Apple Stock Price: Key Levels And Q2 Earnings Outlook

Table of Contents

H2: Key Price Levels to Watch

The Apple stock price (AAPL stock) is constantly fluctuating, making identifying key support and resistance levels vital for investors. These levels represent areas where the price is likely to encounter buying or selling pressure, potentially leading to price reversals or consolidations.

H3: Support Levels

Support levels represent price points where buying pressure is expected to outweigh selling pressure, preventing further price declines. For AAPL stock, several key support levels exist:

- $150: This level represents a significant psychological barrier and coincides with previous lows. A break below this level could signal further downside potential.

- $145: This level offers stronger support, as it aligns with a key trendline and historical support area. A bounce from this level could indicate a short-term buying opportunity.

- $140: This represents a crucial support level. Breaking below this level could trigger a more significant sell-off.

Potential catalysts that could trigger a bounce from these support levels include positive news regarding Q2 earnings, a new product announcement, or a general improvement in market sentiment. [Insert chart/graph illustrating support levels here].

H3: Resistance Levels

Resistance levels are price points where selling pressure is expected to exceed buying pressure, hindering further upward movement. Key resistance levels for Apple stock include:

- $170: This level has acted as resistance in the past and represents a significant psychological barrier. Breaking above this level could signal a stronger bullish trend.

- $180: This level represents a more significant resistance zone, potentially coinciding with previous highs. Overcoming this resistance would be a strong bullish signal.

- $190: This level represents a strong resistance zone, and breaking above it would suggest a significant shift in market sentiment and bullish momentum.

Factors hindering upward momentum might include macroeconomic headwinds, disappointing Q2 earnings, or increased competition. [Insert chart/graph illustrating resistance levels here].

H2: Factors Influencing Apple Stock Price

Numerous factors influence the Apple stock price, ranging from quarterly earnings to broader macroeconomic conditions.

H3: Q2 Earnings Expectations

Analyst forecasts for Apple's Q2 earnings are crucial for predicting short-term price movements. Analysts generally expect [insert expected revenue and EPS figures]. However, potential upside surprises, such as exceeding sales expectations for a specific product line, could significantly boost the Apple stock price. Conversely, downside surprises, like lower-than-expected iPhone sales, could lead to a price decline. A comparison to the previous quarter's performance will also be vital in assessing the results.

H3: Macroeconomic Factors

Global macroeconomic conditions significantly influence consumer spending and, consequently, Apple's stock price. Factors like inflation, interest rates, and global economic growth can all impact demand for Apple's products. High inflation and rising interest rates could dampen consumer spending, potentially affecting Apple's sales and stock price.

H3: Product Launches and Innovation

Apple's reputation for innovation significantly impacts its stock valuation. The launch of new iPhones, Macs, or other products, as well as significant software updates, can create excitement and boost the Apple stock price. Conversely, delays or negative reception of new products can negatively affect the stock. Any upcoming product releases, such as the potential new Apple Vision Pro headset, will be closely watched by investors.

H2: Analyzing Apple Stock Price Trends

Analyzing Apple stock price trends requires a combination of technical and fundamental analysis.

H3: Technical Analysis

Technical analysis uses charts and indicators to predict short-term price movements. Indicators like moving averages (e.g., 50-day, 200-day) and the Relative Strength Index (RSI) can offer insights into potential price trends. For example, a bullish crossover of the 50-day MA above the 200-day MA could suggest a positive trend. However, it's important to note that technical analysis alone is insufficient and should be complemented by fundamental analysis.

H3: Fundamental Analysis

Fundamental analysis focuses on a company's underlying financial health and future prospects. For Apple, key fundamental factors include revenue growth, profit margins, market share, and competitive landscape. A strong fundamental position, characterized by consistent revenue growth and high profitability, usually supports a higher stock valuation.

3. Conclusion:

The Apple stock price (AAPL stock) is influenced by a complex interplay of factors. Monitoring key support and resistance levels, such as $150, $170, and $180, alongside Q2 earnings expectations and broader macroeconomic conditions, is crucial for navigating the market. Understanding both technical and fundamental aspects is essential for making informed investment decisions. Remember, conducting thorough research and staying updated on news and financial analysis is vital. Stay informed about the Apple stock price and make sound investment choices. Further research into Apple's Q2 earnings forecasts and in-depth analysis of its financial statements is recommended before making any investment decisions regarding Apple stock.

Featured Posts

-

Ferrari 296 Speciale Tecnologia Hibrida E Excelencia Em Design

May 25, 2025

Ferrari 296 Speciale Tecnologia Hibrida E Excelencia Em Design

May 25, 2025 -

Ferrari Loeysi Uuden Taehden 13 Vuotias Kuljettaja Sopimukseen

May 25, 2025

Ferrari Loeysi Uuden Taehden 13 Vuotias Kuljettaja Sopimukseen

May 25, 2025 -

Brbs Banco Master Acquisition A Challenge To Brazils Banking Giants

May 25, 2025

Brbs Banco Master Acquisition A Challenge To Brazils Banking Giants

May 25, 2025 -

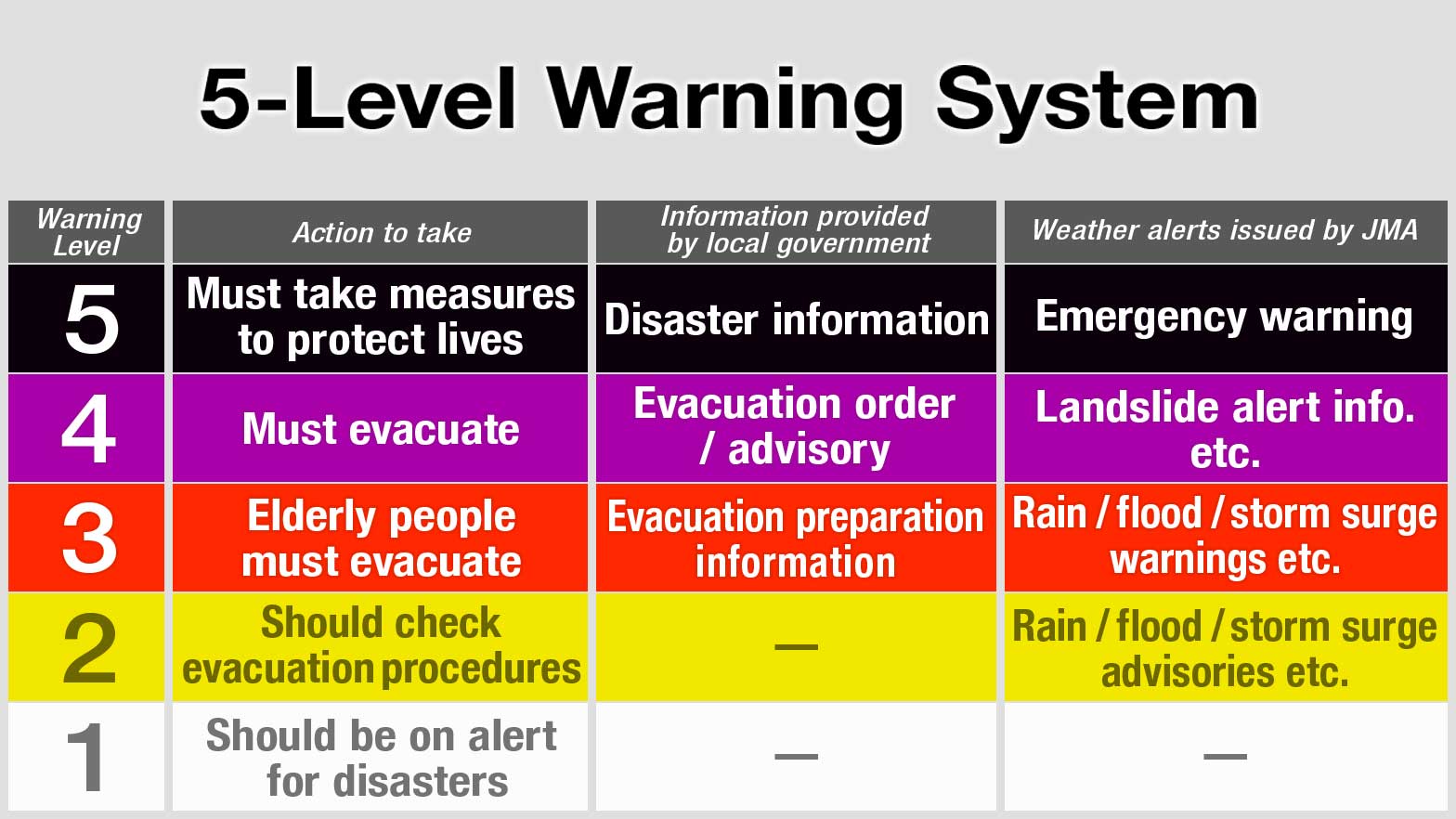

Understanding Flood Alerts Types Warnings And Response

May 25, 2025

Understanding Flood Alerts Types Warnings And Response

May 25, 2025 -

Hospodarsky Pokles V Nemecku Dopady Na Trh Prace A Prehlad Prepustani H Nonline Sk

May 25, 2025

Hospodarsky Pokles V Nemecku Dopady Na Trh Prace A Prehlad Prepustani H Nonline Sk

May 25, 2025