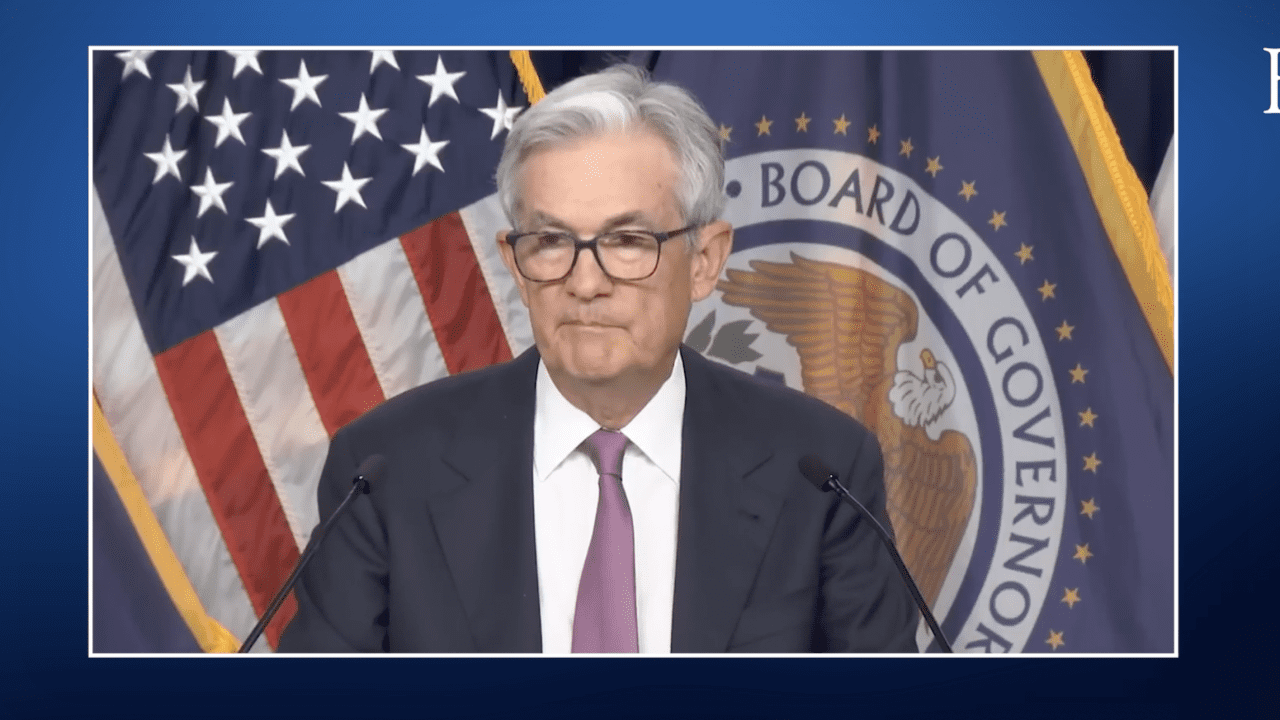

Bank Of Canada's Rate Pause: Expert Analysis From FP Video

Table of Contents

Reasons Behind the Bank of Canada's Rate Pause

The Bank of Canada's decision to pause its interest rate increases wasn't arbitrary. Several key factors, extensively discussed in the FP Video analysis, contributed to this strategic shift in monetary policy. These factors include:

-

Slowing Inflation as a Key Factor: While inflation remains a concern, the rate of increase has shown signs of slowing, suggesting the aggressive interest rate hikes implemented previously are starting to have the desired effect. This slowing inflation rate provided the Bank of Canada with some breathing room to assess the economic landscape.

-

Concerns About Economic Growth and Potential Recession: The Bank of Canada acknowledged concerns about the potential for a recession. Continued aggressive rate hikes could further dampen economic growth, potentially pushing the economy into a downturn. The FP Video experts highlighted the delicate balance between controlling inflation and avoiding a significant economic contraction.

-

Analysis of the Current Strength of the Labor Market: While the labor market remains relatively strong, there are signs of softening. The FP Video analysis explored the potential impact of a weakening labor market on inflation and the overall economy, influencing the Bank of Canada's decision to pause.

-

Assessment of Lingering Supply Chain Issues and Their Impact: Supply chain disruptions, while easing, continue to contribute to inflationary pressures. The FP Video segment analyzed the lingering impact of these disruptions and their influence on the Bank of Canada's decision-making process. The ongoing supply chain issues complicate the inflation picture and necessitated a more cautious approach.

These intertwined factors ultimately led the Bank of Canada to adopt a cautious approach, opting for a pause in interest rate hikes to fully assess the economic impact of previous increases and the evolving economic situation.

Impact of the Rate Pause on Mortgages and Borrowing Costs

The Bank of Canada's rate pause has significant implications for both individuals and businesses, particularly concerning mortgages and borrowing costs. The FP Video experts offered insightful perspectives on these impacts:

-

Potential Stabilization or Slight Decrease in Mortgage Rates: The pause is likely to lead to a stabilization, and potentially a slight decrease, in mortgage rates. This could provide some relief to homeowners and prospective homebuyers facing high borrowing costs.

-

Impact on Consumer Spending and Debt Levels: Lower borrowing costs could stimulate consumer spending, but this effect needs careful monitoring. The FP Video analysis cautioned against potential overspending, which could reignite inflationary pressures. The existing high levels of consumer debt remain a significant factor.

-

Effect on the Overall Housing Market: The impact on the housing market is complex. While lower borrowing costs might boost demand, other factors, such as economic uncertainty and high home prices, will also play significant roles. FP Video experts offered varying opinions on the likely short-term and long-term effects.

-

Analysis of Borrowing Costs for Businesses: Businesses will also experience some relief from stabilized or slightly lower borrowing costs. This could support business investment and economic growth, but the overall economic climate will remain a critical factor.

The FP Video analysis emphasized that the effects on mortgages and borrowing costs will likely be gradual and depend on several other economic indicators.

Future Outlook: What to Expect from the Bank of Canada

Predicting the Bank of Canada's future actions is challenging, but the FP Video analysis provided valuable insights into the likely direction of monetary policy:

-

Discussion of Potential Future Rate Hikes Based on Economic Indicators: Future rate hikes will depend heavily on key economic indicators, such as inflation, GDP growth, and unemployment rates. The FP Video experts highlighted the importance of watching these indicators closely.

-

Experts' Opinions on the Long-Term Inflation Forecast: The long-term inflation forecast remains a critical factor. The FP Video experts offered varying opinions on whether inflation will return to the Bank of Canada's target range and how quickly.

-

Analysis of the Bank of Canada’s Next Steps and Possible Strategies: The Bank of Canada is likely to adopt a data-driven approach, carefully monitoring economic data before making any further decisions on interest rates. The FP Video experts discussed potential strategies, such as a more gradual approach to future rate hikes.

-

Reference to Specific Economic Indicators That Will Shape Future Decisions: The FP Video analysis emphasized the significance of various economic indicators, including the Consumer Price Index (CPI), employment numbers, and real GDP growth, in shaping the Bank of Canada’s future monetary policy decisions.

Alternative Perspectives and Criticisms (if applicable)

The FP Video segment also included alternative perspectives and criticisms regarding the rate pause decision. While the majority of experts agreed with the pause, some expressed concerns that it might be too soon and that inflation could remain stubbornly high. This highlights the inherent uncertainties and complexities of economic forecasting and policymaking.

Conclusion

The Bank of Canada's rate pause is a significant development with far-reaching consequences for the Canadian economy. The reasons behind the pause are multifaceted, involving a complex interplay of slowing inflation, concerns about economic growth, the labor market, and lingering supply chain issues. The impact on mortgages and borrowing costs is likely to be gradual, offering potential relief but also presenting ongoing challenges. The future direction of interest rates will depend heavily on key economic indicators and the Bank of Canada's assessment of the economic outlook. The FP Video analysis provides valuable insights into this complex situation, offering a range of expert perspectives and highlighting the uncertainties inherent in economic forecasting.

Learn more about the Bank of Canada’s decision and its implications by watching the full FP Video analysis on [link to FP Video]. Stay informed on important economic developments and the Bank of Canada's future interest rate decisions. Understand how the Bank of Canada rate pause affects your financial planning.

Featured Posts

-

Morning Retail Comparatif Nutriscore Des Produits Phares Du Petit Dejeuner

Apr 23, 2025

Morning Retail Comparatif Nutriscore Des Produits Phares Du Petit Dejeuner

Apr 23, 2025 -

Where To Invest A Map Of The Countrys Top Business Locations

Apr 23, 2025

Where To Invest A Map Of The Countrys Top Business Locations

Apr 23, 2025 -

Rowdy Tellez Vs Former Team Watch The Sweet Revenge

Apr 23, 2025

Rowdy Tellez Vs Former Team Watch The Sweet Revenge

Apr 23, 2025 -

Bfm Bourse 15h 16h Du 17 02 Analyse Et Perspectives

Apr 23, 2025

Bfm Bourse 15h 16h Du 17 02 Analyse Et Perspectives

Apr 23, 2025 -

Ftc Investigation Into Open Ais Chat Gpt What It Means

Apr 23, 2025

Ftc Investigation Into Open Ais Chat Gpt What It Means

Apr 23, 2025

Latest Posts

-

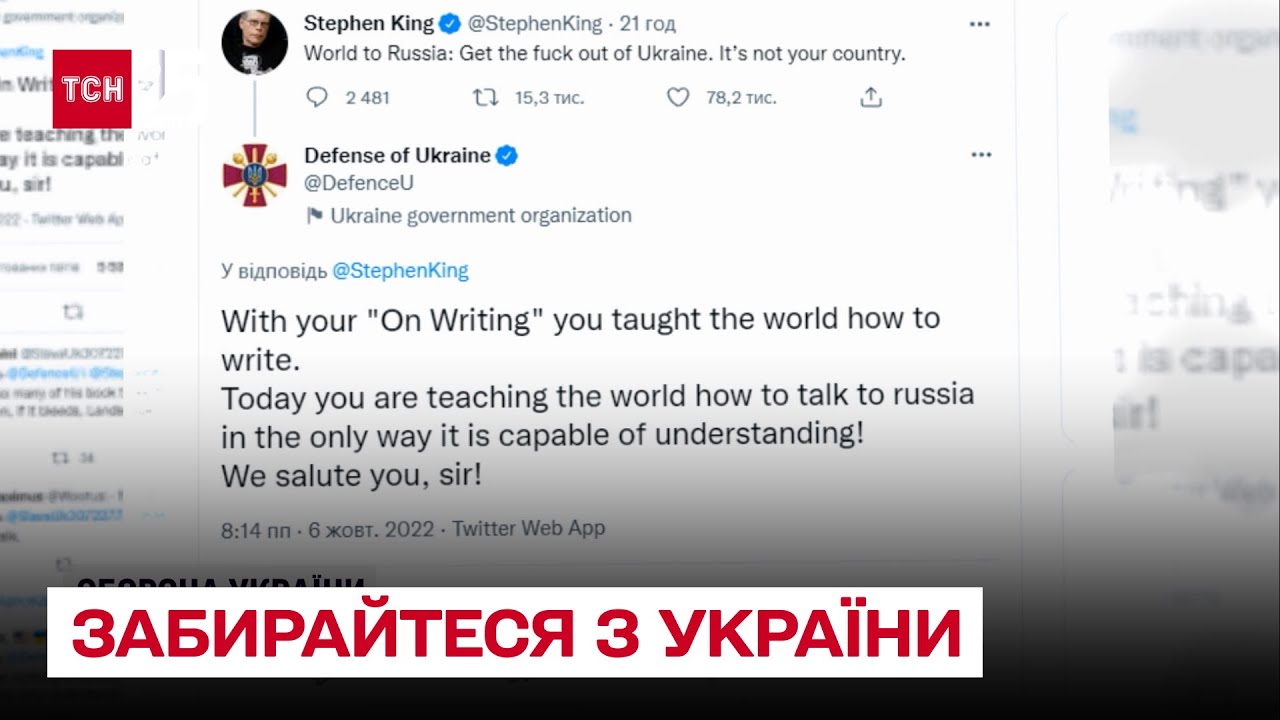

Analiz Zayav Stivena Kinga Chi Ye Mask Ta Tramp Zradnikami

May 10, 2025

Analiz Zayav Stivena Kinga Chi Ye Mask Ta Tramp Zradnikami

May 10, 2025 -

Stiven King Vernulsya V X I Oskorbil Ilona Maska

May 10, 2025

Stiven King Vernulsya V X I Oskorbil Ilona Maska

May 10, 2025 -

King Proti Maska Ta Trampa Khto Praviy U Tsiy Superechtsi

May 10, 2025

King Proti Maska Ta Trampa Khto Praviy U Tsiy Superechtsi

May 10, 2025 -

Zayavi Stivena Kinga Pro Maska Ta Trampa Zrada Chi Politichna Zayava

May 10, 2025

Zayavi Stivena Kinga Pro Maska Ta Trampa Zrada Chi Politichna Zayava

May 10, 2025 -

Stiven King Mask I Tramp Posibniki Putina

May 10, 2025

Stiven King Mask I Tramp Posibniki Putina

May 10, 2025