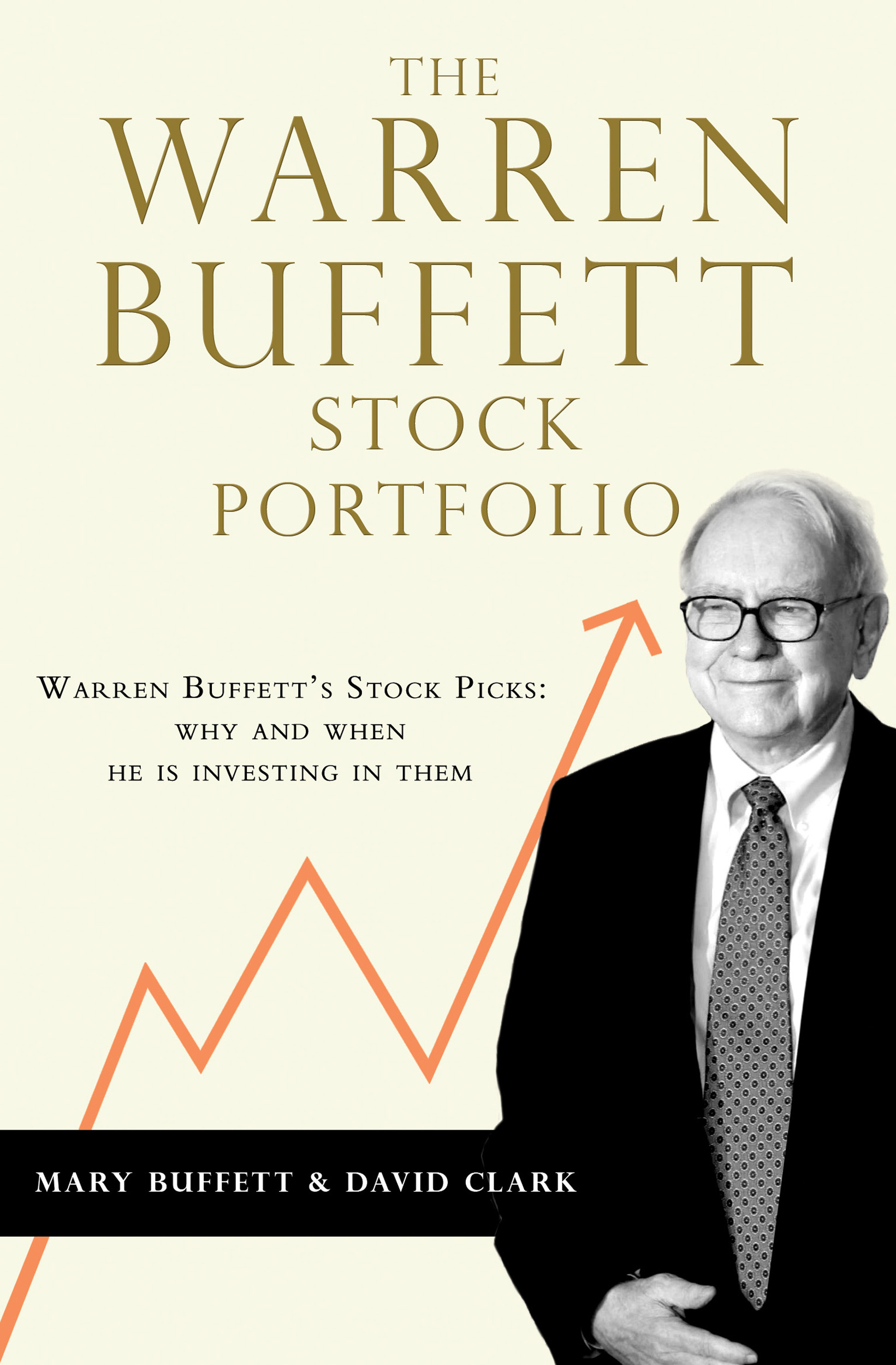

Berkshire Hathaway's Apple Holding: Assessing The Impact Of CEO Transition

Table of Contents

The Current State of Berkshire Hathaway's Apple Investment

Berkshire Hathaway's Apple investment is a cornerstone of its portfolio, a testament to Warren Buffett's faith in Apple's long-term prospects. This substantial holding has generated significant returns for Berkshire over the years, contributing substantially to the company's overall success. Understanding the current state of this investment is crucial to assessing the potential impact of a CEO transition.

- Quantifying the Investment: Berkshire Hathaway's stake in Apple is worth hundreds of billions of dollars, representing a significant percentage of its overall portfolio. The precise value fluctuates with Apple's stock price, but its sheer magnitude underlines its importance to Berkshire's financial health.

- Historical Performance: The investment has historically delivered strong returns, reflecting Apple's consistent growth and market dominance. This track record provides a benchmark against which to measure future performance.

- Long-Term Growth Potential: Apple's continued innovation in areas such as wearables, services, and augmented reality suggests significant long-term growth potential. This sustained growth is vital for maintaining the value of Berkshire's substantial investment.

- Market Position: Apple maintains a strong position in the global technology market, competing effectively with other tech giants. However, maintaining this position will be crucial in ensuring future success and the continued value of Berkshire's Apple holdings.

Potential Scenarios Following a CEO Transition at Apple

A CEO transition at Apple inevitably introduces uncertainty, although the impact will vary depending on the specifics of the transition. We can outline two potential scenarios:

Scenario 1: Smooth Transition, Continued Growth

A smooth transition, characterized by effective succession planning and a seamless handover of responsibilities, is the most optimistic scenario. This would likely maintain investor confidence and ensure continued growth for Apple.

- Continued Innovation: A smooth transition would allow Apple to continue its track record of innovation, mitigating the risk of disruption. A new CEO could build upon existing strategies or introduce fresh perspectives while maintaining the company's core strengths.

- Mitigating Risks: Apple's robust internal structure and strong brand loyalty can mitigate the risks associated with leadership changes. Effective succession planning will further minimize disruption and uncertainty.

- Impact on Stock Price: A smooth transition could see Apple's stock price remain relatively stable or even continue its upward trajectory, benefiting Berkshire Hathaway's investment.

Scenario 2: Disruption and Uncertainty

Conversely, a less-than-smooth transition could lead to uncertainty and potentially negatively impact Apple's stock performance.

- Internal Conflicts: A poorly managed succession could trigger internal conflicts or leadership challenges, diverting resources and attention away from core business operations.

- Strategic Shifts: A new CEO might implement significant strategic shifts that deviate from established practices, potentially impacting Apple's long-term prospects and the value of Berkshire's holdings.

- Decreased Profitability: Disruption and uncertainty could lead to decreased profitability in the short to medium term, impacting the return on Berkshire Hathaway's investment.

Berkshire Hathaway's Response to a CEO Transition at Apple

Berkshire Hathaway's response to a CEO transition at Apple will be crucial in shaping the future of this significant partnership. Warren Buffett's historical approach to investment management during periods of uncertainty provides insights into potential strategies.

- Holding or Adjusting the Stake: Berkshire may choose to hold its current Apple stake, demonstrating confidence in Apple's long-term viability even under new leadership. Alternatively, it could strategically adjust its position depending on market conditions and the company's performance.

- Investment in Competitors: Depending on the transition's outcome, Berkshire might consider diversifying its holdings further by investing in Apple's competitors to balance its portfolio.

- Diversification Strategy: Berkshire's overall diversification strategy plays a crucial role in mitigating the risk associated with any single investment. This strategy ensures that the impact of a downturn in Apple's performance is less significant on the overall portfolio.

The Long-Term Outlook for Berkshire Hathaway's Apple Holding

The long-term implications of the CEO transition at Apple for Berkshire Hathaway's investment are complex and depend on several factors.

- Continued Market Share Growth: Apple's ability to maintain or grow its market share will be a key determinant of the long-term value of Berkshire's holding. New product innovation and strong brand loyalty will be vital.

- Technological Advancements: The pace of technological advancements and Apple's ability to adapt and innovate will significantly influence its future performance and the value of Berkshire's investment.

- Sustainability of the Business Model: The long-term sustainability of Apple's business model, including its ability to generate recurring revenue streams from services, will be vital in shaping the future value of Berkshire's stake.

Conclusion

The impending CEO transition at Apple presents both opportunities and challenges for Berkshire Hathaway's substantial investment. While a smooth transition is likely to maintain the value of the holding, potential disruptions need to be considered. Berkshire's response will be crucial in shaping the future of this significant partnership. Stay informed on the latest developments regarding Berkshire Hathaway's Apple holding and the impact of the CEO transition. Continue to research and analyze the evolving dynamics of this critical investment to make well-informed decisions about your own portfolio. Further research on Berkshire Hathaway's Apple holding is vital for understanding its future performance.

Featured Posts

-

Young Hawaiian Artists Shine Sew A Lei Memorial Day Poster Competition

May 25, 2025

Young Hawaiian Artists Shine Sew A Lei Memorial Day Poster Competition

May 25, 2025 -

Lyudi Lyubyat Schekotat Nervy Trillery I Refleksiya V Rabotakh Fedora Lavrova

May 25, 2025

Lyudi Lyubyat Schekotat Nervy Trillery I Refleksiya V Rabotakh Fedora Lavrova

May 25, 2025 -

Svitski Khroniki Naomi Kempbell U Biliy Tunitsi Na Londonskomu Shou Biznes Zakhodi

May 25, 2025

Svitski Khroniki Naomi Kempbell U Biliy Tunitsi Na Londonskomu Shou Biznes Zakhodi

May 25, 2025 -

Hsv Aufstieg In Hamburg Der Weg Zurueck In Die Bundesliga

May 25, 2025

Hsv Aufstieg In Hamburg Der Weg Zurueck In Die Bundesliga

May 25, 2025 -

Apple Stock And Trump Tariffs A Look At Buffetts Investment Strategy

May 25, 2025

Apple Stock And Trump Tariffs A Look At Buffetts Investment Strategy

May 25, 2025