Apple Stock (AAPL): Key Price Levels To Watch

Table of Contents

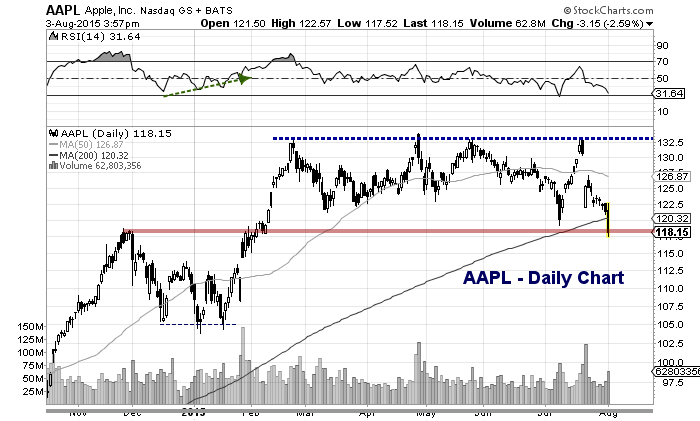

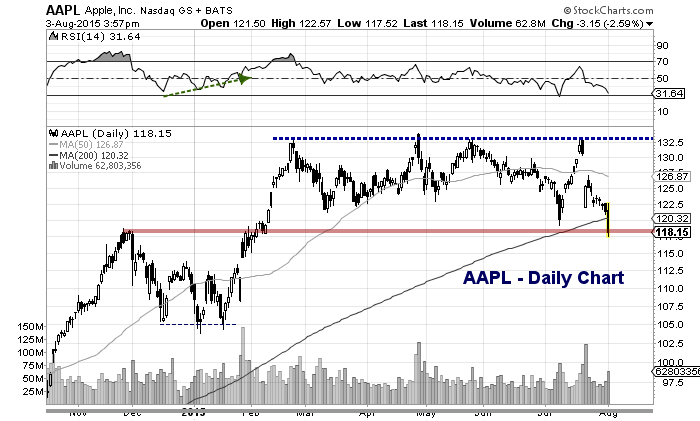

Identifying Key Support Levels for AAPL

What are Support Levels?

Support levels represent price points where the price of a stock is likely to find buying pressure, preventing further declines. Think of them as a floor for the stock price. These levels are often identified by looking at previous price lows where buying interest was strong enough to halt a downward trend.

- Support levels act as potential buying opportunities. If the price drops to a support level, it indicates strong buying interest potentially signaling a bounce.

- Successful support holds can lead to a price reversal and an upward trend.

- Examples of previous AAPL support levels include (Note: These are examples and may not reflect current market conditions. Always conduct your own research): $130 in early 2023, $150 in late 2022. These levels successfully halted declines, at least temporarily, presenting opportunities for buyers.

- Technical indicators like moving averages (e.g., 50-day, 200-day) and Bollinger Bands can help identify potential support zones. A price bounce off a moving average often signals a potential support level.

Current Key Support Levels for Apple Stock

Identifying precise current support levels requires real-time chart analysis, which is beyond the scope of this article. However, we can look at potential zones based on recent price action and significant psychological levels.

- Potential Support Zone 1: (Insert price level based on current market analysis). This level is significant because... (Explain reasoning – e.g., previous low, trendline intersection).

- Potential Support Zone 2: (Insert price level based on current market analysis). This level is supported by...(Explain reasoning – e.g., psychological round number, significant moving average).

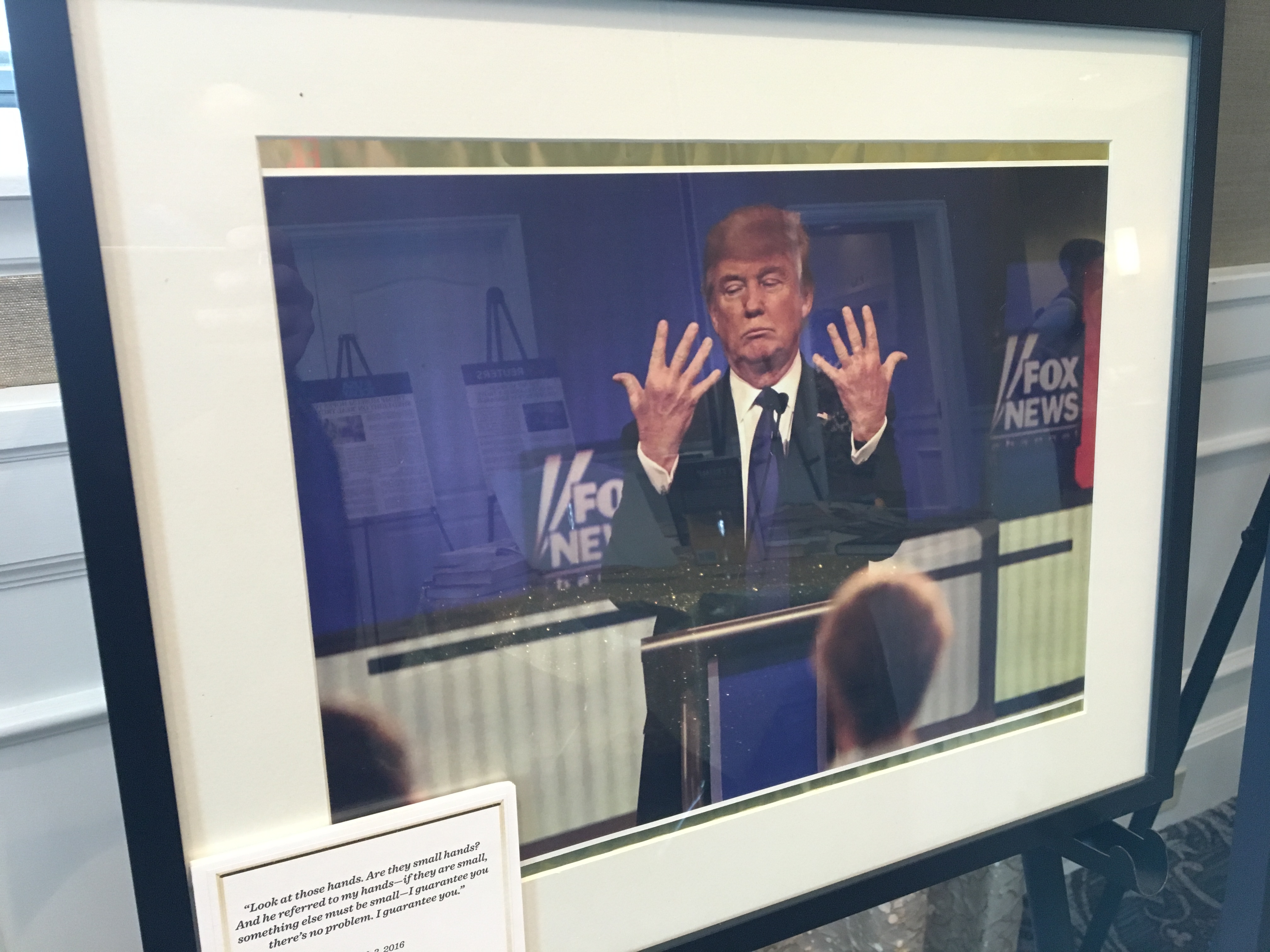

(Include a chart or visual here illustrating these potential support levels.)

Pinpointing Key Resistance Levels for AAPL

What are Resistance Levels?

Resistance levels represent price points where selling pressure is typically strong enough to halt an upward trend. They act as a ceiling for the stock price. These are often previous price highs where sellers were strong enough to push the price lower.

- Resistance levels can signal potential selling opportunities or profit-taking for investors who are long on AAPL.

- A break above a resistance level can indicate a significant price increase.

- Examples of previous AAPL resistance levels include (Note: These are examples and may not reflect current market conditions. Always conduct your own research): $180 in mid-2023, $170 in early 2023. These levels presented selling pressure and potential profit-taking opportunities.

- Technical indicators, such as moving averages and Bollinger Bands, can also assist in identifying resistance levels.

Current Key Resistance Levels for Apple Stock

Similar to support levels, precise resistance levels require real-time analysis. However, potential resistance zones based on recent price action could include:

- Potential Resistance Zone 1: (Insert price level based on current market analysis). This level is significant due to...(Explain reasoning – e.g., previous high, psychological level, trendline).

- Potential Resistance Zone 2: (Insert price level based on current market analysis). This level is supported by...(Explain reasoning – e.g., previous consolidation area, psychological round number).

(Include a chart or visual here illustrating these potential resistance levels.)

Factors Influencing AAPL Price Levels

Macroeconomic Factors

Broader economic conditions significantly impact AAPL's price. Factors such as:

- Interest rates: Higher interest rates can decrease consumer spending and impact Apple's sales.

- Inflation: High inflation erodes purchasing power and can affect demand for Apple products.

- Global economic growth: Slowing global growth can negatively impact Apple's international sales.

Company-Specific News

Apple's performance is intrinsically linked to its product launches, financial reports, and overall market position.

- New product releases: The launch of successful new products (iPhone, iPad, Mac) typically boosts AAPL stock price.

- Financial reports: Strong earnings reports and positive revenue growth usually lead to price increases.

- Supply chain disruptions: Supply chain issues can impact production and negatively impact the stock.

Market Sentiment

Investor sentiment plays a crucial role in driving AAPL's price. A bullish sentiment (positive outlook) generally leads to price increases, while a bearish sentiment (negative outlook) can cause declines. News coverage and social media discussions can greatly influence this.

Risk Management Strategies When Trading AAPL

Setting Stop-Loss Orders

Stop-loss orders are crucial for limiting potential losses. They automatically sell your shares if the price drops to a predetermined level.

Diversification

Diversifying your investment portfolio is essential to reduce risk. Don't put all your eggs in one basket.

Long-Term vs. Short-Term Investing

Consider your investment timeline and risk tolerance. Long-term investing in AAPL is generally considered less risky than short-term trading.

Conclusion

Understanding key support and resistance levels for Apple stock (AAPL) is crucial for making informed investment decisions. We've explored potential support and resistance zones, alongside macroeconomic factors, company-specific news, and market sentiment, all impacting AAPL's price. Remember, these are potential levels; real-time market analysis is essential. Continue your research on Apple stock (AAPL) price levels and other market factors to make informed investment choices. Remember to always consult with a financial advisor before making any investment decisions. Stay updated on the latest movements in Apple Stock (AAPL) and its key price levels. Use this information to successfully navigate the market and achieve your financial goals.

Featured Posts

-

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Fun

May 24, 2025

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Fun

May 24, 2025 -

Glastonbury 2025 Lineup Is It The Best Yet Charli Xcx Neil Young And More

May 24, 2025

Glastonbury 2025 Lineup Is It The Best Yet Charli Xcx Neil Young And More

May 24, 2025 -

Krasivaya Data 89 Svadeb Na Kharkovschine

May 24, 2025

Krasivaya Data 89 Svadeb Na Kharkovschine

May 24, 2025 -

Mia Farrow On Trump Deportations Of Venezuelan Gang Members Warrant Arrest

May 24, 2025

Mia Farrow On Trump Deportations Of Venezuelan Gang Members Warrant Arrest

May 24, 2025 -

La Caduta Delle Borse La Reazione Dell Ue Ai Nuovi Dazi

May 24, 2025

La Caduta Delle Borse La Reazione Dell Ue Ai Nuovi Dazi

May 24, 2025

Latest Posts

-

Trump Administrations Impact On Museum Funding And Cultural Institutions

May 24, 2025

Trump Administrations Impact On Museum Funding And Cultural Institutions

May 24, 2025 -

Analyzing The Long Term Effects Of Trumps Museum Funding Cuts

May 24, 2025

Analyzing The Long Term Effects Of Trumps Museum Funding Cuts

May 24, 2025 -

The State Of Museum Programs Following Trumps Budget Reductions

May 24, 2025

The State Of Museum Programs Following Trumps Budget Reductions

May 24, 2025 -

Funding Cuts And The Future Of Museum Programs A Post Trump Perspective

May 24, 2025

Funding Cuts And The Future Of Museum Programs A Post Trump Perspective

May 24, 2025 -

Trumps Budget Cuts Threaten Museum Programs A Critical Analysis

May 24, 2025

Trumps Budget Cuts Threaten Museum Programs A Critical Analysis

May 24, 2025