Analyzing Uber's Stock Performance During Economic Uncertainty

Table of Contents

The stock market's recent volatility has left many investors wondering about the future. A recent study showed a 20% fluctuation in tech stocks within a single quarter, highlighting the impact of economic uncertainty. Understanding this volatility is crucial, especially for companies like Uber, heavily reliant on consumer spending and sensitive to macroeconomic shifts. This article analyzes Uber's stock performance amidst economic uncertainty, examining the factors influencing its price and offering insights for investors navigating this complex market. We'll explore the interplay between Uber stock, economic uncertainty, stock performance, market volatility, and the company's specific business factors to help you understand the risks and opportunities.

H2: Macroeconomic Factors Impacting Uber's Stock Price

Economic uncertainty significantly impacts Uber's stock price. Several macroeconomic factors play crucial roles:

H3: Inflation and Consumer Spending:

Inflation directly affects consumer spending, a cornerstone of Uber's business model. As prices rise, consumers may reduce discretionary spending, impacting the demand for ride-sharing and food delivery services. Data suggests a strong negative correlation between inflation rates and Uber's ridership in previous inflationary periods.

- Increased fuel costs impacting driver earnings and Uber's operational costs: Higher fuel prices reduce driver profitability, potentially leading to higher fares or a decrease in driver availability.

- Potential shift in consumer preference towards cheaper transportation options: Consumers might opt for public transport or carpooling to save money during inflationary periods.

- Impact of government subsidies and stimulus packages on consumer behavior: Government intervention can either cushion the blow or exacerbate the impact of inflation on consumer spending and, consequently, on Uber's revenue.

H3: Interest Rate Hikes and Investor Sentiment:

Rising interest rates influence investor sentiment and the overall stock market performance. Higher rates increase borrowing costs for companies like Uber, impacting expansion plans and profitability. This can lead to a decrease in investor confidence and a decline in Uber's stock valuation.

- Impact of higher borrowing costs on Uber's expansion plans and profitability: Uber's ambitious growth strategies, including expansion into new markets and technological advancements, become more expensive when interest rates rise.

- Changes in investor risk appetite and its effect on Uber's stock price: During periods of rising interest rates, investors tend to shift towards less risky investments, potentially impacting the valuation of growth stocks like Uber.

- Comparison of Uber's performance to other tech companies during similar periods: Analyzing how Uber performs relative to its tech peers during interest rate hikes can provide valuable context and insights.

H3: Geopolitical Events and Global Uncertainty:

Geopolitical events and global uncertainty significantly impact Uber's operations and stock price. Events like pandemics or wars can disrupt supply chains, affect travel patterns, and influence investor confidence.

- Impact of travel restrictions and lockdowns on Uber's ride-sharing business: Pandemic-related restrictions dramatically reduced demand for ride-sharing services, highlighting Uber's vulnerability to unforeseen global events.

- Changes in demand for Uber Eats during periods of uncertainty: Conversely, demand for food delivery services often increases during lockdowns and periods of uncertainty.

- Geographical diversification of Uber’s operations and its impact on resilience: Uber's global presence can offer some resilience during regional crises, but it’s still susceptible to widespread global events.

H2: Uber's Specific Business Factors and Stock Performance

Beyond macroeconomic factors, Uber's internal performance significantly impacts its stock price:

H3: Competition and Market Share:

The ride-sharing and food delivery markets are fiercely competitive. Competition from Lyft, regional players, and public transportation impacts Uber's pricing strategies and profitability, directly affecting its market share and stock valuation.

- Competition from Lyft, regional players, and public transportation: Uber faces constant pressure to maintain a competitive edge in a rapidly evolving market.

- Uber's strategies to maintain and grow its market share: Understanding Uber's strategies, such as technological innovation, strategic partnerships, and targeted marketing, is crucial in assessing its future performance.

- Analysis of Uber's pricing models and their impact on profitability and consumer demand: Uber’s dynamic pricing model, while crucial for optimizing revenue, can also lead to volatility and impact consumer loyalty.

H3: Technological Innovation and Growth Strategies:

Uber's investments in technology, including autonomous vehicles, significantly influence investor confidence and long-term growth prospects. These investments can lead to increased efficiency, new revenue streams, and a competitive edge.

- Investments in self-driving technology and their potential long-term impact: The success of Uber's autonomous vehicle initiatives could revolutionize its operations and dramatically impact its profitability.

- Expansion into new markets and service offerings (e.g., freight, micromobility): Diversification into new areas helps mitigate risk and create new growth opportunities.

- The role of technology in optimizing efficiency and reducing operational costs: Technological advancements enable Uber to optimize its operations, reduce costs, and improve its overall efficiency.

H3: Financial Performance and Profitability:

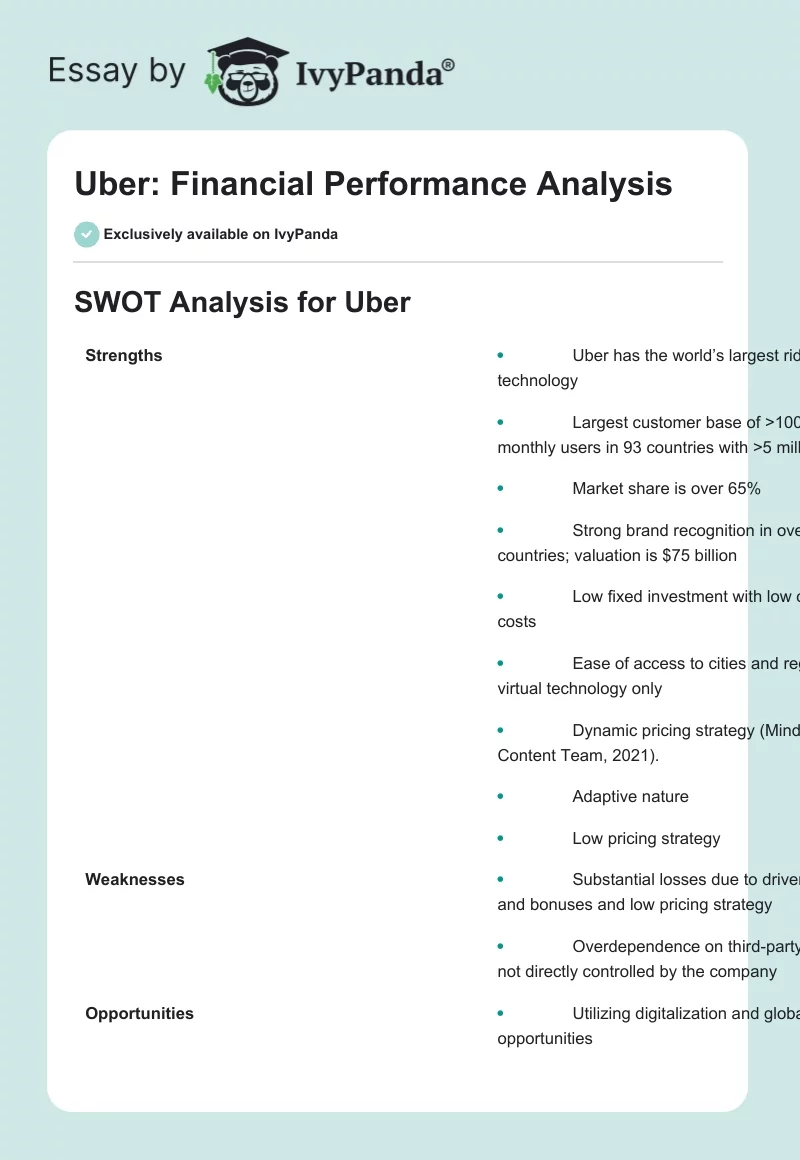

Analyzing Uber's financial statements (revenue, earnings, cash flow) is vital to understanding its financial health. Key metrics like revenue growth, profitability margins, and debt levels significantly influence investor perception.

- Analysis of Uber's revenue growth and profitability margins: Consistent revenue growth and improving profitability are key indicators of a healthy and growing business.

- Evaluation of Uber's debt levels and financial leverage: High debt levels can create financial vulnerability, especially during economic downturns.

- Comparison of Uber’s financial performance with competitors: Benchmarking Uber’s performance against its competitors helps investors gauge its relative strength and position in the market.

3. Conclusion: Understanding Uber's Stock Performance During Economic Uncertainty – A Path Forward

Uber's stock performance is intricately linked to both macroeconomic factors (inflation, interest rates, geopolitical events) and its specific business factors (competition, technological innovation, financial performance). Understanding this complex interplay is critical for investors. While Uber's diversification into food delivery and other services offers some resilience, its dependence on consumer spending makes it vulnerable during economic uncertainty. Therefore, thorough due diligence is crucial before investing in Uber stock. Conduct further research, monitor Uber’s performance in relation to key economic indicators, and carefully analyze the impact of economic uncertainty on Uber stock before making any investment decisions. Only through a comprehensive understanding of both the macroeconomic environment and Uber's specific business performance can investors effectively navigate the volatility inherent in the Uber stock market.

Featured Posts

-

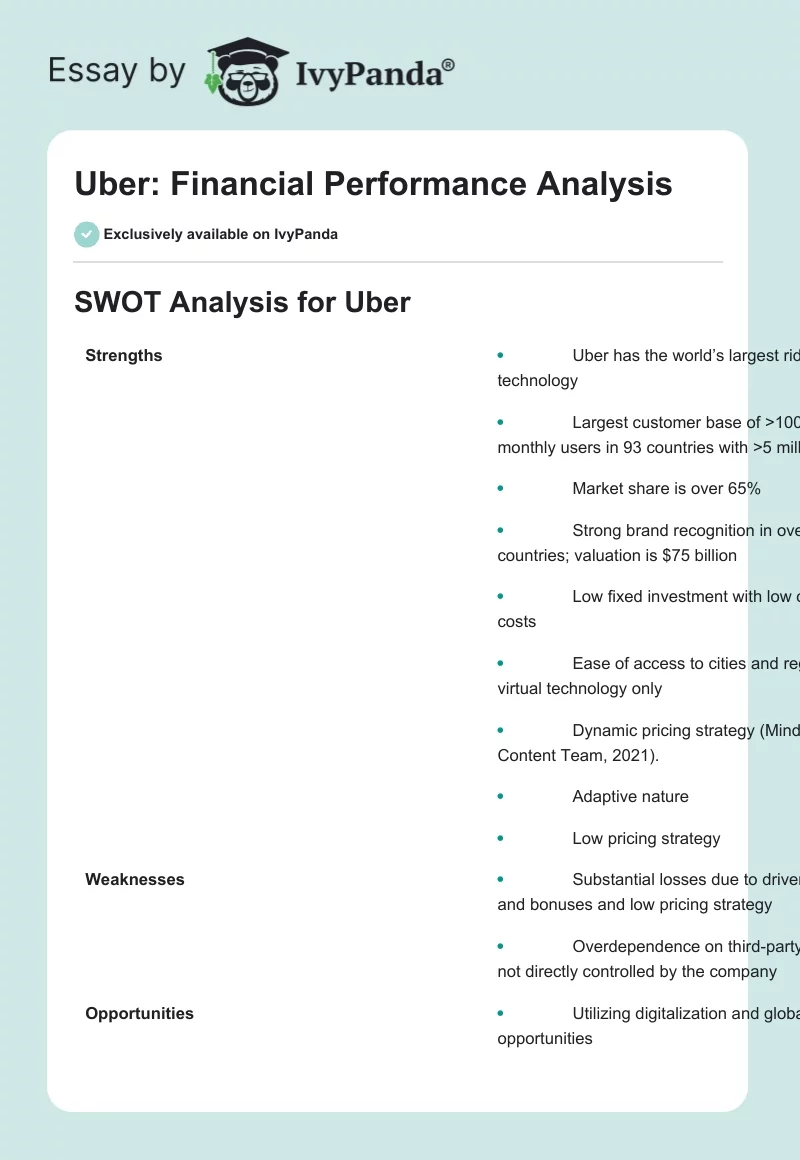

Webby Awards Winners Include Taylor Swift Kendrick Lamar And Simone Biles

May 18, 2025

Webby Awards Winners Include Taylor Swift Kendrick Lamar And Simone Biles

May 18, 2025 -

Luxors Ancient Egypt Themed Buffet To Close Impact And Future Plans

May 18, 2025

Luxors Ancient Egypt Themed Buffet To Close Impact And Future Plans

May 18, 2025 -

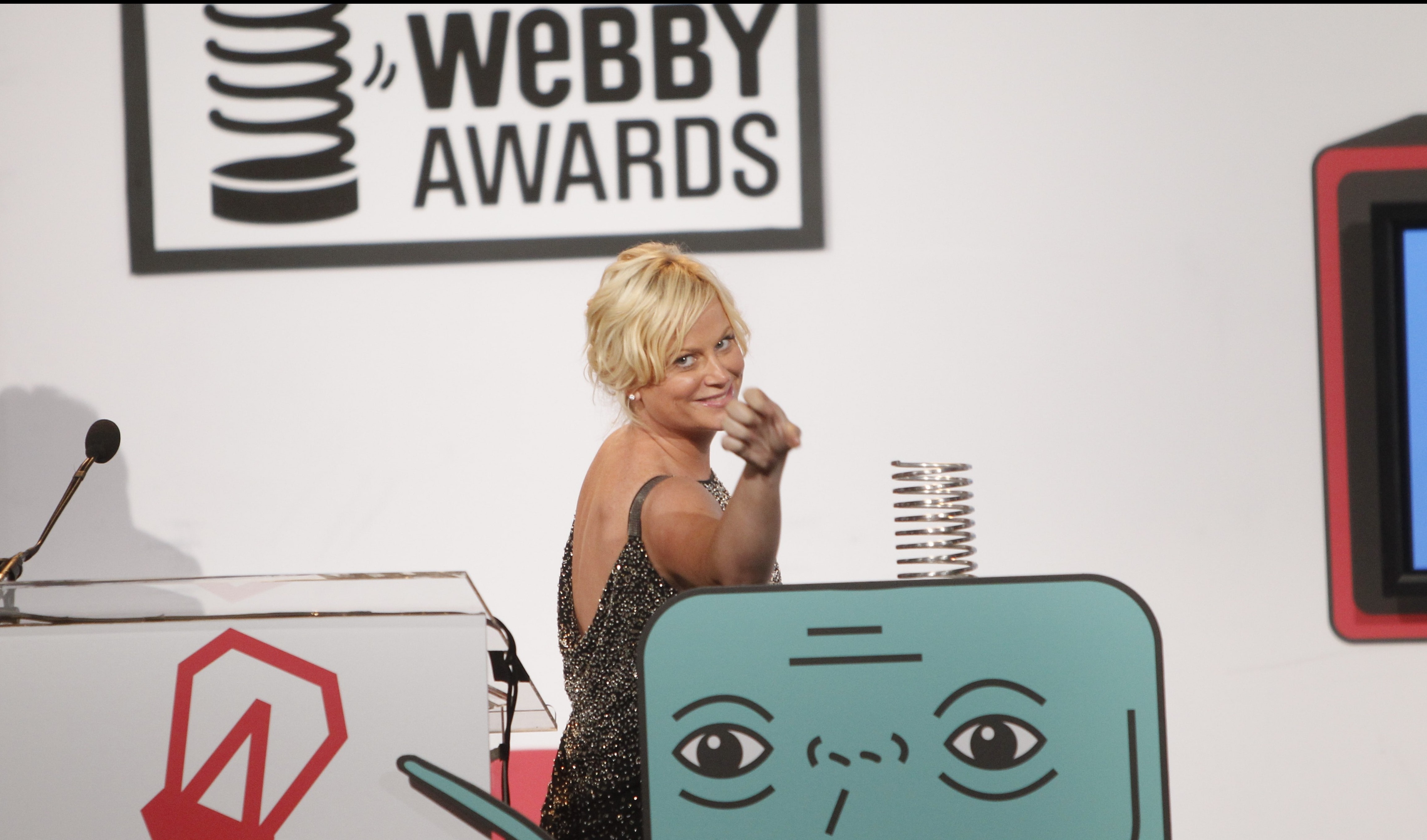

Analysis The Weakening Economic Links Between India And Pakistan Turkey And Azerbaijan

May 18, 2025

Analysis The Weakening Economic Links Between India And Pakistan Turkey And Azerbaijan

May 18, 2025 -

2025 Spring Breakout Rosters A Comprehensive Guide

May 18, 2025

2025 Spring Breakout Rosters A Comprehensive Guide

May 18, 2025 -

Spring Breakout 2025 Rosters Player Predictions And Analysis

May 18, 2025

Spring Breakout 2025 Rosters Player Predictions And Analysis

May 18, 2025