BBAI Stock: A Deep Dive Into The 17.87% Drop And Future Outlook

Table of Contents

Analyzing the 17.87% Drop in BBAI Stock Price

The precipitous fall in BBAI stock price wasn't a singular event but rather the culmination of several interacting factors. Let's dissect the key contributors.

Market Sentiment and Investor Confidence

Negative market sentiment played a significant role in the BBAI stock price decline. Declining investor confidence often leads to sell-offs, amplifying downward pressure.

- Negative News and Media Coverage: Negative press surrounding the company, perhaps related to regulatory scrutiny or competitive challenges, can significantly impact investor perception. For example, reports of potential lawsuits or investigations can trigger immediate sell-offs.

- Poor Earnings Reports: Disappointing earnings reports, consistently missing revenue targets, or a downward revision of future earnings projections can erode investor confidence and trigger a decline in stock price. These reports often highlight underlying issues affecting profitability and future growth potential.

- Overall Market Downturn: A broader market correction or a sector-specific downturn can significantly affect even fundamentally strong companies like BBAI, leading to decreased investor confidence and increased selling pressure. This is often coupled with reduced liquidity.

The impact of negative sentiment can be quantified by observing trading volume spikes during periods of negative news and the correlation between news sentiment and stock price movements.

Impact of Geopolitical Factors

Geopolitical events can exert a powerful influence on global markets, and BBAI stock is not immune.

- International Trade Disputes: Trade wars or escalating tensions between major economies can disrupt supply chains and negatively impact the profitability of companies like BBAI with international operations. Uncertainty related to tariffs and trade restrictions adds further pressure.

- Political Instability in Key Markets: Political instability in regions where BBAI operates can disrupt business activities, potentially leading to production delays, supply chain disruptions, and ultimately, a negative impact on the company's financial performance.

- Currency Fluctuations: Fluctuations in exchange rates can affect the revenue and profitability of companies with significant international exposure, and these fluctuations can be particularly impactful in times of geopolitical uncertainty.

Company-Specific Factors

Internal factors within BBAI itself might have contributed to the stock price drop.

- Management Changes: Unexpected leadership changes or internal conflicts can unsettle investors and create uncertainty about the company's future direction. This uncertainty can trigger sell-offs.

- Product Delays or Failures: Delays in launching key products or product failures can significantly impact the company's revenue streams and future growth projections, leading to a negative reaction from the market.

- Accounting Irregularities or Scandals: Any revelation of accounting irregularities or corporate scandals can severely damage investor confidence and lead to substantial drops in stock price.

Evaluating the Financial Health of BBAI

A thorough assessment of BBAI's financial health is critical to understanding the long-term implications of the recent stock price drop.

Key Financial Metrics

Analyzing key financial metrics provides valuable insights into BBAI's financial strength and stability.

- Revenue Growth: Examining the trend of BBAI's revenue growth over time is crucial to assess its ability to generate sales and increase its market share. Consistent revenue growth is a positive indicator.

- Profitability: Metrics such as gross profit margin, operating profit margin, and net profit margin reveal BBAI's ability to translate sales into profits. Declining profitability is a significant concern.

- Debt Levels: High levels of debt can indicate financial fragility and increase the company's vulnerability to economic downturns. Analyzing debt-to-equity ratios is essential.

- Cash Flow: Positive cash flow indicates the company's ability to generate cash from its operations, which is vital for investment, debt repayment, and overall financial stability.

Debt Levels and Credit Ratings

BBAI's debt burden and credit ratings provide additional insights into its financial risk profile.

- Credit Ratings: Credit rating agencies such as Moody's, Standard & Poor's, and Fitch provide assessments of BBAI's creditworthiness. Downgrades in credit ratings often signal increased financial risk and can negatively impact the stock price.

- Debt Servicing Capacity: Assessing BBAI's ability to service its debt obligations (interest payments and principal repayments) is crucial to understanding its long-term financial sustainability.

Future Outlook and Investment Strategies for BBAI Stock

Despite the recent downturn, several factors could contribute to a potential recovery in BBAI stock.

Potential Catalysts for Growth

Several positive developments could reverse the current trend and drive BBAI stock price upwards.

- Successful Product Launches: The successful launch of new products or services can significantly boost revenue and attract new investors, leading to a rise in stock price.

- Strategic Partnerships: Strategic alliances and partnerships can unlock new markets, enhance technology, and improve efficiency, contributing to improved financial performance.

- Positive Regulatory Developments: Favorable changes in regulations or government policies can significantly impact the industry and improve the prospects for BBAI.

- Strong Earnings Reports: Consistent delivery of strong earnings reports, exceeding expectations, can rebuild investor confidence and lead to a stock price increase.

Risk Assessment and Mitigation Strategies

Investing in BBAI stock involves inherent risks.

- Market Volatility: The stock market is inherently volatile, and BBAI stock is susceptible to market fluctuations, regardless of the company's performance.

- Competition: Intense competition within the industry can put downward pressure on prices and profitability.

- Regulatory Changes: Unfavorable regulatory changes can negatively impact BBAI's operations and financial performance.

Diversification is a crucial risk mitigation strategy. Don't put all your eggs in one basket. Spreading investments across different asset classes reduces the overall risk.

Investment Recommendations

Based on the analysis, determining whether BBAI stock is a buy, sell, or hold depends on individual risk tolerance and investment objectives. A thorough due diligence process, including a review of all available financial data and independent expert opinions, is crucial before making any investment decision.

- Buy: If you have a high-risk tolerance and believe the potential catalysts for growth outweigh the risks, BBAI might be a suitable addition to your portfolio.

- Sell: If you are risk-averse or concerned about the company's financial health, selling your BBAI shares might be a prudent course of action.

- Hold: If you're uncertain, holding your existing shares might be a viable strategy, closely monitoring the company's performance and news.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. Consult a qualified financial advisor before making any investment decisions.

Conclusion

The 17.87% drop in BBAI stock price resulted from a combination of negative market sentiment, geopolitical factors, and company-specific issues. While risks remain, potential catalysts for growth exist. Conduct thorough research, consider your risk tolerance, and consult a financial advisor before investing in BBAI stock. Further research into BBAI stock analysis, BBAI stock investment strategies, and BBAI stock forecasts from reputable sources will be vital for making an informed decision.

Featured Posts

-

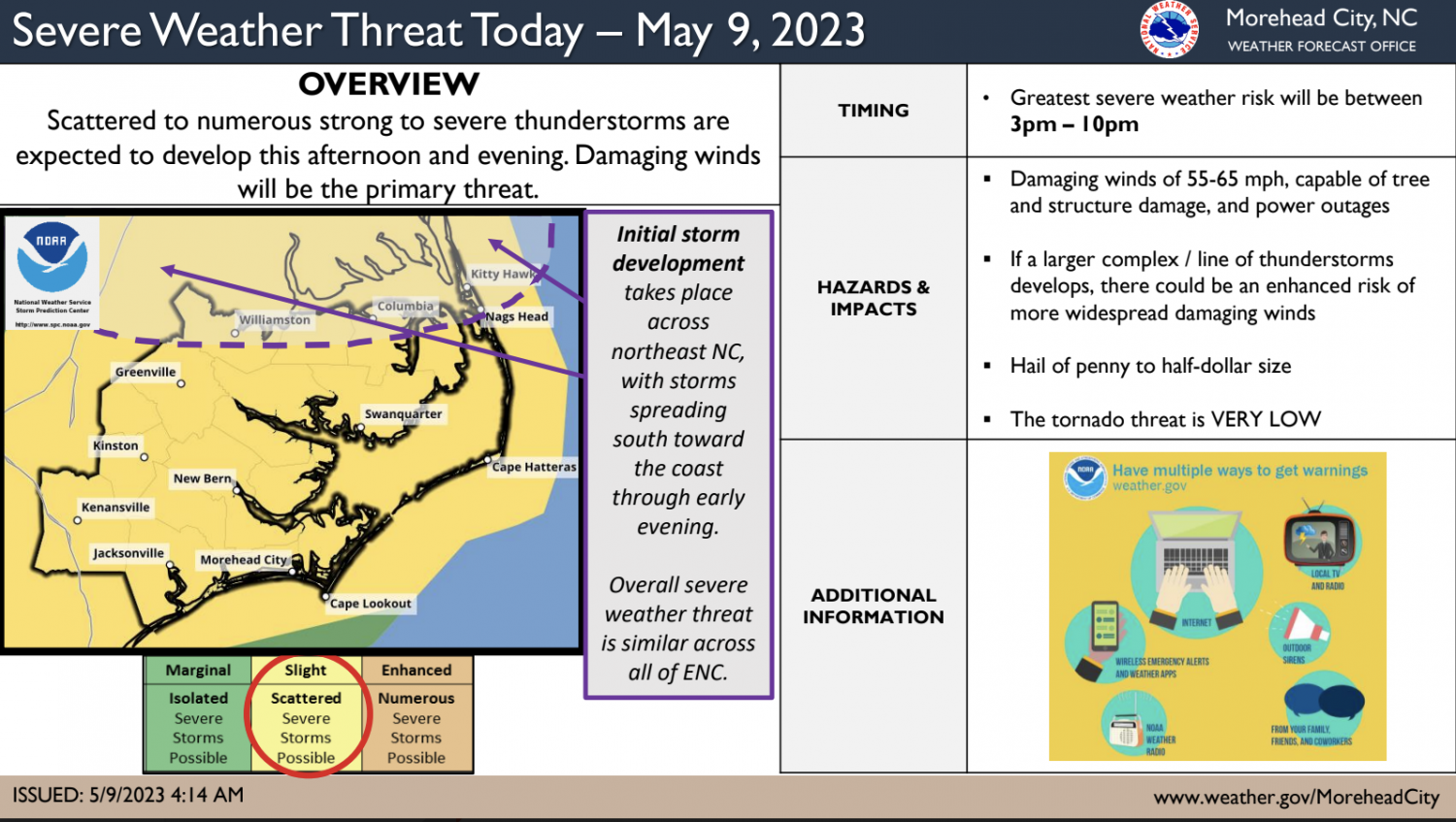

Damaging Winds How Fast Moving Storms Impact Your Area

May 21, 2025

Damaging Winds How Fast Moving Storms Impact Your Area

May 21, 2025 -

Factors Contributing To D Wave Quantum Qbts Stocks 2025 Decline

May 21, 2025

Factors Contributing To D Wave Quantum Qbts Stocks 2025 Decline

May 21, 2025 -

Restauration Du Patrimoine Breton Plouzane Et Clisson Selectionnes Pour La Mission Patrimoine 2025

May 21, 2025

Restauration Du Patrimoine Breton Plouzane Et Clisson Selectionnes Pour La Mission Patrimoine 2025

May 21, 2025 -

Analysis Abc Cbs And Nbcs Handling Of The New Mexico Gop Arson Attack Coverage

May 21, 2025

Analysis Abc Cbs And Nbcs Handling Of The New Mexico Gop Arson Attack Coverage

May 21, 2025 -

Abn Amro Voorspelt Stijgende Huizenprijzen Ondanks Rentestijging

May 21, 2025

Abn Amro Voorspelt Stijgende Huizenprijzen Ondanks Rentestijging

May 21, 2025

Latest Posts

-

Son Dakika Juergen Klopp Un Yeni Takimi Hakkinda Bilinmeyenler

May 22, 2025

Son Dakika Juergen Klopp Un Yeni Takimi Hakkinda Bilinmeyenler

May 22, 2025 -

David Walliams And Simon Cowell Alleged Britains Got Talent Rift Explodes

May 22, 2025

David Walliams And Simon Cowell Alleged Britains Got Talent Rift Explodes

May 22, 2025 -

Arda Gueler In Kariyeri Real Madrid In Yeni Teknik Direktoeruenuen Etkisi

May 22, 2025

Arda Gueler In Kariyeri Real Madrid In Yeni Teknik Direktoeruenuen Etkisi

May 22, 2025 -

Klopp Un Gelecegi Transfer Spekuelasyonlari Ve Analiz

May 22, 2025

Klopp Un Gelecegi Transfer Spekuelasyonlari Ve Analiz

May 22, 2025 -

Britains Got Talent Feud David Walliams Attacks Simon Cowell

May 22, 2025

Britains Got Talent Feud David Walliams Attacks Simon Cowell

May 22, 2025