslararasi Yatirim Pozisyonu Verileri Detayli Analiz

May 17, 2025 -

Kalanicks Regret The Uber Decision That Backfired

May 17, 2025

Kalanicks Regret The Uber Decision That Backfired

May 17, 2025

Latest Posts

-

High Payout Online Casino Ontario Mirax Casino

May 17, 2025

High Payout Online Casino Ontario Mirax Casino

May 17, 2025 -

Secure Australian Crypto Casino Sites Your 2025 Selection Guide

May 17, 2025

Secure Australian Crypto Casino Sites Your 2025 Selection Guide

May 17, 2025 -

7 Bit Casino Leading No Kyc Casino With Instant Withdrawals In 2025

May 17, 2025

7 Bit Casino Leading No Kyc Casino With Instant Withdrawals In 2025

May 17, 2025 -

Finding The Right Bitcoin And Crypto Casino For 2025

May 17, 2025

Finding The Right Bitcoin And Crypto Casino For 2025

May 17, 2025 -

Play At Mirax Casino Your Top Choice For Online Gambling In Ontario 2025

May 17, 2025

Play At Mirax Casino Your Top Choice For Online Gambling In Ontario 2025

May 17, 2025