Assessing The Impact Of Trump's Trade Actions On US Financial Primacy

Table of Contents

The Tariffs and Their Ripple Effects on Global Trade and Finance

Trump's administration implemented sweeping tariffs, targeting various sectors and countries. Notable examples include the tariffs imposed on steel and aluminum imports, as well as the large-scale trade war with China. These actions, intended to protect American industries and jobs, had far-reaching consequences.

The immediate economic effects were significant. Consumers faced increased prices for goods affected by tariffs, disrupting established supply chains. These price increases, fueled by Trump's trade actions, reduced consumer purchasing power and hampered economic growth. Furthermore, retaliatory tariffs imposed by other countries negatively impacted US exports, creating a complex web of economic repercussions. The resulting uncertainty significantly impacted financial markets, leading to volatility and shifting investor sentiment. Currency exchange rates fluctuated wildly, further complicating the economic landscape.

- Increased costs for businesses relying on imported goods: Many businesses faced higher production costs, impacting profitability and competitiveness.

- Reduced consumer purchasing power due to higher prices: Inflationary pressures reduced disposable income and stifled consumer spending.

- Increased uncertainty for international investors: The unpredictable nature of Trump's trade policies created a climate of uncertainty, discouraging foreign investment.

- Negative impact on US exports due to retaliatory tariffs: Other countries responded with their own tariffs, hindering the competitiveness of US goods in international markets.

Impact on US-China Relations and Global Financial Stability

The trade war between the US and China, a defining feature of Trump's trade actions, significantly altered the global financial landscape. This escalation of tensions introduced considerable geopolitical risk and uncertainty, impacting investor confidence worldwide. The conflict damaged international cooperation on trade and finance, raising questions about the effectiveness of multilateral institutions like the World Trade Organization (WTO).

- Increased geopolitical risk and uncertainty: The unpredictable nature of the trade war created a volatile environment for international investment and trade.

- Damage to international cooperation on trade and finance: The trade war undermined the principles of multilateralism and cooperation that underpin the global trading system.

- Potential for further fragmentation of global markets: The trade war contributed to a trend towards regionalization and protectionism, potentially leading to a more fragmented global economy.

- Shifting global trade dynamics away from traditional partners: The trade war prompted some countries to diversify their trade relationships, reducing reliance on the US and China.

Long-Term Implications for US Financial Primacy

Assessing the long-term impact of Trump's trade actions on US financial primacy is complex. While some argue that the policies aimed to strengthen domestic industries, the overall effect appears to have been detrimental. The increased uncertainty and volatility likely decreased investor confidence in the stability of the US economy, potentially leading to capital flight to other financial centers like Shanghai or London.

- Decreased investor confidence in the stability of the US economy: The unpredictable trade policies created uncertainty and discouraged long-term investment.

- Potential for capital flight to other financial markets: Investors may seek safer and more stable markets in response to increased economic uncertainty.

- Long-term impact on US economic growth and competitiveness: The disruptions caused by the trade war could hinder US economic growth and competitiveness in the long term.

- Shift in global financial power dynamics: The trade war might have accelerated the shift in global financial power away from the US towards other emerging economies.

Alternative Perspectives and Policy Recommendations

Differing viewpoints exist on the effectiveness of Trump's trade policies. Some argue that protectionist measures were necessary to protect American industries, while others criticize the approach for its negative impact on global trade and economic stability. Moving forward, a more nuanced and strategic approach to trade negotiations is essential. This should involve strengthening domestic industries while simultaneously promoting free and fair trade, fostering a stable global financial system through robust international cooperation.

- The need for a more nuanced and strategic approach to trade negotiations: Future trade policies should be based on careful analysis and consideration of potential consequences.

- Importance of strengthening domestic industries while promoting free trade: Policies should aim to improve the competitiveness of US industries without resorting to protectionist measures that harm global trade.

- The role of international cooperation in fostering a stable global financial system: Multilateralism and cooperation are essential for managing trade disputes and ensuring a stable global financial system.

Conclusion: Summarizing the Impact of Trump's Trade Actions on US Financial Primacy

Trump's trade actions had a profound and multifaceted impact on US financial primacy. While some argued that protectionist measures were necessary to defend American industries, the resulting trade wars and increased global economic uncertainty likely damaged investor confidence and hampered economic growth. The long-term effects remain a subject of ongoing debate, but the potential for a shift in global financial power dynamics is undeniable. Further research and discussion on the long-term ramifications of Trump's trade actions are crucial for understanding their continuing influence on global finance. To deepen your understanding of this complex issue, explore resources from the World Trade Organization, the International Monetary Fund, and reputable economic research institutions to further analyze the lasting impact of Trump's trade actions and their implications for the future of global finance.

Featured Posts

-

Pope Francis Dead At 88 Following Pneumonia Battle

Apr 22, 2025

Pope Francis Dead At 88 Following Pneumonia Battle

Apr 22, 2025 -

Hegseth Under Fire Pentagon Chaos Claims And Signal Chat Controversy

Apr 22, 2025

Hegseth Under Fire Pentagon Chaos Claims And Signal Chat Controversy

Apr 22, 2025 -

Russias Aerial Assault On Ukraine Us Peace Plan Amidst Deadly Barrage

Apr 22, 2025

Russias Aerial Assault On Ukraine Us Peace Plan Amidst Deadly Barrage

Apr 22, 2025 -

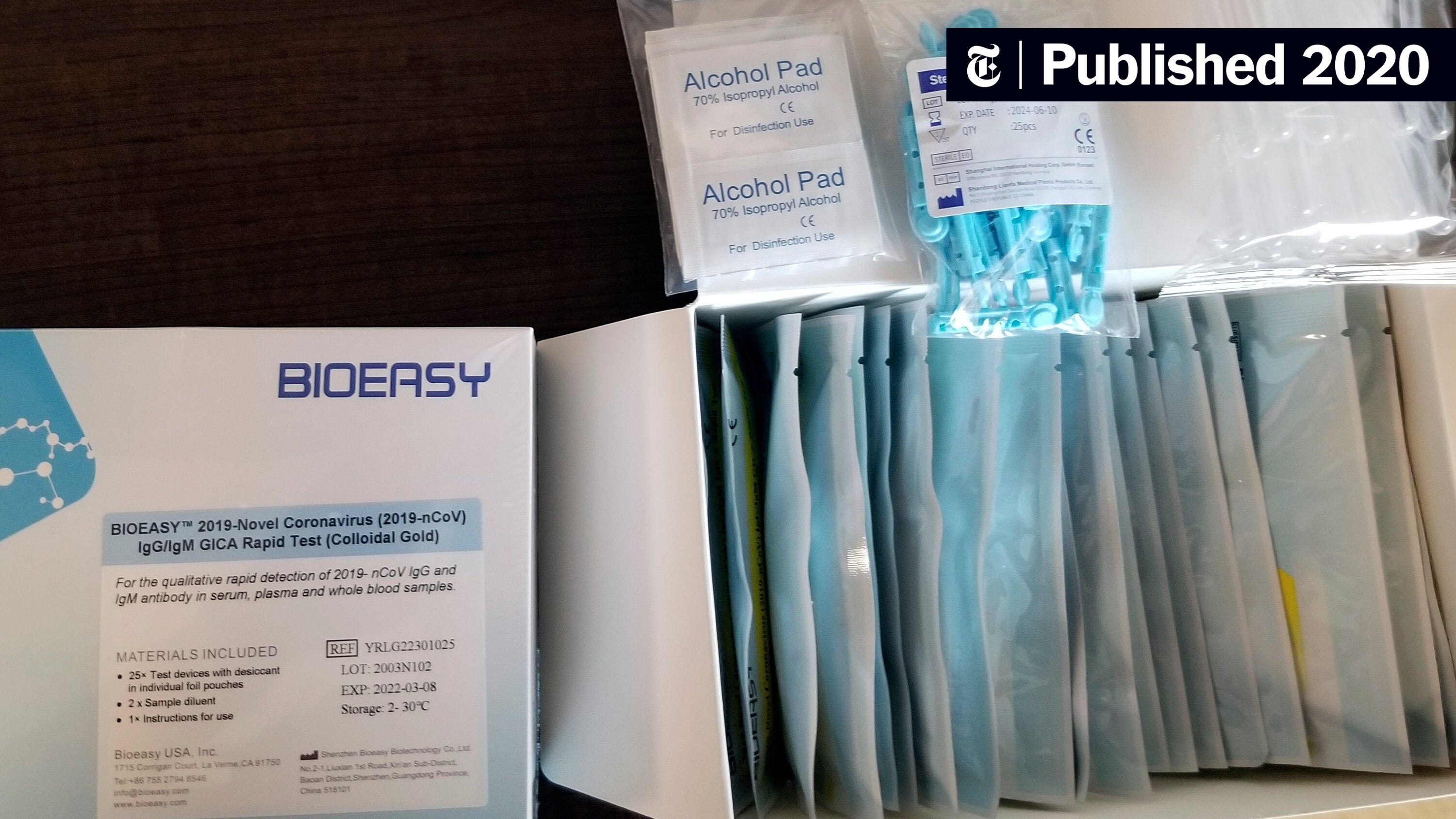

Lab Owner Admits Guilt In Covid 19 Test Result Fraud

Apr 22, 2025

Lab Owner Admits Guilt In Covid 19 Test Result Fraud

Apr 22, 2025 -

Pentagon Chaos And Signal Chat Controversy Examining The Hegseth Allegations

Apr 22, 2025

Pentagon Chaos And Signal Chat Controversy Examining The Hegseth Allegations

Apr 22, 2025