Assessing Climate Risk Before Applying For A Home Loan

Table of Contents

Understanding Your Property's Vulnerability to Climate Change

Before you even start browsing listings, it's vital to understand how climate change could affect your potential property. Different areas face different threats, and ignoring these vulnerabilities can lead to significant financial losses down the line. Key climate-related risks to consider include:

-

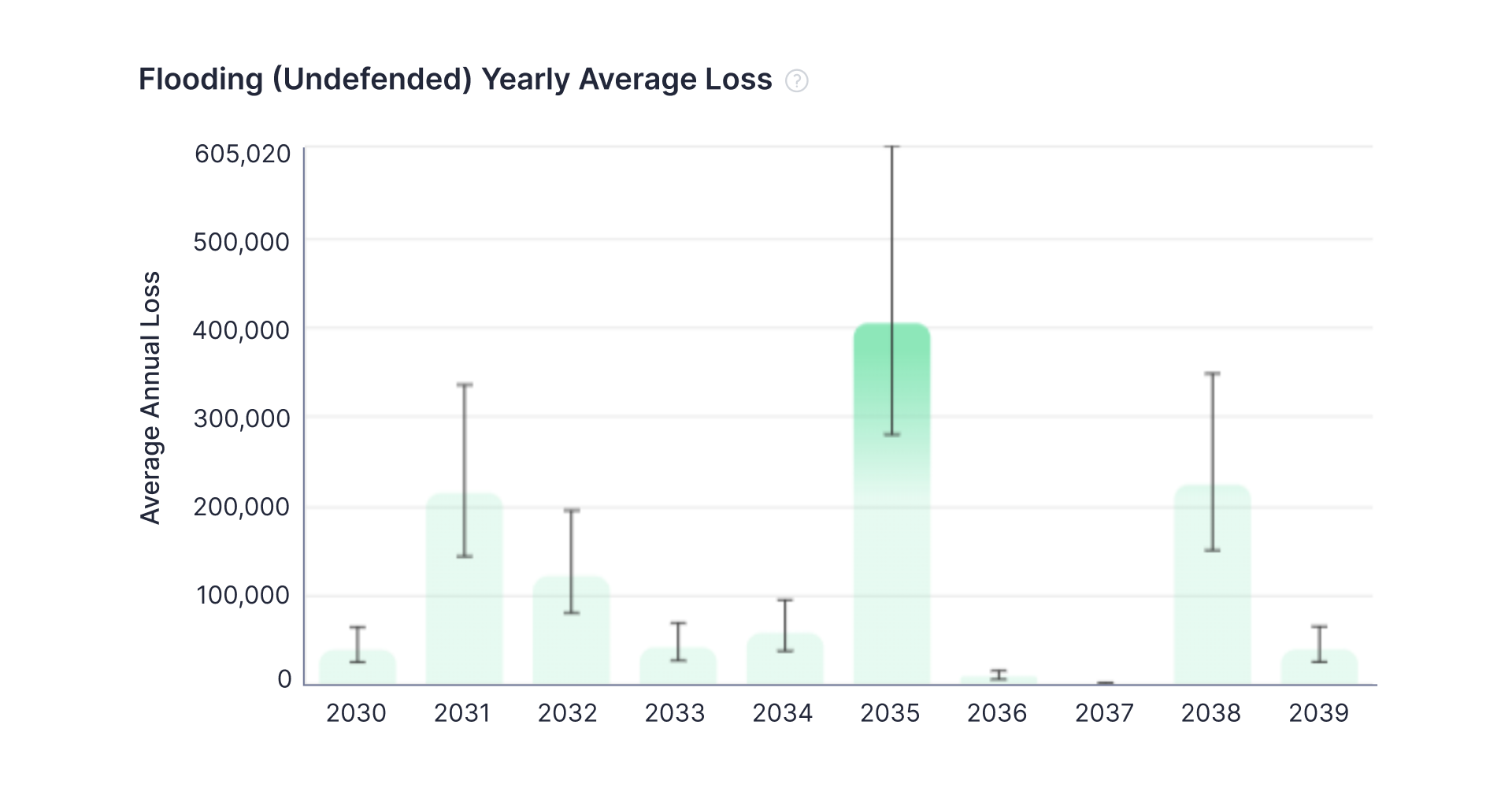

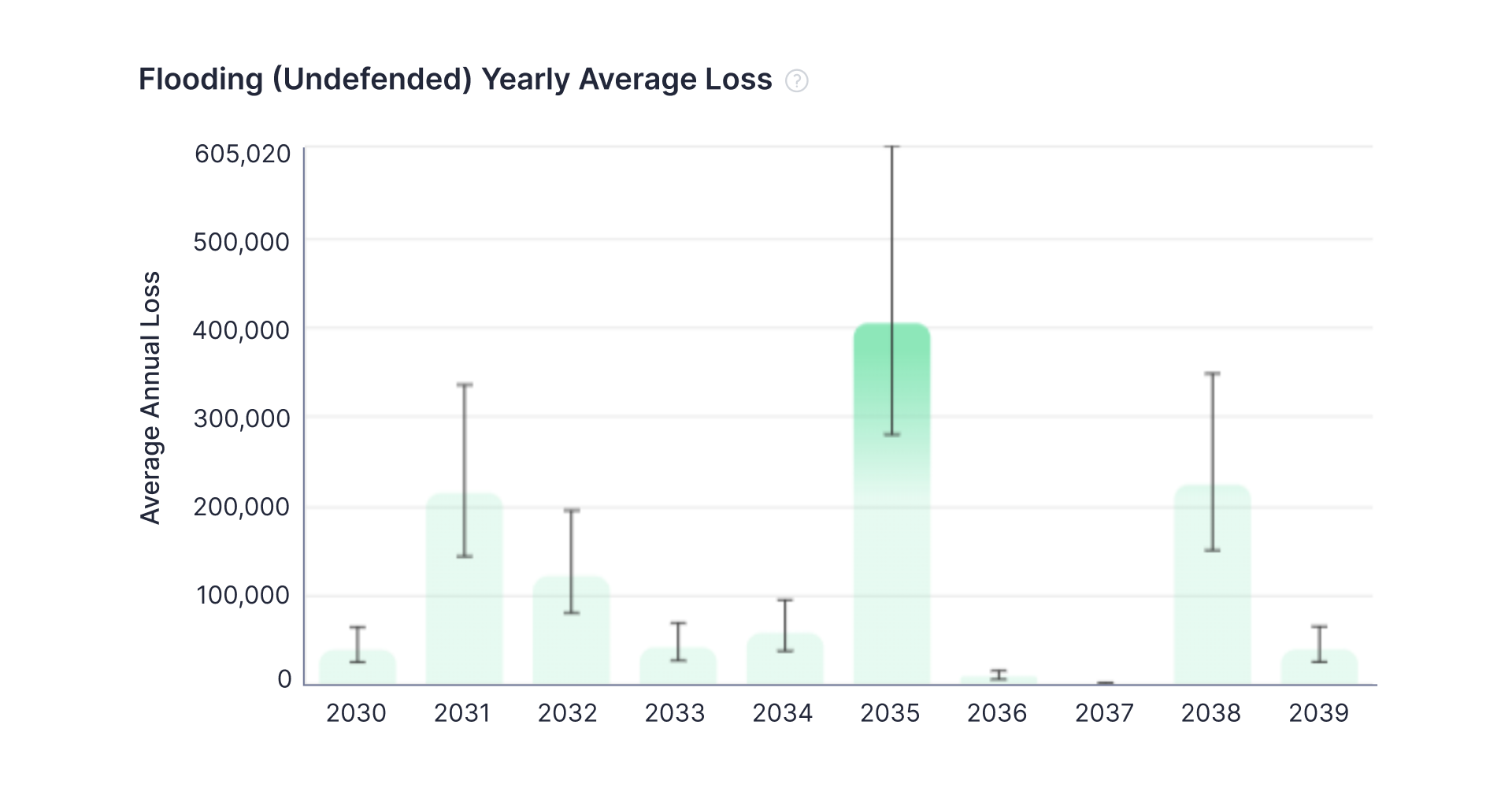

Flood risk: Rising sea levels and increased rainfall are making flooding a more prevalent threat. Utilize online resources like FEMA's flood maps ([link to FEMA flood maps]) to check the flood risk of any property you're considering. Consider the potential for both riverine flooding and coastal flooding, depending on the location. Look for historical flood data as well, going beyond just the current FEMA maps.

-

Wildfire risk: The increasing frequency and intensity of wildfires are devastating communities across the country. Research historical wildfire activity in the area using local fire department records or state forestry websites. Assess the property's proximity to flammable vegetation and its susceptibility to wildfire spread. Consider the building materials and landscaping of the property as well.

-

Drought risk: Prolonged periods of drought can lead to water restrictions, damage to landscaping, and even decreased property values. Check historical drought patterns for the region and consider the property's water source and irrigation system.

-

Extreme weather events: Increased frequency and intensity of extreme weather events like hurricanes, hailstorms, and tornadoes can cause significant damage to properties. Assess the property's resilience to these events, considering its construction and location. Look for historical data on extreme weather events in the area.

-

Sea-level rise: If you're considering a coastal property, understanding the projected sea-level rise in the area is paramount. Consult local and national reports on sea-level rise projections to estimate the potential impact on the property's value and habitability in the coming decades.

Researching Local Climate Change Initiatives and Regulations

Understanding local government regulations and initiatives related to climate change is just as crucial as assessing the property's inherent vulnerabilities. These regulations and initiatives can significantly impact your property's value and insurability. Consider:

-

Climate resilience plans: Many local governments are developing comprehensive plans to address climate change and improve community resilience. These plans often include details on infrastructure improvements, building codes, and other initiatives that might affect your property.

-

Building codes and zoning regulations: Check local building codes and zoning regulations for requirements related to climate resilience. These might include stricter standards for flood-proofing, fire resistance, or energy efficiency.

-

Local government initiatives: Inquire with your local government about any ongoing or planned projects that could affect the property, such as improvements to drainage systems, the creation of firebreaks, or the construction of seawalls.

The Impact of Climate Risk on Your Home Loan Application

Climate risk significantly impacts the home loan application process. Mortgage lenders are increasingly incorporating climate risk assessments into their underwriting procedures. This means that a property perceived as high-risk due to climate change might:

-

Face higher interest rates: Lenders might charge higher interest rates to compensate for the increased risk associated with climate-vulnerable properties.

-

Experience difficulties in loan approval: In some cases, lenders might outright reject loan applications for properties deemed too exposed to climate-related risks.

-

Result in lower appraisal values: Appraisers might lower the value of a property based on its exposure to climate risks, reducing the amount you can borrow.

-

Lead to higher insurance premiums: Insurers might charge significantly higher premiums for properties located in high-risk areas, adding to your overall housing costs.

Full disclosure to your lender about potential climate risks is essential. Don't hide information; being upfront will help avoid complications later in the process.

Protecting Your Investment: Mitigation and Adaptation Strategies

While understanding climate risks is crucial, proactive mitigation and adaptation strategies can significantly protect your investment. Consider these options:

-

Home improvements: Investing in home improvements to increase its resilience to climate risks can be a worthwhile investment. This could include flood-proofing measures, fire-resistant landscaping, or strengthening the structure to withstand extreme weather.

-

Insurance: Obtain comprehensive insurance coverage that specifically addresses climate-related risks. Explore flood insurance, wildfire insurance, and other specialized policies to protect your property from potential damages.

-

Preventative measures: Based on the specific climate risks identified, invest in preventative measures such as installing storm shutters, creating defensible space around your home to reduce wildfire risk, or implementing water conservation measures to mitigate drought impacts.

Conclusion

Assessing climate risk before applying for a home loan is no longer a luxury; it's a necessity. Understanding your property's vulnerability, researching local regulations, and being transparent with your lender are vital steps in securing a sound financial investment. Don't underestimate the importance of assessing climate risk before securing your home loan. Take proactive steps to understand and mitigate climate risks in your home-buying journey. Start your climate risk assessment today! Use resources like FEMA flood maps ([link to FEMA flood maps]) and your local government's climate change reports to begin your due diligence. Remember, a well-informed decision today can save you significant financial hardship tomorrow.

Featured Posts

-

Hamilton And Leclerc The Aftermath Of Ferraris Team Orders Decision

May 20, 2025

Hamilton And Leclerc The Aftermath Of Ferraris Team Orders Decision

May 20, 2025 -

Tampoy Apokalyptika Nea Stoixeia Gia Toys Fonoys

May 20, 2025

Tampoy Apokalyptika Nea Stoixeia Gia Toys Fonoys

May 20, 2025 -

Formula 1 Yeni Sezon Tarihler Sueruecueler Ve Beklentiler

May 20, 2025

Formula 1 Yeni Sezon Tarihler Sueruecueler Ve Beklentiler

May 20, 2025 -

Michael Schumacher Poznavanje Njegove Kceri Gina Marie

May 20, 2025

Michael Schumacher Poznavanje Njegove Kceri Gina Marie

May 20, 2025 -

Amorim Delivers Man Utds Game Changing Forward Signing

May 20, 2025

Amorim Delivers Man Utds Game Changing Forward Signing

May 20, 2025

Latest Posts

-

Finding The Perfect Breezy And Mild Climate For Your Next Vacation

May 20, 2025

Finding The Perfect Breezy And Mild Climate For Your Next Vacation

May 20, 2025 -

Minnesota Twins Baseball 10 Games On Kcrg Tv 9 This Season

May 20, 2025

Minnesota Twins Baseball 10 Games On Kcrg Tv 9 This Season

May 20, 2025 -

Kcrg Tv 9 To Air 10 Minnesota Twins Games

May 20, 2025

Kcrg Tv 9 To Air 10 Minnesota Twins Games

May 20, 2025 -

Understanding A Wintry Mix Of Precipitation

May 20, 2025

Understanding A Wintry Mix Of Precipitation

May 20, 2025 -

Wintry Mix Developing What To Expect

May 20, 2025

Wintry Mix Developing What To Expect

May 20, 2025