Analyzing Uber's (UBER) Investment Potential

Table of Contents

Uber's Financial Performance and Growth Trajectory

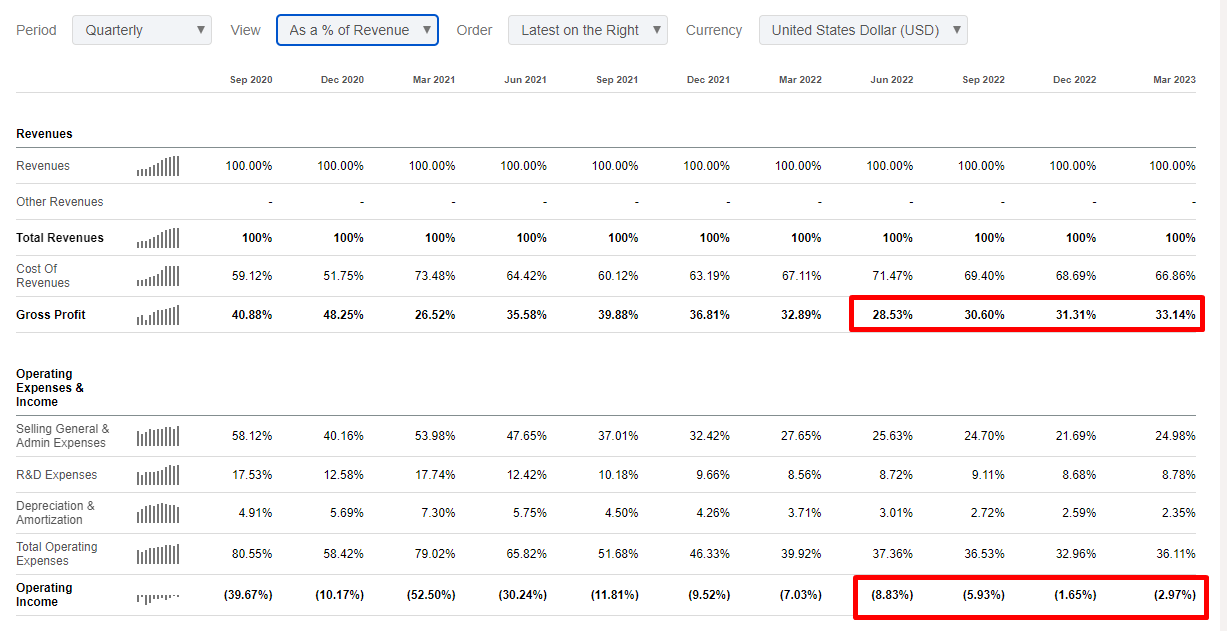

Uber's financial health is a crucial factor in assessing its investment potential. Examining revenue streams, profitability, and expense management provides a clear picture of the company's current state and future trajectory.

Revenue Analysis: A Multi-faceted Approach

Uber generates revenue from various sources, primarily rides, Uber Eats (food delivery), and freight services. Historically, Uber has shown significant year-over-year revenue growth, although profitability remains a challenge.

-

Key Financial Metrics:

- Year-over-year revenue growth: While fluctuating, Uber has consistently shown growth, albeit at varying rates depending on the economic climate and service line.

- Profitability margins: Uber operates with thin margins, facing significant competition and high operating expenses.

- Operating income: Uber has seen periods of operating losses, but also periods of improvement, indicating a long-term push towards profitability.

-

Data Points (Illustrative): (Note: Replace with actual, up-to-date data from Uber's financial reports) Let's assume a hypothetical scenario: In Q1 2024, Uber's revenue increased by 15% year-over-year, driven largely by a 20% increase in Uber Eats revenue. However, operating expenses also rose, resulting in a smaller-than-expected increase in operating income.

-

Analysis: The diversification of revenue streams is positive, mitigating the reliance on any single service. However, consistently achieving higher profitability margins while managing costs across different business segments will be crucial for long-term success and investor confidence.

Profitability and Expenses: The Path to Sustainability

Uber's path to sustainable profitability hinges on effectively managing expenses while driving revenue growth. This requires careful consideration of several key cost factors.

-

Key Expense Categories:

- Operating expenses: Costs associated with maintaining operations, including technology, customer support, and administrative costs.

- Marketing costs: Significant investments in marketing and promotions are necessary to maintain market share and attract new users.

- Driver compensation: A significant portion of Uber's expenses goes towards driver payments, making driver satisfaction and compensation models crucial for profitability.

- Research and development spending: Investments in autonomous vehicle technology and other innovations represent a major long-term expense.

-

Analysis: Improving profitability requires a multi-pronged approach: optimizing operational efficiency, finding ways to reduce marketing costs without sacrificing market share, and effectively managing driver compensation while maintaining a large driver pool. The strategic shift towards profitability will significantly impact the UBER stock price.

Market Share and Competitive Landscape

Uber's market position and the competitive landscape are vital considerations for any potential investor.

Market Dominance and Geographic Reach

Uber enjoys significant market share in many regions globally, but faces fierce competition from various players.

-

Market Share Data (Illustrative): (Replace with actual data) Uber might hold a 70% market share in the US ride-sharing market, but faces stiff competition from Lyft, particularly in certain regions. Internationally, it competes with Didi Chuxing in China and other regional players.

-

Competitive Analysis: The competitive intensity varies across regions. Pricing wars, technological innovation, and regulatory changes constantly impact Uber's market position and require strategic adaptations.

Threats and Opportunities: Navigating the Dynamic Market

Uber operates in a dynamic and ever-evolving market, facing both significant threats and attractive opportunities.

-

Threats:

- Increased competition: The ride-sharing market is attracting new entrants, intensifying competition and pressuring margins.

- Regulatory changes: Government regulations concerning driver classification, safety standards, and pricing can significantly impact profitability and operations.

- Economic downturns: During economic recessions, demand for ride-sharing services can decrease, impacting revenue.

-

Opportunities:

- Expansion into new markets: Untapped markets in developing economies offer significant growth potential.

- New services: Expanding into areas like autonomous vehicles, drone delivery, and other mobility solutions can create new revenue streams and solidify its position as a leader in transportation.

Future Growth Prospects and Technological Innovations

Uber's long-term growth hinges on its ability to innovate and adapt to changing market dynamics.

Autonomous Vehicles and Future Technologies

Uber's investments in autonomous vehicle technology represent a significant long-term strategic bet.

-

Key Partnerships and Investments: Uber has made significant investments in self-driving technology, though it faces significant hurdles and competition in this area.

-

Analysis: While the timeline for widespread autonomous vehicle adoption remains uncertain, the potential returns are substantial. Successful implementation could significantly reduce operational costs and increase efficiency.

Expansion into New Markets and Services

Uber's growth strategy involves both geographic expansion and diversification of services.

-

Potential New Markets and Services: Uber continues exploring new markets and service offerings, constantly seeking opportunities for growth.

-

Analysis: The success of these expansion plans depends on several factors, including regulatory hurdles, local market conditions, and competitive landscapes. Careful risk assessment is crucial.

Investment Risks and Considerations

Investing in UBER stock involves several key risks that must be considered.

Regulatory Risks: A Complex Landscape

Uber faces a complex web of regulatory challenges worldwide, which could significantly impact its operations.

- Potential Regulatory Hurdles: Varying regulations concerning driver classification, data privacy, and safety standards pose substantial challenges in different jurisdictions.

Economic and Geopolitical Factors: Macroeconomic Impacts

Macroeconomic conditions and geopolitical events can affect Uber's performance.

- Potential Macroeconomic Factors: Economic downturns, fuel price fluctuations, and inflation can all impact Uber's revenue and profitability.

- Geopolitical Risks: Political instability, currency fluctuations, and trade wars in various regions can negatively affect Uber's international operations.

Conclusion: Final Thoughts on Uber's (UBER) Investment Potential

Uber presents a complex investment case. While its strong market position and diversification efforts are positive signs, significant challenges remain in achieving sustainable profitability and navigating a competitive and regulatory-heavy landscape. The potential for significant returns from autonomous vehicle technology and expansion into new markets is counterbalanced by substantial risks associated with regulatory hurdles, competition, and macroeconomic factors.

Before making any investment decisions regarding UBER, consider the information presented and conduct thorough due diligence. Further analysis of UBER's investment potential is crucial, including reviewing its latest financial statements and industry analysis. Assess your risk tolerance before investing in UBER.

Featured Posts

-

Mexican Navy Training Vessel Collision With Brooklyn Bridge Two Dead

May 19, 2025

Mexican Navy Training Vessel Collision With Brooklyn Bridge Two Dead

May 19, 2025 -

Trumptan Skandali Gazze Paylasimi Ve Sok Edici Detaylar

May 19, 2025

Trumptan Skandali Gazze Paylasimi Ve Sok Edici Detaylar

May 19, 2025 -

Gencler Ve Aileler Icin 2025 Trend Nevresim Takimi Modelleri

May 19, 2025

Gencler Ve Aileler Icin 2025 Trend Nevresim Takimi Modelleri

May 19, 2025 -

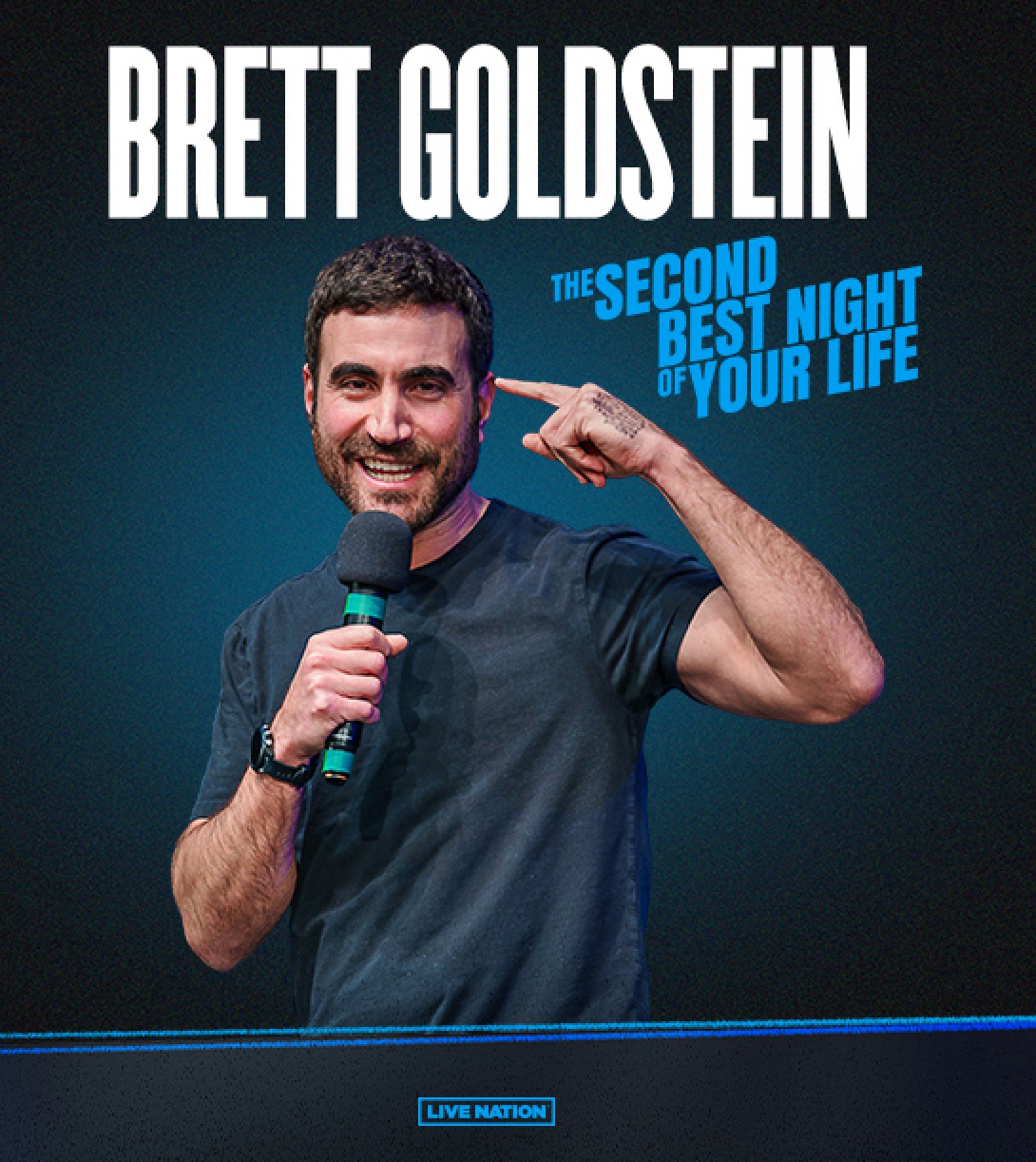

Hbo To Air Brett Goldsteins First Comedy Special This April

May 19, 2025

Hbo To Air Brett Goldsteins First Comedy Special This April

May 19, 2025 -

Pargs Eurovision In Concert 2025 Participation Confirmed

May 19, 2025

Pargs Eurovision In Concert 2025 Participation Confirmed

May 19, 2025