Bank Of Canada Interest Rate Cuts: Analyzing The Impact Of Tariffs On Employment

Table of Contents

The Impact of Tariffs on Canadian Businesses and Employment

Tariffs, essentially taxes on imported or exported goods, create significant ripple effects throughout the Canadian economy, directly impacting employment levels.

Reduced Export Demand

Tariffs imposed by other countries on Canadian goods directly reduce export demand. This significantly impacts businesses heavily reliant on international trade, often leading to job losses.

- Example: The imposition of US tariffs on Canadian lumber exports resulted in decreased sales and, consequently, layoffs in the forestry and lumber processing sectors.

- Quantifiable Data: While precise figures are complex to isolate, reports indicate thousands of job losses in sectors like agriculture and manufacturing due to retaliatory tariffs. Further research from Statistics Canada and industry reports is crucial for more precise data.

- Ripple Effect: Job losses in export-oriented sectors trigger a ripple effect, impacting related industries like transportation, logistics, and support services, further exacerbating unemployment.

Increased Input Costs

Tariffs on imported goods increase production costs for Canadian businesses, making it more expensive to operate. This can lead to reduced hiring, price increases, or even layoffs to maintain profitability.

- Example: Increased tariffs on steel and aluminum significantly impacted Canadian manufacturers, raising input costs and forcing some to reduce their workforce or relocate production.

- Impact on SMEs: Small and medium-sized enterprises (SMEs) are particularly vulnerable to increased input costs due to their limited resources and capacity to absorb price shocks. Many lack the economies of scale to offset increased costs.

- Government Support: The Canadian government offers various support programs aimed at mitigating the effects of increased input costs for businesses, such as grants, tax credits, and loan programs. However, the effectiveness of these programs in preventing job losses remains a subject of ongoing debate.

Shifting Global Trade Dynamics

Tariffs significantly influence Canadian businesses' strategic decisions, leading to shifts in production, investment, and employment. Uncertainty surrounding future tariffs often leads to hesitancy.

- Examples: Some companies have relocated production facilities to countries with more favorable trade relationships, leading to job losses in Canada. Others have reduced investment in expansion or new technologies due to tariff-related uncertainty.

- Job Creation in New Sectors: While some jobs are lost, shifts in trade can lead to the creation of jobs in new sectors or regions. For example, increased domestic demand for certain goods might spur growth in related industries. This positive impact, however, is often overshadowed by job losses in export-oriented sectors.

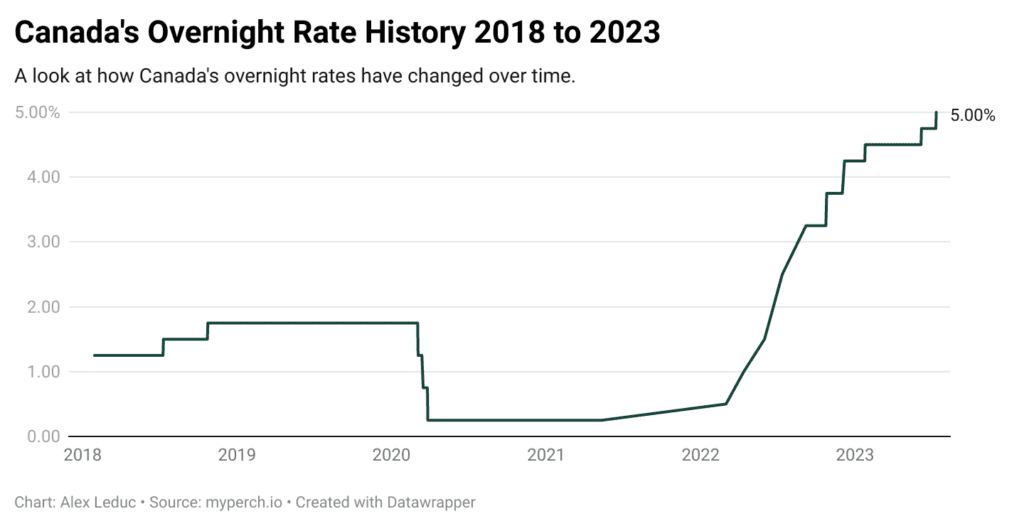

The Bank of Canada's Response: Interest Rate Cuts as a Mitigation Strategy

The Bank of Canada uses interest rate cuts as a tool to mitigate the negative economic impacts of tariffs on employment.

Stimulating Economic Growth

Interest rate cuts aim to stimulate economic activity by making borrowing cheaper. This encourages investment, both business and consumer, potentially leading to job creation.

- Mechanism: Lower interest rates reduce borrowing costs for businesses, enabling them to invest in expansion, new equipment, and hiring. Lower mortgage rates stimulate consumer spending, boosting demand and driving economic growth.

- Increased Spending and Investment: Lower interest rates theoretically lead to increased consumer spending and business investment, creating a positive feedback loop that generates jobs and stimulates economic growth.

- Effectiveness of Past Cuts: The effectiveness of past interest rate cuts in mitigating economic downturns varies depending on various factors, including the severity of the downturn and the overall state of the global economy. Analysis of past cycles provides valuable context for assessing the current situation.

Balancing Inflation and Employment

The Bank of Canada’s mandate involves controlling inflation while promoting full employment. Interest rate cuts represent a tool to manage this delicate balance, especially during periods of tariff-related economic challenges.

- Inflationary Pressures: Lower interest rates can lead to increased borrowing and spending, potentially fueling inflation. The Bank carefully monitors inflation indicators to ensure that rate cuts do not lead to unsustainable price increases.

- Inflation Targets: The Bank of Canada has an inflation target range (typically around 2%), which guides its interest rate decisions. Maintaining price stability is a key consideration in any rate adjustment.

- Trade-offs: There’s often a trade-off between controlling inflation and promoting full employment. The Bank must carefully weigh the potential risks and benefits of interest rate cuts in the context of tariff-related economic challenges.

Long-Term Implications and Policy Recommendations

Understanding the long-term implications requires a comprehensive analysis.

Predicting Future Employment Trends

Predicting future employment trends requires careful consideration of tariff policies, global economic conditions, technological advancements, and the Bank of Canada's monetary policy response. Sophisticated econometric models are often used to project potential employment outcomes under various scenarios.

Policy Adjustments for Supporting Industries

Government policies should actively support industries negatively impacted by tariffs through targeted financial assistance, retraining programs, and initiatives to diversify export markets.

Diversifying Export Markets

Reducing reliance on specific trade partners is crucial for mitigating the impact of future tariffs. Canadian businesses should explore and develop new export markets to reduce vulnerability to trade disruptions.

Conclusion

The relationship between Bank of Canada interest rate cuts, tariffs, and employment in Canada is complex and multifaceted. While interest rate cuts can stimulate economic growth and potentially mitigate some job losses caused by tariffs, they also pose risks like increased inflation. Policymakers must carefully consider the trade-offs involved and implement strategies to support Canadian businesses and workers facing economic challenges due to trade disputes. Understanding the impact of Bank of Canada interest rate cuts and the influence of tariffs on Canadian employment is crucial for navigating the current economic landscape. Stay informed and actively participate in the discussion to advocate for policies that support Canadian workers and businesses. Further research and engagement with government resources, like Statistics Canada reports and the Bank of Canada's publications, are strongly recommended.

Featured Posts

-

Chantal Ladesou Sa Paisible Retraite Loin De Paris

May 12, 2025

Chantal Ladesou Sa Paisible Retraite Loin De Paris

May 12, 2025 -

John Wick Chapter 5 Release Date Plot And Cast Details

May 12, 2025

John Wick Chapter 5 Release Date Plot And Cast Details

May 12, 2025 -

New York Yankees Lineup Aaron Judge And The Battle For The Leadoff Spot

May 12, 2025

New York Yankees Lineup Aaron Judge And The Battle For The Leadoff Spot

May 12, 2025 -

Selena Gomez Accidental Sale Of Diamond Ring To Fans

May 12, 2025

Selena Gomez Accidental Sale Of Diamond Ring To Fans

May 12, 2025 -

Estrategia Exportadora El Regalo De Uruguay Que Busca Conquistar El Mercado Chino

May 12, 2025

Estrategia Exportadora El Regalo De Uruguay Que Busca Conquistar El Mercado Chino

May 12, 2025

Latest Posts

-

The End Of An Era Jessica Simpsons Reflections On Marriage And Loss

May 12, 2025

The End Of An Era Jessica Simpsons Reflections On Marriage And Loss

May 12, 2025 -

Jessica Simpson And Eric Johnson A Public Appearance Following Separation Announcement

May 12, 2025

Jessica Simpson And Eric Johnson A Public Appearance Following Separation Announcement

May 12, 2025 -

The Comeback Jessica Simpson Performs After A 15 Year Break

May 12, 2025

The Comeback Jessica Simpson Performs After A 15 Year Break

May 12, 2025 -

Are Jessica Simpson And Eric Johnson Back Together New Sighting Sparks Debate

May 12, 2025

Are Jessica Simpson And Eric Johnson Back Together New Sighting Sparks Debate

May 12, 2025 -

Jessica Simpson On Divorce A Look At The Emotional Toll

May 12, 2025

Jessica Simpson On Divorce A Look At The Emotional Toll

May 12, 2025