Apple Stock Suffers Setback Amidst Tariff Announcement

Table of Contents

The Impact of Tariffs on Apple's Supply Chain

A significant portion of Apple's products, most notably the iPhone, are manufactured in China. This heavy reliance on Chinese manufacturing makes the company highly vulnerable to tariffs imposed on goods imported from that country. Increased tariffs directly translate to higher manufacturing costs for Apple, potentially squeezing profit margins and impacting the Apple stock price.

-

Supply chain disruption: Increased tariffs lead to supply chain disruptions. The complexity of Apple's global supply chain, involving numerous suppliers and intricate logistics, makes it difficult to quickly adjust to these changes. Delays in sourcing components and increased transportation costs add to the problem.

-

Increased manufacturing costs: The direct impact is higher costs for producing iPhones and other Apple products. These increased costs are likely to be passed on to consumers, potentially reducing demand and impacting sales figures, which in turn affects the Apple stock.

-

Impact on specific products: The iPhone, iPad, and MacBooks are particularly vulnerable, as a significant portion of their components are sourced from or assembled in China. Even seemingly minor components facing tariffs can have ripple effects throughout the entire supply chain.

-

Global trade tensions: The ongoing trade war uncertainty creates instability, making it difficult for Apple to accurately forecast costs and plan for future production. This uncertainty further impacts investor confidence and negatively affects the Apple stock price.

Investor Sentiment and Market Reaction

The tariff announcement triggered an immediate sell-off in Apple stock, reflecting investor concerns about the company's future profitability. Negative investor sentiment contributed significantly to the decline, with many anticipating reduced consumer demand due to higher prices. Market analysts are offering varied predictions on the long-term impact, creating volatility in the Apple stock market.

-

Stock market volatility: The Apple stock price experienced significant volatility following the tariff news, reflecting the uncertainty surrounding the long-term consequences. Trading volume increased dramatically as investors reacted to the news.

-

Sell-off and decreased investor confidence: The sell-off reflects a loss of investor confidence in Apple's ability to maintain its profit margins and sustain its growth trajectory in the face of increased trade barriers.

-

Market analysis and predictions: While some analysts remain optimistic about Apple's long-term prospects, others express concerns about the potential impact on sales and profitability. A wide range of stock price predictions currently exists.

-

Comparison with other tech companies: The reaction of Apple’s stock should be compared to how other tech companies heavily reliant on Chinese manufacturing fared during similar periods of trade tension. This provides context for assessing the severity of the situation.

Alternative Strategies and Mitigation Efforts by Apple

Apple is likely exploring various strategies to mitigate the impact of tariffs. Diversification of its manufacturing base, relocation of some production outside China, and cost-cutting measures are all potential options.

-

Manufacturing diversification: Apple could shift some of its manufacturing to other countries like Vietnam, India, or Mexico to reduce its dependence on China. However, this is a complex and time-consuming process.

-

Manufacturing relocation: Relocating manufacturing facilities is expensive and logistically challenging, requiring significant investment and coordination. It also raises concerns regarding workforce availability and infrastructure in alternative locations.

-

Cost-cutting measures: Apple might implement cost-cutting measures to offset the increased tariffs, potentially affecting research and development budgets or marketing expenses. This could impact future product innovation and market penetration.

-

Historical approach to challenges: Considering Apple's past responses to economic challenges provides insight into their likely strategic actions. Analyzing their historical performance gives an indication of their resilience in the face of adversity.

Long-Term Outlook and Future Predictions for Apple Stock

The long-term implications of the tariffs on Apple's financial performance are uncertain. While the short-term impact is clearly negative, the long-term effects depend on various factors.

-

Long-term financial performance: The sustained impact will depend on consumer demand elasticity, Apple's ability to absorb increased costs, and the overall resolution of trade tensions.

-

Stock price scenarios: Potential scenarios range from a gradual recovery to a prolonged period of depressed stock prices, depending on how the company adapts to the new trade landscape.

-

Impact of other economic factors: Other macroeconomic factors, such as global economic growth and consumer confidence, will also play a significant role in shaping the future of Apple stock.

-

Expert opinions and forecasts: Integrating expert opinions and market forecasts provides a more holistic view, allowing for a more nuanced assessment of the long-term outlook.

Conclusion:

The recent tariff announcement has undeniably dealt a blow to Apple stock, highlighting the vulnerability of global tech companies to trade wars and geopolitical uncertainties. The impact on Apple's supply chain, investor sentiment, and long-term prospects remains a significant concern. The situation is dynamic and requires constant monitoring.

Call to Action: Stay informed about the evolving situation regarding Apple stock and the ongoing trade tensions to make informed investment decisions. Continue to monitor the Apple stock price, understand the complexities of the Apple stock market position, and prepare for potential future fluctuations influenced by tariffs and global trade dynamics.

Featured Posts

-

Amundi Msci World Ii Ucits Etf Dist A Comprehensive Guide To Net Asset Value

May 25, 2025

Amundi Msci World Ii Ucits Etf Dist A Comprehensive Guide To Net Asset Value

May 25, 2025 -

Nationwide Tennis Participation Surges Over 25 Million Players Projected By August 2024

May 25, 2025

Nationwide Tennis Participation Surges Over 25 Million Players Projected By August 2024

May 25, 2025 -

Vospominaniya O Sergee Yurskom V Teatre Mossoveta

May 25, 2025

Vospominaniya O Sergee Yurskom V Teatre Mossoveta

May 25, 2025 -

Rassel I Khemilton 300 Y Podium Mercedes

May 25, 2025

Rassel I Khemilton 300 Y Podium Mercedes

May 25, 2025 -

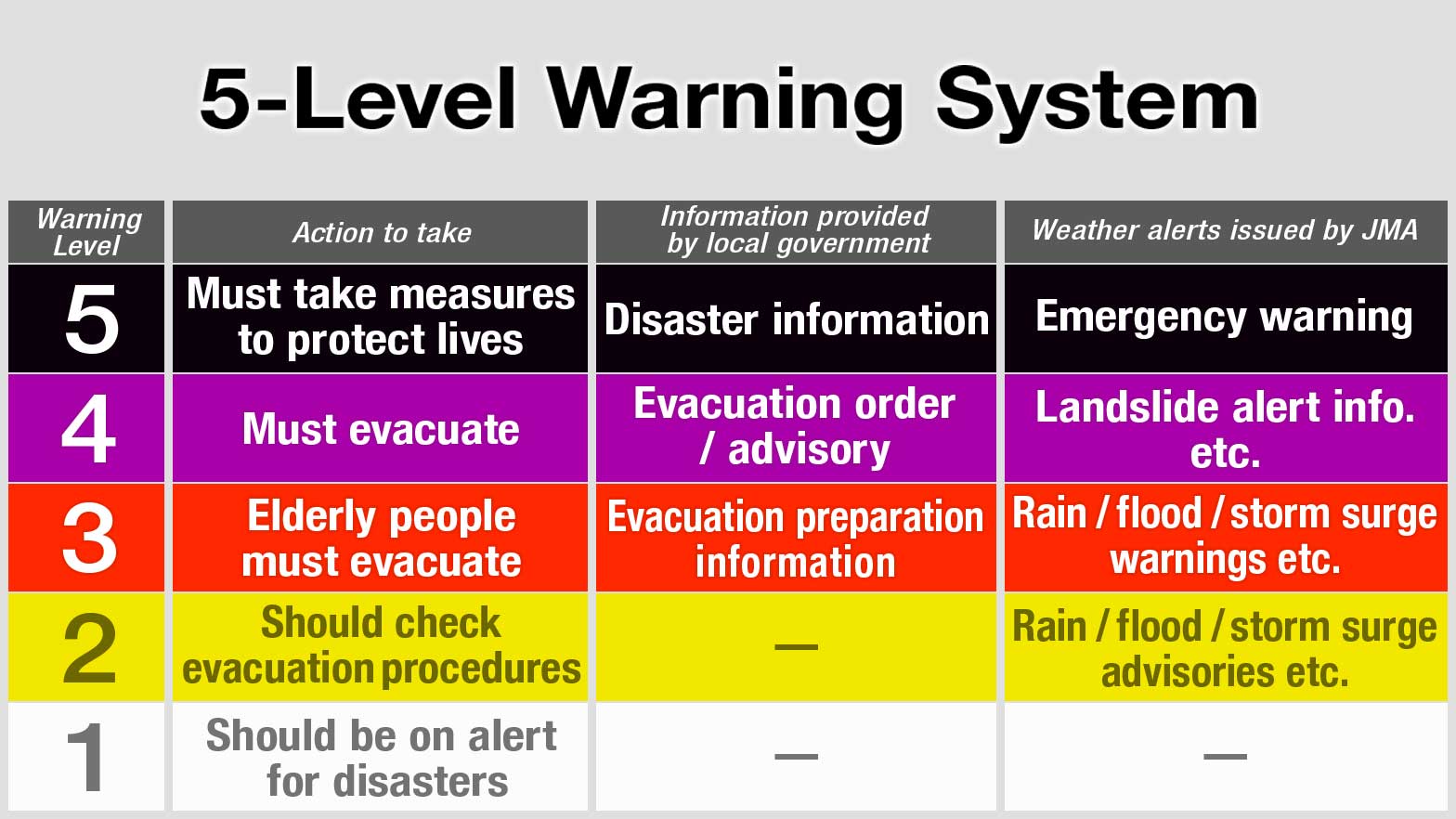

Understanding Flood Alerts Types Warnings And Response

May 25, 2025

Understanding Flood Alerts Types Warnings And Response

May 25, 2025