Andreessen Horowitz-Backed Omada Health Prepares For US IPO

Table of Contents

Omada Health's Business Model and Market Position

Omada Health tackles the pervasive challenge of chronic disease management by leveraging a sophisticated telehealth platform. Their approach focuses on providing personalized, remote care for individuals battling conditions such as diabetes and hypertension. The company's digital therapeutics and remote patient monitoring capabilities allow for continuous engagement and support, improving patient outcomes and reducing healthcare costs.

This innovative approach positions Omada Health strategically within the rapidly expanding telehealth industry. Its target market includes individuals with chronic conditions, healthcare providers seeking efficient patient management solutions, and employers aiming to improve employee wellness programs. The competitive landscape includes other telehealth providers offering chronic disease management programs, but Omada Health differentiates itself through:

- Personalized care plans: Tailored programs based on individual patient needs and progress.

- Engaging digital tools: User-friendly mobile apps and wearable integration for seamless data collection and monitoring.

- Expert-led coaching: Support from certified health coaches providing guidance and motivation.

- Strong clinical evidence: Demonstrated efficacy in improving patient outcomes and reducing healthcare utilization.

Omada Health's market share is steadily growing, fueled by the increasing adoption of telehealth and the rising prevalence of chronic diseases. Strategic partnerships with leading healthcare systems and payers further solidify its position in the market.

The Role of Andreessen Horowitz (a16z)

Andreessen Horowitz's significant investment in Omada Health underscores the venture capital firm's belief in the company's potential and the broader telehealth market. a16z, renowned for its insightful investments in disruptive technologies, has a proven track record of success in the healthcare technology sector. Their involvement in Omada Health's journey, likely through multiple Series Funding rounds, significantly influences the company's valuation and prospects for a successful IPO.

a16z's strategic investment isn't just about financial backing; it extends to providing valuable mentorship, industry connections, and operational expertise. This support is crucial for navigating the complexities of scaling a telehealth business and preparing for a successful public offering. Other notable a16z investments in the digital health space include:

- Teladoc: A leader in virtual care.

- Flatiron Health: A provider of oncology data and analytics.

- Clover Health: A Medicare Advantage provider utilizing technology.

a16z's investment strategy typically focuses on companies with disruptive technologies and strong potential for growth. Their participation in the Andreessen Horowitz-Backed Omada Health IPO signifies their confidence in Omada Health's ability to capitalize on the growing demand for digital health solutions. While the exact expected return on investment remains undisclosed, a successful IPO is anticipated to yield significant returns for a16z.

IPO Details and Expectations

The anticipated Omada Health IPO is generating considerable excitement within the investment community. While the exact timeline, offering size, and valuation remain subject to change, the IPO is expected to generate significant investor interest. The company has likely filed the necessary regulatory paperwork with the SEC, including a detailed prospectus outlining its financials, business model, and risk factors.

The success of the IPO hinges on several factors, including market conditions, investor sentiment towards the telehealth sector, and Omada Health's ability to demonstrate sustained growth and profitability. Potential risks associated with the IPO include competition, regulatory changes, and the inherent volatility of the stock market. Analysts are closely monitoring Omada Health’s performance and making forecasts for its post-IPO share price and market capitalization. The offering price will be determined through a process involving underwriters who assess market demand and provide guidance to the company.

Future Outlook for Omada Health Post-IPO

Post-IPO, Omada Health is likely to focus on several key growth strategies to solidify its market leadership and expand its reach. These may include:

- Expanding service offerings: Adding new chronic conditions to its platform and developing innovative digital therapeutics.

- Strategic acquisitions: Acquiring complementary companies to enhance its technology and service capabilities.

- International expansion: Entering new geographic markets to tap into global demand for telehealth solutions.

The long-term success of Omada Health hinges on its ability to continuously innovate, adapt to evolving market trends, and maintain strong clinical outcomes. Its commitment to technology innovation will be crucial in staying ahead of the competition and maintaining a strong market position within the dynamic digital health landscape. The company's post-IPO performance will be a key indicator of the future of digital health investment and the broader telehealth industry's potential.

Conclusion: The Andreessen Horowitz-Backed Omada Health IPO and its Implications

The Andreessen Horowitz-Backed Omada Health IPO represents a significant milestone for the digital health sector. Omada Health's innovative approach to chronic disease management, coupled with the backing of a leading venture capital firm, positions the company for substantial growth and success. The IPO's outcome will have wide-ranging implications for the telehealth market, influencing investment trends, technology adoption, and the overall trajectory of digital health innovation. Stay informed about the Andreessen Horowitz-Backed Omada Health IPO and its developments by following reputable financial news sources and industry publications. The future of digital health is unfolding before our eyes, and this IPO is a key part of that story.

Featured Posts

-

High Potential Season 1 When Morgan Wasnt So Smart

May 10, 2025

High Potential Season 1 When Morgan Wasnt So Smart

May 10, 2025 -

Kormanyepuelet Noi Mosdo Letartoztatas Floridai Eset Egy Transznemu Novel

May 10, 2025

Kormanyepuelet Noi Mosdo Letartoztatas Floridai Eset Egy Transznemu Novel

May 10, 2025 -

Asylum Seekers From Three Countries Face Uk Crackdown

May 10, 2025

Asylum Seekers From Three Countries Face Uk Crackdown

May 10, 2025 -

Your Nl Federal Riding Candidate Profiles And Platforms

May 10, 2025

Your Nl Federal Riding Candidate Profiles And Platforms

May 10, 2025 -

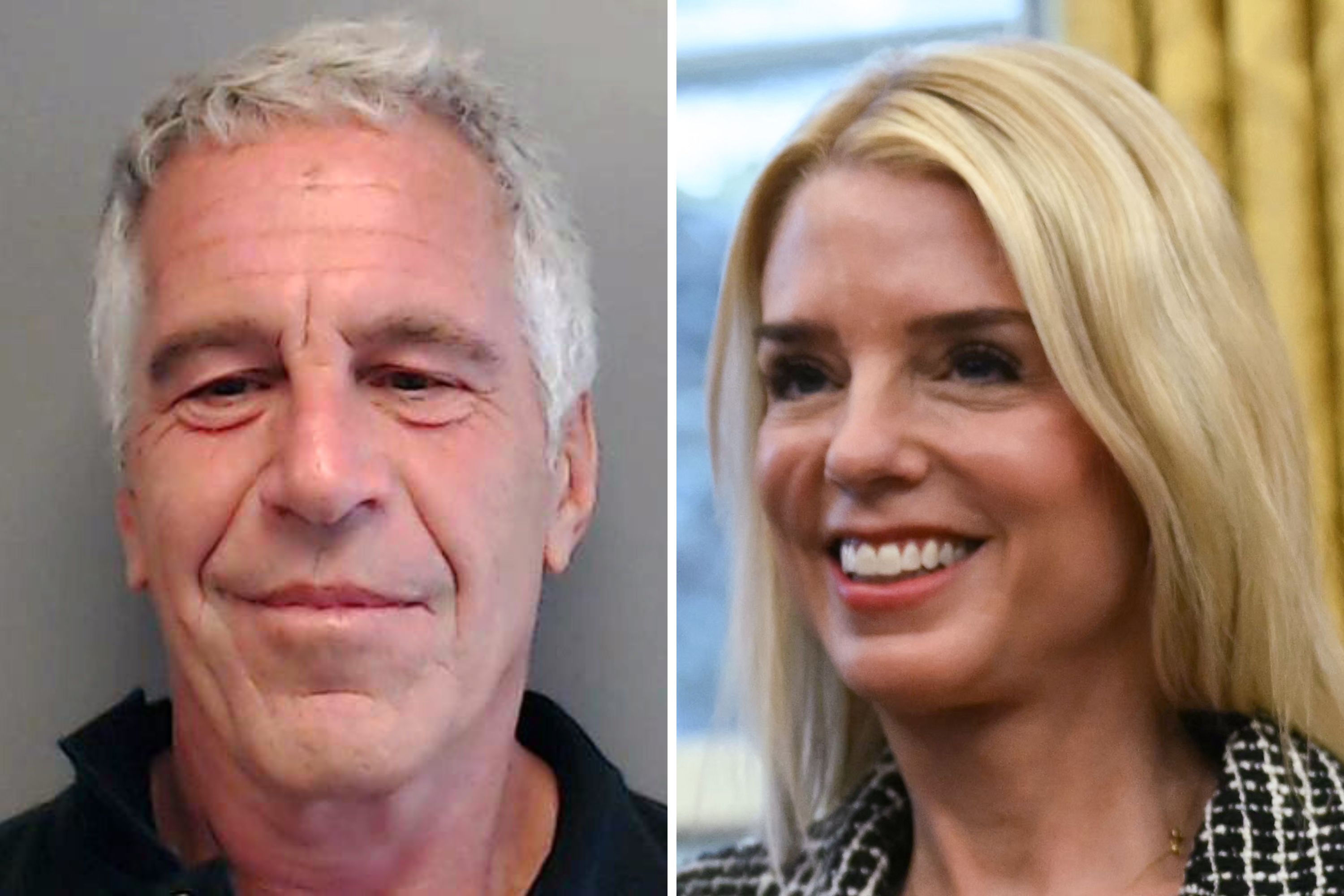

Public Vote On Jeffrey Epstein Files Examining Ag Pam Bondis Decision

May 10, 2025

Public Vote On Jeffrey Epstein Files Examining Ag Pam Bondis Decision

May 10, 2025