Apple Stock (AAPL): Important Price Levels And Future Predictions

Table of Contents

Analyzing Historical Price Trends of Apple Stock (AAPL)

Understanding past performance is vital for predicting future price movements of Apple Stock (AAPL). By analyzing historical data, we can identify key support and resistance levels and use technical indicators to gauge momentum.

Identifying Past Support and Resistance Levels

Support levels represent price floors where buying pressure overwhelms selling pressure, preventing further declines. Resistance levels are price ceilings where selling pressure outweighs buying pressure, hindering upward movement. Identifying these levels in AAPL's historical data helps us anticipate potential price reversals.

- Key Historical Support Levels:

- $100 (March 2020) – This level held during the initial COVID-19 market crash.

- $130 (August 2022) – A significant support level tested multiple times.

- Key Historical Resistance Levels:

- $180 (January 2022) – A strong resistance level that capped price increases for several months.

- $160 (October 2022) – A level repeatedly tested during a period of market uncertainty.

- Market Events Influencing Price Levels: The COVID-19 pandemic, supply chain disruptions, and changes in investor sentiment significantly impacted these price levels. Product launches, like the iPhone 14, also played a role.

Moving Averages and Technical Indicators

Technical indicators provide further insights into AAPL's price trends. Moving averages, such as the 50-day and 200-day, smooth out price fluctuations and highlight overall trends. Other indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) help gauge momentum and potential reversals.

- 50-day Moving Average: A shorter-term indicator, often used to identify short-term trends.

- 200-day Moving Average: A longer-term indicator, often used to identify long-term trends. A bullish crossover occurs when the 50-day crosses above the 200-day, suggesting a potential uptrend.

- RSI: Measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- MACD: Identifies changes in momentum by comparing two moving averages. A bullish signal emerges when the MACD line crosses above its signal line.

Current Key Price Levels for Apple Stock (AAPL)

Identifying current support and resistance levels is crucial for making informed trading decisions regarding Apple Stock (AAPL). These levels act as potential pivot points for future price movements.

Identifying Crucial Support Levels

Current support levels for AAPL are dynamic and change based on market conditions. However, based on recent price action, certain price points may act as key support. Breaking below these levels could signal further downward pressure.

- Potential Support Level 1: (Specify a recent price point based on current market data) – A breach below this level could trigger further selling.

- Potential Support Level 2: (Specify a slightly lower recent price point based on current market data) – This represents a stronger support level, and a breach here could indicate a significant downward trend.

- Implications of a Price Breach: Breaking below key support levels could lead to further price declines, potentially triggering stop-loss orders and exacerbating selling pressure.

Pinpointing Potential Resistance Levels

Resistance levels represent obstacles to further price increases. Breaking through these levels would signal a stronger upward trend in Apple Stock (AAPL).

- Potential Resistance Level 1: (Specify a recent price point based on current market data) – This level might cap price increases in the short term.

- Potential Resistance Level 2: (Specify a slightly higher recent price point based on current market data) – Overcoming this level would suggest stronger bullish momentum.

- Potential Catalysts for Price Increases: Positive news regarding new product launches, strong earnings reports, or overall improvement in market sentiment could drive the price above resistance levels.

Future Predictions for Apple Stock (AAPL) and Factors Influencing Price

Predicting the future price of Apple Stock (AAPL) is inherently challenging, but analyzing several factors can provide a clearer outlook.

Impact of New Product Launches

Apple's new product launches significantly influence investor sentiment and AAPL's stock price. Historically, successful product releases have boosted the stock price.

- Expected Product Launches: (List anticipated product releases, e.g., new iPhones, Apple Watches, etc., and their expected release dates)

- Potential Market Impact: (Discuss the potential impact of each launch, considering features, pricing, and market demand).

- Historical Correlation: (Mention how past product launches have affected AAPL's stock performance).

Economic Factors and Market Sentiment

Macroeconomic factors like inflation, interest rates, and overall market sentiment heavily influence AAPL's price.

- Current Economic Trends: (Discuss current inflation rates, interest rate hikes, and their potential impact on the tech sector and consumer spending).

- Investor Sentiment: (Analyze current investor sentiment towards AAPL and the broader tech market). Positive sentiment typically drives prices higher, while negative sentiment leads to declines.

Competitive Landscape and Technological Advancements

Competition from other tech giants and rapid technological advancements constantly impact AAPL's future prospects.

- Key Competitors: (List key competitors like Samsung, Google, Microsoft, and discuss their impact on AAPL's market share and innovation).

- Emerging Technologies: (Discuss the impact of emerging technologies like AR/VR, AI, and the Metaverse on AAPL's future growth).

Conclusion

Understanding key price levels and the factors influencing Apple Stock (AAPL) is paramount for informed investment decisions. Analyzing historical trends, identifying current support and resistance levels, and considering the impact of new product launches, economic conditions, and competition provides a more comprehensive picture. While predicting the future is impossible, this analysis helps investors make better-informed choices. Remember, breaking below key support levels can signal further declines, while breaking through resistance levels suggests a stronger uptrend.

Key Takeaways:

- Support and resistance levels act as significant price pivot points.

- New product launches, economic conditions, and competition all impact AAPL's price.

- Thorough research and understanding of these factors are essential for making informed investment decisions.

Call to Action: By understanding the key price levels and factors influencing Apple Stock (AAPL), you can make more informed investment decisions. Conduct your own thorough research, consider diversifying your investment portfolio, and consult with a financial advisor before investing in Apple stock (AAPL) or any other security. Remember to assess your own risk tolerance and financial goals before making any investment decisions.

Featured Posts

-

Best Of Bangladesh In Europe Strengthening Partnerships For Future Success 2nd Edition

May 24, 2025

Best Of Bangladesh In Europe Strengthening Partnerships For Future Success 2nd Edition

May 24, 2025 -

Glastonbury 2025 Lineup Confirmed Performers And How To Buy Tickets

May 24, 2025

Glastonbury 2025 Lineup Confirmed Performers And How To Buy Tickets

May 24, 2025 -

Legendas F1 Motor Egyedi Porsche Koezuti Modell

May 24, 2025

Legendas F1 Motor Egyedi Porsche Koezuti Modell

May 24, 2025 -

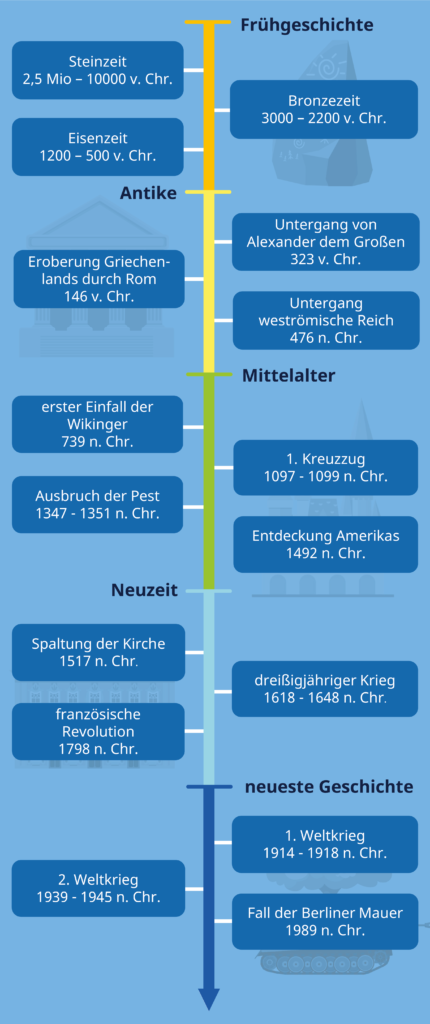

Aktienmarkt Frankfurt Dax Entwicklung Und Wichtige Terminstaende Am 21 Maerz 2025

May 24, 2025

Aktienmarkt Frankfurt Dax Entwicklung Und Wichtige Terminstaende Am 21 Maerz 2025

May 24, 2025 -

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist

May 24, 2025

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist

May 24, 2025

Latest Posts

-

Open Ais 2024 Event Streamlined Voice Assistant Development

May 24, 2025

Open Ais 2024 Event Streamlined Voice Assistant Development

May 24, 2025 -

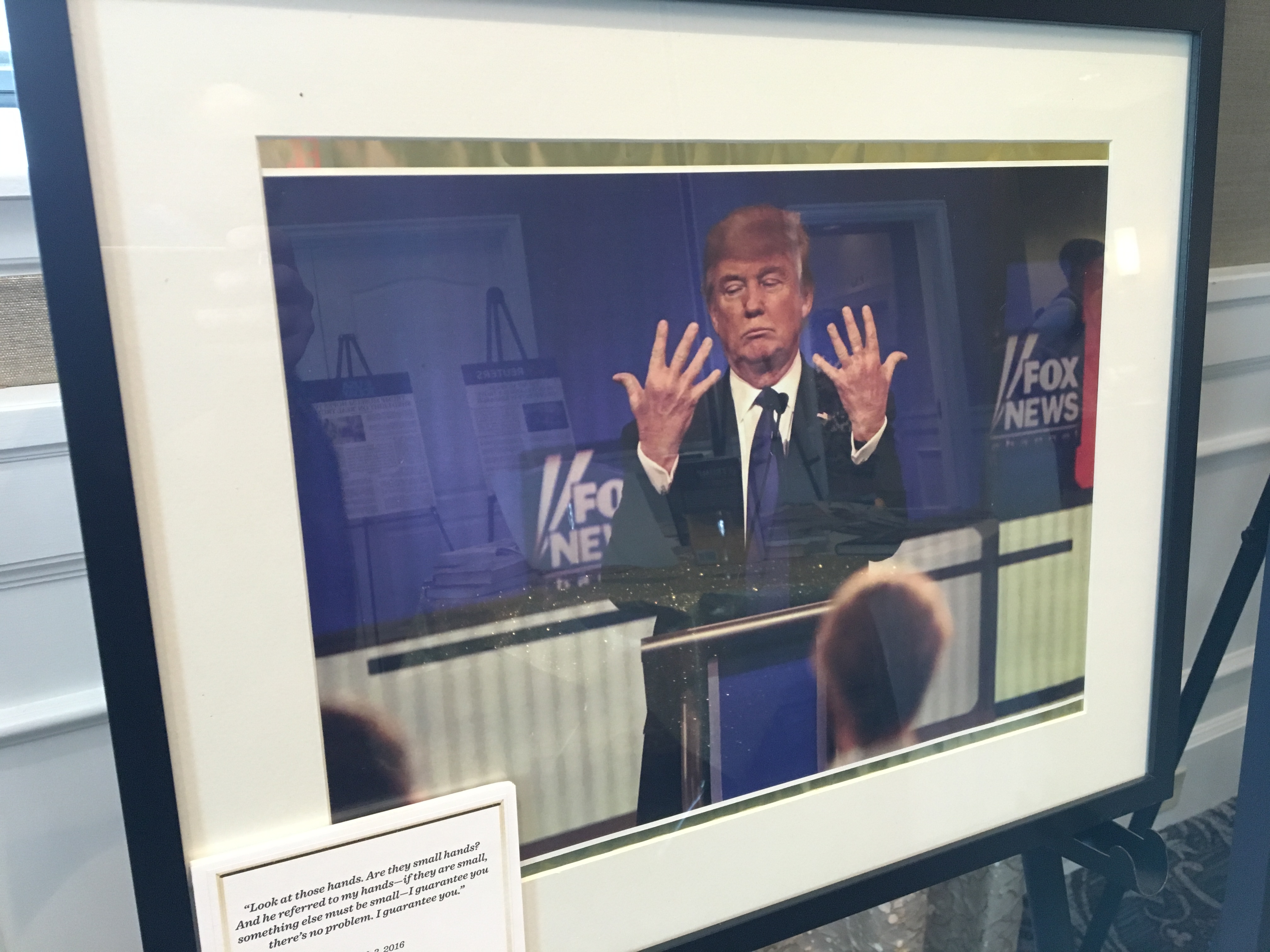

Trump Administrations Impact On Museum Funding And Cultural Institutions

May 24, 2025

Trump Administrations Impact On Museum Funding And Cultural Institutions

May 24, 2025 -

Analyzing The Long Term Effects Of Trumps Museum Funding Cuts

May 24, 2025

Analyzing The Long Term Effects Of Trumps Museum Funding Cuts

May 24, 2025 -

The State Of Museum Programs Following Trumps Budget Reductions

May 24, 2025

The State Of Museum Programs Following Trumps Budget Reductions

May 24, 2025 -

Funding Cuts And The Future Of Museum Programs A Post Trump Perspective

May 24, 2025

Funding Cuts And The Future Of Museum Programs A Post Trump Perspective

May 24, 2025