AT&T On Broadcom's VMware Acquisition: A 1,050% Price Increase

Table of Contents

Understanding the VMware Acquisition and its Impact

Broadcom's acquisition of VMware represents a monumental shift in the enterprise software and networking landscapes. Understanding its implications is crucial for businesses of all sizes.

Broadcom's Acquisition Strategy

Broadcom, known for its prowess in semiconductors, has been steadily expanding its footprint in the software sector through strategic acquisitions. The VMware acquisition is a prime example of this aggressive growth strategy, aiming for significant market consolidation and increased control over crucial enterprise technologies.

- Semiconductor to Software Giant: Broadcom's history demonstrates a clear shift from a focus on hardware to a broader portfolio encompassing software and infrastructure.

- Market Dominance: This acquisition significantly increases Broadcom's market share, potentially leading to a more dominant position in the enterprise software and networking sectors.

- Synergies and Integration: The potential for integrating VMware's virtualization technologies with Broadcom's existing portfolio presents significant opportunities for cost-saving and enhanced product offerings, though this remains to be seen.

VMware's Role in the Enterprise Landscape

VMware is a cornerstone of modern enterprise IT infrastructure. Its virtualization technologies are integral to countless data centers and cloud deployments worldwide. The acquisition raises concerns about the future of this critical technology.

- Virtualization Leader: VMware's vSphere, vSAN, and NSX products are industry-standard virtualization solutions powering many businesses' IT operations.

- Data Center and Cloud Infrastructure: VMware plays a central role in how businesses manage their data centers and cloud infrastructure, and any changes could have significant repercussions.

- Widespread Adoption: The sheer number of organizations relying on VMware makes this acquisition a game-changer for the entire technology ecosystem.

AT&T's Price Hike: A Case Study

AT&T's reported 1,050% price increase on certain services following the Broadcom-VMware deal is a striking example of the potential fallout. While the exact specifics might vary depending on the service and contract terms, the magnitude of the increase is undeniable.

The 1,050% Increase Explained

While AT&T hasn't publicly detailed the specific reasons for this dramatic increase across all affected services, it's likely linked to the increased costs associated with the VMware acquisition and the subsequent changes in the technology landscape. This increase directly impacts businesses relying on AT&T's networking services for their VMware environments.

- Affected Services: The precise services impacted by the price increase require further investigation, but it's likely to include networking, bandwidth, and potentially other services related to VMware's products.

- Magnitude of the Increases: The 1,050% figure represents an average across potentially a range of different service offerings and pricing models. The actual increase experienced by individual clients may vary.

- Official Statements: AT&T's official communication regarding this price increase needs to be analyzed to understand their justification fully.

Implications for AT&T Customers

This price hike has profound implications for AT&T customers, forcing them to re-evaluate their budgets and IT strategies.

- Financial Burden: The substantial increase in networking costs represents a significant financial burden for businesses, potentially impacting profitability and growth.

- Business Operations: Disruptions to services and potential budget overruns can have cascading effects on various aspects of business operations.

- Alternatives: Businesses are now actively seeking alternative networking providers and exploring cloud solutions that reduce their reliance on VMware and potentially AT&T’s infrastructure.

Broader Market Implications of the Acquisition

The Broadcom-VMware acquisition has far-reaching consequences that extend beyond the immediate impact on AT&T customers.

Impact on Competition

The acquisition raises concerns about reduced competition and the potential for increased market dominance by Broadcom.

- Monopolies and Reduced Choices: The combined power of Broadcom and VMware could create a less competitive market, limiting choices for businesses and potentially leading to higher prices across the board.

- Antitrust Scrutiny: Regulatory bodies are likely to scrutinize this acquisition for potential antitrust violations, examining its impact on competition and consumer choice.

Long-Term Effects on Pricing and Innovation

The long-term consequences of this acquisition are still unfolding, but the potential for higher prices and reduced innovation is a real concern.

- Future Price Increases: This acquisition could set a precedent for future price increases across related services, affecting businesses dependent on this technology stack.

- Reduced Innovation: With less competition, the incentive to innovate may decrease, potentially leading to slower technological advancements and fewer options for customers.

Conclusion

Broadcom's acquisition of VMware and the subsequent reported 1,050% price increase by AT&T underscore a significant shift in the enterprise technology landscape. This event carries substantial implications for businesses, requiring careful consideration of budgeting, strategic planning, and potential alternatives. The potential for reduced competition and future price increases cannot be ignored.

Learn more about mitigating the impact of the AT&T price increase. Explore alternative VMware solutions and analyze your networking costs in response to the Broadcom acquisition. Proactive planning is crucial for navigating this evolving situation and ensuring the long-term health and stability of your business's IT infrastructure.

Featured Posts

-

Vietnam Man Arrested After Breaking Throne Armrest

May 27, 2025

Vietnam Man Arrested After Breaking Throne Armrest

May 27, 2025 -

Global Travel Slowdown Redeem Your Loyalty Points Now

May 27, 2025

Global Travel Slowdown Redeem Your Loyalty Points Now

May 27, 2025 -

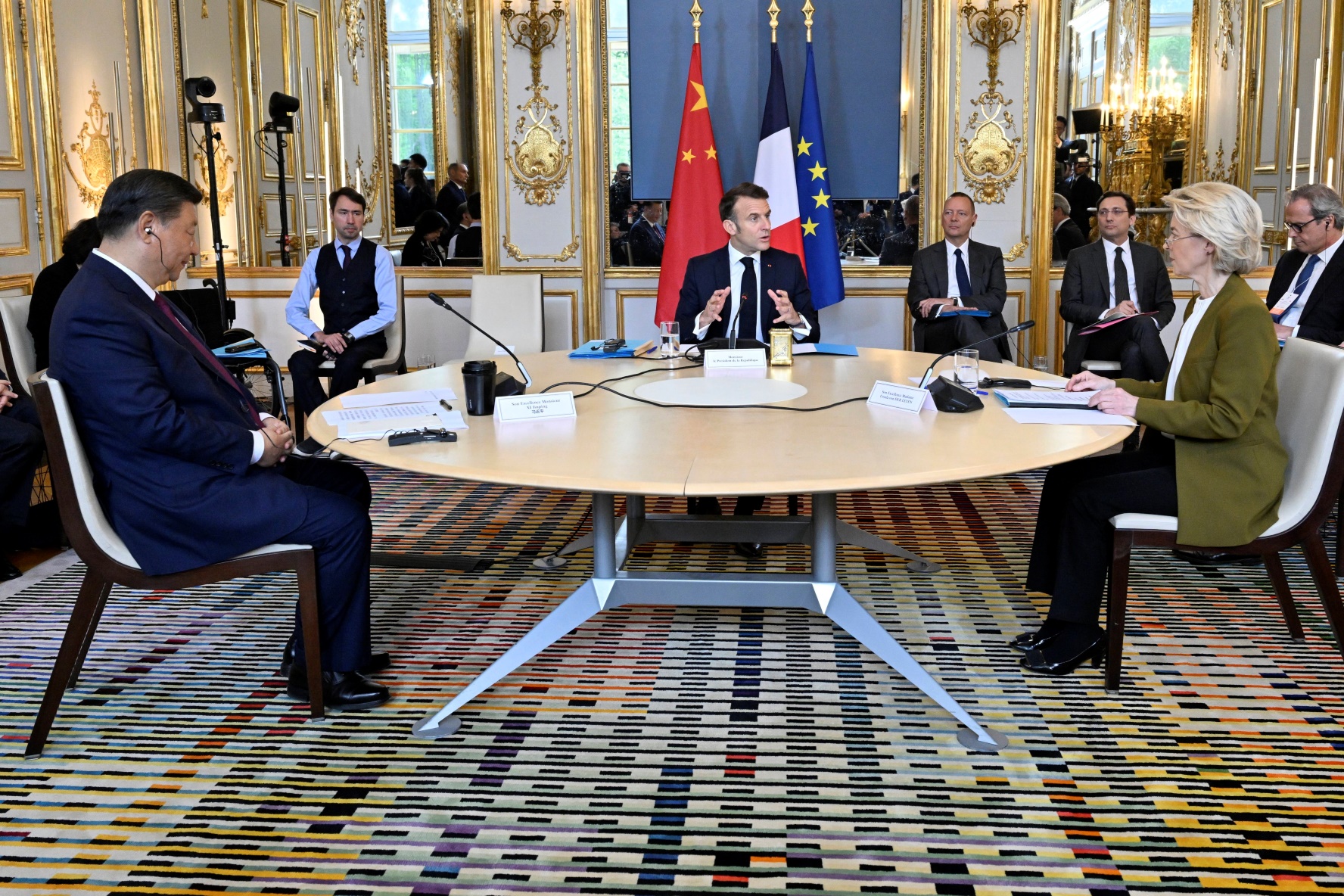

Navigating Us Tariffs And Chinas Growing Influence In The Asia Pacific Region

May 27, 2025

Navigating Us Tariffs And Chinas Growing Influence In The Asia Pacific Region

May 27, 2025 -

Trump Extends Eu Tariff Deadline To July 9th

May 27, 2025

Trump Extends Eu Tariff Deadline To July 9th

May 27, 2025 -

Osimhens Potential Move To Galatasaray A Turkish Pundits Perspective

May 27, 2025

Osimhens Potential Move To Galatasaray A Turkish Pundits Perspective

May 27, 2025

Latest Posts

-

Kunst Vintage And Mehr Entdecken Sie Den Markt Auf Dem Coty Gelaende In Koeln Bickendorf

May 29, 2025

Kunst Vintage And Mehr Entdecken Sie Den Markt Auf Dem Coty Gelaende In Koeln Bickendorf

May 29, 2025 -

Flohmarkt And Kunstmarkt Koeln Bickendorf Das Coty Gelaende Erwacht

May 29, 2025

Flohmarkt And Kunstmarkt Koeln Bickendorf Das Coty Gelaende Erwacht

May 29, 2025 -

Koelner Bickendorf Kunst Und Vintage Auf Dem Ehemaligen Coty Gelaende

May 29, 2025

Koelner Bickendorf Kunst Und Vintage Auf Dem Ehemaligen Coty Gelaende

May 29, 2025 -

C O Pop Festival In Koeln Der Ultimative Festivalguide

May 29, 2025

C O Pop Festival In Koeln Der Ultimative Festivalguide

May 29, 2025 -

Fuenf Tage Musik Das Erwartet Sie Beim C O Pop Festival In Koeln

May 29, 2025

Fuenf Tage Musik Das Erwartet Sie Beim C O Pop Festival In Koeln

May 29, 2025