Bajaj Twins Drag On Sensex And Nifty 50: Flat Close Amidst Geopolitical Concerns

Table of Contents

Bajaj Finance's Performance and its Impact

Decline in Bajaj Finance Share Prices

Bajaj Finance, a financial heavyweight, experienced a noticeable decline in its share price. The percentage drop, while varying slightly depending on the day's closing, was significant enough to ripple through the market. Several factors contributed to this downturn:

- Weak Quarterly Earnings: Disappointing quarterly earnings often trigger sell-offs, and Bajaj Finance was no exception. Lower-than-expected profits fueled investor concerns.

- Concerns about Rising NPAs (Non-Performing Assets): An increase in NPAs, a key indicator of financial health, can significantly impact investor confidence. Any perceived rise in NPAs for Bajaj Finance likely contributed to the share price decline.

- Impact of Interest Rate Hikes: Rising interest rates generally impact lending institutions. The increase in interest rates could have reduced the profitability of Bajaj Finance's lending operations.

- Overall Market Sentiment: The prevailing negative market sentiment, influenced by geopolitical factors, also played a role in the sell-off of Bajaj Finance shares.

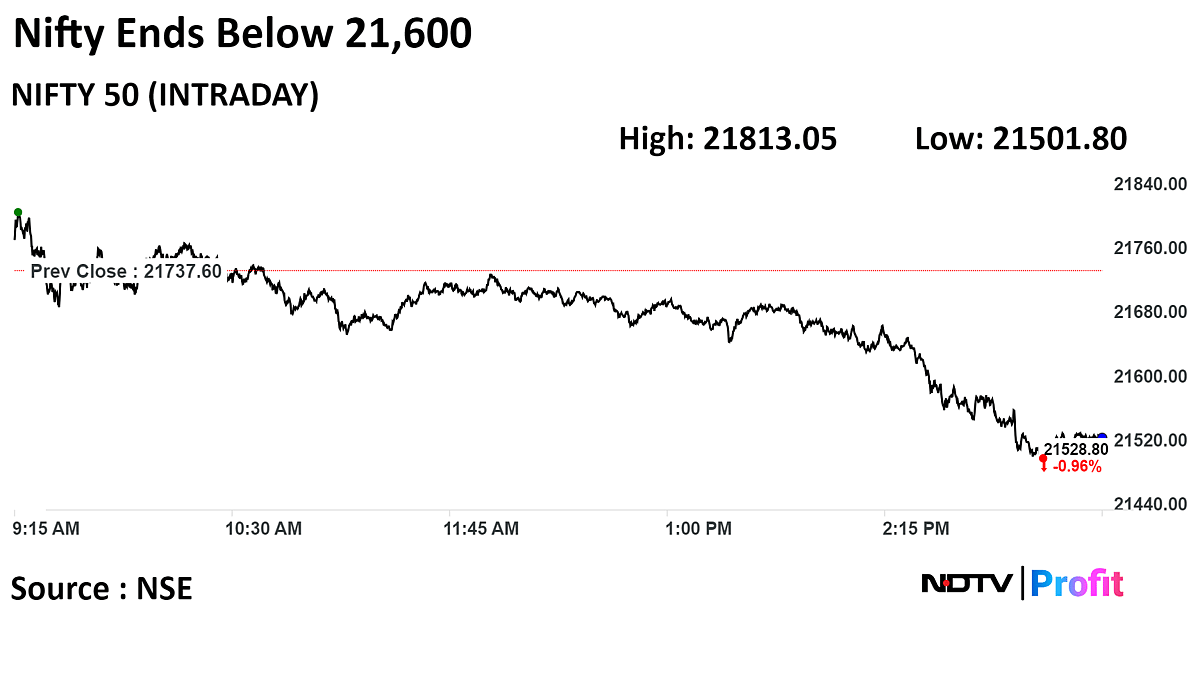

Ripple Effect on the Sensex and Nifty 50

Bajaj Finance holds substantial weightage in the Sensex and Nifty 50. Its decline had a considerable knock-on effect:

- Bajaj Finance's significant weightage in the indices: The sheer size and influence of Bajaj Finance means any significant movement in its share price directly impacts the overall index performance.

- Investor response to the decline: The decline in Bajaj Finance's share price triggered a sell-off in other related financial stocks, exacerbating the negative impact on the indices.

- Impact on other financial stocks: Investor sentiment towards the financial sector as a whole can be negatively affected by a major player like Bajaj Finance underperforming, leading to a broader sell-off.

Analyst Opinions and Future Outlook

Analysts offer mixed opinions regarding Bajaj Finance's future. While some predict a recovery based on the company's long-term growth potential and resilience, others express caution, citing ongoing economic challenges and potential risks:

- Predictions on share price recovery: Some analysts predict a recovery based on future earnings and the company's strong fundamentals.

- Potential catalysts for growth: Expansion into new markets and the development of innovative financial products could act as catalysts for future growth.

- Risk factors to consider: Continued interest rate hikes and potential further increases in NPAs pose significant risks.

Bajaj Auto's Performance and its Contribution to the Downturn

Underperformance of Bajaj Auto Shares

Bajaj Auto, another significant component of the Indian market, also underperformed, contributing to the overall negative market sentiment. The drop in its share price can be attributed to various factors:

- Slowdown in sales: A slowdown in two-wheeler sales, possibly due to economic conditions or changing consumer preferences, impacted Bajaj Auto's performance.

- Competition in the two-wheeler market: Intense competition in the two-wheeler market, with both domestic and international players, puts pressure on pricing and profit margins.

- Impact of rising input costs: Rising input costs, particularly raw materials and fuel, reduce profitability.

- Global supply chain disruptions: Global supply chain issues continue to affect manufacturing and sales, impacting Bajaj Auto's production and delivery.

Sectoral Impact and Market Sentiment

Bajaj Auto's underperformance negatively affected investor sentiment towards the auto sector as a whole:

- Investor confidence in the auto sector: The decline in Bajaj Auto's share price eroded confidence in the overall auto sector's performance.

- Comparative performance of other auto companies: Investors often compare the performance of different companies within the same sector; Bajaj Auto's underperformance likely influenced assessments of other auto companies.

- Overall market outlook for the auto industry: The performance of Bajaj Auto, a major player, contributed to a more pessimistic outlook for the auto industry.

Expert Analysis and Future Predictions

Expert opinions on Bajaj Auto's future vary. While some highlight the company's long-term growth potential and brand recognition, others point to challenges in the market:

- Potential for recovery: New product launches and strategic initiatives could drive future growth.

- Long-term growth prospects: The company's strong brand and market presence suggest long-term growth potential, although it faces intense competition.

- Key risks and challenges facing the company: Maintaining market share and navigating rising input costs and global supply chain disruptions remain key challenges.

Geopolitical Factors Exacerbating Market Volatility

Global Uncertainty and its Impact

Prevailing geopolitical uncertainties significantly influenced investor sentiment, contributing to market volatility:

- Specific geopolitical events (e.g., the war in Ukraine, rising inflation): These events created global economic uncertainty, impacting investor risk appetite.

- Impact on global markets: Global market instability directly impacts Indian markets, as investors often react to international events.

- Risk aversion among investors: Uncertainty often leads to risk aversion, causing investors to sell off assets and move to safer investments.

Influence on Foreign Institutional Investor (FII) Activity

Geopolitical concerns affected Foreign Institutional Investor (FII) activity in Indian markets:

- FII investment trends: FIIs often reduce investment in emerging markets during times of global uncertainty.

- Impact on market liquidity: Reduced FII investment can impact market liquidity, potentially leading to increased volatility.

- Potential for capital flight: Increased risk aversion can lead to capital flight from emerging markets, including India.

Conclusion: Bajaj Twins and the Future of Indian Markets

The underperformance of the Bajaj Twins—Bajaj Finance and Bajaj Auto—significantly impacted the Sensex and Nifty 50, contributing to a flat close amidst already heightened geopolitical concerns. Global uncertainty and its impact on FII activity further exacerbated market volatility. While the future remains uncertain, careful monitoring of the Bajaj Twins' performance, along with macroeconomic indicators and geopolitical developments, is crucial. To make informed investment decisions, monitor the Bajaj Twins closely, stay updated on Bajaj Finance and Bajaj Auto performance, and understand the impact of the Bajaj Twins on your portfolio.

Featured Posts

-

Jayson Tatum Faces Continued Criticism From Colin Cowherd

May 09, 2025

Jayson Tatum Faces Continued Criticism From Colin Cowherd

May 09, 2025 -

Planned Elizabeth Line Strikes Impact On Services This February And March

May 09, 2025

Planned Elizabeth Line Strikes Impact On Services This February And March

May 09, 2025 -

F1 Facing Crisis Jeremy Clarkson Offers Potential Solution As Ferrari Dq Threat Looms

May 09, 2025

F1 Facing Crisis Jeremy Clarkson Offers Potential Solution As Ferrari Dq Threat Looms

May 09, 2025 -

Surviving The Trade War A Cryptocurrencys Path To Victory

May 09, 2025

Surviving The Trade War A Cryptocurrencys Path To Victory

May 09, 2025 -

Amy Walsh Defends Wynne Evans Following Sexual Slur Allegation

May 09, 2025

Amy Walsh Defends Wynne Evans Following Sexual Slur Allegation

May 09, 2025