Are High Stock Market Valuations A Concern? BofA Says No.

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Red Flag

BofA argues that current high stock prices, while seemingly inflated, aren't necessarily a harbinger of an immediate market crash. Their rationale rests on several key pillars:

-

Low Interest Rates: BofA points to persistently low interest rates as a key factor supporting higher stock valuations. Lower borrowing costs make it cheaper for companies to invest and expand, leading to increased earnings and higher stock prices. This environment incentivizes investment in equities rather than bonds, pushing up stock prices.

-

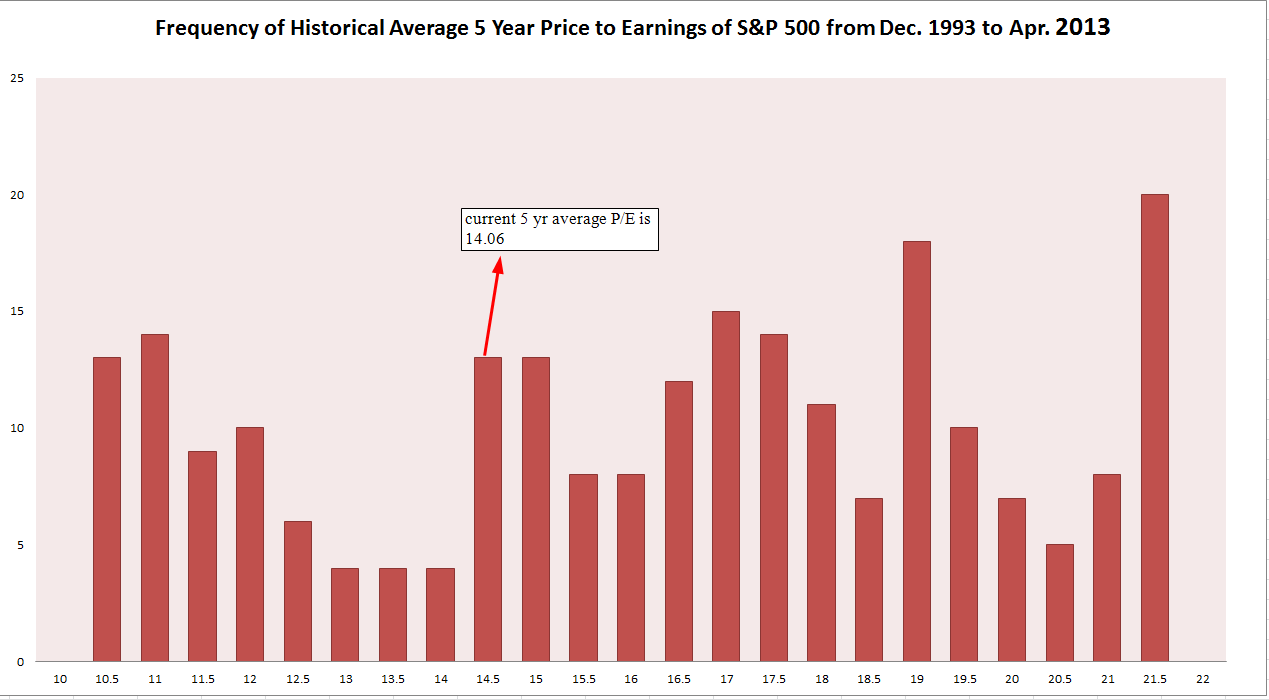

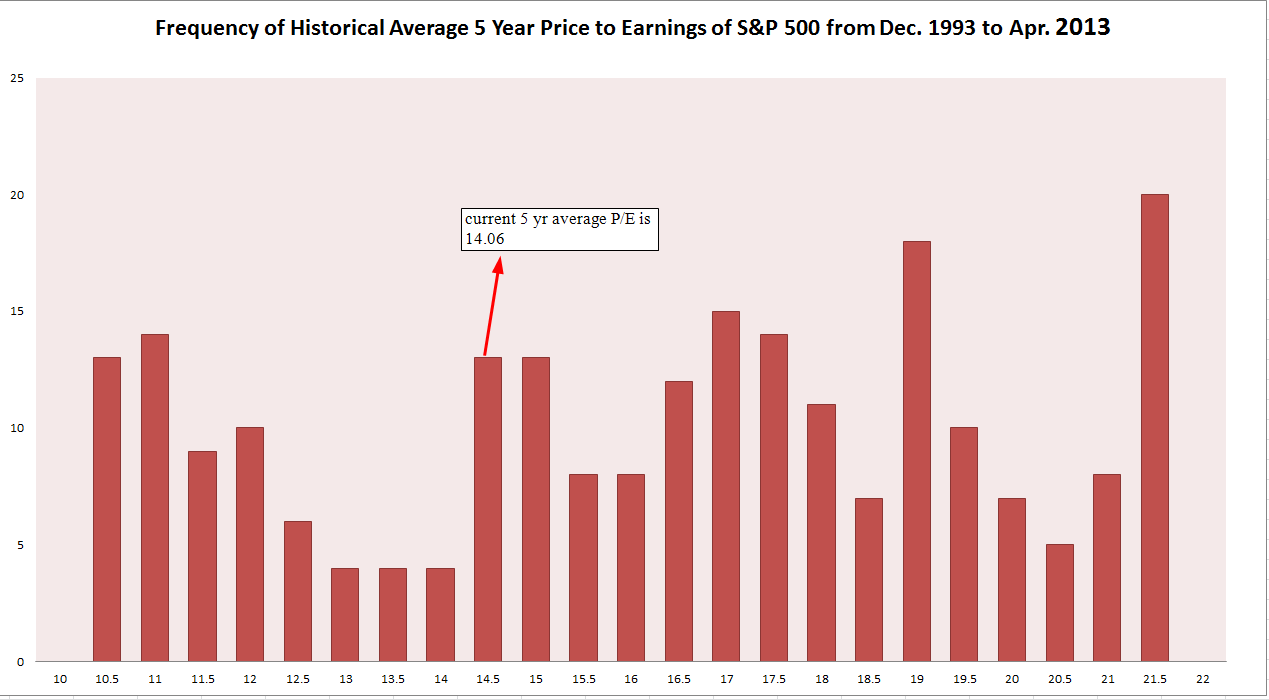

Strong Corporate Earnings Growth: Despite high valuations, many companies continue to demonstrate robust earnings growth. This suggests that the current stock prices are, at least partially, justified by underlying fundamental strength. BofA's analysis likely includes data comparing current P/E ratios (Price-to-Earnings ratios) with historical earnings growth to support this argument.

-

Technological Advancements Driving Innovation: Rapid technological advancements are driving innovation and productivity gains across various sectors. These innovations can lead to higher long-term growth potential, justifying higher valuations for companies positioned to benefit from these trends. Think of the sustained growth in tech stocks, for instance.

-

Long-Term Growth Potential: BofA likely projects continued long-term economic growth, suggesting that current high stock market valuations reflect future earnings potential rather than an unsustainable bubble. Their models probably incorporate projections of GDP growth, inflation, and other macroeconomic factors.

-

Data Support: BofA's reports likely contain specific data points and charts supporting these claims. For example, they might compare current valuation metrics to historical averages, demonstrating that while valuations are high, they are not unprecedented. Looking at specific sectors and their growth trajectories compared to their stock prices would further strengthen their arguments.

Counterarguments and Potential Risks: Addressing the Skeptics

While BofA presents a compelling case, it's crucial to acknowledge potential counterarguments and risks:

-

Potential for a Market Bubble: The persistent rise in stock prices could indicate a speculative bubble, where prices are detached from fundamentals. A sudden correction could lead to significant losses for investors.

-

Vulnerability to Rising Interest Rates: A shift towards higher interest rates could negatively impact stock valuations. Increased borrowing costs could dampen corporate earnings growth and reduce investor appetite for equities.

-

Geopolitical Risks: Geopolitical events, such as trade wars or international conflicts, could create market volatility and negatively impact stock prices regardless of underlying valuations.

-

Overvaluation in Specific Sectors: While overall valuations might be supported by long-term growth prospects, specific sectors could be overvalued. Careful sector-specific analysis is crucial for informed investment decisions.

-

Historical Comparisons: Comparing current market conditions to past market cycles, particularly those that ended in corrections or crashes, is vital. Identifying similarities and differences can help assess the potential for a future market downturn.

Analyzing BofA's Methodology and Data Sources

Understanding BofA's methodology is crucial to evaluating their conclusions. Their analysis likely involves:

-

Key Economic Indicators: BofA likely uses various economic indicators, including GDP growth, inflation rates, interest rates, and corporate earnings data, to support their assessment.

-

Data Sources: Identifying the specific data sources used (e.g., government statistics, company filings, proprietary data) helps assess the reliability and potential biases in their analysis.

-

Reliability and Potential Biases: It’s important to consider potential biases in BofA's analysis. As a major financial institution, their perspective might be influenced by their own interests and investments. Independent verification of their data and conclusions is advisable.

Limitations of BofA's analysis might include reliance on predictive models which are inherently uncertain and the inability to perfectly foresee unexpected events that could significantly impact market valuations.

What Investors Should Consider: Navigating High Valuations

Despite BofA's optimistic view, investors should remain cautious and take a strategic approach:

-

Diversification: Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate) and sectors reduces risk and helps mitigate potential losses.

-

Long-Term Investment Horizons: Investing with a long-term perspective can help weather short-term market fluctuations. Focusing on long-term growth potential reduces the impact of short-term volatility.

-

Risk Tolerance Assessment: Understanding your own risk tolerance is paramount. Investors with a lower risk tolerance might choose more conservative investment strategies.

-

Sector-Specific Analysis: Conducting thorough research and analysis of specific sectors can help identify undervalued opportunities and avoid overvalued assets.

-

Due Diligence: Thorough due diligence, including independent research and analysis, is crucial before making any investment decisions.

High Stock Market Valuations: BofA's Perspective and Your Next Steps

BofA's argument against the immediate threat of high stock market valuations rests on low interest rates, strong corporate earnings, technological innovation, and long-term growth potential. However, potential risks, including the possibility of a market bubble, vulnerability to rising interest rates, and geopolitical uncertainties, must be considered. A balanced approach acknowledges both sides of the debate.

Don't let uncertainty about high stock market valuations paralyze you. Take control of your financial future by conducting thorough research, assessing your risk tolerance, and developing a robust investment strategy that aligns with your individual circumstances and goals. Careful market analysis and a well-defined investment strategy are key to navigating the complexities of high stock market valuations.

Featured Posts

-

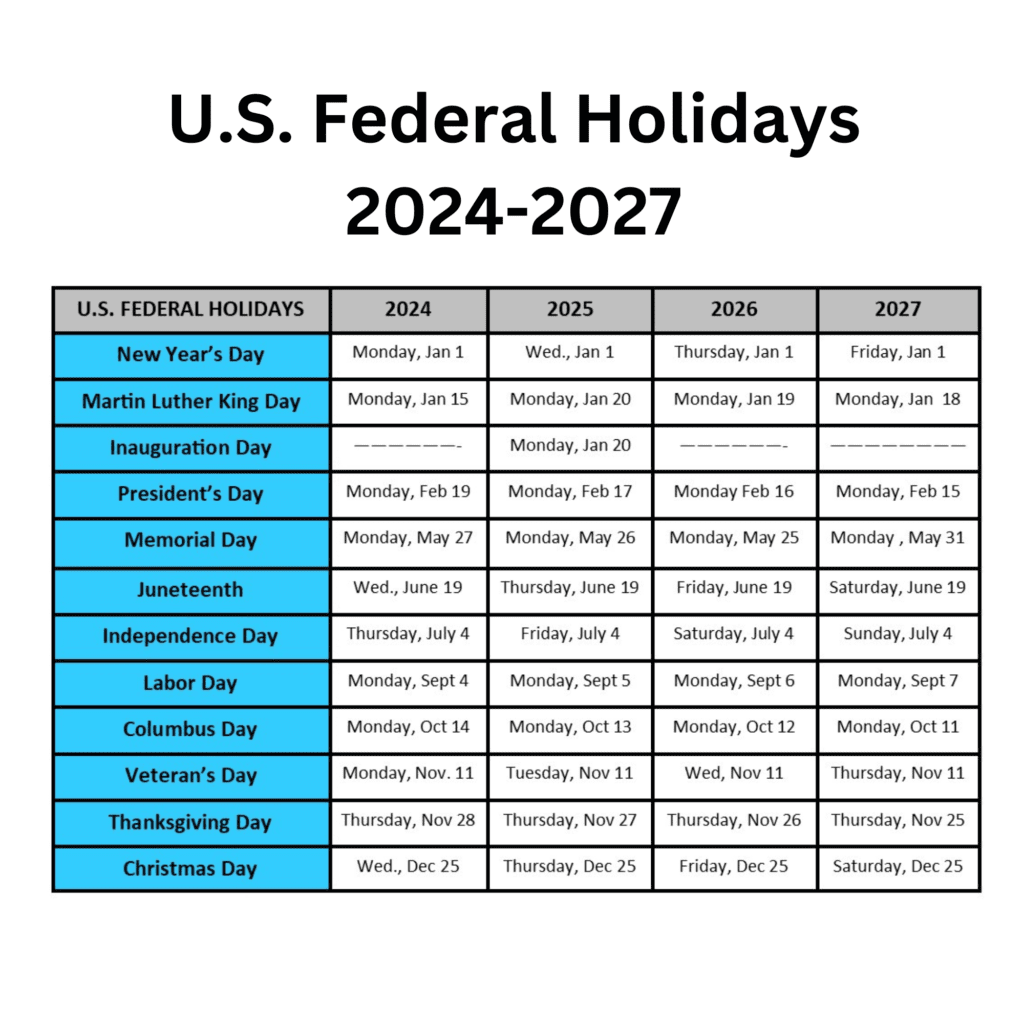

2025 Us Holiday Dates Comprehensive List Of Federal And Non Federal Holidays

Apr 23, 2025

2025 Us Holiday Dates Comprehensive List Of Federal And Non Federal Holidays

Apr 23, 2025 -

Open Ai Facing Ftc Probe Analysis Of Potential Regulatory Actions

Apr 23, 2025

Open Ai Facing Ftc Probe Analysis Of Potential Regulatory Actions

Apr 23, 2025 -

Artfae Aw Ankhfad Ser Aldhhb Balsaght Alywm

Apr 23, 2025

Artfae Aw Ankhfad Ser Aldhhb Balsaght Alywm

Apr 23, 2025 -

Bu Aksamki Diziler 17 Subat Pazartesi

Apr 23, 2025

Bu Aksamki Diziler 17 Subat Pazartesi

Apr 23, 2025 -

Bfm Bourse 15h 16h 17 02 Revue De La Journee

Apr 23, 2025

Bfm Bourse 15h 16h 17 02 Revue De La Journee

Apr 23, 2025

Latest Posts

-

Wednesday March 12 Nyt Strands Solutions Game 374

May 10, 2025

Wednesday March 12 Nyt Strands Solutions Game 374

May 10, 2025 -

Nyt Crossword Strands April 6th 2025 Hints And Answers

May 10, 2025

Nyt Crossword Strands April 6th 2025 Hints And Answers

May 10, 2025 -

Nyt Strands Game 374 Hints And Solutions For Wednesday March 12

May 10, 2025

Nyt Strands Game 374 Hints And Solutions For Wednesday March 12

May 10, 2025 -

Nyt Strands Puzzle Solutions Saturday February 15th Game 349

May 10, 2025

Nyt Strands Puzzle Solutions Saturday February 15th Game 349

May 10, 2025 -

February 15th Nyt Strands Answers Game 349

May 10, 2025

February 15th Nyt Strands Answers Game 349

May 10, 2025