Are High Stock Market Valuations A Problem? BofA's Take

Table of Contents

High stock market valuations are a recurring concern for investors. Are they a problem this time around? This article examines Bank of America's (BofA) assessment of the current situation, exploring whether these elevated valuations present a significant problem and what investors should consider. We'll delve into BofA's analysis, considering factors like interest rates, economic growth, and corporate earnings to understand the implications for your investment strategy.

BofA's Stance on Current Market Valuations

BofA's stance on current stock market valuations is often nuanced and evolves with changing economic conditions. While they haven't issued a blanket "bullish," "bearish," or "neutral" statement, their recent reports reflect a cautious optimism. Their analyses typically involve a careful weighing of potential risks and rewards associated with prevailing market conditions.

- Reports and Analyses: BofA's Global Research team publishes frequent reports on market valuations, often referencing key economic indicators and historical data. These reports, available to clients and often summarized in the financial press, provide detailed insights into their assessment.

- Key Metrics: BofA utilizes several key metrics to gauge market valuation, including the Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (CAPE or Shiller PE), and various sector-specific valuation ratios. They scrutinize these metrics to identify potential overvaluations or undervaluations in different market segments.

- Valuation Thresholds: BofA doesn't explicitly define a single "problematic" valuation threshold. Instead, their analysis considers multiple factors, including the relationship between valuations and expected future earnings growth, interest rate levels, and overall economic conditions. High valuations become more concerning when coupled with other negative signals.

Factors Influencing BofA's Perspective

Several crucial factors influence BofA's perspective on high stock market valuations. Understanding these factors is key to interpreting their overall assessment.

Interest Rate Environment

- Impact on Valuations: Higher interest rates generally lead to lower stock valuations. This is because higher rates increase the discount rate used in calculating present value, making future earnings less attractive to investors. Conversely, lower rates can support higher valuations.

- BofA's Interest Rate Predictions: BofA's economists regularly predict future interest rate movements based on economic data and central bank policies. These predictions significantly influence their assessment of market valuations. Their forecasts affect investor expectations and thus market pricing.

- Impact on Profitability: Rising interest rates increase borrowing costs for companies, potentially impacting profitability and reducing future earnings expectations, which consequently affects valuations.

Economic Growth Projections

- Economic Forecasts: BofA publishes detailed forecasts for economic growth, considering factors like GDP growth, inflation, and unemployment. These forecasts are crucial for assessing the sustainability of current stock market valuations.

- Growth and Valuations: Strong economic growth typically supports higher stock valuations, as companies experience increased earnings. Conversely, weak economic growth or a recession can lead to lower valuations.

- Headwinds and Tailwinds: BofA's analysis considers potential headwinds (e.g., inflation, geopolitical risks, supply chain disruptions) and tailwinds (e.g., technological innovation, government stimulus) that could impact economic growth and market valuations.

Corporate Earnings and Profitability

- Earnings Analysis: BofA meticulously analyzes corporate earnings reports to assess the profitability of companies across different sectors. This analysis helps them understand the fundamental basis for current market valuations.

- Inflation and Supply Chain Issues: Inflation and supply chain disruptions significantly impact corporate earnings and profitability. BofA’s analysis takes these factors into account when evaluating valuations.

- Earnings Growth and Valuations: A disconnect between earnings growth and stock market valuations is a major cause for concern. High valuations unsupported by strong earnings growth indicate potential overvaluation.

Investment Strategies Based on BofA's Analysis

BofA's assessment doesn't directly dictate a specific investment strategy, but it informs potential approaches.

- Sector Rotation: Based on BofA's analysis of relative valuations across different sectors, investors might consider rotating out of overvalued sectors and into undervalued ones.

- Defensive Investing: In a high-valuation environment, many investors prefer defensive investing strategies focusing on lower-risk, dividend-paying stocks.

- Value Investing: BofA's valuation analysis can help identify potentially undervalued companies, which are the focus of value investing strategies.

- Risk Management: In a high-valuation market, risk management is crucial. This includes diversification, careful position sizing, and setting stop-loss orders.

Alternative Perspectives and Counterarguments

While BofA's analysis provides valuable insights, it's crucial to consider alternative perspectives.

- Differing Viewpoints: Other financial institutions may have different assessments of stock market valuations, based on varying methodologies and assumptions.

- Unconsidered Factors: BofA's analysis might not fully capture all relevant factors impacting market valuations. For example, technological advancements or unexpected geopolitical events could significantly influence market dynamics.

- Limitations of Analysis: Any single analysis, including BofA's, has limitations. It’s essential to consider multiple viewpoints and conduct your own research.

Conclusion

BofA's analysis of high stock market valuations suggests a cautious approach. While the bank doesn't necessarily declare high valuations as an immediate problem, their analysis emphasizes the importance of considering factors like interest rates, economic growth, and corporate earnings. High valuations, when combined with negative signals in other areas, present increased risk. Understanding whether high stock market valuations are a problem requires careful consideration of these factors. Stay informed about market trends and consult with a financial advisor to develop a strategy that aligns with your risk tolerance and investment goals in this environment of potentially high stock market valuations. Continue researching current valuations and seeking expert advice to navigate the complexities of the stock market and make informed investment decisions.

Featured Posts

-

Addressing Housing Affordability Is Gregor Robertson Right

May 25, 2025

Addressing Housing Affordability Is Gregor Robertson Right

May 25, 2025 -

2009 Brawn Gp Jenson Buttons Championship Winning Machine

May 25, 2025

2009 Brawn Gp Jenson Buttons Championship Winning Machine

May 25, 2025 -

Kazuo Ishiguro An Exploration Of Memory And Forgetting

May 25, 2025

Kazuo Ishiguro An Exploration Of Memory And Forgetting

May 25, 2025 -

Uitstel Trump Leidt Tot Herstel Op De Aex Alle Fondsen Winnen

May 25, 2025

Uitstel Trump Leidt Tot Herstel Op De Aex Alle Fondsen Winnen

May 25, 2025 -

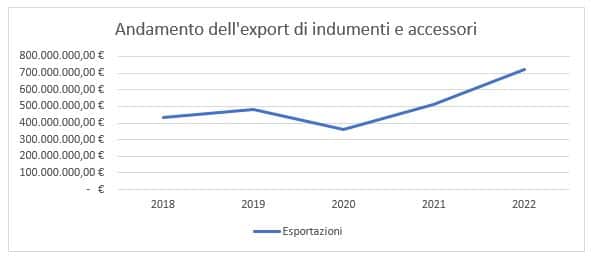

L Effetto Dei Dazi Sulle Importazioni Di Moda Negli Stati Uniti

May 25, 2025

L Effetto Dei Dazi Sulle Importazioni Di Moda Negli Stati Uniti

May 25, 2025