Bank Of Canada Holds Rates: FP Video Interviews Leading Economists

Table of Contents

Economists' Reactions to the Rate Hold

The overall consensus among the economists interviewed for the FP videos was a cautious expectation of a rate hold, though the degree of surprise varied. While some predicted a pause, others felt a rate hike remained a possibility given persistent inflationary pressures. The main arguments against a rate increase centered on concerns about slowing economic growth and the potential for further tightening to exacerbate a slowdown.

- Dr. Anya Sharma of the University of Toronto: "The Bank of Canada's decision to hold rates reflects a growing recognition of the fragility of the economic recovery. Further increases could tip the economy into recession."

- Mr. Ben Carter, Chief Economist at National Bank Financial: "While inflation remains above the Bank of Canada's target, the softening of several key economic indicators suggests a prudent pause is warranted at this juncture."

- Ms. Chloe Dubois, Senior Economist at TD Economics: "The rate hold isn't necessarily a sign of victory over inflation; rather, it's a strategic recalibration, allowing the Bank to assess the impact of past rate increases."

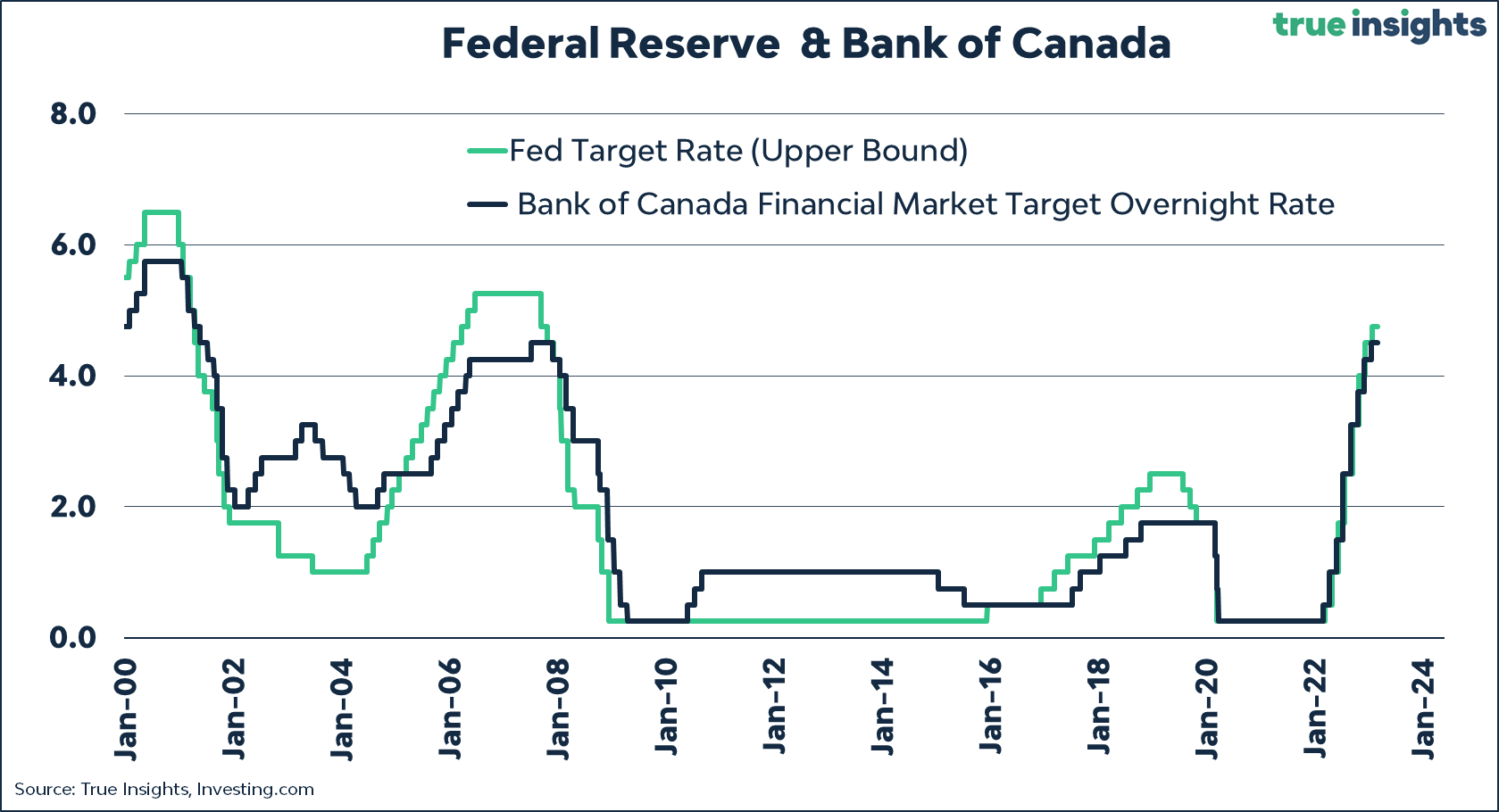

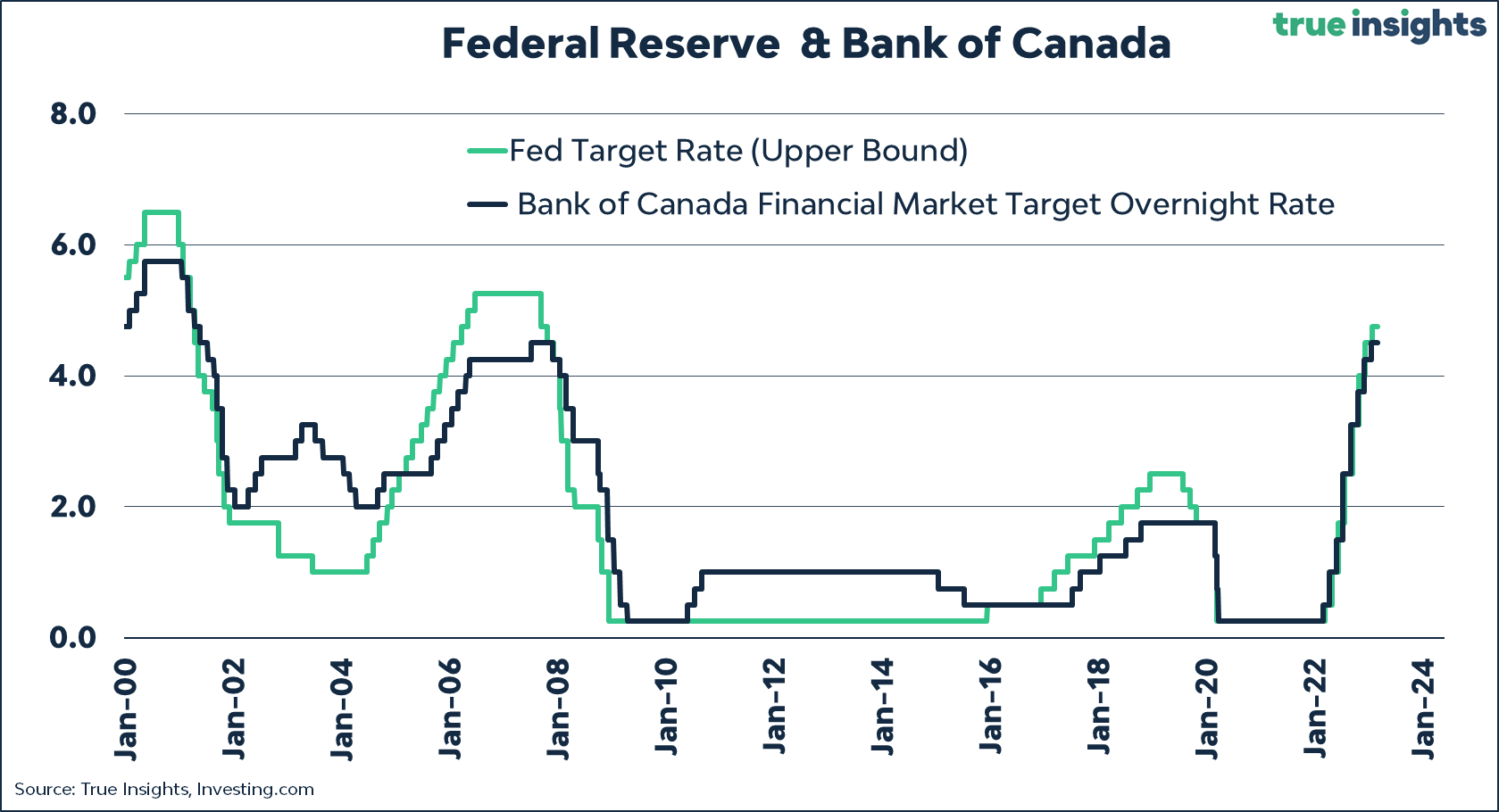

Analysis of Current Economic Conditions

Several key economic indicators influenced the Bank of Canada's decision. The inflation rate, while still elevated, showed signs of moderation, suggesting that past interest rate hikes are beginning to have their intended effect. GDP growth remained sluggish, indicating slower than anticipated economic expansion. The unemployment rate, however, remained relatively low, suggesting a still-tight labor market.

- Inflation Rate: The economists in the FP interviews discussed the recent easing in inflation, with many pointing towards supply chain improvements and a softening in demand as contributing factors. However, core inflation remains a concern.

- GDP Growth: Slower-than-expected GDP growth fueled the arguments for a rate hold, highlighting concerns about the potential for a recessionary scenario. Economists cited global uncertainty and weakening consumer spending as contributing factors.

- Unemployment Rate: The relatively low unemployment rate presented a mixed signal, with some economists arguing it justified further rate hikes, while others countered that wage growth was not accelerating to the extent that would warrant additional tightening.

Predictions for Future Interest Rate Movements

Forecasts for future interest rate changes varied among the economists interviewed. While a significant portion predicted a prolonged pause, some suggested further rate hikes could be necessary if inflation proves more persistent than anticipated. The primary factors influencing future decisions were identified as inflation's trajectory, GDP growth, and the overall global economic outlook.

- Scenario 1 (Prolonged Pause): Many economists suggested the Bank of Canada might hold rates steady for an extended period, allowing time to assess the cumulative impact of past increases on the economy.

- Scenario 2 (Further Rate Hikes): A minority of economists cautioned that if inflation remains stubborn, the Bank may be forced to resume its tightening cycle to bring inflation back to its target of 2%.

- Influencing Factors: Economists highlighted the importance of upcoming inflation data releases, global economic developments, and the resilience of the Canadian labor market in shaping the Bank of Canada's future decisions.

Impact on the Canadian Housing Market and Other Sectors

The Bank of Canada's decision to hold rates has significant implications for various sectors of the Canadian economy. The housing market, particularly sensitive to interest rate changes, is expected to see some relief from further price declines. However, the impact on business investment and consumer spending is less clear, with some economists expecting modest growth while others foresee more subdued activity.

- Housing Market: A pause in rate hikes provides some stability for the housing market, potentially preventing further significant price drops. However, economists cautioned that affordability remains a major challenge.

- Business Investment: The uncertainty surrounding future interest rate moves might lead to some caution in business investment decisions.

- Consumer Spending: Consumer confidence could be impacted by the ongoing uncertainty, potentially leading to more cautious spending habits.

Conclusion: Understanding the Bank of Canada's Rate Decision – Key Takeaways and Next Steps

The Bank of Canada's decision to hold interest rates reflects a careful balancing act between managing inflation and supporting economic growth. Economists' opinions diverge regarding the future path of interest rates, with predictions ranging from a prolonged pause to further rate hikes, depending on the evolution of key economic indicators. Understanding these nuanced perspectives is critical for navigating the evolving Canadian economic landscape. Learn more by watching the full FP video interviews on the Bank of Canada's interest rate decision to stay informed about future Bank of Canada rate announcements.

Featured Posts

-

Execs Office365 Accounts Breached Millions Made Feds Say

Apr 23, 2025

Execs Office365 Accounts Breached Millions Made Feds Say

Apr 23, 2025 -

Near Fatal Manhole Explosion Familys Account Of Escape

Apr 23, 2025

Near Fatal Manhole Explosion Familys Account Of Escape

Apr 23, 2025 -

Rayadas Triunfa Con Doblete De Burky

Apr 23, 2025

Rayadas Triunfa Con Doblete De Burky

Apr 23, 2025 -

L Analyse D Amandine Gerard Je T Aime Moi Non Plus Europe Et Marches

Apr 23, 2025

L Analyse D Amandine Gerard Je T Aime Moi Non Plus Europe Et Marches

Apr 23, 2025 -

On Refait La Seance Fdj Schneider Electric Et L Actualite Parisienne Du 17 02

Apr 23, 2025

On Refait La Seance Fdj Schneider Electric Et L Actualite Parisienne Du 17 02

Apr 23, 2025

Latest Posts

-

The End Of An Era Mourning The Loss Of Americas First Nonbinary Person

May 10, 2025

The End Of An Era Mourning The Loss Of Americas First Nonbinary Person

May 10, 2025 -

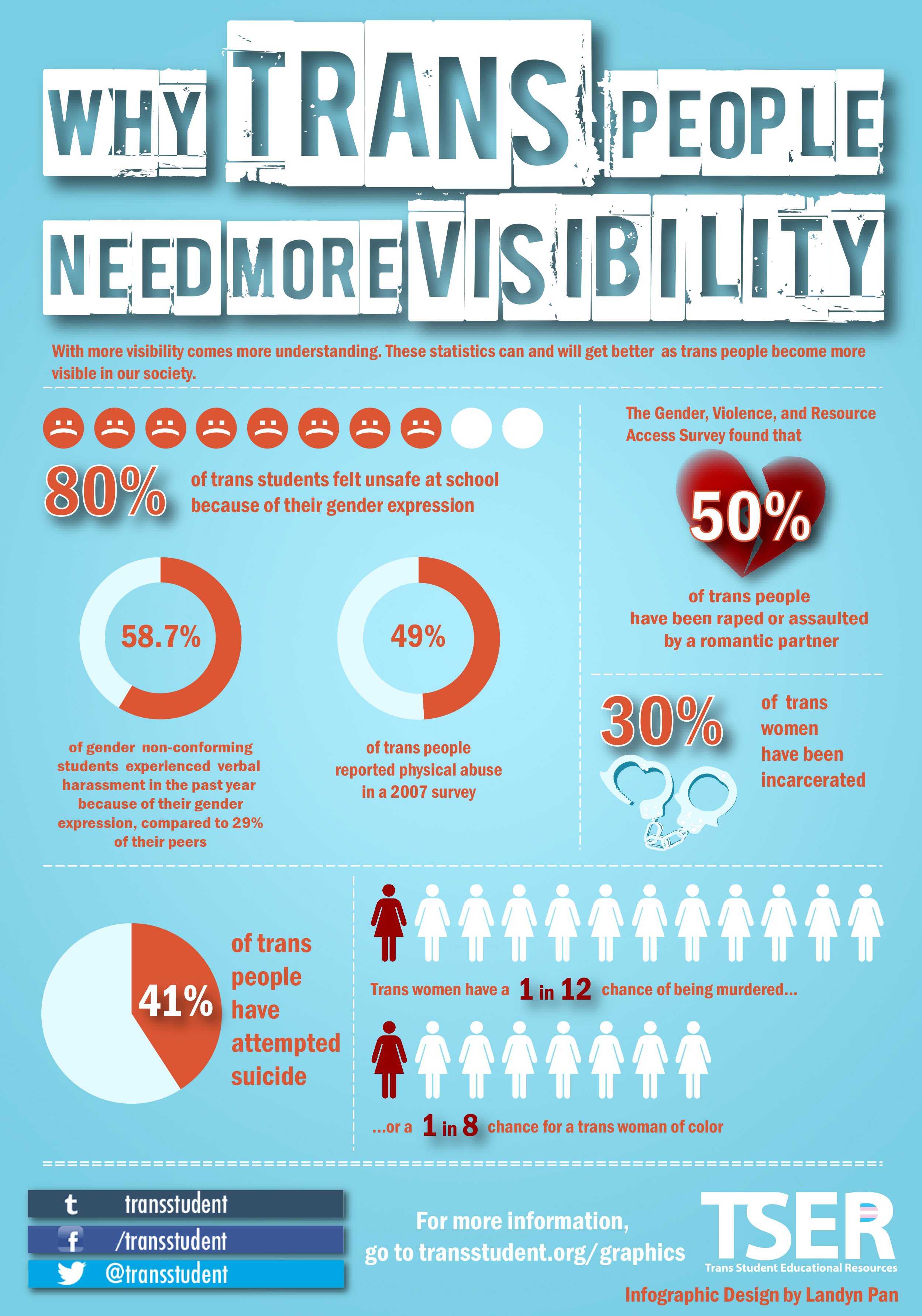

International Transgender Day Of Visibility Becoming A Stronger Ally

May 10, 2025

International Transgender Day Of Visibility Becoming A Stronger Ally

May 10, 2025 -

Remembering Americas First Nonbinary Person A Life Cut Short

May 10, 2025

Remembering Americas First Nonbinary Person A Life Cut Short

May 10, 2025 -

3 Actions You Can Take This International Transgender Day Of Visibility

May 10, 2025

3 Actions You Can Take This International Transgender Day Of Visibility

May 10, 2025 -

Death Of A Pioneer Reflecting On The Loss Of Americas First Nonbinary Person

May 10, 2025

Death Of A Pioneer Reflecting On The Loss Of Americas First Nonbinary Person

May 10, 2025