Assessing The Investment Potential Of Uber (UBER) Stock

Table of Contents

Uber's Financial Performance and Growth Trajectory

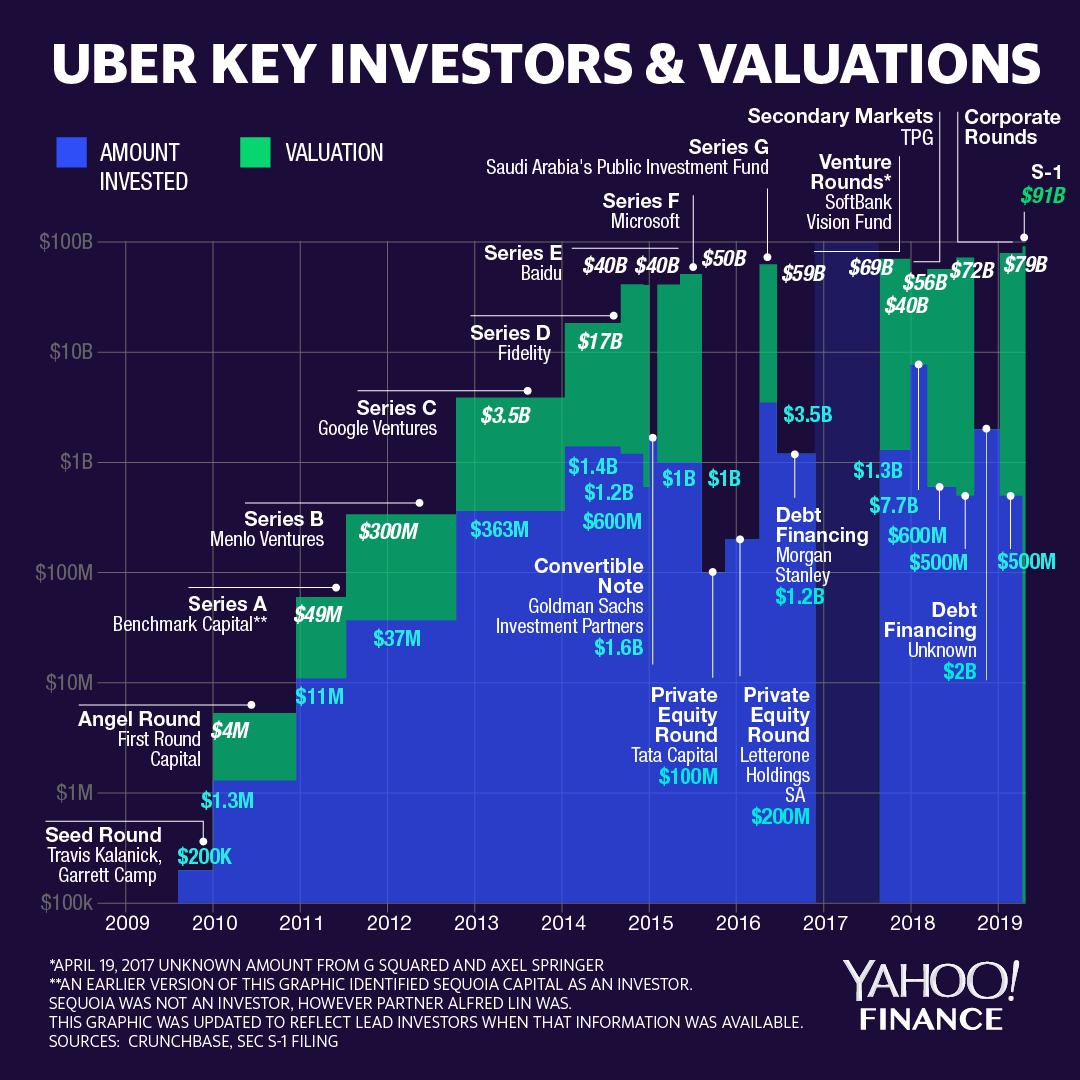

Analyzing Uber's financial health is crucial for assessing its investment potential. We need to look beyond headline numbers to understand the underlying trends and drivers of its performance. Uber's revenue growth has been substantial, fueled by its diverse business segments: ride-sharing, Uber Eats (food delivery), freight transportation, and others. However, profitability remains a key focus for the company.

- Historical Revenue Growth Rate: Uber has demonstrated impressive revenue growth over the years, though the rate has fluctuated with economic conditions and the intensity of competition.

- Profitability Trends: While Uber has shown progress toward profitability, achieving consistent net income has been a challenge, particularly given significant operating expenses. Analyzing EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) offers a clearer picture of operational profitability.

- Key Financial Ratios: Examining metrics such as the Price-to-Earnings ratio (P/E), Debt-to-Equity ratio, and others, provides insights into Uber's valuation and financial risk profile compared to its peers like Lyft and Didi. These ratios need to be considered in context with the company's stage of growth.

- Comparison to Competitors: Benchmarking Uber's financial performance against competitors like Lyft and Didi is vital to assess its relative strength and market positioning. This comparative analysis reveals areas of superior performance and potential vulnerabilities.

Market Position and Competitive Landscape

Uber's market share across its diverse segments is a critical indicator of its long-term viability. The ride-sharing market, while still dominant for Uber, faces increasing competition from both established players and new entrants. Uber Eats competes in a fiercely competitive food delivery market, battling giants like DoorDash and Grubhub.

- Global Market Presence and Penetration: Uber's global reach is a significant advantage, offering diversification and growth opportunities in various markets. However, market penetration varies considerably across different regions.

- Market Share in Key Regions: Analyzing Uber's market share in key regions allows us to understand its competitive dominance and potential for future growth within specific geographic areas. Variations in market share reflect differing levels of competition and regulatory environments.

- Competitive Analysis of Key Rivals: Assessing the strengths and weaknesses of key competitors, such as Lyft, Didi, and regional players, allows for a more nuanced understanding of Uber's competitive positioning and its ability to maintain or expand market share.

- Analysis of Uber's Competitive Advantages and Disadvantages: Uber’s brand recognition, technological infrastructure, and network effects provide strong competitive advantages. However, challenges remain in areas such as driver relations, regulatory hurdles, and intense competition in its diverse segments.

Future Growth Opportunities and Challenges

Uber's future growth hinges on its ability to capitalize on emerging opportunities while mitigating significant challenges. Autonomous vehicle technology presents a potential game-changer, though its deployment faces considerable hurdles. Expanding into new markets and offering innovative services are crucial for sustained growth.

- Potential for Expansion into New Geographic Markets: Untapped markets globally represent significant growth potential for Uber, although navigating varying regulatory landscapes and cultural nuances poses challenges.

- Growth Potential in Autonomous Vehicle Technology: Autonomous vehicles could drastically reduce operational costs and improve efficiency, but the technology is still in its early stages of development and faces regulatory and safety concerns.

- Opportunities in the Emerging Markets for Last-Mile Delivery: The growing demand for last-mile delivery services presents a considerable opportunity for Uber, though competition is intense and profit margins may be thin.

- Risks Associated with Regulatory Changes and Driver Labor Issues: Regulatory changes and labor disputes present ongoing risks to Uber's operations, profitability, and overall business model.

Valuation and Investment Risks

Evaluating Uber's current valuation requires a thorough examination of its financial performance, growth prospects, and the inherent risks associated with investing in the company's stock. The volatility of the stock market, competitive pressures, and regulatory uncertainties make UBER stock a relatively high-risk investment.

- Current Stock Price and Market Capitalization: Understanding the current stock price and market capitalization provides a benchmark for evaluating its valuation relative to its peers and its historical performance.

- Price-to-Sales Ratio and Other Valuation Metrics: Using various valuation metrics, such as the Price-to-Sales ratio, helps determine whether the stock is overvalued or undervalued compared to its fundamentals and future growth potential.

- Assessment of Potential Upside and Downside Scenarios: Analyzing potential scenarios—best-case, worst-case, and most likely—offers insights into the range of possible outcomes for the investment.

- Identification of Key Risk Factors Affecting UBER Stock: Identifying and assessing key risks—intense competition, regulatory hurdles, economic downturns, and changes in consumer preferences—is essential for making informed investment decisions.

Conclusion: Making Informed Decisions on Uber (UBER) Stock

Investing in Uber (UBER) stock presents both exciting opportunities and considerable risks. While Uber has demonstrated strong revenue growth and a leading market position in several segments, profitability and competition remain significant concerns. Thorough due diligence, including a careful analysis of its financial performance, competitive landscape, future prospects, and inherent risks, is crucial before investing. Understanding the complexities of the UBER stock investment potential is paramount. Further research, including reviewing financial statements and industry analyses, will enhance your ability to make informed investment decisions. Remember, this article is for informational purposes only and is not financial advice. Conduct your own research and consult with a financial advisor before making any investment decisions regarding UBER stock or any other security.

Featured Posts

-

Witness Trumps Humiliation A Defining Moment On The Lawrence O Donnell Show

May 17, 2025

Witness Trumps Humiliation A Defining Moment On The Lawrence O Donnell Show

May 17, 2025 -

All The Moto News You Need Gncc Mx Sx Flat Track And Enduro

May 17, 2025

All The Moto News You Need Gncc Mx Sx Flat Track And Enduro

May 17, 2025 -

Todays Network18 Media And Investments Share Price April 21 2025 Nse Bse And Expert Forecasts

May 17, 2025

Todays Network18 Media And Investments Share Price April 21 2025 Nse Bse And Expert Forecasts

May 17, 2025 -

Student Loan Payment Problems Repairing Your Credit

May 17, 2025

Student Loan Payment Problems Repairing Your Credit

May 17, 2025 -

Negative Response To Fortnites New Backward Music Feature

May 17, 2025

Negative Response To Fortnites New Backward Music Feature

May 17, 2025

Latest Posts

-

Valerio Therapeutics Update On 2024 Financial Statement Approval

May 17, 2025

Valerio Therapeutics Update On 2024 Financial Statement Approval

May 17, 2025 -

Valerio Therapeutics S A Postponement Of 2024 Financial Report And Statement Approval

May 17, 2025

Valerio Therapeutics S A Postponement Of 2024 Financial Report And Statement Approval

May 17, 2025 -

Analyzing The Knicks Near Miss In Overtime

May 17, 2025

Analyzing The Knicks Near Miss In Overtime

May 17, 2025 -

The Knicks Nail Biting Overtime Loss A Look Back

May 17, 2025

The Knicks Nail Biting Overtime Loss A Look Back

May 17, 2025 -

Solid Earnings Boost Rockwell Automation And Peers Fuel Wednesdays Market Rise

May 17, 2025

Solid Earnings Boost Rockwell Automation And Peers Fuel Wednesdays Market Rise

May 17, 2025