Apple Could Hit $254: One Analyst's Prediction And Investment Implications

Table of Contents

The Analyst's Rationale Behind the $254 Apple Stock Price Prediction

Equity analyst Sarah Chen from the esteemed investment firm, Alpha Investments, recently issued a bullish prediction, estimating Apple (AAPL) could reach a staggering $254 per share. Chen's projection is based on several key factors contributing to a positive outlook for Apple stock. These factors paint a picture of sustained growth and innovation at the Cupertino-based giant.

-

Strong iPhone 15 Sales Projections: Pre-orders and early sales data for the iPhone 15 series suggest strong demand, potentially exceeding initial expectations. This points to sustained revenue streams and bolstering Apple's position as a market leader.

-

Continued Growth in Apple Services Revenue: Apple's services sector, encompassing subscriptions like Apple Music, iCloud, and Apple TV+, continues to demonstrate robust growth. This recurring revenue stream offers stability and predictability, crucial for long-term stock valuation.

-

Expansion into the Metaverse and Emerging Technologies: Apple's rumored foray into augmented and virtual reality (AR/VR) technologies represents a significant potential growth driver. While specifics are yet to be revealed, the potential market size makes this a compelling factor in the $254 Apple stock price prediction.

-

Positive Investor Confidence: Overall investor sentiment towards Apple remains strong, reflected in consistent positive market reactions to Apple's financial reports and product announcements.

-

Strategic Acquisitions and Partnerships: Apple's history of strategic acquisitions and collaborations suggests a continuous effort to diversify and innovate, further enhancing its long-term growth prospects.

Potential Risks and Challenges to Reaching the $254 Target

While the $254 Apple stock price prediction is optimistic, it's essential to acknowledge potential headwinds that could hinder Apple's price trajectory. A balanced perspective necessitates considering these challenges:

-

Global Economic Slowdown: A global recession or significant economic downturn could negatively impact consumer spending, potentially reducing demand for Apple products.

-

Competition from Android Devices: Intense competition from Android manufacturers presents an ongoing challenge, particularly in emerging markets where price sensitivity is a key factor.

-

Supply Chain Issues Impacting Production: Geopolitical instability and unexpected events can disrupt Apple's intricate global supply chain, leading to production delays and impacting revenue projections.

-

Antitrust Scrutiny or Regulatory Actions: Increased regulatory scrutiny and potential antitrust investigations could pose a significant risk to Apple's growth and profitability.

-

Geopolitical Instability Affecting Markets: Global geopolitical events can create market uncertainty, negatively impacting investor confidence and stock prices.

Investment Implications: How to Approach the $254 Apple Stock Price Prediction

The $254 Apple stock price prediction presents both opportunities and risks for investors. Several investment strategies could be considered, each with its own level of risk:

-

Buy and Hold Strategy for Long-Term Growth: This classic strategy involves purchasing Apple stock and holding it for an extended period, aiming to benefit from long-term growth.

-

Dollar-Cost Averaging to Mitigate Risk: This strategy involves investing a fixed amount of money at regular intervals, regardless of the stock price. It helps mitigate the risk associated with market volatility.

-

Options Trading (Proceed with Caution): Options trading offers leveraged exposure to Apple's price movements but carries significantly higher risk and requires a thorough understanding of options strategies. Consult a financial advisor before engaging in options trading.

-

Diversifying Your Portfolio to Reduce Risk: It's crucial to diversify your investment portfolio across different asset classes to reduce overall risk exposure. Don't put all your eggs in one basket, especially when relying on a single stock price prediction.

Remember, investment decisions should be made based on thorough personal research and, ideally, after consulting with a qualified financial advisor.

Alternative Predictions and Market Sentiment on Apple Stock

It's important to note that not all analysts share the same bullish outlook on Apple's stock price. Some predict more modest gains, while others express more cautious forecasts. Overall market sentiment on Apple stock is currently positive, but this can shift quickly based on various news and events. Staying informed about relevant news and announcements is crucial for making informed investment choices.

Conclusion: Should You Invest Based on the $254 Apple Stock Price Prediction?

The $254 Apple stock price prediction presents a compelling case for potential investors, but it's crucial to remember that it's just one prediction among many. The potential for substantial gains is balanced by considerable risks associated with any individual stock, particularly one as high-profile as Apple. Thorough research, considering both the upside and downside potential, and consultation with a financial advisor are critical steps before making any investment decisions regarding the Apple stock price. Learn more about Apple stock and its potential to hit $254, and make informed decisions about your investment strategy. Contact a financial advisor to discuss your options and create a personalized investment plan.

Featured Posts

-

Kapitaalmarktrentes Stijgen Verder Euro Breekt Door 1 08

May 24, 2025

Kapitaalmarktrentes Stijgen Verder Euro Breekt Door 1 08

May 24, 2025 -

Is The Glastonbury 2025 Lineup The Best Ever Featuring Charli Xcx Neil Young And More Must See Acts

May 24, 2025

Is The Glastonbury 2025 Lineup The Best Ever Featuring Charli Xcx Neil Young And More Must See Acts

May 24, 2025 -

M62 Resurfacing Westbound Closure From Manchester To Warrington

May 24, 2025

M62 Resurfacing Westbound Closure From Manchester To Warrington

May 24, 2025 -

Disneys Biggest Competitor Universals 7 Billion Theme Park Investment

May 24, 2025

Disneys Biggest Competitor Universals 7 Billion Theme Park Investment

May 24, 2025 -

Les Personnes Cles Du Brest Urban Trail Benevoles Artistes And Partenaires

May 24, 2025

Les Personnes Cles Du Brest Urban Trail Benevoles Artistes And Partenaires

May 24, 2025

Latest Posts

-

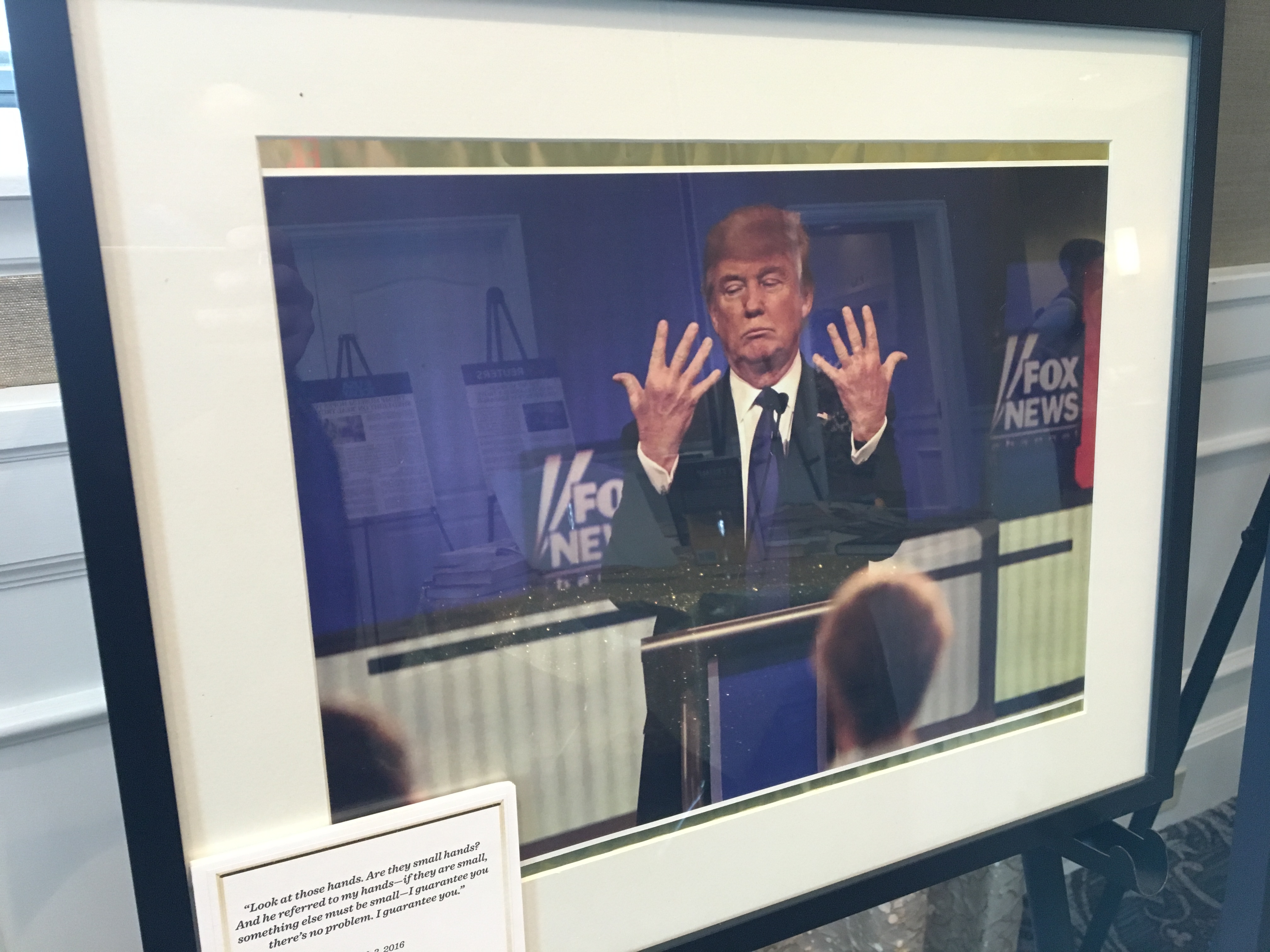

Trump Administrations Impact On Museum Funding And Cultural Institutions

May 24, 2025

Trump Administrations Impact On Museum Funding And Cultural Institutions

May 24, 2025 -

Analyzing The Long Term Effects Of Trumps Museum Funding Cuts

May 24, 2025

Analyzing The Long Term Effects Of Trumps Museum Funding Cuts

May 24, 2025 -

The State Of Museum Programs Following Trumps Budget Reductions

May 24, 2025

The State Of Museum Programs Following Trumps Budget Reductions

May 24, 2025 -

Funding Cuts And The Future Of Museum Programs A Post Trump Perspective

May 24, 2025

Funding Cuts And The Future Of Museum Programs A Post Trump Perspective

May 24, 2025 -

Trumps Budget Cuts Threaten Museum Programs A Critical Analysis

May 24, 2025

Trumps Budget Cuts Threaten Museum Programs A Critical Analysis

May 24, 2025