Apple Stock: Q2 Financial Report And Future Outlook

Table of Contents

Apple's Q2 2024 Financial Performance: A Deep Dive

Revenue and Earnings

Apple's Q2 2024 financial report showcased impressive results, although slightly below some analyst expectations. The company reported [insert actual revenue figure here] in revenue, representing a [insert percentage] year-over-year growth. Earnings per share (EPS) came in at [insert actual EPS figure here], a [insert percentage] increase compared to the same period last year.

- Revenue: [insert actual revenue figure]

- EPS: [insert actual EPS figure]

- Year-over-Year Revenue Growth: [insert percentage]

- Year-over-Year EPS Growth: [insert percentage]

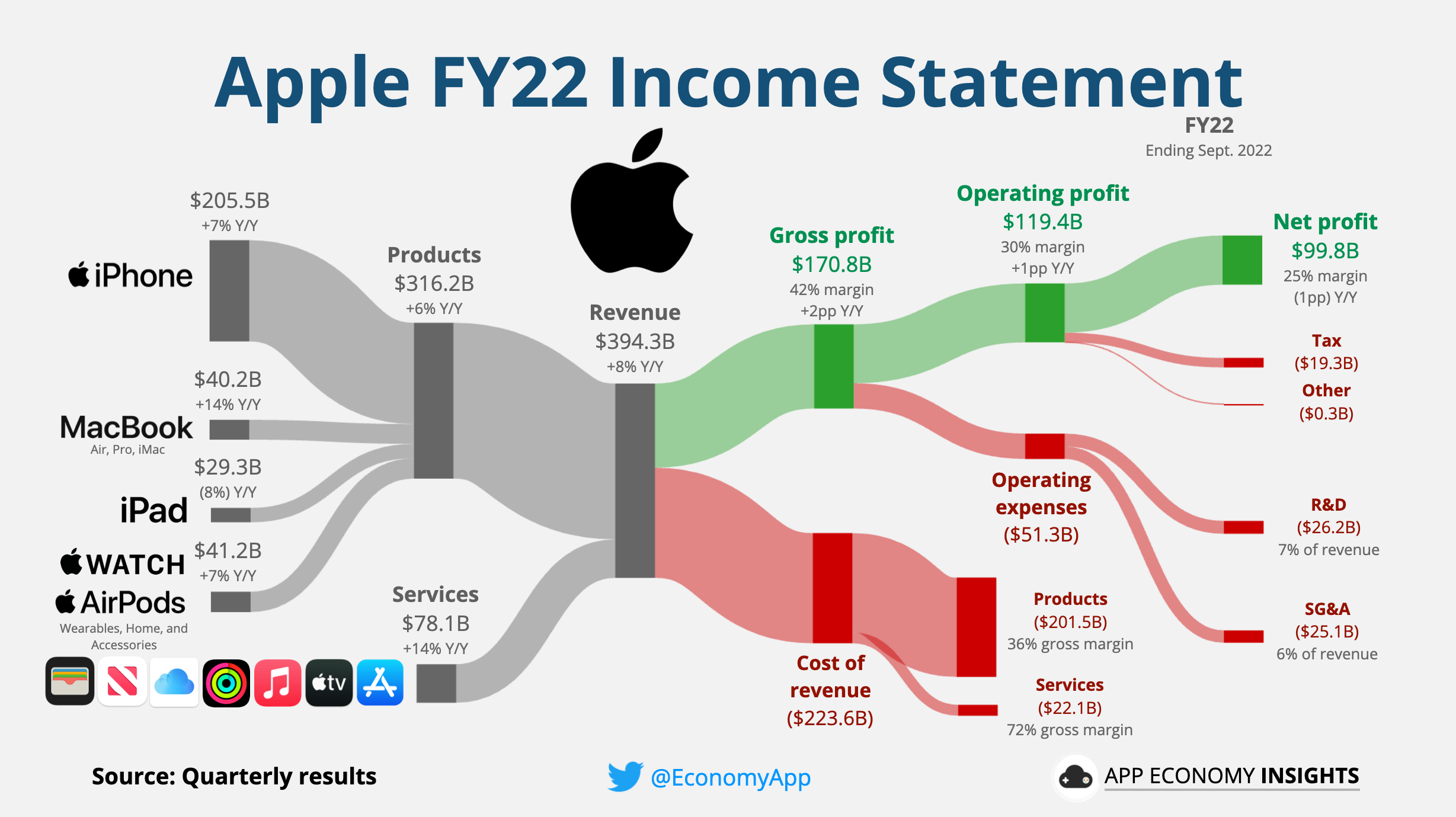

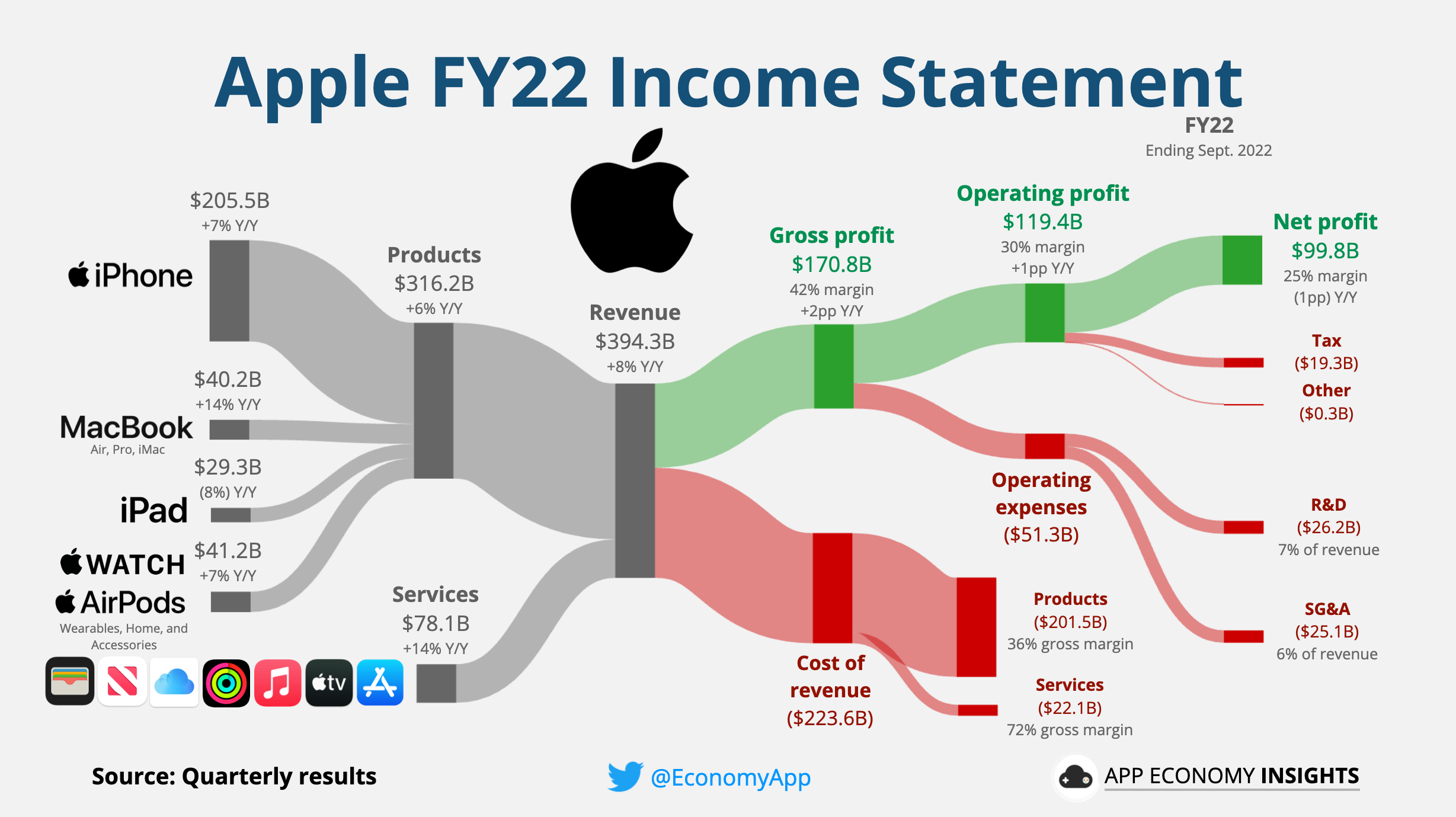

This performance can be attributed to several factors, including robust iPhone sales, sustained growth in the services segment, and continued strong demand for wearables. However, supply chain constraints and macroeconomic headwinds did impact overall results, slightly dampening the growth trajectory compared to previous quarters. A visual representation of this data (chart/graph) would be included here.

Segment Performance

Analyzing Apple's performance by segment provides a clearer picture of its strengths and weaknesses.

- iPhone: Generated [insert revenue figure] in revenue, showing a [insert percentage] year-over-year growth. The strong performance highlights continued demand despite higher prices for certain models.

- iPad: Recorded [insert revenue figure] in revenue, demonstrating [insert percentage] year-over-year growth/decline. [Brief explanation of performance – e.g., impacted by new product releases or market saturation]

- Mac: Achieved [insert revenue figure] in revenue, exhibiting [insert percentage] year-over-year growth/decline. [Brief explanation of performance – e.g., affected by economic downturn impacting consumer spending on high-end computers]

- Wearables, Home, and Accessories: Contributed [insert revenue figure] to overall revenue, with [insert percentage] year-over-year growth. This segment continues to be a strong driver of growth for Apple.

- Services: The Services segment remains a significant revenue generator, contributing [insert revenue figure] and demonstrating impressive [insert percentage] year-over-year growth. This highlights the recurring revenue model's resilience.

Key Financial Metrics

Beyond revenue and EPS, key financial metrics offer further insight into Apple's financial health.

- Gross Margin: [insert percentage] – reflects Apple's pricing power and efficiency in managing costs.

- Operating Margin: [insert percentage] – indicates the profitability of Apple's operations.

- Free Cash Flow: [insert figure] – demonstrates Apple's ability to generate cash, crucial for future investments and returns to shareholders.

Analyzing the Factors Influencing Apple Stock Performance

Market Conditions

The overall stock market and tech sector significantly influence Apple stock performance. Currently, [briefly describe the state of the stock market and tech sector]. Macroeconomic factors like rising interest rates, persistent inflation, and geopolitical uncertainties continue to create volatility. These factors can impact consumer spending and investor sentiment, indirectly affecting Apple’s stock price.

- Interest Rates: Rising interest rates can impact consumer spending and borrowing, potentially reducing demand for Apple products.

- Inflation: High inflation can lead to decreased consumer spending and increased input costs for Apple, squeezing profit margins.

- Geopolitical Events: Global instability can create uncertainty in the market, affecting investor confidence in tech stocks like AAPL.

Competition and Innovation

Apple faces intense competition from other tech giants like Samsung, Google, and Microsoft. The company’s success depends on continuous innovation. While Apple maintains a strong brand reputation, competitors are constantly innovating, presenting challenges to Apple’s market share. [mention specific examples of new product releases from competitors and how they impact Apple]. Apple's ongoing development of AR/VR technology, improved chipsets, and software updates are key to maintaining its competitive edge and driving future growth.

- Key Competitors: Samsung, Google, Microsoft, etc.

- New Product Releases (Apple): [mention specific new products and their potential impact]

- Upcoming Technologies: AR/VR, improved chipsets, etc.

Investor Sentiment

Investor sentiment toward Apple stock is generally positive, but subject to fluctuations influenced by various factors including earnings reports, product announcements, and macroeconomic conditions. Analyst ratings are largely positive, [mention specific ratings and their rationale], while recent news coverage is [mention positive and negative news coverage]. Social media sentiment is mostly [mention general sentiment – positive, negative, or mixed], reflecting the general market mood regarding Apple's future prospects.

- Key Analyst Ratings: [Mention specific ratings and sources]

- Recent News Headlines: [Mention positive and negative headlines]

- Social Media Buzz: [Describe the overall tone of social media discussion]

Future Outlook and Predictions for Apple Stock

Growth Projections

Analysts predict continued growth for Apple, although at a potentially slower pace compared to previous years. [mention specific growth projections from reputable sources]. Key drivers for future growth include: expansion into new markets, continued growth in the services segment, and the development of innovative products and services in emerging technologies.

- Growth Projections: [insert percentage and timeframe]

- Potential Areas of Future Growth: Services, emerging markets, new product categories.

Potential Risks and Challenges

Apple faces several potential risks and challenges:

- Supply Chain Disruptions: Global supply chain volatility could continue to impact production and availability of Apple products.

- Increased Competition: Intensifying competition from tech rivals could erode Apple’s market share.

- Regulatory Changes: Increasing regulatory scrutiny could lead to higher costs and potential restrictions on Apple's operations.

- Economic Slowdown: A global economic slowdown could significantly impact consumer spending on electronics, affecting Apple's sales.

Investment Strategies

Based on the Q2 report and the overall outlook, potential investment strategies for Apple stock include:

- Buy and Hold: This strategy is suitable for long-term investors who believe in Apple's long-term growth potential.

- Dollar-Cost Averaging: This approach involves investing a fixed amount of money at regular intervals, mitigating the risk of investing a large sum at a market peak.

- Sell (if applicable): [Mention when a sell strategy may be appropriate, e.g., if the investor's risk tolerance is exceeded].

Conclusion

Apple's Q2 2024 financial report demonstrates continued strength, despite facing macroeconomic headwinds and competition. While growth may moderate compared to previous years, Apple's robust ecosystem, strong brand loyalty, and innovative product pipeline position it favorably for continued long-term growth. However, investors should carefully consider the potential risks and challenges before making any investment decisions. Remember that all investments carry risk.

Stay updated on the latest developments in Apple stock (AAPL stock) by regularly checking our website for in-depth analysis and expert opinions. Conduct thorough research and consult a financial advisor before making any investment decisions.

Featured Posts

-

2 2 Million Treatment How One Fathers Rowing Helped His Son

May 25, 2025

2 2 Million Treatment How One Fathers Rowing Helped His Son

May 25, 2025 -

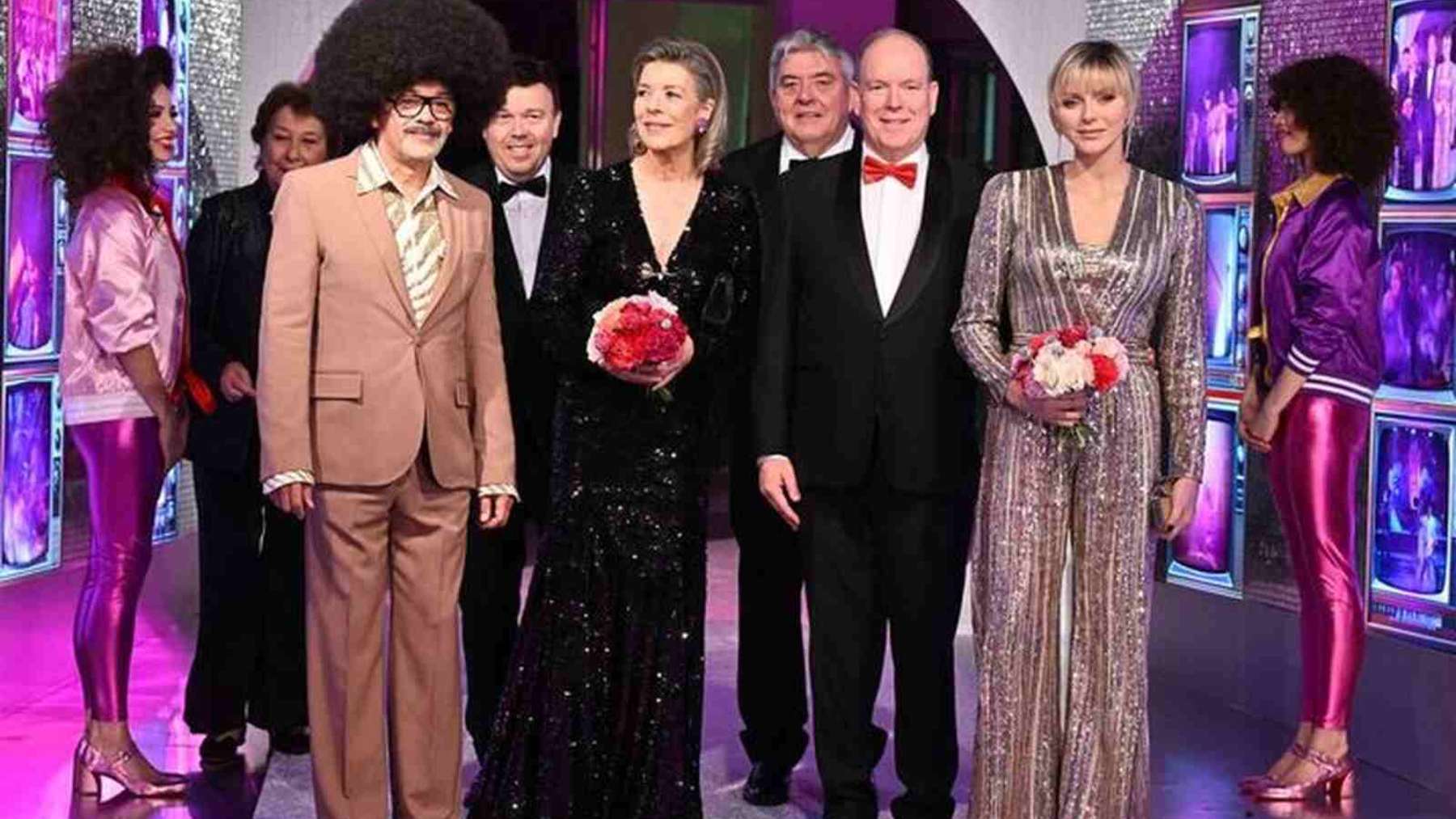

Vestidos De Ensueno Los Looks Mas Destacados Del Baile De La Rosa 2025

May 25, 2025

Vestidos De Ensueno Los Looks Mas Destacados Del Baile De La Rosa 2025

May 25, 2025 -

Memorial Day 2025 Air Travel Best And Worst Days To Fly

May 25, 2025

Memorial Day 2025 Air Travel Best And Worst Days To Fly

May 25, 2025 -

Elon Musk And Dogecoin Is He Really Leaving

May 25, 2025

Elon Musk And Dogecoin Is He Really Leaving

May 25, 2025 -

Escape To The Country Top Locations For A Tranquil Lifestyle

May 25, 2025

Escape To The Country Top Locations For A Tranquil Lifestyle

May 25, 2025