Bessent's Warning: US Debt Limit Measures May Expire In August

Table of Contents

Bessent's Concerns and the Urgency of the Situation

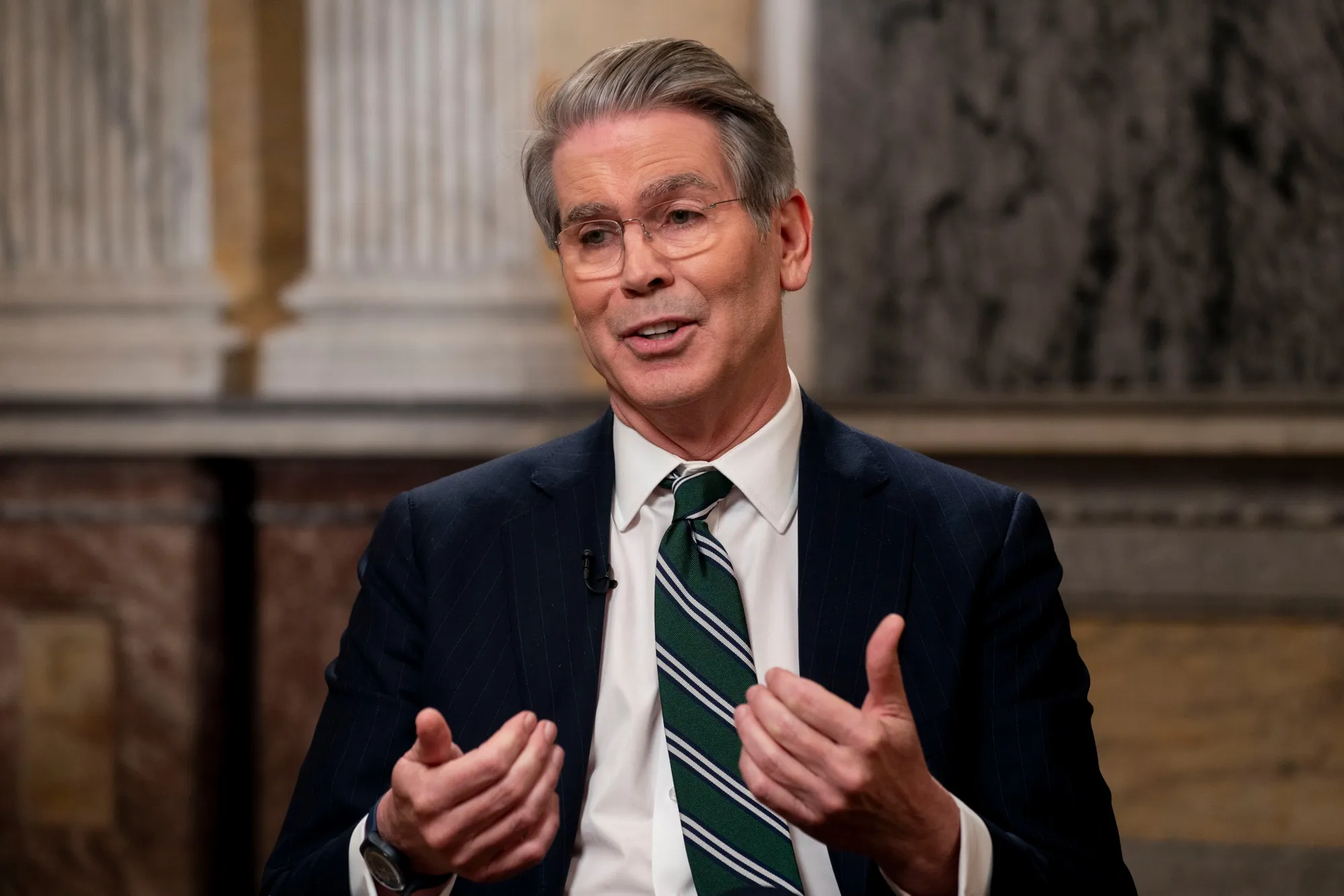

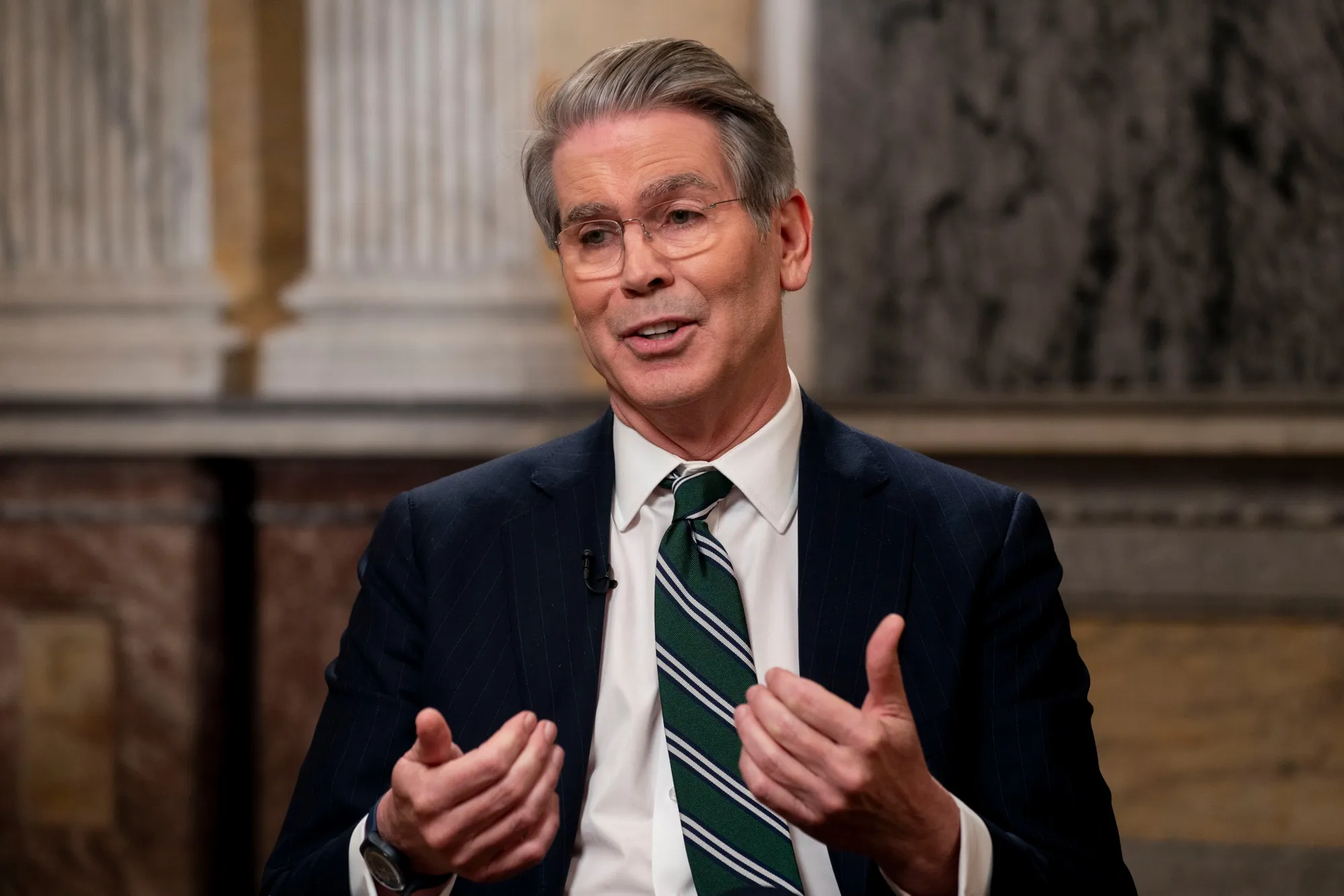

[Insert Bessent's Name and Title/Credentials here] is a respected [His/Her area of expertise, e.g., economist, financial analyst] with extensive experience in [His/Her area of expertise related to the debt ceiling, e.g., government fiscal policy, macroeconomic analysis]. Their concerns center around the rapidly approaching August deadline for the current US debt limit measures. Bessent's warning highlights the severe repercussions of inaction, painting a concerning picture of potential economic fallout.

- Specific warnings issued by Bessent: [Insert specific quotes or paraphrased warnings from Bessent. Be sure to cite the source properly]. These warnings emphasize the potential for a significant market downturn.

- Potential impacts on government spending and operations: Failure to raise the debt ceiling could lead to a partial or complete government shutdown, disrupting essential services and impacting millions of Americans. This could ripple through the economy, affecting everything from social security payments to national defense.

- Sectors likely to be affected: The financial markets are particularly vulnerable. A credit rating downgrade, a likely consequence of exceeding the debt limit, would increase borrowing costs for the government and the private sector, hindering economic growth. Government services, from infrastructure projects to social programs, would face severe cuts or delays.

Understanding the US Debt Limit and its Implications

The US debt limit, also known as the debt ceiling, is the total amount of money the US government is legally allowed to borrow to meet its existing obligations. This limit isn't about spending new money; it's about paying for expenses already incurred, such as Social Security benefits, military salaries, and interest on the national debt. Exceeding this limit has severe consequences.

- Potential government shutdown: Without sufficient funds, the government would be forced to shut down non-essential services, leading to widespread disruption.

- Credit rating downgrades and increased borrowing costs: A failure to address the debt ceiling could lead to a credit rating downgrade, making it significantly more expensive for the government to borrow money. This would increase the national debt and further strain the economy.

- Negative impact on investor confidence and economic growth: Uncertainty surrounding the debt ceiling creates instability, undermining investor confidence and negatively impacting economic growth.

Political Landscape and the Path Forward

Raising or suspending the debt ceiling is a complex political process, often fraught with partisan gridlock. [Describe the current political landscape concerning the debt ceiling – include details on the positions of different political parties, highlighting any potential areas of compromise or conflict].

- Potential bipartisan negotiations: While significant challenges remain, the need for a solution necessitates bipartisan negotiations. [Discuss potential areas of compromise, including specific policy proposals being considered].

- Obstacles to reaching a consensus: [Discuss the key obstacles to reaching a consensus, such as differing ideological viewpoints, political posturing, and potential use of the debt ceiling as a leverage point].

- Possible short-term and long-term solutions: [Discuss potential short-term solutions, such as a temporary increase in the debt ceiling, and long-term solutions, such as comprehensive fiscal reforms aimed at reducing the national debt].

Preparing for Potential Market Volatility

The potential for market volatility associated with the US debt limit crisis necessitates proactive measures from investors and businesses. Careful planning can help mitigate some risks.

- Diversification of investment portfolios: Diversification reduces exposure to any single asset class, mitigating potential losses.

- Monitoring economic indicators closely: Closely following key economic indicators, such as inflation, interest rates, and market sentiment, allows for informed decision-making.

- Developing contingency plans for potential disruptions: Businesses should develop contingency plans to address potential disruptions to supply chains, operations, and revenue streams.

Conclusion

Bessent's warning about the August deadline for the US debt limit serves as a critical wake-up call. The potential consequences of exceeding the debt ceiling are severe, ranging from a government shutdown to significant market volatility and increased borrowing costs. Understanding the implications of the debt limit is crucial for both individuals and businesses. Stay informed about the US Debt Limit, understand the implications of the August deadline, and prepare for potential market volatility related to the US Debt Limit. Proactive financial planning and a close watch on the political developments are essential steps to navigate this period of uncertainty. Engage in responsible financial planning to protect yourself and your investments during this critical time.

Featured Posts

-

Free Streaming Watch Sylvester Stallone In The Action Thriller Armor

May 11, 2025

Free Streaming Watch Sylvester Stallone In The Action Thriller Armor

May 11, 2025 -

The Instagram Tik Tok War Insights From The Ceos Testimony

May 11, 2025

The Instagram Tik Tok War Insights From The Ceos Testimony

May 11, 2025 -

Did Cbs Stealing The Vmas Sound The Death Knell For Mtv

May 11, 2025

Did Cbs Stealing The Vmas Sound The Death Knell For Mtv

May 11, 2025 -

The Valspar Championship Lowrys Road To Contention

May 11, 2025

The Valspar Championship Lowrys Road To Contention

May 11, 2025 -

Celtics Dominant Win Secures Division Title

May 11, 2025

Celtics Dominant Win Secures Division Title

May 11, 2025