Appeal Filed: FTC Fights Microsoft's Activision Blizzard Purchase

Table of Contents

The FTC's Arguments Against the Microsoft-Activision Blizzard Merger

The FTC's opposition to the Microsoft-Activision Blizzard merger centers around concerns about market dominance and the potential harm to consumers.

Concerns about Market Domination

The FTC argues that the merger would grant Microsoft an unacceptable level of control over the video game market, particularly in the console gaming sector. This dominance, they claim, would stifle competition and ultimately harm consumers.

- Reduced competition for popular game franchises like Call of Duty: The FTC fears that Microsoft could make Call of Duty, a hugely popular franchise, exclusive to its Xbox ecosystem, thereby disadvantaging competitors like Sony PlayStation. This could significantly reduce consumer choice and potentially lead to increased prices for players.

- Potential for Microsoft to exclude rivals from accessing Activision Blizzard games: The concern extends beyond Call of Duty. The FTC worries that Microsoft could leverage its ownership of Activision Blizzard to restrict access to other popular titles, preventing rivals from offering a complete and competitive game catalog.

- Higher prices and less innovation for gamers: With reduced competition, the FTC predicts that gamers could face higher prices for games, fewer innovative titles, and a less dynamic gaming landscape overall. The lack of competition could lead to stagnation in terms of quality and features.

Impact on Game Streaming Services

Beyond console gaming, the FTC also expresses significant concerns about the impact on the burgeoning cloud gaming market.

- Restricting access to Activision Blizzard games on rival streaming services: Microsoft's control over Activision Blizzard's games could allow it to restrict access to these titles on competing cloud gaming platforms like GeForce Now or Google Stadia. This would give Xbox Cloud Gaming an unfair advantage.

- Creating an unfair competitive advantage for Xbox Cloud Gaming: By limiting access to popular games on rival platforms, Microsoft could effectively cripple competition in the cloud gaming space, cementing its dominance in this rapidly growing market.

- Limiting consumer choice and innovation in cloud gaming: Restricting access to games on rival streaming services would significantly limit consumer choice and ultimately stifle innovation within the cloud gaming industry as a whole.

Microsoft's Defense of the Acquisition

Microsoft has vigorously defended its acquisition, arguing that it will ultimately benefit gamers and the industry as a whole.

Commitment to Fair Competition

Microsoft maintains that it is committed to fair competition and will continue to make Activision Blizzard titles available across multiple platforms.

- Promises to keep Call of Duty on PlayStation: A key element of Microsoft's defense is its repeated promise to keep Call of Duty on the PlayStation platform, ensuring continued access for PlayStation gamers.

- Claims to enhance game development and innovation: Microsoft argues that the merger will lead to increased investment in game development and technological advancements, ultimately benefiting gamers with better and more innovative games.

- Arguments against the FTC’s market dominance claims: Microsoft refutes the FTC's claims of market dominance, arguing that the gaming market is highly competitive and that the merger would not create a monopoly.

Benefits of the Merger for the Gaming Industry

Microsoft further argues that the merger will stimulate innovation and investment within the broader gaming industry.

- Investment in new game development and technologies: The combined resources of Microsoft and Activision Blizzard could lead to significant investments in new game development, potentially resulting in more high-quality games and technological advancements.

- Expansion of the gaming market to reach new audiences: Microsoft argues that the merger could help expand the gaming market by attracting new audiences and bringing innovative gaming experiences to a wider range of players.

- Potential for improved gaming experiences: The merger could, according to Microsoft, lead to improved gaming experiences for players through enhanced game development, cross-platform play, and technological advancements.

The Judge's Initial Ruling and the FTC's Appeal

A US District Judge initially ruled in favor of Microsoft, allowing the acquisition to proceed. The judge found that the FTC had not provided sufficient evidence to demonstrate that the merger would substantially lessen competition. However, the FTC immediately filed an appeal, arguing that the judge misapplied the law and failed to adequately consider the potential harm to competition. The FTC's appeal focuses on the legal grounds and seeks to overturn the initial ruling, which could significantly delay or even prevent the merger from closing.

Potential Outcomes and Implications

The outcome of the FTC's appeal remains uncertain. Potential outcomes include:

- Affirmation of the original ruling: The appellate court could uphold the lower court's decision, allowing the merger to proceed.

- Reversal of the ruling: The appellate court could overturn the lower court's decision, blocking the merger.

- A compromise: A potential compromise could involve Microsoft agreeing to certain concessions to address the FTC's concerns, potentially resulting in a modified merger.

Regardless of the outcome, this case has significant implications for antitrust enforcement in the tech industry and the future of video game mergers and acquisitions. The decision will set a precedent for future cases involving mergers and acquisitions in the tech sector, influencing how regulators approach such deals in the years to come. The impact on the gaming industry and consumers will be considerable, potentially impacting game prices, innovation, and the overall competitive landscape.

Conclusion

The FTC's appeal against the Microsoft-Activision Blizzard merger is a crucial development with far-reaching consequences. The outcome of this legal battle will shape the future of tech mergers and acquisitions, impacting competition, innovation, and consumer choice within the gaming industry. This FTC fight against Microsoft’s Activision Blizzard purchase is a landmark case that requires ongoing attention. Stay informed about the latest developments to understand the potential impact on the gaming landscape and the future of antitrust regulation in the tech industry. Understanding the intricacies of this case is crucial for anyone interested in the future of gaming and tech industry regulation.

Featured Posts

-

10 Best Pete Townshend Songs Of All Time

May 23, 2025

10 Best Pete Townshend Songs Of All Time

May 23, 2025 -

Honeywell Acquires Johnson Mattheys Catalyst Technologies Expanding Its Portfolio

May 23, 2025

Honeywell Acquires Johnson Mattheys Catalyst Technologies Expanding Its Portfolio

May 23, 2025 -

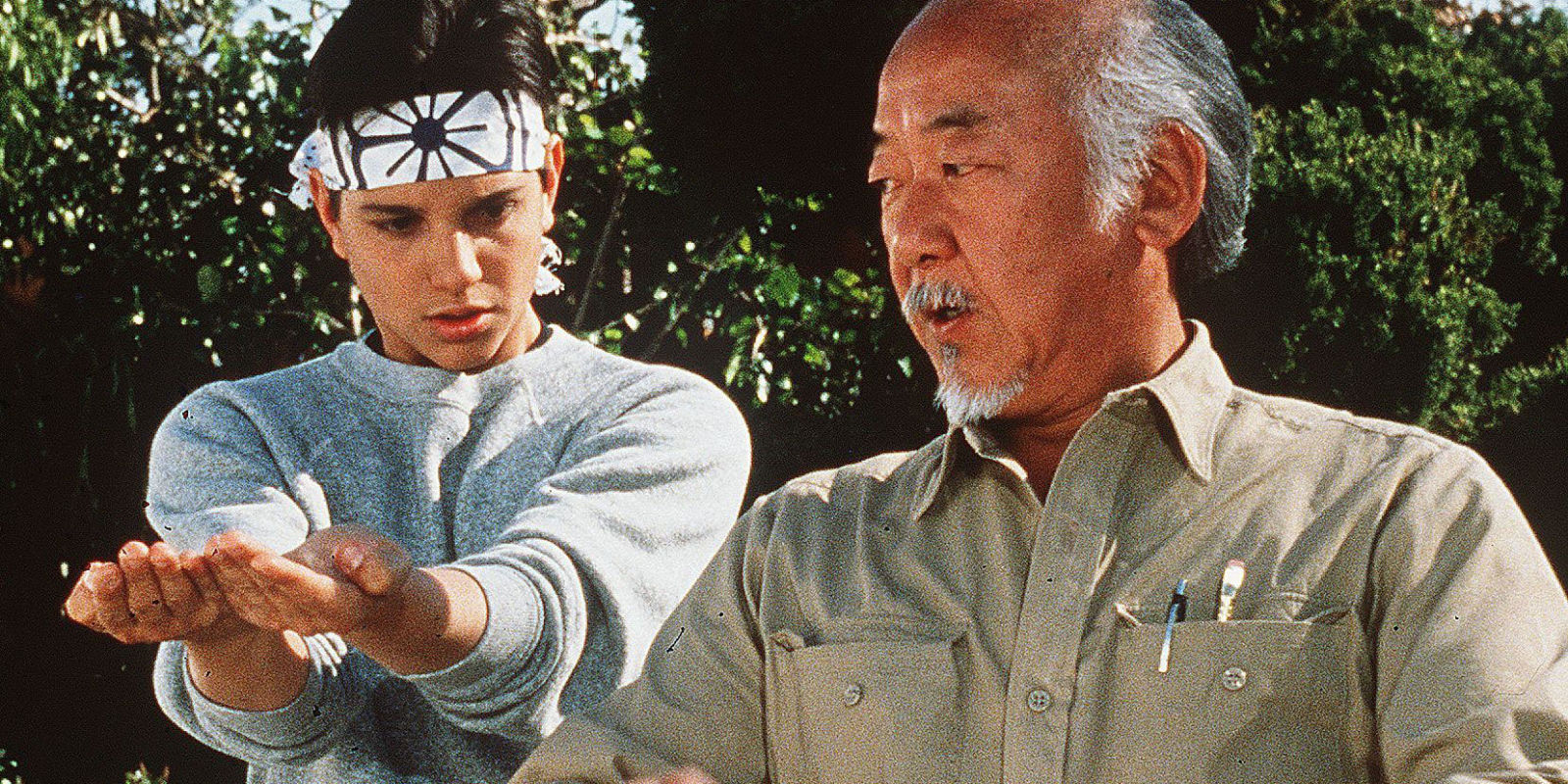

Understanding The Connections Karate Kid Legend Of Miyagi And The Larger Story

May 23, 2025

Understanding The Connections Karate Kid Legend Of Miyagi And The Larger Story

May 23, 2025 -

Zak Starkey Returns As The Whos Drummer Pete Townshend Confirms

May 23, 2025

Zak Starkey Returns As The Whos Drummer Pete Townshend Confirms

May 23, 2025 -

Unveiling The Mystery The Real Story Behind The Whos Band Name

May 23, 2025

Unveiling The Mystery The Real Story Behind The Whos Band Name

May 23, 2025

Latest Posts

-

Is The Last Rodeo Worth Watching A Balanced Review

May 23, 2025

Is The Last Rodeo Worth Watching A Balanced Review

May 23, 2025 -

The Last Rodeo A Critical Look At The Bull Riding Film

May 23, 2025

The Last Rodeo A Critical Look At The Bull Riding Film

May 23, 2025 -

When Is Memorial Day 2025 Florida Store Hours Publix Etc

May 23, 2025

When Is Memorial Day 2025 Florida Store Hours Publix Etc

May 23, 2025 -

Neal Mc Donoughs Physical Transformation For New Bull Riding Video

May 23, 2025

Neal Mc Donoughs Physical Transformation For New Bull Riding Video

May 23, 2025 -

The Last Rodeo Movie Review Familiar Story Powerful Impact

May 23, 2025

The Last Rodeo Movie Review Familiar Story Powerful Impact

May 23, 2025