Bad Credit Loans: Understanding Guaranteed Approval And Direct Lender Options

Table of Contents

Understanding "Guaranteed Approval" Bad Credit Loans

The Truth Behind the Claims

The phrase "guaranteed approval" for bad credit loans is often misleading. True guaranteed approval is rare and usually associated with predatory lending practices. Lenders making such claims often attach extremely unfavorable terms to compensate for the perceived risk. Scrutinizing offers carefully is paramount to avoid exploitation.

- High interest rates: Expect significantly higher interest rates compared to loans for borrowers with good credit.

- Excessive fees: Be wary of hidden fees and charges that can inflate the total cost of the loan.

- Short repayment terms: Short repayment periods can lead to larger monthly payments, increasing the likelihood of default.

- Hidden costs: Always read the fine print to uncover any hidden costs or unexpected fees.

Pre-approval, while seemingly similar to guaranteed approval, also has limitations. Pre-approval doesn't guarantee you'll receive the loan; it only indicates the lender is likely to approve your application based on the information provided. Your actual approval is contingent on a full credit check and verification of your financial information.

What Lenders Actually Offer

Responsible lenders understand that many people face credit challenges. While they won't offer "guaranteed approval," they do offer loans to borrowers with bad credit, focusing on responsible borrowing practices.

- Credit score improvement strategies: Many lenders offer resources or advice to help you improve your credit score over time.

- Responsible borrowing habits: Lenders prioritize responsible lending, ensuring borrowers can realistically manage their repayments.

- Exploring alternative financing options: If a traditional loan isn't feasible, lenders might suggest alternative financing options, such as secured loans or lines of credit.

Comparing interest rates and fees from multiple lenders is vital to securing the most favorable terms. Don't settle for the first offer; shop around to find the best deal for your specific circumstances.

The Benefits of Direct Lenders for Bad Credit Loans

Simplified Application Process

Dealing directly with a lender streamlines the application process, offering greater transparency and efficiency. You interact with the decision-maker directly, avoiding intermediaries.

- Less paperwork: Direct lenders often have simpler application processes, requiring less documentation.

- Faster processing times: Applications are typically processed more quickly without the delays introduced by brokers.

- Direct communication with the lender: You can directly address any questions or concerns with the lender.

Better Interest Rates and Terms

Direct lenders often offer more competitive interest rates and loan terms than brokers. By cutting out the middleman, you can potentially save money on fees and obtain more favorable repayment options.

- Avoid paying broker fees: Brokers charge fees, which increase the overall cost of your loan. Direct lenders eliminate this expense.

- Potentially negotiate better terms: You have a more direct line of communication to negotiate better interest rates or repayment terms.

- Build a relationship with the lender: A direct relationship allows you to establish a rapport with the lender, benefiting you in future financing needs.

Data Privacy and Security

Protecting your personal information is paramount. Direct lenders generally offer better data privacy and security compared to using loan brokers.

- Reduced risk of data breaches: Fewer intermediaries reduce the potential points of data vulnerability.

- Transparent data usage policies: Direct lenders usually have clear data usage policies, ensuring transparency.

- Direct control over your financial information: You retain greater control over how your financial data is used.

Finding Reputable Direct Lenders for Bad Credit Loans

Research and Comparison

Thorough research is key to finding a reputable lender. Don't rush the process; take the time to investigate potential lenders thoroughly.

- Check online reviews: Read reviews from other borrowers to gauge their experiences and identify potential red flags.

- Look for licensing and accreditation: Ensure the lender is properly licensed and accredited in your jurisdiction.

- Compare interest rates and fees: Carefully compare interest rates, fees, and repayment terms before making a decision.

Understanding Loan Terms and Conditions

Before committing to any loan, meticulously read and understand all terms and conditions. This step is crucial to avoid unexpected costs or unfavorable repayment terms.

- APR (Annual Percentage Rate): Understand the total cost of borrowing, including interest and fees.

- Repayment schedule: Ensure the repayment schedule aligns with your budget and financial capabilities.

- Fees: Identify and understand all associated fees, including origination fees, late payment fees, and prepayment penalties.

- Penalties for late payments: Be aware of the penalties for late or missed payments.

Seeking Financial Advice

Before applying for a bad credit loan, consider seeking professional financial advice. A financial advisor can help you navigate your options and make informed decisions.

- Consult a financial advisor: A financial advisor can provide personalized guidance based on your financial situation.

- Explore credit counseling services: Credit counseling services can offer strategies for improving your credit score and managing debt.

- Build a sound financial plan: Develop a financial plan that addresses your short-term and long-term financial goals.

Conclusion

Obtaining bad credit loans requires careful consideration. While the promise of "guaranteed approval" is often misleading, responsible lenders offer viable options for borrowers with less-than-perfect credit scores. By working directly with a reputable lender and understanding the loan terms, you can improve your chances of securing a loan that fits your needs. Remember to research thoroughly, compare offers, and seek professional financial advice to make informed decisions. Don't fall victim to predatory lenders promising guaranteed approval for bad credit loans; instead, focus on finding a responsible direct lender to help you achieve your financial goals. Start your search for reputable lenders offering bad credit loans today!

Featured Posts

-

Tim Sar Basarnas Cari Balita Hilang Diduga Tenggelam Dan Terseret Arus Di Balikpapan

May 28, 2025

Tim Sar Basarnas Cari Balita Hilang Diduga Tenggelam Dan Terseret Arus Di Balikpapan

May 28, 2025 -

Millions Stolen In Office365 Executive Account Hack Fbi Investigation

May 28, 2025

Millions Stolen In Office365 Executive Account Hack Fbi Investigation

May 28, 2025 -

Raphinhas Fire Power Barcelonas Quarter Final Push

May 28, 2025

Raphinhas Fire Power Barcelonas Quarter Final Push

May 28, 2025 -

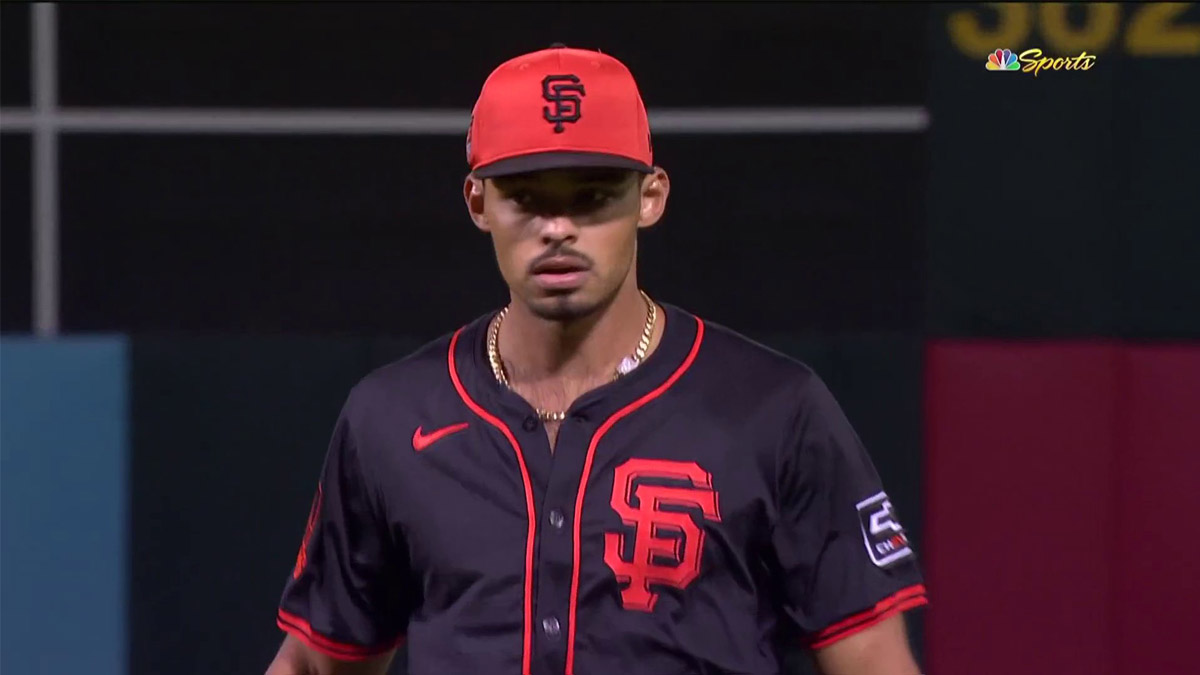

Diamondbacks Defeat Giants Jordan Hicks Struggles Contribute To San Franciscos Loss

May 28, 2025

Diamondbacks Defeat Giants Jordan Hicks Struggles Contribute To San Franciscos Loss

May 28, 2025 -

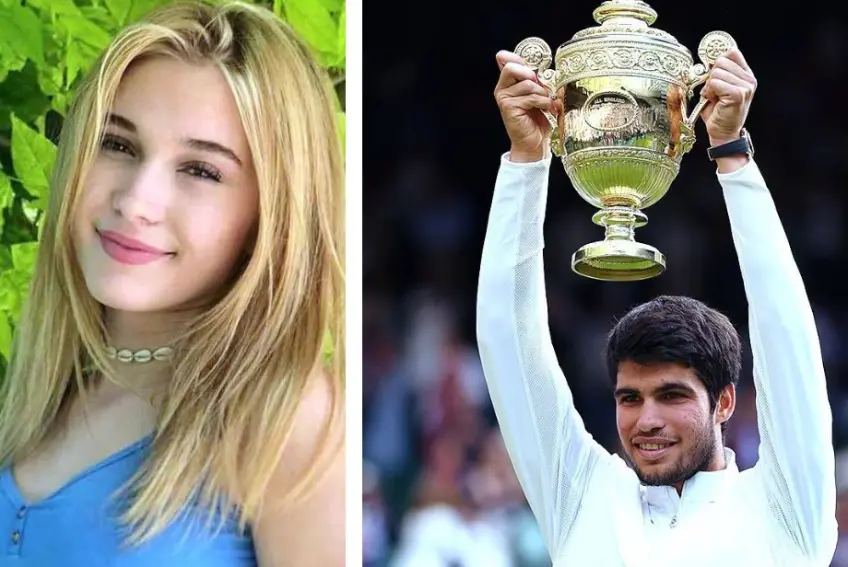

Alcaraz Ends Sinners Winning Streak At Italian Open

May 28, 2025

Alcaraz Ends Sinners Winning Streak At Italian Open

May 28, 2025

Latest Posts

-

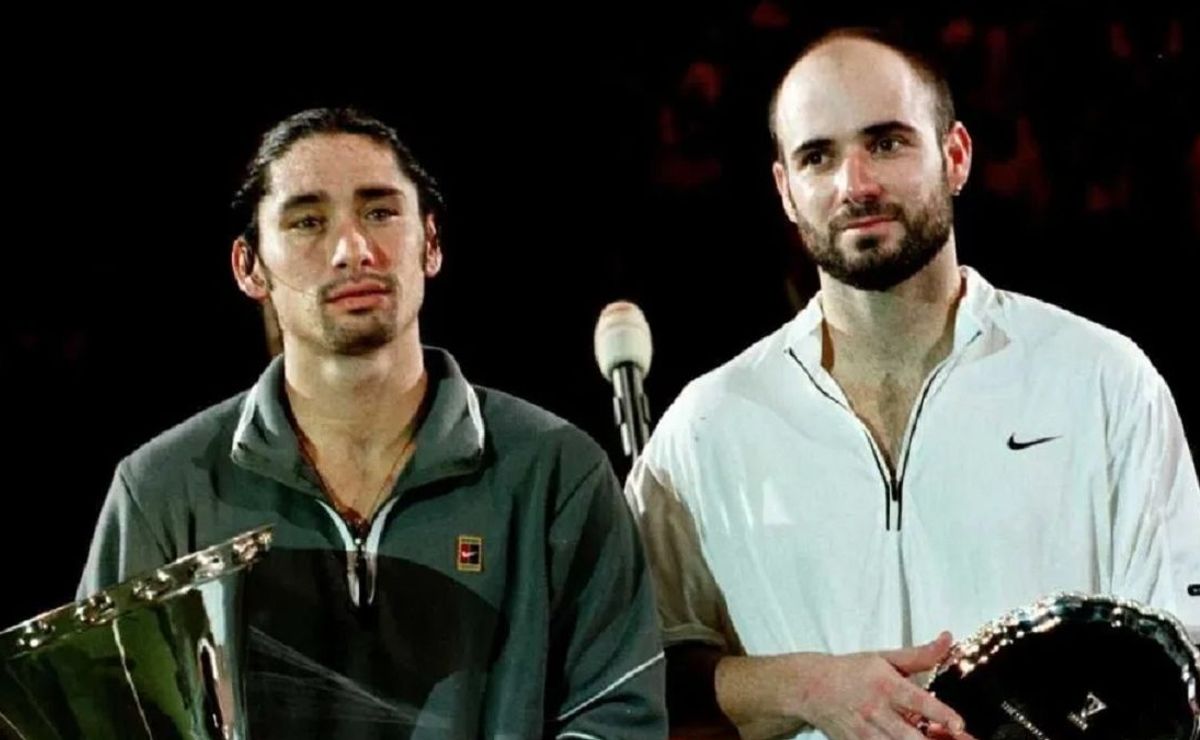

Controversial Revelaciones Un Tenista Argentino Y Su Opinion Sobre Marcelo Rios

May 30, 2025

Controversial Revelaciones Un Tenista Argentino Y Su Opinion Sobre Marcelo Rios

May 30, 2025 -

El Regreso De Andre Agassi Mas Alla Del Tenis

May 30, 2025

El Regreso De Andre Agassi Mas Alla Del Tenis

May 30, 2025 -

Un Tenista Argentino Arremete Contra Rios Era Un Dios Del Tenis

May 30, 2025

Un Tenista Argentino Arremete Contra Rios Era Un Dios Del Tenis

May 30, 2025 -

Andre Agassi Regresa Al Deporte Un Nuevo Comienzo Fuera De La Pista

May 30, 2025

Andre Agassi Regresa Al Deporte Un Nuevo Comienzo Fuera De La Pista

May 30, 2025 -

El Chino Rios Revelaciones De Un Tenista Argentino Sobre Una Leyenda

May 30, 2025

El Chino Rios Revelaciones De Un Tenista Argentino Sobre Una Leyenda

May 30, 2025