Apple Stock Slumps On $900 Million Tariff Projection

Table of Contents

The $900 Million Tariff Projection: A Deep Dive

The source of the alarming $900 million figure is a recent report by [Source Name - e.g., a reputable financial analysis firm or news outlet]. This projection considers the impact of increased tariffs on Apple products imported from [Country of Origin - e.g., China]. Several factors contributed to this estimate, including the specific tariff rates imposed, the volume of Apple products affected, and the complexities of Apple's global supply chain. The analysis takes into account not only existing tariffs but also potential future increases.

Which Apple products are most affected? The report pinpoints several key product lines:

- iPhones: The most significant impact is expected on iPhone production, with an estimated [Percentage]% increase in cost due to tariffs.

- iPads: Similar to iPhones, iPads are heavily reliant on manufacturing in [Country of Origin], leading to a projected [Percentage]% cost increase.

- MacBooks: The production of MacBooks is also expected to be significantly impacted, leading to an estimated [Percentage]% price increase.

- Apple Watch & AirPods: Even smaller products like the Apple Watch and AirPods are not immune, with projected cost increases of [Percentage]% and [Percentage]% respectively.

This tariff increase significantly impacts Apple's already complex and globally dispersed supply chain, potentially causing delays and increased production costs.

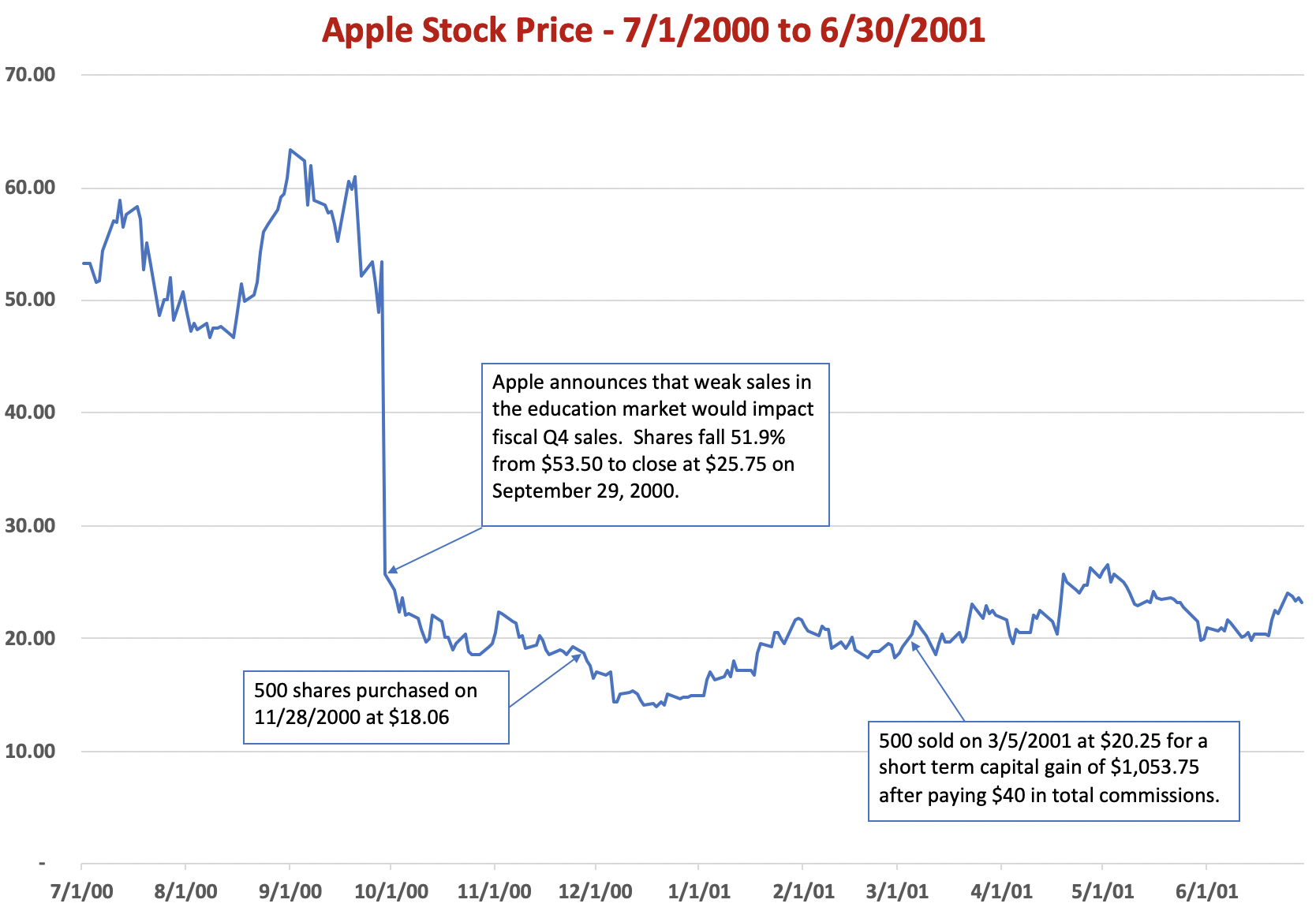

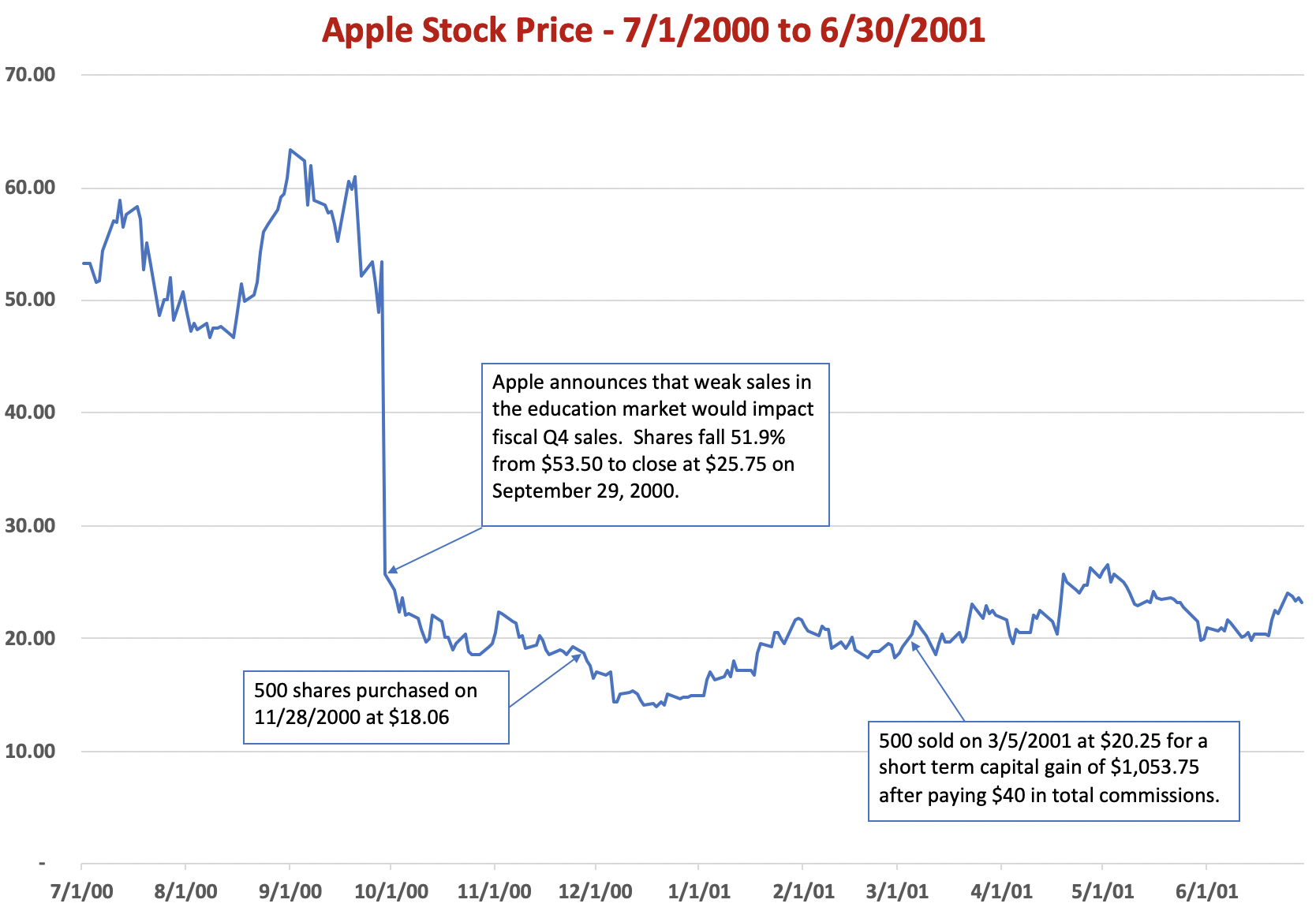

Market Reaction and Investor Sentiment

The news of the $900 million tariff projection triggered an immediate and noticeable reaction in the market. Apple's stock price experienced a sharp [Percentage]% drop following the release of the report. Trading volume also increased significantly, indicating heightened investor activity and concern.

Investor sentiment turned overwhelmingly negative, exemplified by:

- Stock sell-offs: Many investors reacted by selling off their Apple stock, contributing to the price decline.

- Analyst downgrades: Several financial analysts downgraded their ratings on Apple stock, citing the tariff impact as a significant risk factor.

- Reduced confidence: Overall, confidence in Apple's short-term prospects decreased among investors.

Quotes from prominent financial analysts and experts further underscored the severity of the situation, highlighting the potential for long-term damage to Apple's profitability.

Apple's Potential Responses to the Tariff Increase

Faced with this significant challenge, Apple has several potential strategies to mitigate the impact of the tariff increases:

- Shifting production: Relocating some or all of its manufacturing operations to countries with more favorable trade agreements could significantly reduce tariff costs. However, this is a complex and time-consuming process.

- Absorbing costs: Apple could choose to absorb some or all of the increased costs, avoiding price increases for consumers. This would, however, negatively impact profit margins.

- Increasing prices: Passing on the increased costs to consumers by raising prices is another option. This could, however, reduce demand for Apple products.

- Lobbying efforts: Engaging in lobbying efforts to influence trade policy and potentially reduce or eliminate the tariffs could be a long-term strategy.

The feasibility and effectiveness of each of these strategies will depend on various factors, including the magnitude of the tariff increase, consumer demand elasticity, and the geopolitical landscape.

Long-Term Implications for Apple and Investors

The long-term implications of this $900 million tariff projection are significant and uncertain. The increased costs could impact Apple's profitability, potentially affecting future product launches, revenue, and earnings. The impact on consumer spending and demand for Apple products remains a key uncertainty. If consumers are unwilling or unable to absorb price increases, demand could fall, further impacting Apple's financial performance.

Several long-term considerations include:

- Future product launches: The cost increases might affect the pricing and timing of future product releases.

- Overall revenue and earnings: Apple's revenue and earnings could be significantly affected, impacting shareholder returns.

- Long-term stock performance: The stock price recovery trajectory will depend on Apple's ability to effectively manage the tariff challenge and maintain consumer demand.

Conclusion: Navigating the Apple Stock Slump and Tariff Challenges

The $900 million tariff projection represents a significant challenge for Apple, triggering a substantial stock slump and raising concerns among investors. The company's response to this challenge, whether through production shifts, cost absorption, price adjustments, or lobbying efforts, will play a crucial role in determining its long-term trajectory. Staying informed about further developments regarding Apple stock and the ongoing tariff situation is crucial for investors. For in-depth Apple stock analysis and insights into the impact of tariffs on investment strategies, consult reputable financial news sources and expert analysis. Understanding the evolving tariff landscape is essential for making informed investment decisions regarding Apple stock.

Featured Posts

-

Sean Penn And Woody Allen Examining A Continued Me Too Controversy

May 25, 2025

Sean Penn And Woody Allen Examining A Continued Me Too Controversy

May 25, 2025 -

Understanding Jensons Fw 22 Extended Key Features And Benefits

May 25, 2025

Understanding Jensons Fw 22 Extended Key Features And Benefits

May 25, 2025 -

Are The New Ferrari Hot Wheels Sets Really Mamma Mia Good

May 25, 2025

Are The New Ferrari Hot Wheels Sets Really Mamma Mia Good

May 25, 2025 -

Anchor Brewing Shuttering Whats Next For The Iconic Brewery

May 25, 2025

Anchor Brewing Shuttering Whats Next For The Iconic Brewery

May 25, 2025 -

Hells Angels An Examination Of Their Criminal Activities And Law Enforcement Response

May 25, 2025

Hells Angels An Examination Of Their Criminal Activities And Law Enforcement Response

May 25, 2025